Valeant Shares May Hit the Rocks

…and so may activist investor Bill Ackman.

Short-seller turned activist investor Bill Ackman has just recorded a $2 billion write-down on his portfolio due to a failed bet on the Canadian drugmaker Valeant Pharmaceuticals. But he promises to fight back, as he still believes he can build value in the company.

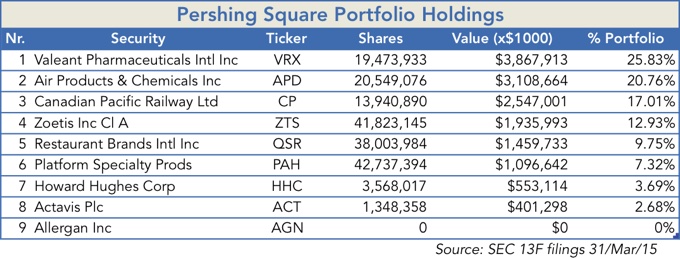

In the 13F form filled with the SEC for the quarter ending 31-Mar-15, Pershing Square (Ackman’s hedge fund company) reported holding almost 20 million Valeant shares, by then worth around $3.9 billion and accounting for 25% of the hedge fund’s entire portfolio – representing a significant risk to its investors. But Ackman, who is in the business of unlocking company value by actively influencing management, thought there was massive value in the Canadian drug maker. A few months later his position was worth nearly $5.1 billion as Valeant’s shares rose from $198 to $263. But then, suddenly, his world turned upside down as Valeant’s business practices were questioned by investors, adding pressure to its share price. Valeant’s business model is based on acquiring undervalued medicines and hiking their prices overnight. With Hillary Clinton promising to impose limits on excessively high pricing in the industry, the whole Valeant business model has been called into question and the shares have started to decline.

Last month, at a time when the shares were finally finding some ground after suffering steep declines, Andrew Left’s Citron Research published a report alleging accounting irregularities at Valeant, which involve a network of specialty pharmacies that the company has never disclosed to investors. The shares plunged 40% in a single session, as investors were scared away due to the Enron-like similarities. Ackman’s $3.9 billion investment (value at the end of Q1) shrank to $1.8 billion (at a share price of $91.98). Pershing Square’s portfolio suffered a $2.1 billion loss in just a few months on a single bet.

The story behind Valeant Pharmaceuticals is rather too complex to analyse here, as there is an entire set of grey areas regarding the company’s accounting practices and its network of specialty pharmacies, still to be uncovered in full. It is not my intention to analyse the prospects for the company in detail or determine its current value. But there are two points to make here – one regarding Ackman’s attitude and another regarding the company’s business model.

First of all, it seems odd to me that someone investing others’ money would follow such a rudimentary risk strategy. At committing one fourth of a $14 billion portfolio into a single position in a company with limited and doubtful growth prospects, Ackman seems more like an all-in poker player than a professional portfolio manager. While delivering alpha is key for a hedge fund, downside risk protection should never be at stake. Judging by the reduced number of holdings in Pershing’s portfolio over time (currently just nine), it seems that Pershing stands to achieve a levered bet on the market more than anything else, one that has substantial more risks than the market offers. By concentrating money in just a few positions, Ackman is too exposed to idiosyncratic risk. While the whole drug manufacturing (specialty & generic) industry is down 1.5% YTD, Valeant is down 35.7%. In Ackman’s case, the performance is even worse.

Second, Valeant’s prospects seem very limited and risky. Ackman often acquires a significant position in a company to be able to force management to act in his interests. He then expects to sell his entire position at a profit. But this time he was overly optimistic about the potential that could be unlocked, as this company is almost entirely dependent on the pricing power it has in the short run. The company shot itself in the foot for the long-term due to its very high prices and almost non-existent R&D. Valeant is not really a drug maker, as I presented above. The company invests just 3% of its revenues in R&D. Valeant is all about acquiring other companies, cutting their R&D and other costs, and massively hiking the prices of the drugs it sells, to squeeze out all the juice it can in the short term. Such a policy is a long-term loser because, over time, these drugs lose market share to competitors who produce alternative drugs more efficiently and market them at substantially lower prices. By then the juice is gone and Valeant just acquires more companies to do the same thing all over again. This is a tremendously inefficient business model, where short-term growth is fuelled by debt and price increases, and nothing is built for the long run.

I would say that Valeant’s growth model is somewhat similar to that of a central bank. When there is not enough inflation, a central bank purchases assets on a large scale, in the hope it will lead to asset price increases and then to gains in the real economy and to higher consumer prices. When the programme starts losing steam, the central bank just increases the pace at which it purchases assets. That was the case with Ben Bernanke when he rolled out 3-4 quantitative easing programmes. That is also the case with Mario Draghi, as he unfolded a €1.1 trillion easing programme at the beginning of the year and is already preparing to extend it. But then, when the central bank stops buying assets, the real economy stops growing and everyone realises that a price bubble has been created. A crash is by then on the cards, but the central bank can always try to avoid it by buying more and more assets.

By its turn, Valeant is not able to grow from its R&D pipeline, as the company spends just 3% of its revenue developing new products. To propel its share price the company relies on acquisitions that extend its portfolio of drugs. It then hikes the price of the acquired drugs, making money for a while, but then losing market share over time. The juice is soon gone and Valeant proceeds to the next acquisition. This process repeats over time. But while growth is delivered, debt grows indefinitely, meaning that if sentiment changes and credit becomes tighter, the music will finally stop. Yes, it will stop because Valeant is not a central bank which can always print more money to fuel the bubble. Valeant’s debt cannot grow indefinitely.

If Hilary Clinton’s comments on drug prices do translate in the near future into drug price limits, Valeant will face a tough period, as its business model is dependent on the price hikes it sets and not on new products developed in-house. All this raises a red flag, in particular when one is planning to purchase a $3.9 billion stake in a company…

I don’t see Valeant’s shares sinking to zero in the near term, but I guess that a company carrying $30 billion in long-term debt on its balance sheet will feel the heat coming from an interest rate rise. Provided that we now are located at the lower extreme of interest rates, the scenario can only worsen. With Yellen threatening a December hike, it is time for Ackman to decide whether he wants to spend his remaining $1.8 billion stake on Christmas gifts or in a war against Andrew Left and the market.

P.S.: When I finally finished writing this article I discovered that Valeant’s shares had declined from the aforementioned $91.98 to $81.24 throughout the day. That makes for another $209 million loss for Ackman’s portfolio… unless he sold them in the meantime.

Comments (0)