Four ETFs for value, recovery and momentum

With the market in high spirits, Filipe R. Costa suggest four ETFs for value, recovery and momentum.

Nothing seems to be able to keep the market down for long, not even a pandemic! In recent years, the uptrend has been so strong that everybody thinks a dip is just another opportunity to buy. Within such a framework, it’s ever more difficult to choose the right stocks and investment themes.

On the one hand, value should be the key factor when selecting stocks at a time when everything looks overvalued. To benefit from companies that still look undervalued, I suggest two ETFs: one to benefit from the upside potential in the battered down airliners and another to profit from a niche market – the world of sports.

On the other hand, betting against enthusiasm is risky! Sentiment plays a long-lasting role in stock pricing. This is where the new BUZZ ETF enters the investment scene. Social networks do have a role in stock pricing. We just can’t help but listen to them.

This month I suggest four ETFs. I will start with the VanEck Vectors Social Sentiment ETF, which aims to profit from sentiment, and then proceed to the two value plays – US Global Jets ETF and Roundhill MVP ETF. My last suggestion is the Hoya Capital Housing ETF, which develops the concept that there’s a shortage of housing in the US. Real estate has strong fundamentals and is going to play an important role in driving returns higher in the near future. All we have to do is to diversify in the sector and minimise interest rate risk.

VanEck Vectors Social Sentiment ETF (NYSEARCA:BUZZ)

While fundamentals are the key driver of stock returns in the long run, investor sentiment and emotions play an important role in short-term pricing. This means that, besides relying on fundamentals when adding shares to a portfolio, we should also keep an eye on sentiment. The price of a stock may remain disconnected from fundamentals for long periods of time. During the late 1990s, for example, the sentiment for new tech companies was so positive that investors completely disregarded their fundamentals for years. Even though it turned out that such prices couldn’t be sustained forever, most of us couldn’t oppose that market for so long.

While Fama and French talk about rational and efficient markets, there’s a large body of research dedicated to behavioural finance and collecting evidence against the traditional efficient market hypothesis (EMH). As human beings, we are influenced by emotions and we are unable to process all information that is available at each time. People just follow trends and professional investors don’t always have the best incentive to oppose that. Just look at what happened to the smart money in the GameStop case. Let’s assume they were right about GameStop stock being worthless. Some of them just ended in trouble for following such conviction, even if they’re right. It’s costly to oppose a market and some stocks just disconnect from their fundamentals and follow trends that may last for a long period of time.

We try to measure market sentiment using the VIX index, the put/call ratio, some moving averages, 52-week highs and lows, consumer confidence and sentiment indexes, among many other indicators. These indicators capture sentiment at the market level. Research shows that positive sentiment leads to positive returns over the short term (momentum) but tends to revert over the medium term. This reversion leads to contrarian investment strategies.

While being a good market timing instrument, sentiment is worthless when picking individual stocks, when measured at the market level. To build a portfolio of stocks based on sentiment, we need individual sentiment measures. There haven’t been many attempts to measure sentiment at the individual stock level. But this is exactly where the BUZZ ETF is grounded.

As I mentioned above, we shouldn’t ignore the power of the crowd in pricing stocks. Specifically, in the GameStop case that I mentioned above, a subReddit group name r/WallStreetBets almost led Point72, Melvin Capital and Citron Capital out of the market by opposing their short bets. The price of the stock was boosted from below $10 by the end of 2020 to almost $400 earlier this year. No matter what the smart money thinks, they were unable to drive the price to the supposed fundamentals. The stock was in a hot streak and if you attempted to short it at $100 you would have been squeezed. Opposing such sentiment is too risky. Investors may be willing to buy on fundamentals but need to avoid shorting these hot streaks when they’re still on fire.

If social networks have the power to bend the smart money, then we should listen to their story. Individual posts on social media about a stock are, most of the time, worthless. But, when taken together they constitute the “wisdom of crowds”, which helps outperform the overall market. A nascent body of research has been trying to analyse posts on Twitter, StockTwits, Reddit and other social media to understand their value in beating the market. Using algorithms, researchers collect all posts by stock ticker and analyse the text within each post to attribute them a positive, negative or neutral score. After collecting all these scores, stocks may be ranked by sentiment. Buying positive sentiment stocks and selling negative sentiment stocks has been reported to be a strategy that outperforms. This is where BUZZ enters the investment scene. The recently launched ETF relies on these ideas and implements them in a real-world setting. The index on which BUZZ relies, determines a list of 75 eligible stocks each quarter, following a proprietary algorithm that attempts to rank stocks according to social media sentiment. They then re-rank these stocks every month. To avoid problems, they rely only on big cap names.

While BUZZ was launched just a few weeks ago, this is not exactly a new fund. The first attempt to create such an ETF occurred in 2016 with the launch of Sprott Buzz Social Media Insights ETF. It was one of the first ETFs relying on AI to build an underlying index to track performance. Unfortunately, it was unable to catch much attention and was shut down in 2019 with just $10m in assets under management. However, it appears this time is different, as BUZZ has already attracted $500m.

Buzz tracks the performance of BUZZ NextGen AI US Sentiment Leaders Index, an index tracking the performance of 75 large cap US stocks which exhibit the highest degree of positive investor sentiment based on mentions in social media. It currently includes big ticket names like Apple, Amazon, Netflix, DraftKings and Novavax. In my view, this is an interesting addition to an already balanced portfolio. It allows the investor to capture trends in a systematic way. However, there are risks that shouldn’t be ignored. Most stocks included in BUZZ are heavily exposed to a momentum factor, which works well when the market is rising, but can perform badly during a downtrend. If the broad market goes down, sentiment on these stocks will decline faster than the time it takes for the fund to get rid of them and replace them with other stocks. Ongoing charges are 0.75%.

US Global Jets ETF (NYSEARCA:JETS)

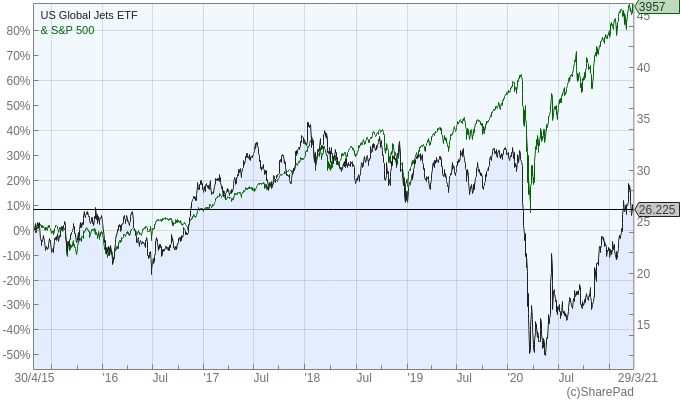

Airlines have been in deep trouble since the beginning of 2020, as international travel has been suffering the largest slump in its history. From a price of $31.95 on 12 February 2020, JETS collapsed to a price of $12.19 on 19 March. Despite the broad market’s fast recovery, JETS was still trading around $12 after three months. Only after the summer could JETS reverse a significant part of the losses. However, the ETF is currently trading at $26.68, which is still 16.5% below its price on 12 February 2020. In the same period, the S&P 500 is up 17.6%. This is a massive underperformance, which can be attributed to the disproportionate impact of the pandemic. While the future for international travel and airlines is still foggy, I believe bookings will start picking up as more and more people are vaccinated and lockdowns become less widespread. In a market plagued with overvalued stocks, JETS is still a very decent value play.

Roundhill MVP ETF (NYSEARCA:MVP)

Let’s now take a look at something new and different – the MVP ETF, which invests in professional sports. MVP was launched just a few weeks ago and is attracting investors. It offers exposure to the world of professional sports by investing in companies from across the globe which are involved in the theme. The fund currently has 37 holdings and includes professional sports teams (Borussia Dortmund, Manchester United), professional sports leagues (Formula One, WWE) and sports media and apparel companies (Nike, Adidas, MSG Networks). This theme is very specific and difficult to get exposure to because there are too few sports teams that are publicly traded. MVP makes it easier for investors to get access to the prominent companies in the market.

Roundhill has been in the spotlight lately, with two of its targeted funds: the Sports Betting ETF (NYSEARCA:BETZ) and the eSports ETF (NYSEARCA:NERD). The pandemic lockdowns have boosted eSports in a manner that appears permanent. I believe the MVP ETF will also be a success. Most of the companies in the fund have been severely hit by the pandemic. Many of them are still suffering with the lack of crowds at sports events. With the vaccination programmes gathering pace around the world and valuations still depressed, this fund offers an opportunity to enter the market at a good time.

Hoya Capital Housing ETF (NYSEARCA:HOMZ)

In my article last month, one of my suggestions was an investment in real estate, specifically in iShares Global REIT ETF (NYSEARCA:REET). There’s a global shortage of housing, which will continue to boost housing prices and benefit an investment in real estate. If inflation starts trending higher, and provided that central bankers are unwilling to hike interest rates for now, real estate will turn even more appealing.

I believe most of the analysis is still valid and the real estate ETFs I suggested last month are still a go this month. However, I’m digging a little deeper this time to concentrate my attention on a very specific REIT, which attempts to capture the performance of the entire US housing market by including the stocks of companies ranging from home builders to data services providers and real estate investment trusts. Hoya Capital Housing (HOMZ) follows the performance of the Housing 100 Index, which tracks spending on housing according to its contribution to GDP spending. The index includes homeowners and rental operations (30%), home building and construction (30%), home improvement and furnishings (20%) and home financing, technology and services (20%). Compared with the many existing real estate ETFs, HOMZ is broader and better diversified. For this reason, Hoya Capital expects its index to become a future benchmark for housing. However, we can already say that because of its diversification across several segments, HOMZ is less volatile and less sensitive to economic factors like interest rates. This allows the fund to be more exposed to the big trends behind housing in the US: a shortage of housing and an ageing of the existing housing stock. These trends should favour a rise in prices. Top holdings include Lowe’s Companies, The Home Depot, Lennar Corp., KB Home and MDC Holdings.

In my view, the fundamentals of the market favour an investment in real estate and HOMZ seems a very good fit. Besides being more diversified than others, thus reducing volatility, it is less exposed to a potential interest rate hike. Additionally, real estate provides diversification benefits to a portfolio. Considering that the S&P 500 index weights less than 5% in real estate and that housing costs account for 33% of consumer spending, there’s a good reason to add a specific real estate layer to a broad market exposure.

Final words

The pandemic will change the world forever and accelerate trends that were already gathering pace. Some companies will see their relative weighting reduced in the long term. This is the case, for example, with retail vs online sales. But there’s a lot of other companies that will fully recover. Airliners and sports teams are among them, I believe. At the same time, we shouldn’t disregard the power of the crowd, and looking at sentiment as an investment theme may bring some diversification and profits to a portfolio. At the same time, real estate continues to be a very good bet, in particular when interest rate risk is reduced.

Comments (0)