A Real Recovery or a ‘Dead-Cat Bounce’?

This week the S&P 500 closed on a positive note and put an end to a multi-week losing streak that almost led the index into bear territory. However, I believe this to be more of a dead-cat bounce than a real inversion, as economic data continues to point to weakness. Too many years of ‘easy’ money filled Wall Street with excess liquidity, boosting stock prices to unsustainable levels.

On the one hand, money flowing to the stock market is the primary reason why inflation remained subdued. But, on the other hand, this excess liquidity mixed with a buying-the-dip mentality, created the conditions for market crashes to happen from time to time. Unfortunately, inflation is rising faster than anticipated (even though I still believe this has nothing to do with monetary easing) and central banks are tightening. All that easy money sitting in the market will disappear.

I believe we aren’t done yet. We will to assist a downtrend trend that could even end in a crash, if central bankers put too much pressure on liquidity. But one way or another, the next few months will most likely be weak for stocks. However, every cloud has a silver lining, and the current market correction will provide some good entry points for growth stocks later in the year.

An ugly start

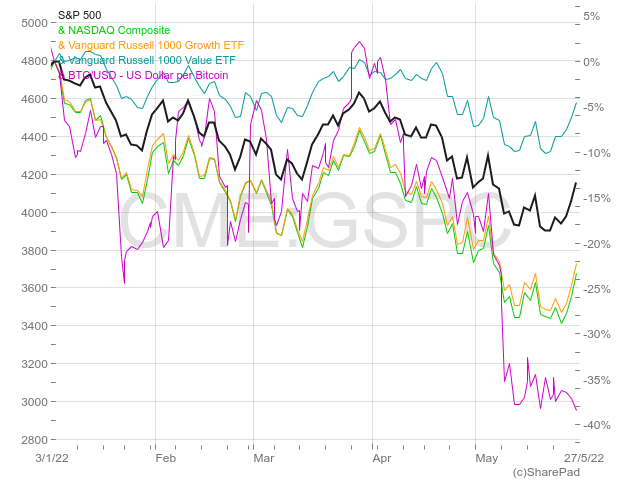

Stock charts for the year don’t look very good. The S&P 500 is down 13.5% and the Nasdaq is down 23%. Bitcoin, the once high-flying digital asset, is down more than 38% (and other digital assets have dropped even further).

The growth-oriented Nasdaq index is always exposed to heavier losses than the broad market, as most of its components rely on high-growth prospects. These assets behave like long-term bonds in terms of reaction to interest-rate changes, as they have a long duration. This happens because most of their promised disbursements to investors occur way into the future (if at all), as opposed to high-dividend stocks.

Digital assets like bitcoin and ethereum are even more exposed to interest-rate risk, even though rarely I see that recognised by crypto traders. When the Federal Reserve (Fed) starts hiking rates, growth stocks top the price declines. The chart below shows what’s going on this year so far. As can be easily spotted, the loss accumulated by the Vanguard Russell 1000 Value (NASDAQ:VONV) is pretty flat compared with the other assets, in particular with its sister fund, the Vanguard Russell 1000 Growth (NASDAQ:VONG) ETF. While the growth fund has gone down by 22%, the value fund has managed to contain losses to 4.5%.

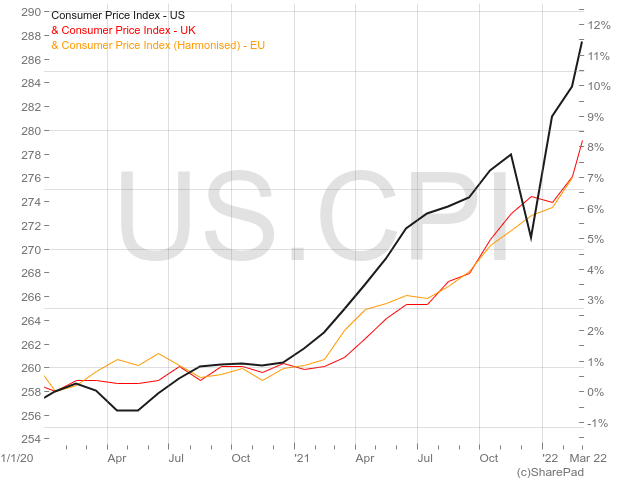

With inflation accelerating around the globe, I expect the Fed to continue hiking interest rates. Any surprises coming from the Fed would most likely, be negative, as the current level of interest rates is still very far away from what is usually considered a neutral rate. Besides, to tame inflation, the Fed must tighten its policy to a higher level than the neutral rate, otherwise inflation will continue rising above its desired level.

Rising interest rates and inflation will sooner or later impact consumer behaviour and reduce financial markets’ liquidity. There are still many downside risks for growth stocks, as investors re-evaluate growth prospects. Recently, we saw some good examples reminding us that there are limits to growth. Meta, the parent company for Facebook and Instagram, is racing to enter new markets as its core business is struggling. Netflix is also experiencing difficulties, losing subscribers daily. As far as the story goes, the culprit is the easing of lockdown measures, but time will eventually uncover some deeper problems with the company’s growth model.

Value is not dead

At times of ‘free’ money, all growth seems unlimited. When that money becomes scarce, growth is re-evaluated. I believe we will see lower prices during the summer before any recovery materialises. After all, we have been seeing heightened volatility and stock declines but the current price/earnings ratios for the US markets are still high, particularly if profits deteriorate. However, value companies are trading at reasonable prices and finally it is time to bet on a factor that has been under-loved for the last 10 years. Value is not dead, it has just been put to sleep by easy money.

There are several ways of betting on value. This week I’m looking at the simplest of all − buying broad-based ETFs. As mentioned above, one good option is the Vanguard Russell 1000 Value ETF (NASDAQ:VONV). Another option is the Vanguard Value ETF (NYSEARCA:VTV).

The most popular is VTV because it is much larger, holding $145bn in assets, compared with VONV (just $9bn). VTV is also one of the cheapest options in the market with ongoing fees of just 0.04%. However, the fees for VONV are not a deal-breaker at a still low 0.08% (despite being double VTV’s fees). An investment of $10,000 would see $4 and $8 paid in fees annually, respectively. Choosing between them is a matter of personal preference. If you prefer a fund that is more concentrated on the biggest market caps, then VTV is your best option. For a less concentrated bet and on a lower average market cap, VONV has the edge. In any case, the top five holdings are the same for both funds, even if in different proportions. The funds’ performance has been similar over the years, with VTV gaining some advantage when markets decline.

I vote dead cat bounce. The fed tightening is not due to start for another couple of months. I don’t see it getting better this year. IMO