An investment strategy for (a lack of) inflation?

Inflation expectations are on the rise, but what happens if those expectations fail to materialise?

I really can’t make up my mind about inflation. Everyone believes that inflation is going to rise quickly, as the consequence of unprecedented fiscal and monetary stimulus. But while that’s a possibility, I’m more concerned with a potential bust of the stock market than with inflation. The last full cycle of interest rate increases occurred between June 2004 and June 2006. Since that point, the FED not only cut interest rates to near zero but also allowed its balance sheet to expand from $850 million to $7.6 billion. While I understand the concern about inflation, I keep asking myself: why would inflation suddenly rise, if it remained subdued for fifteen years?

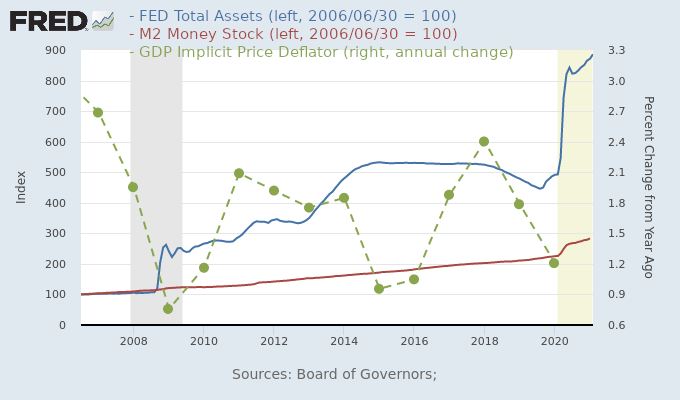

We’ve lost the link between money growth and inflation. Or perhaps we never had the correct link? As far as the quantity theory of money goes, inflation should be roughly equal to the change in the money supply less the change in real GDP. However, that seems not to be the case. Since mid 2006, the FED’s balance sheet grew 7.7x and the M2 money stock grew 1.8x. In the same period, real GDP grew 1.2x. The quantity theory would have predicted price growth of 1.6x in the period but prices grew just 1.25x. Thus, the link seems broken and there’s no reason to believe it will reconnect any time soon.

The missing link with inflation

A good explanation for a missing connection between monetary expansion and inflation comes from Richard Werner’s quantity theory of credit. To cut a long story short, what Werner claims is that this is all about credit and not exactly money, because our system allows commercial banks to create deposits out of nothing through credit, which are then used to make purchases. Only when that money is used for consumption does it lead to inflation. If it is employed to expand capacity, it will lead to GDP growth. However, there is a third possibility, which consists of using the money to purchase non-GDP items, like financial assets and houses. When that happens, the only inflation that will be created is asset inflation.

The theory helps understand what is currently happening. Despite the FED allowing its balance sheet to grow 7.7x and M2 to grow 1.6x, the money isn’t being used in the real economy. Instead, it is being directed towards financial markets, which survived Covid-19 without a scratch. Corporations prefer to pay dividends and repurchase shares rather than expand their business while consumers are placing bets in stock markets instead of buying computers or holidays. Unfortunately, non-GDP transactions don’t generate any wealth, which means that these transactions, without an accompanying enlargement of GDP just create bubbles. This is the main reason why I started this article by saying that I am more worried about a potential bubble than inflation.

Deploying an investment strategy

In order to protect against the downside that concerns me, I’m going to suggest two ETFs that invest in equities but which follow a more defensive strategy, either by building a long-short position or by investing in very large, long-established companies. If there’s something rotten, small growth companies will suffer the most, as well as any high-flying unprofitable tech.

Nonetheless, market outcomes and economic predictions are uncertain. Inflation expectations are already rising and even if inflation doesn’t soar now, fixed income may suffer because yields rely on expectations rather than on realised numbers. I still believe that bonds are an important part of a portfolio because I think the US market is largely overvalued. However, we need to reduce, if not eliminate, interest rate risk because of the growing inflation expectations. A floating rate ETF can come in handy here.

The most important part about inflation is the impact it has on real interest rates, which are roughly equal to their nominal counterparts less inflation. After a year plagued by a pandemic, marked with shutdowns, quarantines and fear, I expect 2021 to bring new life to the global economy. Apartment rents, air fares, hotel rates, entertainment services: all are expected to rise in the face of increased demand. The FED will see the movement as temporary, which means it will refrain from acting. This will allow for an erosion of real interest rates, but the extent of it remains to be seen. For this reason, and while I am more concerned with a potential bust, I will also consider an investment in precious metals and real estate ETFs. Let’s put all this together.

Defensive ETFs

First Trust Long/Short Equity ETF (NYSEARCA:FTLS)

Instead of investing in the broad market, FTLS buys one part of it and sells the other. Currently, its long exposure is 99.35% and its short exposure is -29.10% for a net exposure of 70.25%. The short exposure provides a cushion against sudden market declines. Let’s take as an example the peak of the pandemic last year between February and March. While the S&P 500 declined 30%, FTLS was able to halve those losses. However, since hitting a low in March 2020, the S&P 500 rose 70% while FTLS just rose 31%. But I’m willing to exchange some upside potential for downside protection, which is exactly what FTLS does.

Invesco Defensive Equity ETF (NYSEARCA:DEF)

DEF is another possibility for those looking for some downside protection, as it is designed to provide exposure to stocks that perform well during bearish markets. While it doesn’t provide the same protection FTLS provides, it invests in some big, well established companies, which are better equipped to whether down a downturn than the broad market. DEF invests in 100 big names in equal parts. Its current holdings include Walt Disney, Oracle, Intuitive Surgical and Electronic Arts. Ongoing charges come at 0.53%.

Floating Rate ETFs

VanEck Vectors Investment Grade Floating Rate ETF (NYSEARCA:FLTR)

I still believe bonds are a good investment, but I want to eliminate interest rate risk. This is where a floating rate (floater) comes in handy.

Floaters have a very low effective duration, which reduces (if not eliminates) interest rate risk. Coupon payments are indexed to a benchmark interest rate, such as LIBOR. This means that, if market rates start rising, your coupon payments would also rise.

FLTR invests in short-term US dollar-denominated investment-grade bonds. The majority of the bonds are issued by US companies (56%), but the fund also includes issues by companies spread all over developed countries. Its ongoing charges are 0.14%.

Precious Metals

The good news about gold is that it cannot be produced or printed. The bad news is that it doesn’t pay interest. Gold is a good replacement for debased money because its supply is rigid, but an investment in the metal always implies an opportunity cost, which comes in the form of the lost interest rate one could achieve by investing in bonds.

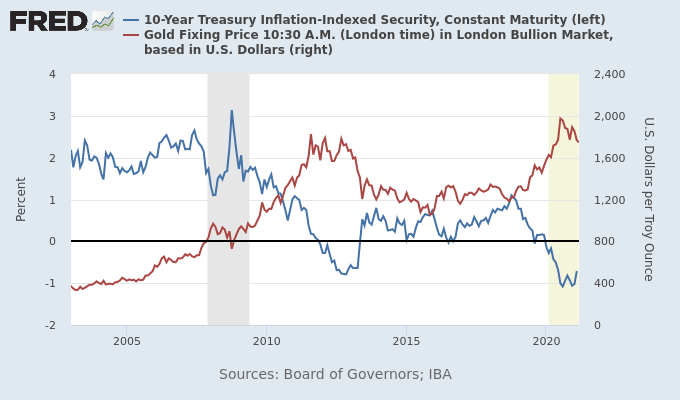

Contrary to popular belief, what drives gold prices higher isn’t inflation but the decline it produces in real interest rates. When real interest rates erode, the cost of carry for gold declines and then demand for gold increases and so does price. But, if the rise in inflation is matched with a proportional increase in nominal interest rates, gold prices should not move by much. Gold has a high correlation with real interest rates and the US dollar.

If the inflation thesis is correct and, in particular, if inaction from the FED materialises this year, gold will benefit. But it’s not just gold that may benefit, it’s the precious metals complex. Most metals share negative correlations with real interest rates and the dollar. This negative correlation is well pronounced in the chart below, where gold prices are plotted against a 10-year inflation-protected bond.

The negative point about precious metals is that, over the short term, they are positively correlated with the stock market. If stocks crash, so will precious metals. If you’re looking for a hedge against a market downturn, you should look elsewhere.

The ETF industry offers many alternatives concerning an investment in precious metals. I like the idea of buying physically-backed ETFs. If something goes wrong, you still own the gold, not paper. The SPDR Gold Trust (NYSEARCA:GLD) is the largest physically-backed gold ETF. Each share is backed with 1/10th of an ounce of gold. Unfortunately, its ongoing expenses are a bit high at 0.40%. Additionally, one share currently costs $172.5, which may be on the high side for small investors trying to fraction their investment.

Alternatively, investors that like the popularity of GLD may opt for an investment in the SPDR Gold Minishares (NYSEARCA:GLDM). It is backed with 1/100th of an ounce of gold, which makes one share of GLDM worth 1/10th of one share of GLD. Thus, when GLD trades at $172.5, GLDM trades at around $17.25. As a plus, ongoing costs come at the much lower rate of 0.18%. Institutional investors are used to trading GLD, but from the perspective of smaller investors, GLDM is the best option.

My third proposal regarding precious metals is the Aberdeen Standard Physical Precious Metals Basket Shares ETF (NYSEARCA:GLTR), which invests in a basket of metals, including gold, silver, platinum and palladium. GLTR is physically-backed like the other two but gives a more diversified access to precious metals as it invests in four of them. So far this year, it’s platinum which is driving returns higher, as gold has been lagging. GLTR comes with ongoing expenses of 0.60%.

Real Estate

Unlike what happened in 2007-2009, when the financial crisis came as the result of a credit crunch starting in the mortgage market, this time we have an income problem, which isn’t related with the credit. The end of the pandemic will push a few prices higher and real estate is usually a good hedge against inflation.

The iShares Global REIT ETF (NYSEARCA:REET) offers broad exposure to REITs from around the world, from both developed and emerging markets. The fund has more than 300 holdings and comes with ongoing expenses of 0.14%.

Alternatively, you may opt to invest in two separate ETFs, one for US real estate and the other for the rest of the world. The Vanguard Real Estate Index Fund (NYSEARCA:VNQ) offers exposure to the US market and comes with very low ongoing charges of 0.12%. To complement this ETF with international exposure, you have the Vanguard ex-US Real Estate Index Fund (NYSEARCA:VNQI), which invests 20% in Emerging Markets, 27% in Europe and 48% in the Pacific region. This ETF also comes with ongoing charges of 0.12%. The advantage of the Vanguard option is that it comes cheaper than the iShares one. However, you will end up with two different ETFs instead of just one.

Final words

While the US stock market recovered quickly from the pandemic, the real economy is clearly lagging. In February 2020, the US economy had an unemployment rate of just 3.5%, a number that shot up to 14.8% in just two months to hit a high not seen in many years. Since that, the numbers have been recovering but, almost one year after, the unemployment rate is still on the high side at 6.3%. Even though both the government and the FED have been trying to lead the economy towards a V-shaped recovery, the reality seems less rosy than that. From this observation comes two points to consider when investing. Firstly, if the central bank indirectly finances the government expenditure, inflation may rise. Secondly, if there is a huge disconnect between the real economy and financial markets and too much money is thrown into non-productive activities like buying shares, then we are at risk of creating a bubble, which is just another form of inflation (asset inflation). After considering both perspectives, I believe the best bet is to find assets that can eliminate interest rate risk, survive a potential downturn and hedge for inflation.

Comments (0)