Why the Change of Heart at This Popular Investment Trust?

On 1st August the Board of the BlackRock Income Strategies Trust (LON:BIST) announced that it was going to review the fund’s investment objective and policy. The news came as a surprise to its shareholders, many of whom had invested after the new mandate was implemented last February.

BIST’s current remit is to provide investors with a long-term source of income that grows in line with inflation, and with more capital stability than an all equity portfolio. It uses a multi-asset approach to target a total portfolio return equal to the UK Consumer Price Index (CPI) plus 4% per annum over the medium term (5-7 years) before ongoing charges of 0.68%.

In their statement the Board said that they had been considering the objective in the context of the prevailing market conditions and investment outlook post the recent UK Brexit Referendum. Interest rates have fallen since the policy was adopted last February and “there has been a significant decline in the universe of investments which could support a multi-asset approach to meeting the stated investment objective and total portfolio return target.”

The fund was previously called British Assets and is one of the oldest investment trusts, having been launched in 1898. In October 2014 it was decided to move from its global equity remit to a more flexible multi‐asset approach with a rising annual dividend and to appoint a new investment manager. The changes were intended to appeal to the growing number of investors who were expected to take advantage of the new pension freedoms by opting for income drawdown rather than buying an annuity.

At the end of June the largest weighting in the £403m fund was the 37.5% allocation to equities, 24.6% of which were listed in the UK. A further 26.7% was invested in fixed interest, with 12% in alternatives, 7.4% in commodities, 5.1% in volatility strategies and 11.3% in cash.

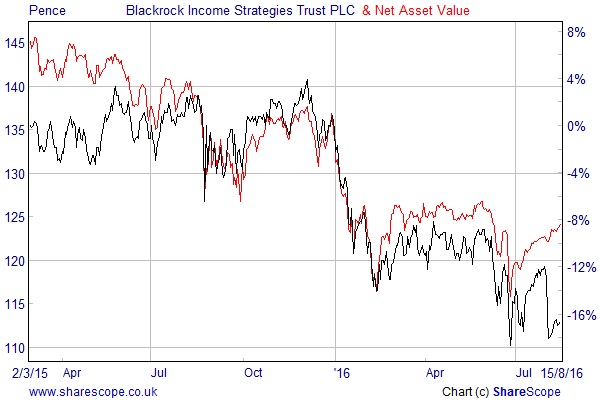

Unfortunately the performance has been incredibly disappointing. Since the start of March 2015 the shares are down around 16% and they now trade at a much wider than normal discount to NAV of almost 9%. If BIST maintains its quarterly dividend of 1.635 pence it would give the fund a yield of 5.8%.

One of the problems could be the high target return, which has forced it to invest a bigger proportion of its assets in equities than would seem consistent with the low volatility and capital preservation aspects of its objective. Another issue is the fund’s long‐term debt, a £60m 6.25% bond that matures in 2031. This gives it a gross gearing rate of 17% based on the current net assets and adds to the risk and the cost.

Despite the uncertainty, existing investors would be well advised to wait for the Board to conclude its review to see what it comes up with, as a well-received change in policy would probably be accompanied by a narrowing of the discount – especially when the share buyback programme is resumed – and hopefully an improvement in performance.

There may also be some wider implications as there are a number of these target return funds – the rest are all open-ended – that have been created in the last 12 months to appeal to retirees who use their pension fund for income drawdown. It is possible that they might run into similar problems in the current low interest rate environment.

Comments (0)