Beware… but Follow the Money

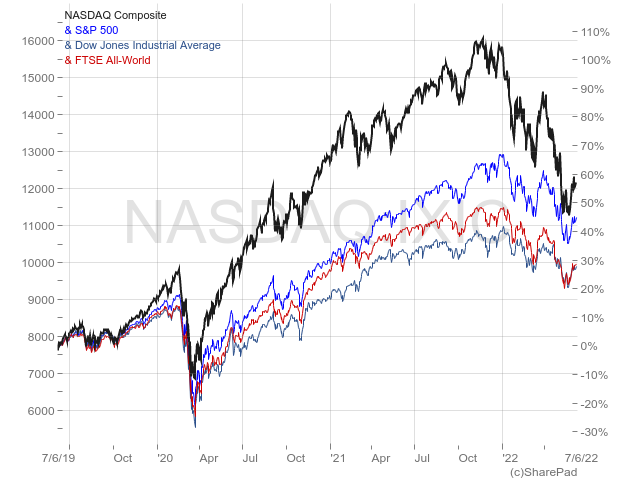

Volatility in financial markets is here to stay, as investors await more data to confirm whether we’re heading towards a recession or returning to growth. Year to date, the S&P 500 is down 14% and the Nasdaq 24%. That’s a pretty bad start for the year and raises the question of whether this is a buying opportunity or a warning.

I addressed this issue in my last blog, A Real Recovery or a ‘Dead-Cat Bounce’. My perspective is that central banks will need to put the brakes on, and that much of the easy money that was delivered into the markets will vanish over the next few quarters.

Rising interest rates will have an impact on consumer spending sooner rather than later, with some of the effects already being seen in the recent performance of consumer-discretionary stocks. Another segment of the market likely to suffer losses is technology, as rising interest rates are a heavy burden on expected future cash flows, thus reducing stock prices.

Even if inflation is rising less than a few months ago, the rate of price increases is still too high and requires strong central-bank action. I believe, therefore, that the best place to stay in the market is in value stocks, as I mentioned in my last blog. An ETF such as the Vanguard Russell 1000 Value (NASDAQ:VONV) presents a simple, diversified and cheap way of getting rid of much of the volatility that is associated with rising interest rates and high inflation. After years of underperformance, it seems value is now ready to beat growth.

However, there is another development we can’t ignore. Warren Buffett is buying stocks again and many other ‘insiders’ are doing the same. After a sell-off that lasted seven consecutive weeks, some indicators point to rarely seen levels of insiders’ buying activity.

For example, according to CNBC Fast Money data, insiders bought more than $400m in stocks this quarter, with April recording a level 17% above the five-year average. The seller/buyer ratio is currently at four/three, a number well below the normal. Data published by The Washington Service confirms the trend; the ratio of companies with insider buying, to those with selling, has doubled in a short period of time and is hitting a level close to what was observed in March 2020. All this trading corresponds to purchases in open market, as opposed to programmed trading.

Insider selling activity is usually much greater than buying activity because insiders are given stock options, which they exercise to purchase shares at low prices and then resell for a profit and income. Therefore, insider selling activity rarely conveys much information about market direction and cannot be interpreted as a selling sign.

However, open-market purchases are different, as they aim to explore market opportunities. Why would an insider buy shares now if they think the market is overvalued and will continue to go down? Well, they may be wrong. But, when many insiders are thinking the same way, that’s very unlikely. If they don’t know about their own business, who does? Insiders − and not hedge funds − are the smart money.

Corporate executives are currently ‘buying the dip’ more than they did in March 2020 after the Covid-19 pandemic crash. Strong insider buying has been historically a good sign for markets. Research has shown that such activity helps predict future positive returns. I wouldn’t go so far as to say that it marks an absolute bottom for markets, because there are still many economic uncertainties, but we can’t ignore that this insider buying activity conveys smart information about short-term prospects. Insiders feel that stocks are undervalued.

I’m far from an insider, so I’m just analysing what’s currently happening, based on broad economic conditions and market indicators. If insiders are buying, it’s because some bounce is likely to occur.

In the short term, investors may benefit from some bold action, by trading the stocks that were hit the most. That means, for example, buying technology stocks or even crypto-related stocks. If you’re happy with that kind of risk, then the GlobalX Blockchain ETF, which lost two thirds of its value this year or the recently created Fidelity Crypto Industry and Digital Payments ETF may be good propositions.

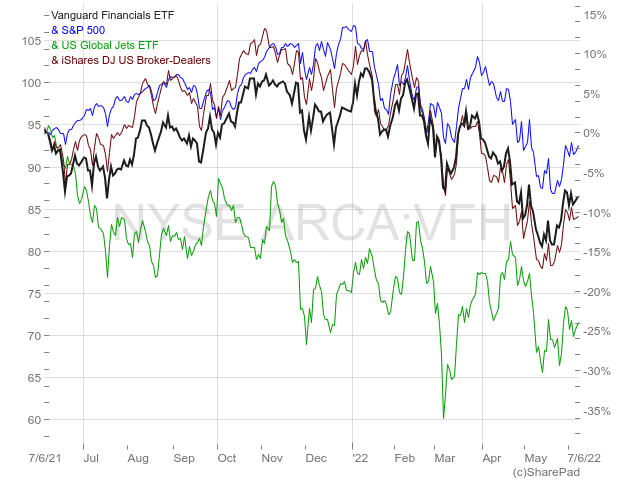

However, I would prefer buying financials and airline stocks. These sector/industries are not exactly composed of growth stocks and have been battered down over time either by the pandemic or unfavourable macro conditions, and are posed for a recovery. At the same time, they carry much less risk than technology or growth stocks.

Vanguard Financials Index Fund ETF (NYSEARCA:VFH)

Performance year to date/one year: -11.4%/-7.9%Net assets: $10.6bn

Fees: 0.10%

Holdings: 375

Top holdings: Berkshire Hathaway, JPMorgan Chase, Bank of America, Wells Fargo and S&P Global

This ETF is a very cheap option as its ongoing charges amount to just 0.10% and it covers a well-diversified portfolio of financials. The sector may benefit from a broad-based bounce and also still benefits from a mild increase in interest rates.

iShares US Broker-Dealers & Securities Exchange ETF (NYSEARCA:IAI)

Performance year to date/one year: -17.6%/-10.4%

Net assets: $443.6m

Fees: 0.41%

Holdings: 30

Top holdings: Morgan Stanley, Charles Schwab, Goldman Sachs, LPL Financial and Raymond James

Companies operating in the investment-services sector have suffered heavier losses than the broader financial sector, as retail investors have been pulling money out of stocks due to the extended decline observed this year. Year-to-date performance for Charles Schwab, Robinhood Markets and Coinbase is scary. They have lost 23%, 55% and 73% of their value, respectively. In my view they are currently a buying opportunity. However, the iShares IAI ETF offers a more diversified trade on this particular industry.

U.S. Global Jets ETF (NYSEARCA:JETS)

Performance year to date/one year: -7.7% / -24.6%Net assets: $3,1B

Fees: 0.60%

Holdings: 52

Top holdings: United Airlines, Delta Airlines, American Airlines, Southwest Airlines and Spirit Airlines

Since the start of the pandemic, airline stocks have been under heavy pressure. The industry found it difficult to survive the Covid-19 lockdown measures but is recovering. The odds for another lockdown are low and this industry has a large margin for recovery. Again, most of these stocks are value stocks, which is beneficial in the current circumstances. The top holdings in JETS are from the US, but the fund invests in global airlines.

Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG)

Performance year to date/one year: -27.7% (since 21 April)

Net assets: $10.7m

Fees: 0.39%

Holdings: 39

Top holdings: Block Inc, Coinbase Global, Marathon Digital and Riot Blockchain

Certainly not for the fainthearted, FDIG is a bold bet on a short-term bounce. The fund is designed to reflect the performance of a global universe of companies engaged in activities related to cryptocurrency, blockchain technology and digital payments processing. After the collapse of Terra Networks along with its (not-so) stable UST coin, market distrust has increased. However, crypto is here to stay in the long term.

Global X Blockchain ETF (NASDAQ:BKCH)

Performance year to date/one year: -64.7% / -66.0%

Net assets: $64.5m

Fees: 0.50%

Holdings: 25

Top holdings: Coinbase Global, Riot Blockchain Marathon Digital, Galaxy Digital and Canaan

Another bold option for the crypto market is the Global X Blockchain ETF, which invests in companies related to blockchain technology. After losing two thirds of its value in one year, BKCH may be positioned for a short-term recovery.

A few final words

I currently have mixed feelings about the market. On the one hand, we have been heading towards a recession and the market is declining because investors placed the growth ‘bar’ too high. After all, we’re not in recession yet and many of the risks that were here at the beginning of the year have increased.

On the other hand, prices have declined to the point that insiders are buying. Given their particularly privileged position, they certainly know much more than I know about their own businesses. When many of these insiders are buying at the same time, some kind of bottom in the market must be occurring, even if just for the short term.

With all this in mind, I still think the safer place to be is on the value side of the market, as opposed to the growth side. However, for a short-term relief rally, trading technology and other growth-oriented assets may prove worth it. From the five ETFs presented above, VFH, IAI and JETS are the safer trades.

Comments (0)