Seven ETFs for (financial) health

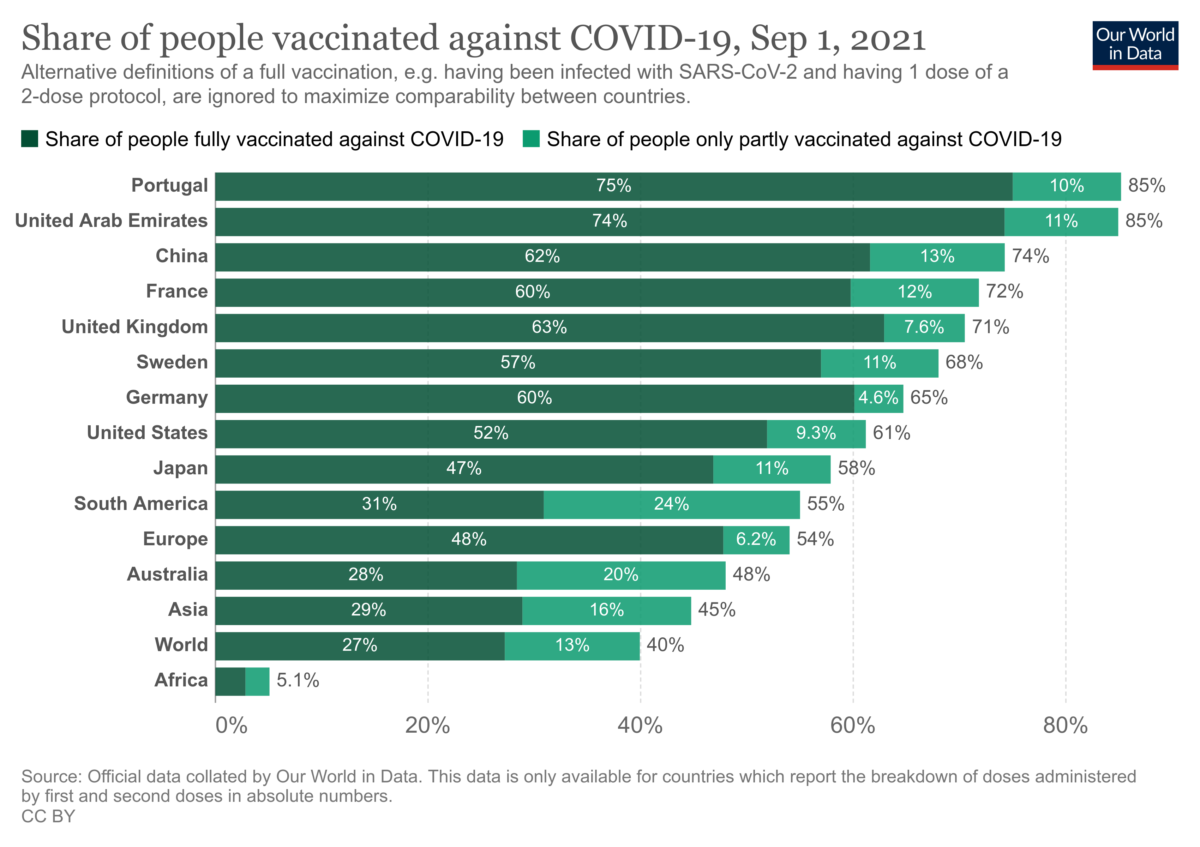

We’re all tired of Covid-19, lockdowns and restrictions on freedom. However, the pandemic isn’t over. Three quarters of the world’s population remains unprotected against the virus, opening a back door for future infections and an opportunity for ‘big pharma’ and biotechnology companies.

Looking in the rear mirror, we see a devastating disease that took more than four million lives and kept all of us apart for a prolonged period. But there’s a silver lining. The pandemic accelerated the modernisation and robotisation of our society, which is key for future gains in productivity. More importantly, it accelerated the research and development of new drugs and treatments, including the use of RNA (ribonucleic acid) to treat challenging diseases.

I believe that the pharmaceuticals industry and the biotech sector in particular have regained life and are worth investing in for the next few years. The case of Moderna (NASDAQ:MRNA) is an example of how it pays to be a patient investor. However, biotech is a tough business, as it ‘burns’ cash year after year, without any assurance that the final results will be profitable. ETFs are therefore an excellent way of gaining exposure to a promising market in a diversified way, without being too exposed to the results of just one or a few companies. Today, I’m looking at seven ETFs that I believe offer good, near-term opportunities for investors.

A bet on (against) Covid-19

It would be great if we could extinguish SARS-CoV-2 and get back to normal life, but the more we advance with the vaccination programme, the better we understand that it will be very difficult to achieve group immunisation with it. What we found was a way of preventing death and hospitalisation, while living with the threat of the disease. While this is not exactly good news for us and our way of life, it’s somewhat better news for companies involved in Covid treatment and prevention.

Vaccinations seem to be preventing hospitalisations and deaths, but we have seen a rising number of breakthrough cases. Scientists and health-care providers are concerned about how long the immunisation provided by the vaccines can last, in particular for the oldest and in the face of virus mutations. Israel approved booster shots for almost the entire population and the US is now advancing with the same for the immunodepressed. At the same time, the Pfizer/BioNTech vaccine is now fully approved in the US and all countries are lowering the minimum age required to take it. This means that there’s ample margin for the big players in the Covid-19 vaccine market to prolong their current income stream into the future.

I believe the world will follow in the footsteps of Israel regarding a third vaccine shot and vaccines are going to be extended eventually for the under-12s in the near future. Currently, 5.4bn doses of vaccines have been given and 2.1bn people are fully vaccinated, which represents just one quarter of the world’s population. I believe that these facts will help the revenue outlook for pharmaceuticals/biotech companies. The aggregate vaccine sales generated by Pfizer, Astra Zeneca, Moderna and Johnson & Johnson (J&J) totalled $18.6bn during the first half of the year and are expected to reach $60bn by the end of the year. Pfizer, alone, is reaping half of those revenues. What we need is to find ETFs that invest in companies that are directly or indirectly related to Covid-19. This leads me to my first ETF proposal, the VanEck Vectors Pharmaceutical ETF (NASDAQ:PPH).

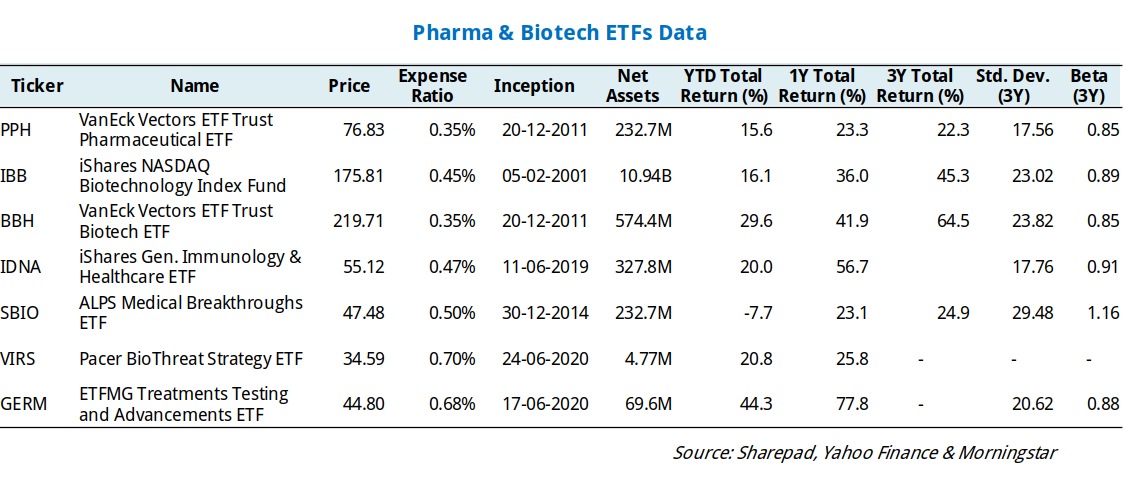

The VanEck Vectors Pharmaceutical ETF (NASDAQ:PPH) was created in 2000 and is highly targeted towards big pharma, as it only invests in 25 companies. The fund invests in companies from a few different countries and includes the top vaccine producers: Pfizer; AstraZeneca; Moderna; and J&J. It also invests in other companies that are somewhat involved with Covid-19 treatment. For example, it invests in Novartis, a company that’s currently providing manufacturing capacity to Pfizer and is involved in the development of Rockefeller University’s novel, monoclonal antibody duo treatment that neutralises the SARS-Cov-2 virus. Another investment is in GSK, which produces adjuvants for vaccine mass production while also being involved in monoclonal antibody products to prevent disease. One way or the other, many of the 25 holdings of PPH are involved in the treatment or prevention of Covid-19 and are, at the same time, the biggest players in pharmaceuticals. While being heavily concentrated, this ETF is much less risky than others because of the mean market cap of the companies involved. The fund is up 22.7% in one year and shows the lowest risk of all funds presented here. As a side note, it is worth mentioning that this fund doesn’t invest in Moderna, as it isn’t really a pharmaceutical company.

Looking for broad biotech exposure?

One of the big themes that regained strength with the pandemic is biotech. The use of RNA technology for vaccine production has been a boost for the sector, which is attracting new money into research and development of new medicines and treatments. Unlike big pharma, stocks in the biotech sector are usually smaller, and are cash-burners. They spend a lot of money trying to figure out ways to treat known diseases and conditions without any assurance that one day they can turn that research into something that can be marketed and profitable. An excellent example is Moderna. The company has been accumulating losses since 2010 and the Covid vaccine is its first marketed product. Moderna’s turnover was just $75m in 2020, but it then started rising, quarter after quarter, to $232m, then $803m, $1,937m and now $6,291m. This big boost explains why Moderna’s stock price rose from $20 at the end of 2019 to $400 today.

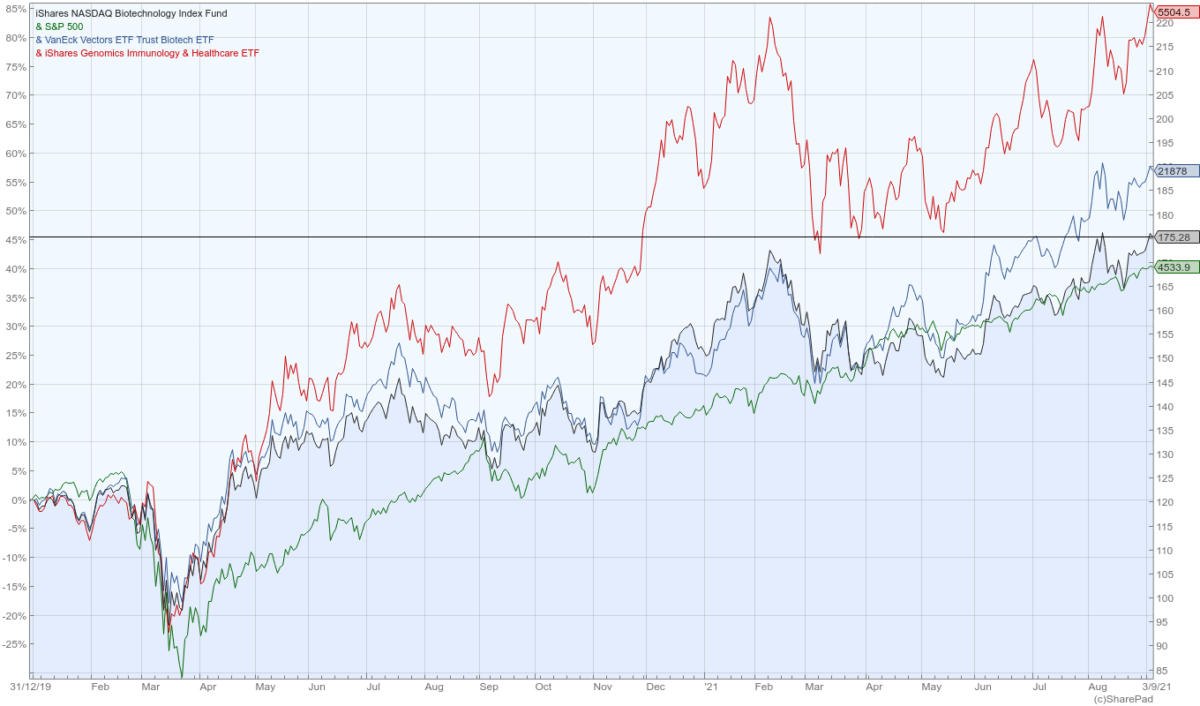

Investors in biotech stocks are looking for the next Moderna, which may be a profitable investment but very risky at the same time. I have three ETFs in mind for those looking for medical breakthroughs without wishing to take too much risk. These are the iShares Biotechnology ETF, the VanEck Vectors Biotech and the iShares Genomics Immunology and Healthcare ETF.

iShares Biotechnology ETF (NASDAQ: IBB) is a broad-based ETF with 270 holdings. The fund seeks to track the investment results of an index composed of US-listed equities in the biotech sector. It includes companies like Moderna and BioNTech, which helped boost its one-year return to 34.8%. But there are many other companies. I would say this ETF fits well for investors looking for the safest bet on biotech. IBB comes with an expense ratio of 0.45% and has 11.5bn in assets under management.

VanEck Vectors Biotech (NASDAQ:BBH) is a more targeted bet with just 24 holdings. The fund’s goal is to invest in companies involved in the development, production and marketing of drugs based on genetic analysis and diagnostic equipment. Its top holdings are similar to those of IBB and include both Moderna and BioNTech. But the companies targeted are smaller than in IBB and riskier. Many of them are currently unprofitable.

iShares Genomics Immunology and Healthcare ETF (NYSEARCA:IDNA) invests in companies from developed and emerging markets that are involved in innovation in genomics, immunology and bioengineering. It has returned more than 50% in one year, mainly due to its exposure to the high returns of Moderna, Pfizer and Intellia Therapeutics. This last company saw its stock price boosted in June due to breakthroughs in amyloidosis treatments. IDNA holds 48 companies and is a portfolio that mixes big with small companies and profitable with promising businesses. From the lot of three, this is the riskier ETF.

A bolder approach towards biotech

If you’re looking for a slightly different exposure to biotech, then I have three suggestions that are bolder. These include the Pacer BioThreat Strategy ETF, the ALPS Medical Breakthroughs ETF and the ETFMG Treatments Testing and Advancements ETF.

Pacer BioThreat Strategy ETF (BATS:VIRS) tracks the Life Sci BioThreat Strategy Index to invest in US-listed companies whose products or services help to protect against, endure or recover from biological threats to human health. The index targets seven subthemes:

- Research of current and future pandemics.

- Combat agents of biological warfare.

- Detect the presence of biological threats.

- Secure national borders and ports and strengthen homeland security.

- Aid in stockpiling of products needed in times of natural disasters and disease outbreaks.

- Improve food and water safety and purity.

- Enable technology to benefit work and stay at home mandates.

VIRS is not exactly a pharma or biotech ETF. Its top holdings include Abbot Labs and J&J but also companies like Nvidia and Netflix. Thus, the approach is widely different here, which is interesting in terms of diversification. The expense fees are 0.70%, the highest of the ETFs reviewed today.

Alps Medical Breakthroughs ETF (NYSEARCA:SBIO) invests in US-listed stocks of companies operating in the biotech sector. It targets companies with a market cap between $200m and $5bn to exclude both the more illiquid companies and the biggest caps. Additionally, the fund uses a few criteria to assure it invests in companies with high potential but that are not exactly starting from scratch or don’t have enough cash to go through the process of developing new drugs and treatments.

In its selection, SBIO requires companies to have enough cash for two years at their current burn rate and only invests in companies with one or more drugs in Phase II or Phase III FDA clinical trials. The fund holds 126 equities and is well-diversified across companies. Its top holding, Vir Biotechnology represents 3.7% of the portfolio, which is way below most of the funds reviewed here. However, SBIO has the worst performance on record year-to-date, with a loss of 7.7%. Nevertheless, this kind of investment should be allowed time and we shouldn’t focus too much on the performance for short periods. Many of the companies in which the fund invests are engaged in promising research. More often than not, good results for just one company compensate for several disappointing results from others.

ETFMG Treatments Testing and Advancements ETF (NYSEARCA:GERM) focuses on vaccines, treatments and the testing market. It gives a direct exposure to the biotech companies engaged in the testing and treatment of infectious diseases. It’s not just about Covid-19, but its launch mid-2020 certainly was well-timed. According to the ETF provider, there were 36 epidemics between 2011 and 2018 in the US alone. They estimate the value of the global human vaccines market to grow to $72.5bn by 2024. Three quarters of the fund is exposed to treatments and one quarter to testing. As expected, top exposures include Moderna and BioNTech, two of the most important vaccine providers. Other holdings include, Novavax, Curevac, Vir Biotechnology and Zai Lab. Unlike SBIO, this ETF is highly concentrated. Its two top holdings represent 20% of the fund, which requires caution from less diversified investors.

Final words

The Covid-19 pandemic changed the way we live. We don’t know for sure whether this is temporary or long-lasting. However, some sectors and themes such as online retail, biotech and health were given a boost and will be in the spotlight for the years to come. The ageing of the population mixed with what we learned from the pandemic are good reasons to tilt an investment portfolio towards the health-care industry, in particular pharmaceuticals and biotech. The easier way to get exposure is through an investment in PPH, IBB, BBH or IDNA. Bolder investors may look at VIRS, SBIO and GERM.

Comments (0)