Value back in value investing

Richard Gill, CFA, takes a look at two companies which appear to be trading at below their intrinsic value and look like good investments to ride the expected global economic recovery.

Many investors consider the “value” approach to investing to be timeless. Popularised by the Father of Value Investing, Benjamin Graham, back in the 1930s, the strategy sees investors buy securities which are trading at a discount to their so called “intrinsic value” in the hope that Mr Market eventually realises their true worth. These securities tend to be issued by unloved, cyclical or ex-growth companies, with their valuation metrics, such as price to book and earnings ratios, tending to be lower than the market average.

In theory, this approach should be able to deliver decent returns in any sort of market conditions. In his introduction to classic book The Intelligent Investor, Graham states that, “The underlying principles of sound investment should not alter from decade to decade…”.

But like yo-yos and skinny jeans, Graham’s investment style goes in and out of fashion amongst the investment community. Over the past ten years or so, value investing has been notably out of fashion, with the post 2008/09 recession bull market, record low interest rates and unprecedented printing of money by governments worldwide having favoured growth based investment styles.

What’s more, the past decade has seen growth investing outperform value investing, not least evidenced by the US technology stocks boom. On a wider basis, the MSCI World Value Index, which captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets, showed annualised growth of 6.17% in the ten years to October 2020. This compares to a 12.15% annual return in the similarly constructed MSCI World Growth Index – all the more significant when compounded over time. This performance has led many market commentators to ask the question, “is value investing dead?”

But has the tide started to turn in the direction of value once again? In the past month or so, following news of various coronavirus vaccines being found to be safe and effective, value stocks have rallied in the hope that the economy will one day soon get back to normal. It’s worth noting that value stocks have historically outperformed in the early stages of an economic recovery, a situation that many would argue we are now in.

Some notable recent risers include the unloved bankers Barclays and Lloyds, both up 38% since 1st November, with the best FTSE 100 performer since then being airline owner International Consolidated Airlines, up 71%. Meanwhile, US tech stocks including Apple, Facebook and Amazon have seen their shares stall after reaching peaks in September, but many would argue they remain in bubble territory.

In the spirit of Benjamin Graham, this month I am taking a look at two companies which look to be trading at below their intrinsic value and look like good investments to ride the expected global economic recovery.

M.P. EVANS GROUP

On the back of a sustained rally in the palm oil price, Simon Cawkwell is currently singing the virtues of Indonesia based producer R.E.A. Holdings. Elsewhere in the country I like the look of AIM listed peer M.P. Evans Group (LON:MPE), a business which posted record numbers last year, producing 230,000 tonnes of crude palm oil (CPO) from a crop of just over 1 million tonnes. Founded in the 1870s by Matthew Pennefather Evans, the company was originally in the business of tea and rubber but moved into oil palms in the 1970s as the financial rewards became clear.

Palm oil is an edible vegetable oil derived from the fruit of the oil palm, a highly efficient plant which delivers the highest yield per hectare of any vegetable oil. A cheap and versatile product, the oil is used in a range of food products from ice-cream to biscuits and in non-edible items including soap and shampoo. Due to the climate, oil palms grow very well in Indonesia, the world’s largest producing country. They typically take four years before they become productive, with peak yields being reached around years 10 to 12. Having consistently planted c.2,200 hectares on average every year since 2005, spending c.$500 million in the process, M.P. Evans is well placed for growth over the coming years as investment in its biological assets literally bears fruit.

At the end of 2019 the company’s main assets were 39,400 planted hectares of majority held oil palm plantations in Indonesia, 12,200 hectares of associated smallholder co-operative schemes, plus three palm-oil mills. Added to these, the company buys additional fresh fruit bunches from third-parties to produce oil in its mills. In Indonesia, M.P. Evans’s plantations are spread across five provinces and held on long-term renewable leases issued by the government. There are also some smaller assets in Malaysia but the current focus is on expanding the Indonesian estate.

The elephant in the room here is that palm oil production has gained a bad reputation over recent years, mainly due to concerns over plantation owners causing deforestation and the destruction of animal habitats. M.P. Evans however has a clear sustainability strategy, demonstrating its commitment through membership of industry body the Roundtable on Sustainable Palm Oil (RSPO). Any new land is only planted when it has been subject to an independent social impact assessment and the company is currently working towards attaining 100% production of certified sustainable palm oil by certifying its independent smallholders.

Growing palms

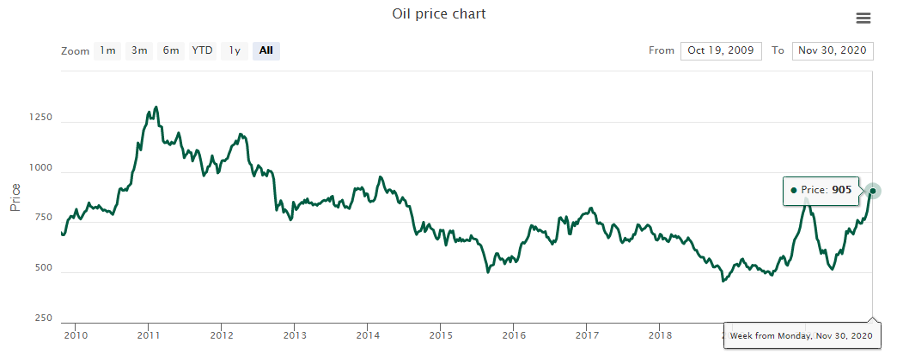

The two main factors affecting M.P. Evans’ revenues are the palm oil price and the amount of oil being produced. Encouragingly, both are currently seeing positive trends. Firstly, crop harvests are expected to increase throughout the current decade as more palms reach production age and maturity. Secondly, palm-oil prices have risen strongly in the last six months, with the current $905 per tonne having not been seen since mid-2014.

Crude palm oil price – 10 year chart. Source: Company

The company’s most recent numbers, covering the six months to 30th June 2020, reported an excellent performance, with revenues up by 64% to $75.89 million. This was driven by a 31% increase in crude palm oil produced (which included fresh fruit bunches brought in), along with a 23% increase in average palm oil prices to $648 per tonne. At the bottom line, the company’s operating leverage was demonstrated, with the H1 2019 net loss of $0.52 million being turned into a profit of $4.3 million. Following the performance, the interim dividend was maintained at 5p per share.

Meanwhile, the balance sheet showed total borrowings of $97.7 million at the period end as the company continued to invest in expanding its operations. Cash however fell from $26 million at the year-end in December to $11.8 million, mainly due to additional capital investment of $16.6 million and the paying back of $6.8 million of debt. A key point is that M.P. Evans expects to effectively complete the investment programme on its existing projects by the end of 2022, which will reduce demands on operating cash flow at a time when crop and production levels are expected to continue to grow.

The most recent update reported that in the ten months to October 2020 the group processed 19% more fresh fruit bunches than in the same period in 2019. This came following a focus on increasing crops from independent smallholders, which rose by 87%. Notably, the company recently piloted its traceability programme for independent smallholders, key for achieving its goal of attaining 100% production of certified sustainable palm oil. Another key line from management in the update was that the company, “…is on the threshold of a substantial increase in production, revenue and cash flow.”

O’il have some of that

Shares in M.P. Evans have had a volatile year, plunging to a near four year low of 400p in March before recovering sharply to the current level of 622.5p. That capitalises the business at £339 million, high enough for inclusion in the AIM 100 and UK 50 indices. However, I see significant room for growth in the valuation.

As discussed above, oil production is set to continue growing in the coming years and capital investment is set to fall, all of which will boost free cash flows. This is all under the backdrop of a rising palm oil price, with every $1 dollar increase going straight through to operating profits. What’s more, corporation tax in Indonesia was cut from 25% to 22% at the start of 2020 and will decrease to 20% from 2021 onwards, further boosting future earnings.

At the end of the last financial year an independent valuation of the company’s land and property assets was undertaken. Applying a market value per planted hectare to the company’s estate, then adding in other assets and removing net debt, delivered an equity value of $792 million, or 1,101p per share. That implies upside of 77% from the current price. Analysts at FinnCap, applying a valuation of $18,000/ha to the company’s plantations, have a less generous target price of 1,000p, but one which still suggests 61% upside. There is also a dividend yield of 2.85% on offer should last year’s total payment of 17.75p be maintained.

CITY PUB GROUP

Perhaps no industry has been hit harder than travel & leisure during the past nine months as a result of the UK’s pandemic inspired restrictions. So it’s no surprise to have seen shares in the sector bounce back sharply following the recent vaccine announcements. Since 1st November, the FTSE AIM Travel & Leisure Index has soared in value by 65%, making it the best performing sector in the whole of the junior market. Nevertheless, I think that value opportunities remain.

It is to the much unloved pub industry we go for my second company this month, with my top pick being City Pub Group (LON:CPC). The business is an owner and operator of premium pubs and pubs with accommodation located across Southern England and Wales. Founded in October 2011, the company had grown its portfolio to a total of 48 boozers by June 2020 and listed on AIM in November 2017 raising a total of £35 million for itself and £11.6 million for selling shareholders.

The company’s pub portfolio consists of predominantly freehold, managed pubs, offering a wide range of high quality drinks and food tailored to each of its pubs’ customers. This gives each pub its own individual style and character, in contrast to many of the chain pub operations which are around today.

City Pub Group is headed up by co-founder and Chairman Clive Watson. Some investors might know him from the Capital Pub Company, a business which he also co-founded in 2000 and listed on AIM in 2007 with a valuation of £32.3 million. Capital Pub then expanded its portfolio before it was taken over by Greene King in 2011 for £93 million.

Last Orders

At the time of the IPO in November 2017, Capital Pub Group had the goal of doubling the size of its trading estate (then 33 sites) by mid-2021. However, following the forced pub closures in March this year this strategy was revised to focus more on high turnover sites which could generate higher levels of EBITDA. Unsurprisingly, the six months to June 2020 were a challenging period for the company, with all of its estate shut from the end of March. As a result, revenues for the period fell from £27.1 million to £12.1 million, with an adjusted EBITDA loss of £1.2 million posted.

In reaction, a number of cost cutting and efficiency measures were implemented to put the company in a position to exit the lockdown in better shape. Any unnecessary capital expenditure was stopped, with four planned development projects suspended for the short term. Other initiatives included streamlining suppliers to benefit from economies of scale, along with a centralisation and expansion of marketing activities. Also, the company is appraising its estate for any excess space which could be sold for alternative uses.

The balance sheet was significantly strengthened during the period via a £22 million share issue at 50p per share. That left the company with net debt of just £13 million at the period end, much lower than many peers within the pub sector. Given the strength of its balance sheet, the company believes it will be in a good position to take advantage of any acquisition opportunities should they arise out of the current downturn.

As at the date of the results on 30th September 37 of 48 trading pubs had reopened since 5th July, with those with large outdoor areas and in close proximity to residential areas being focussed upon. Revenues were strong at around 80% of previous levels, generating positive cashflow, with the company benefiting from the Eat Out To Help Out scheme. Unfortunately, we are yet to receive an update on trading following the second round of enforced closures in November.

Drinks all round

City Pub Group shares bottomed out at 47p in March and following a sharp rise in November have recovered to 92.5p. The main attraction of the investment case here is the asset base, with net assets on the balance sheet as at 30th June amounting to £96.8 million. That figure provides complete backing to the current market cap of £96 million.

What’s more, in the interims the company noted that on a “normalised” trading basis the directors’ valuation of the pubs portfolio is circa £150 million, implying a net asset value per share of approximately 132p. That suggests 43% upside to the current price when trading gets back to normal, an event which is perhaps less than a year away. It should be noted however that management did not elaborate further on how the valuation was reached.

Analysts at Liberum Capital have a slightly higher target price of 135p for the shares and recently noted that Capital Pub Group continues to trade at a discount to many of its peers. I think investors could do worse than to follow Clive Watson, who in mid-November showed his confidence, buying an additional 25,000 shares in the company at an average price of 73.2p.

Comments (0)