The Fund That Can Make Money Whatever the Weather

In the last few months there has been growing concern about the risks facing the global economy, with one of the most chilling statements coming from Lord Rothschild, the chairman of RIT Capital Partners, who said that we may be “in the eye of a storm”.

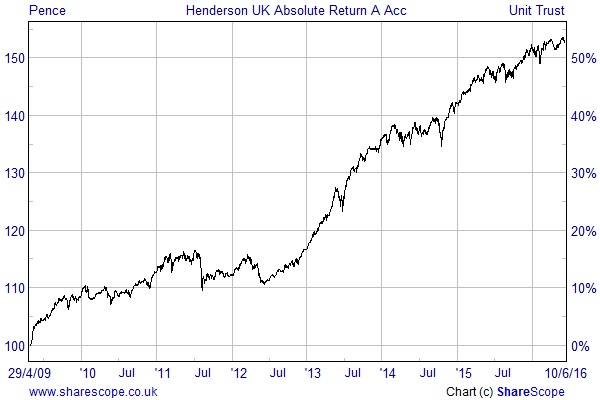

The increased air of caution and lack of direction in the stock market may make this a good time to increase your exposure to absolute return funds. A decent option could be Henderson UK Absolute Return, which has one of the most consistent records in the Targeted Absolute Return sector with a 5-year gain of 37.1%.

The £1.5bn fund aims to provide a positive long-term return regardless of whether the markets go up or down. It invests primarily in UK company shares and uses contracts-for-difference to short those that the managers think will lose value. This enables them to make money from rising and falling prices, while hedging out some of the general market risk.

At the end of April the fund had 96 long positions with the top five being Aviva, Legal & General, Informa, Taylor Wimpey and RELX. The managers, Ben Wallace and Luke Newman, had also put together a short book of 62 stocks with the net market exposure – after offsetting the one against the other – being just 18.1%.

Wallace and Newman have around a third of the portfolio in core, long-term positions based on the expected underlying earnings growth. The rest is invested in tactical longs and shorts that are designed to take advantage of short-term trends and mis-pricings. This allows them to make money from market volatility, especially when there is a high dispersion of returns with some companies doing well and others struggling.

One of the most interesting aspects of the fund is that it is the bottom up stock selection decisions that determine the net market exposure of the portfolio. The managers have a huge amount of discretion in this area as they can vary it from -50% all the way up to +75%.

It is not easy to take advantage of this sort of mandate, but it is a big plus if you can pull it off as it allows you to generate equity-like returns at a much lower level of risk. According to FE Trustnet, the fund has a three-year annualised volatility of just 3.69%, which is about a quarter of what you would get from the FTSE 100 index.

Henderson UK Absolute Return aims to generate positive returns every year, although it isn’t guaranteed and there is a risk that over the short term it could fall in value. Since it was set up in 2009 the only calendar year when it failed in this objective was 2011 when the fund lost 0.44%. It also fell slightly in the first four months of 2016, but over the course of its first seven years it has achieved an impressive annualised return of 6.11%.

Comments (0)