ETFs For Increasing Volatility And Recession

After some ups and downs in the COVID-19 aftermath, US markets are on a strong uptrend. Tech stocks and, particularly, megacap tech stocks are rising to unchartered territory, similarly to what happened during the Nasdaq bubble of the 1990s. In the meantime, Bitcoin surged 80%.

One reason frequently pointed to justify the current uptrend is the worst-case scenarios not materialising. Despite the Federal Reserve rising the benchmark rate by 5% since March 2022, the US economy is still growing faster than expected and creating jobs. Fears of a recession were dismissed with the latest GDP numbers showing the US economy grew at an annualised rate of 2% during the first quarter. None of the potential disruptive events, such as a credit crisis, a worldwide economic slowdown, geopolitical unrest, an AI technology bubble, or interest rate increases, have had a significant impact yet. Inflation in the US has been last reported at 4.0%, a significant drop from last year’s 8.6% over the same month. If the numbers continue dropping, we may be near the end of the rate cycle and central bank tightening. However, institutional investors are still worried about interest rates.

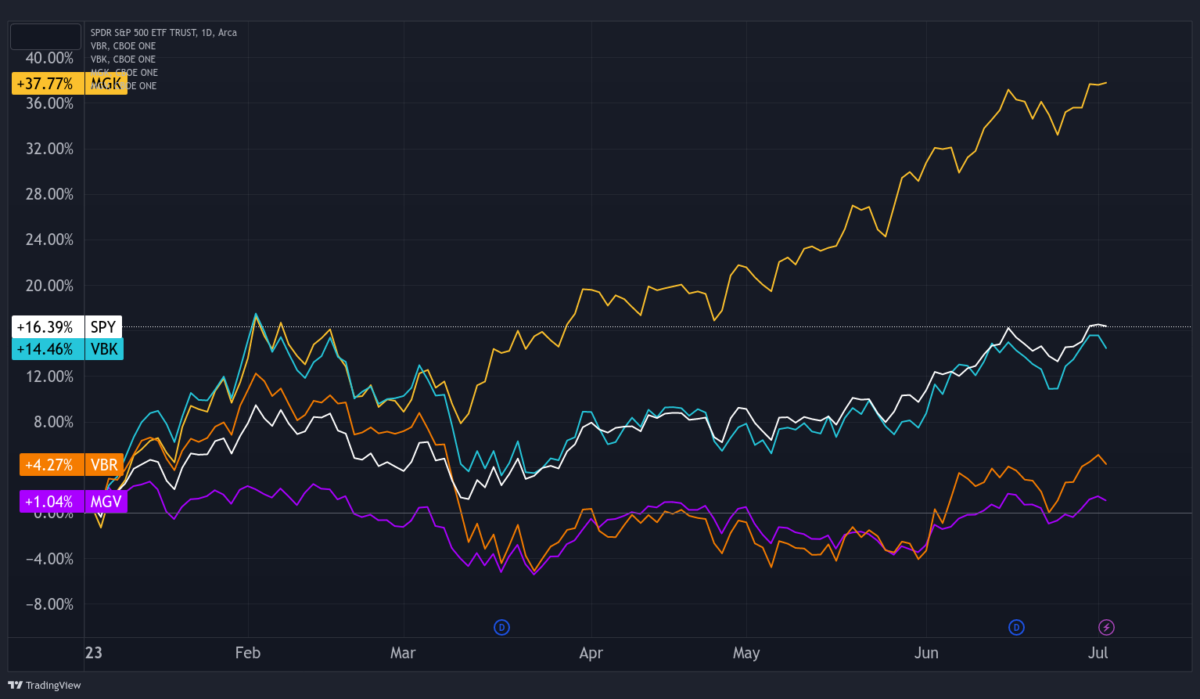

Although inflation may be in sight at present and there may not be a great deal of tightening expected from the central bank, there are still valid reasons to be concerned about the recent market rally. It’s not broad-based. I mean, not all stocks are rising. If we discount tech megacaps like Nvidia (+195% YTD) and Meta (+136% YTD), the rise would appear flatter. This rise has been all about megacaps and growth.

The chart above shows YTD performance of the S&P 500 and four ETFs: a megacap growth fund (MGK), a megacap value fund (MGV), a small-cap growth (VBK) and a small-cap value (VBR). Both value funds (VBR and MGV) underperformed the S&P 500. The small-cap growth rose at par with the S&P 500 and the megacap growth more than duplicated the S&P 500 rise.

Investors are betting heavily on the AI revolution. They believe the megacap growth complex will be at the forefront of the next revolution and are buying at whatever price. This has also pushed investors into riskier assets in general. CCC-rated borrowers have returned 10% YTD while the safest AA-rated corporate bonds returned just 2.7%. Investors are also investing in companies with weak balance sheets, those which would struggle the most with continuing rate rises. Nonetheless, every ascend has its limit, and the stock market will be impacted by high interest rates and a slowing economy. Investors are betting on a quick reversion of interest rates, which will unlikely happen. The current 4% level for inflation is still double the central bank’s target. To bring inflation down, the Federal Reserve will need to keep nominal rates above inflation for some time. These rates are expected to take down borrowers, those relying on too much debt.

With the above in mind, I think I’ll pass the remaining upside potential and engage in more defensive strategies. Growth appears overvalued under the current interest rate scenario. I prefer stocks from defensive sectors, as they are better prepared for the upcoming volatility and downturn, in case interest rates start showing their teeth. To play this theme I believe that the Vanguard Consumer Staples ETF and the Consumer Staples Select Sector SPDR Fund are top choices. Additionally, and bringing back the ETFs from the chart above, I think it’s worth investing in small-cap value as these stocks appear highly undervalued. For that sake, the Vanguard Small-Cap Growth ETF is a good option. Here are my options:

Vanguard Consumer Staples ETF (NYSEARCA:VDC)

Vanguard offers the most cost-efficient ETF choices. In this particular case, VDC runs on ongoing charges of just 0.10%, which equates to $10 for each $10,000 invested, per year. VDC holds 99 US stocks from companies that provide direct-to-consumer products that, based on consumer spending habits, are considered non-discretionary. Top holdings include behemoth companies like Procter & Gamble, PepsiCo, Coca-Cola, Costco Wholesale and Walmart. These stocks underperform the broad market during exuberant times, but they show their strengths when investors start looking at risks again. Most of them pay dividends, which may prove a nice complement to price performance. VDC is averaging 9.6% per year in total returns since its inception in 2004. Where it excels is in the reduced volatility of returns.

Consumer Staples Select Sector SPDR Fund (NYSEARCA: XLP)

For an alternative, XLP offers a similar exposure to Consumer Staples. The fund is also cheap with ongoing charges of 0.10%. However, it’s more concentrated than VDC, investing in just 37 stocks. But roughly investors get similar exposure to the consumer staples sectors.

Invesco S&P 500 Low Volatility ETF (NYSEARCA: SPLV)

One good option for potential upcoming turbulence is to invest in a low volatility ETF like SPLV. SPLV has been doing worse than the market this year because investors want stocks that are more volatile. However, this might change if interest rates increase more. The rationale and strategy of the fund are extremely straightforward. It looks at realised volatility for the last 12 months for S&P 500 stocks and selects the 100 less volatile. Fund fees are a little higher than for the other ETFs in the list, but still manageable at 0.25%.

Vanguard Small-Cap Value ETF

This fund has underperformed the market YTD as investors are trailing growth stocks instead. VBR tracks the performance of the CRSP US Small Cap Value Index, which measures the performance of small-cap value stocks. One good thing about this ETF is its diversification inside small caps, as it invests in 848 stocks. The top holding represents just 0.70%. Another good point is about fees, which are just 0.07%.

Last Words

One key characteristic of the stock market is mean-reversion. When prices start disconnecting from reality due to some exuberance, it may pay to oppose it. I’m not saying to sell the rally, as exuberance may last for longer than the money needed to oppose it. But, staying on the safer side, buying more conservative stocks, is a wise strategy, even if leading towards some lost upside. The ETFs above allow for safer bets in conservative sectors like consumer staples and in low volatility stocks. The key idea is to invest in companies with stronger balance sheets, less exposed to interest rates. Next week I will be looking into building a do-it-yourself simple strategy based on these principles.

Comments (0)