Responsible Housing IPO targets supported accommodation

The new REIT will join the wider social housing sector that is looking to address the shortage of affordable and suitable properties in the UK.

It is widely accepted that there is not enough social housing in this country, but the lack of government funding suggests that it will have to be the housebuilders and housing associations that plug the gap. The resulting demand for permanent private capital has prompted the launch of several new investment trusts over the last few years.

The latest of these is the Responsible Housing REIT that is hoping to raise up to £250m at its IPO with the money being invested in a diversified portfolio of supported housing accommodation across the UK. It is targeting an NAV total return of a least 7.5% per annum over the medium term with a dividend yield of five percent on the issue price.

Responsible Housing will acquire and create quality, fit-for-purpose accommodation to cater for supported residents across a number of care sectors including adults and young people with learning disabilities, mental health issues, physical disabilities, addiction, those with support needs, the elderly and otherwise vulnerable individuals, as well as those in temporary accommodation.

Sustainable solution?

The properties will be let to registered charities, housing associations and other organisations, with the leases aligned to the length of care-provision packages and break clauses where appropriate. Hopefully this will ensure that it doesn’t run into problems with the regulator in the same way that some of the other trusts in the sector have.

Responsible Housing will be managed by BMO Asset Management who say that the strategy is underpinned by long-term demographic demand and a lack of quality, fit-for-purpose property to meet the needs of the people it is looking to help. BMO has identified a pipeline of target assets that exceeds the £250m that it is aiming to raise.

The regulator of social housing has highlighted questions about the sustainability of lease-based models in the sector and has deemed a number of housing associations to be in breach of financial viability standards, but there is no doubt about the high level of demand for these types of properties. There is a real pressure to keep residents out of more expensive hospital care and a pressing social need for sustainable solutions.

The bigger picture

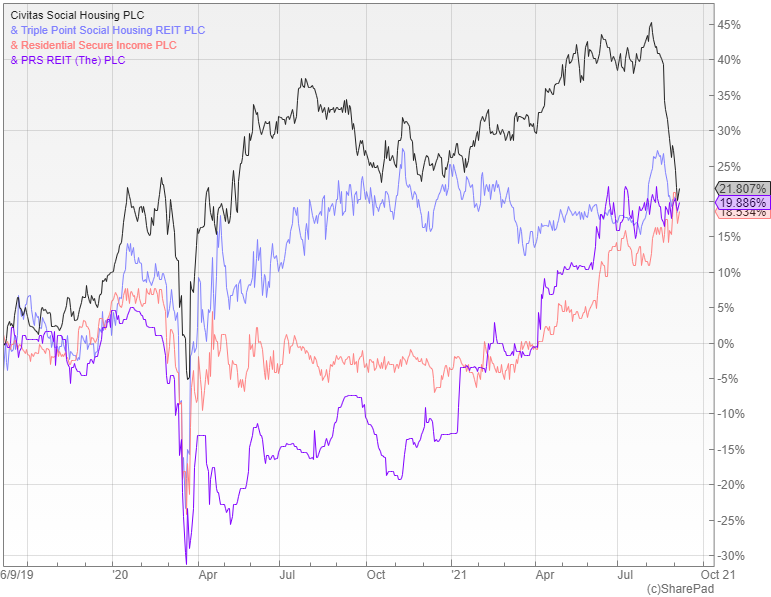

At £630m the biggest trust in the sector is Civitas Social Housing (LSE: CSH), which operates specialised supported-living accommodation and has been shifting its focus towards medically intensive care properties. It is yielding over five percent and had been doing well, but the shares have dropped around 17% in the last month following an adverse regulatory review of one of its major leaseholders, Auckland Home Solutions.

Triple Point Social Housing (LON: SOHO) has also been affected by the Auckland decision, although not to the same extent with the shares down about four percent in a month. It is yielding five percent with the dividends fully covered by earnings according to its latest results.

Other options include Residential Secure Income (LON: RESI), which focuses on shared ownership and is yielding 4.5%. There is also the PRS REIT (LON: PRSR) that invests in newly-built family housing for rent, an area that could grow rapidly as institutional investors replace the buy-to-let landlords who are deserting the sector following changes to the tax rules.

Comments (0)