Ignore what you read: Tesla is not worth more than GM or Ford

It’s all about the Enterprise Value

For the last few days, you would have probably seen headlines such as “Tesla is worth more than Ford – and GM is in sight” and people arguing about whether Tesla is worth being valued at the same level as GM and Ford. All those discussions highlight a major issue with how people incorrectly value companies.

Imagine someone wants to buy Tesla, or Ford, or GM today. The price you would have to pay is not just the market capitalisation, debt repayments and cash in the books. The concept we should be looking at is enterprise value. We at CityFALCON run London Value Investing Club, and make sure that to consider enterprise value when performing fundamental company research.

Please note that the purpose of this piece is not to discuss whether Tesla is a good or bad investment at this stage but to explain the importance of looking at the enterprise value.

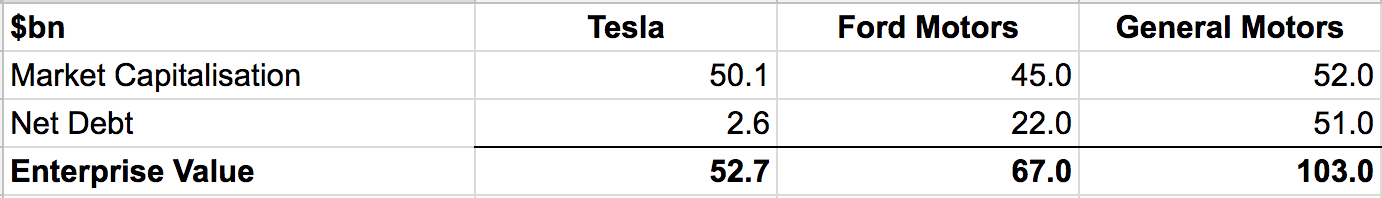

Below a comparison of the enterprise value of Tesla, Ford and GM. As you can see, General Motors’s enterprise value is twice as high as Tesla:

Source: Google Finance (6 April 2017)

What is Enterprise Value (EV)?

Enterprise value is an economic measure reflecting the market value of a business. It is a sum of claims by all claimants: debtholders (secured and unsecured) and shareholders (preferred and common).

Enterprise value is one of the fundamental metrics used in business valuation, financial modeling, accounting, portfolio analysis, and risk analysis.

Beware the pitfalls of focusing only on market capitalisation

Companies can raise capital in different ways — through equity, debt or convertible debt. Also, some companies generate a ton of cash and may or may not give out dividends. By focusing only on market capitalisation, investors are not considering the entirety of the business. If you are comparing companies with different capital structures, do look at the enterprise value.

So why do some analysts and media focus only on market capitalisation? Simple answer — market capital is easy to find, calculate and track on a continuous basis. EV calculations are not easily available and/or not usually updated on a regular basis. When doing my research, I calculate the EV by looking at the balance sheet of companies and not only the market capitalisation.

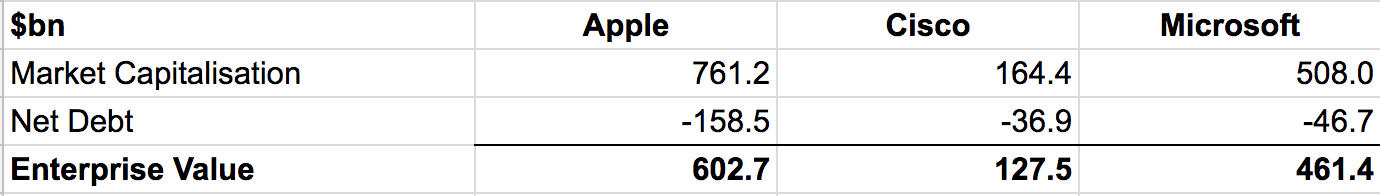

Examples of companies with negative net debt you’re probably overvaluing

Source: Google Finance (6 April 2017)

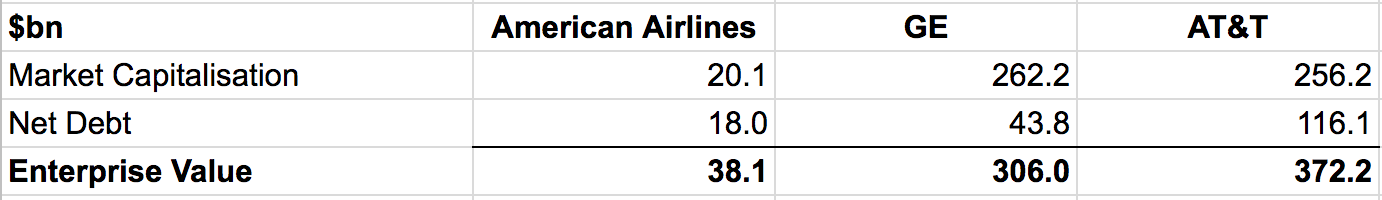

Examples of companies with high debt you’re probably undervaluing

Source: Google Finance (6 April 2017)

You can track fundamental stories including tweets about Tesla, GM, and Ford Motors on the CityFALCON platform here.

About the author

Ruzbeh Bacha is the founder and CEO of CityFALCON, and runs value investing meet-ups in 10 cities. He has been investing and trading in the markets for the last 15 years, is a qualified accountant and has an MBA from University of Oxford.

Comments (0)