Two follow-ups take me into the IOsphere – will these shares reach escape velocity?

Today I am following up on recent news from two of my profile companies – the timing could prove fortuitous.

These two IO stocks are into exploration and exploitation – Iofina (LON:IOF) and IOG (LON:IOG) – both look capable of strong short-term upside.

Both companies are steeped in supplying markets where prices are rising faster than normal.

And both issued statements last week.

One is valued at just £31m, while the other at £152m.

One is on over 50 times current year price earnings, the other just 9 times.

One company has already broken above my price objective, while the other has been a slow starter but is now closing in on my earmarked level.

The shares of each company trade at under 30p.

But most importantly I consider that both companies have the capability of rising over 50% and still look attractive to new investors.

Iofina – rising spot prices

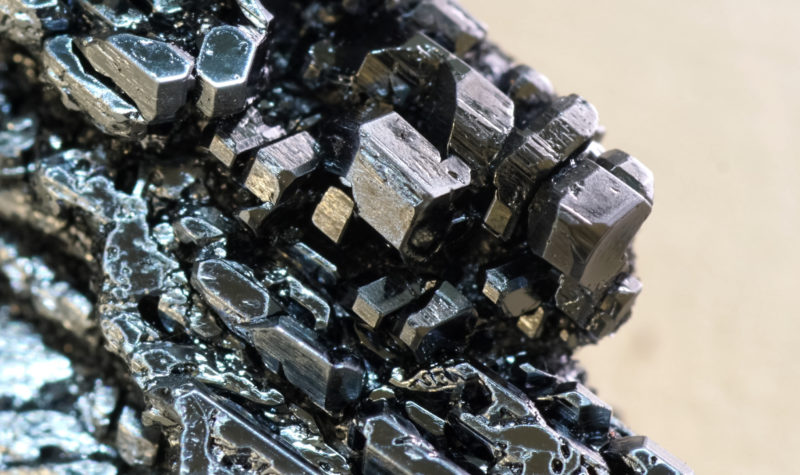

The London-based Iofina, which was set up in 2005, is a vertically integrated business that specialises in the production of Iodine and the manufacturing of specialty chemical products.

It is engaged in the exploration and production of iodine, iodine specialty chemical derivatives, produced water, and natural gas in both the US and the UK.

Notably Iofina is the second largest producer of iodine in North America.

It offers halogen chemicals, disinfectants, electronic specialty gases, sanitisers, heat stabilisers, preservatives, and specialty intermediates, as well as animal health, mineral separation, and odour control products.

Those various products are for use in the electronics/semiconductor, pharmaceutical, food and beverage, personal care, paints and coatings, dairy, chemical intermediates, gemmological, fish and wildlife, and nylon markets.

The company also provides turnkey mid-stream fee-based solutions to third party brine stream operators to extract iodine.

The business

The group operates through two manufacturing entities – Iofina Resources and Iofina Chemical.

Iofina Resources – develops, builds, owns and operates iodine extraction plants using its own technology, and currently operates five producing plants in Oklahoma.

Iofina Chemical – manufactures high quality halogen speciality chemicals derived from raw iodine.

Recent Q3 Trading Update

After having announced record interim results at the end of September, last week’s Q3 update confirms that the outlook has continued to improve.

Production is on track for its H2 target, while iodine prices continue to creep higher.

The market for iodine and iodine complexes remains robust. The strong demand and tight supply of iodine have continued into October.

The spot price was around $37kg in early September and has gone up to around $40kg currently.

The construction of its next iodine plant is still expected to commence before the year-end.

Going forward

The outlook for demand of iodine suggests that it will remain strong into 2022.

President and CEO Dr Tom Becker stated: “We are heading for another strong year. The company is on track to meet its H2 crystalline iodine production target and demand for our products continues to be robust. With the iodine spot price also climbing higher, the outlook is certainly encouraging.

Importantly, we remain focused on increasing our production capacity and continue to negotiate terms for our latest plant, IO#9, with construction expected to start before the year end. We look forward to providing further updates in due course.”

Broker’s View

Analyst Jonathan Wright at finnCap is estimating that the current year to end December will see revenues up from $29.7m to $36.7m, with adjusted pre-tax profits leaping from $1.3m to $4.5m, generating 2.3c (0.7c) in earnings per share.

For the 2022 year he is going for $39.1m of sales and $6.1m in profits, worth 3.2c per share in earnings.

Conservatively, current forecasts are based on a 2022 iodine price of just US$35/kg.

My View

On the face of it, against such strong iodine prices, I consider that the broker may well be too cautious in his 2022 forecasting.

Even so, I note that he has a price objective of 25p on the shares, currently 16p, so there is some strong upside potential for this little £31m capitalised group.

I believe that my own price objective will be beaten very shortly, with Jonathan Wright’s aim being an easy ambition for 2022.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p)

IOG – first gas due soon

My second company profile follow-up concerns the recently added IOG (LON:IOG) the Net Zero UK gas and infrastructure operator focused on high return projects.

Early last week the group provided a drilling update on the Southwark field, the third of its Phase 1 fields after Elgood and Blythe.

A drilling rig supplied by Noble Corporation, had recently been used on completion work on the Blythe gas field. It was then transferred for use on the group’s Southwark interest.

On Sunday of last week, it was starting its routine jacking-up operations, when a mechanical problem on one of its legs was identified, necessitating an immediate halting of the installation procedure.

Drilling had not started.

The rig went to full muster while the issue was assessed and all 66 people on board have remained safe and well.

Subsequently the rig has been transported back to port for assessment.

It is understood that there was no damage to the rig hull or to the Southwark platform itself.

This will obviously cause a slight delay in planned operations on the group’s Saturn Banks gas project drilling programme for Q2 2022.

No impact on ‘first gas’ within weeks

However, there has not been any impact upon the group’s Blythe and Elgood fields.

That is very important, it also throws up an excellent buying opportunity.

Blythe and Elgood are still expected to deliver first gas in this final quarter of the group’s trading year.

Broker’s View

The group is expected to see initial revenues in the year to end December of some £15m (£nil).

That should turn the group around from a £6.8m loss last year to a £3.6m adjusted pre-tax profit for this year, worth 0.6p (1.1p loss) in earnings per share.

The massive uplift is expected in the coming year, with estimates of £108.5m of sales and an excellent £64.9m profit, worth a mega 10.2p in earnings per share.

Consider that against the group’s shares, which peaked recently at 32.5p, but are currently trading at around the 29p level.

My View

Just think – 29p to buy 10.2p of earnings – that is a staggeringly low rating.

Even more so when you consider that currently gas prices are at record levels.

In my view that really does make the shares of IOG look too good to miss – just get out there and take advantage of the price easing on the rig news of last week.

Although they have already reached my price objective, the shares could easily hit 45p to 50p.

Remember the market is all about opportunity!

(Profile 06.09.21 @ 22.5p set a Target Price of 30p*)

Comments (0)