Stocks in Focus: Rural Broadband Solutions

Derren Nathan of Hybridan stockbrokers takes a detailed look at Rural Broadband Solutions, which specialises in providing fibre quality broadband to rural communities.

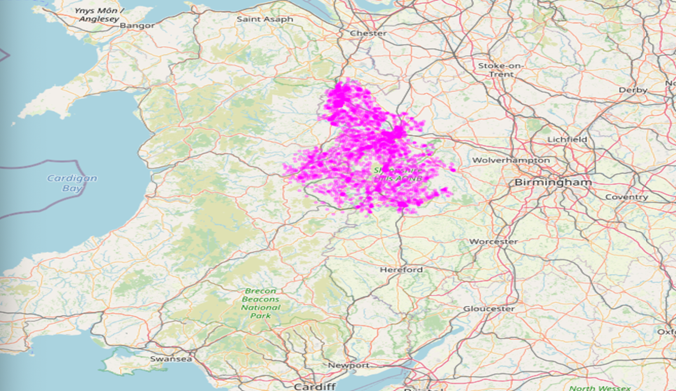

Rural Broadband Solutions Plc (AQSE:RBBS) (formerly SAPO Plc) last month made its first foray into the rural broadband space, completing the reverse takeover of Secure Web Services Limited (SWS), a provider of alternative high-speed broadband services to customers within rural areas of Shropshire. This has been accompanied by a £2.5m placing at 2.5p which, post the acquisition, leaves a cash balance of circa £1.2m to fund network upgrades and expansion (alongside Government voucher schemes) and client acquisition. SWS enjoys high levels of recurring revenues, almost zero attrition and EBITDA margins of over 30%. It is an essential utility provider to its customers who otherwise have to rely on legacy copper cables that if not close enough to the fibre cabinet (often the case in rural areas) can lead to sub optimal internet connectivity. SWS solves this issue through a combination of fixed and wireless technologies where low population density makes a full fibre solution economically unviable.

RBBS aims to grow subscriptions through a programme of upgrading its core network to deliver Gigabit capable services and by offering its customer base free installation utilising the Gigabit and Regional Gigabit Voucher scheme, which could mean that the majority of its expansionary capex requirements are Government funded. What’s more, the March 2020 Budget reiterated the Government’s £5bn commitment to fund gigabit-capable deployment in the hardest to reach 20% of customers/households. Full gigabit capability nationwide has the potential to drive productivity and industrial innovation and has become a necessity.

RBBS currently has a monthly recurring customer base of over 2,300 customers. In 2019, SWS posted turnover of circa £730,000 and EBITDA of circa £250,000. We share RBBS’s confidence that it can double its customer base within its existing coverage area to circa 5,000 within 36 months, not factoring in acquisitions or geographic expansion. We would expect the experienced management team to be extremely active on deals and new territories.

As we find ourselves in the midst of another partial national lockdown, the importance of fast internet for all is yet again apparent for professional and social activity, as well as protecting the vulnerable. The COVID-19 pandemic has thrust the issue of domestic connectivity higher up the political agenda in the UK. According to an article on the trade website ITProPortal.com on 5 August, internet traffic in the UK has surged by 78.6% since the end of February 2020. A reliable and fast broadband connection is being ever more viewed as an essential utility in the same way that energy and water supply are. Such provision is essential for people to connect, stay entertained and stay safe by working from home. This view is now transcending generations.

Such connectivity is now equally important to pensioners (perhaps even more so in isolated rural locations) who whilst being deprived of face-to-face contact, have also been embracing virtual forms of communication to keep support networks, healthcare appointments, family ties and social interactions alive. In the healthcare world video consultations are ever more commonplace from GP Practices through to more specialist units.

Enabling Gigabit connectivity across the UK has the potential to drive economic recovery from the current challenging environment, particularly given that home-based working, delivery of health services, entertainment and even education is likely to remain a larger part of the ‘new normal’.

A study earlier this year from Assembly Research, has forecast that the UK Government’s deployment of “gigabit-capable broadband” could provide a £51.4bn gross value to the economy in five years. This would largely be due to productivity increases. But gigabit connectivity for all could unlock completely new ways of doing things in the same way that railways drove the industrial revolution.

The reality of what constitutes an acceptable internet speed is continually moving up the megabit per second scale. The Government currently defines decent broadband as a download speed of at least 10Mbps, and an upload speed of at least 1Mbps. An estimated 155,000 UK properties (0.5%) are unable to get even “decent” broadband.

From March 2020, the new Universal Service Obligation requires that every household be entitled to at least a 10bps service. If a customer does not receive this, they are entitled to request it from BT/Ofcom. If there is no provider possible, the main operator, Universal Services Provider must provide this service and that provider will get a government subsidy of up to £3,400 per household (by way of an incentive to Openreach or KCOM (in Hull Only) to ensure that all users get a minimum standard of service). However, if there is a 10Mbps provider registered with Ofcom, BT must direct the customer to that provider; SWS is registered as a 10Mbps provider throughout its service area. This therefore provides a significant opportunity for RBBS, enhanced by the recent OFCOM conferred permissions for SWS to build infrastructure on public and private land.

During his campaign to become leader of the Conservative party, Boris Johnson pledged to ensure full fibre optic connectivity across the UK by 2025. This pledge has somewhat softened since taking office. Instead, ministers are now seeking to roll out “gigabit-capable” speeds over a less defined timeframe but as it stands that population is unlikely to comprise much more than the 10% currently benefitting from full fibre, still leaving the majority of the country requiring an upgrade to ensure it is future proofed. Ultrafast connectivity as defined by Ofcom equates to connections capable of delivering download speeds of 300Mbps or more.

The term fibre can be rather misleading to the uninformed. FTTC or fibre-to-the-cabinet is where a roadside box or cabinet is connected to the telephone exchange by fibre optic cables. However, the link from this station in the network to the premises it serves can be traditional copper cabling with the ultimate broadband speeds dropping rapidly as the distance from the cabinet to the premises widens.

In a sample of cabinets assessed by Ofcom in 2019, it was estimated that some 87% of Openreach (the BT-owned company that manages the UK’s local access network) cabinets had been upgraded to FTTC. However, the above dynamic encapsulates why FTTC is generally not a satisfactory solution for rural communities. Pure or full fibre-to-the-premises (FTTP) on the other hand suffers no such loss of connection. This perhaps makes sense in more densely populated areas where individual cabling tributaries can be used to serve multiple users and there is already perhaps sub surface ducting installed for other utilities which the fibre can be run through. The costs of laying fibre can vary tremendously depending on terrain, existing infrastructure, and permissions and we estimate can cost anything from £25k to £500k over a 5k distance. Our discussions with RBBS management suggest that an equivalent wireless connection which can deliver up to 10Gbps (ten thousand Mbps) is much less variable, typically costing some £30k.

RBBS notes that satellite services are not competitive because fixed line solutions deliver quicker and better-quality broadband, and government funding does not fund satellite infrastructure. As yet, satellite technology is not able to match fixed line solutions. 5g mobile networks could be viewed as another competitive threat, but we believe the reality is that areas that are truly rural in nature will be very far down the priority list of mobile network operators as has been the case with previous generations of mobile connectivity. Indeed, Openreach recently warned that Government targets appear to be in jeopardy, specifically referencing that for rural areas ‘it is harder, more expensive and very labour intensive to get the job done’.

Openreach has not completely ignored governmental pressure to close the urban divide, committing to bring full fibre to some 3.2m homes across 251 market towns and villages in the UK over the next six years. However, a market town as such acts as a hub for rural regions, and smaller villages such as those served or targeted by RBBS may well continue to be overlooked by Openreach.

As a case in point within the SWS heartland of Shropshire, there is only one town that makes the proposed expansion list. Ludlow, a market town of some 10,000 inhabitants, is situated near the edge of SWS’s current coverage area. We believe that less populated deep rural areas such as those where the majority of the company’s current client base are situated, will remain a low priority for larger Internet Service Providers who continue to focus on more densely populated areas amenable to a full fibre or fibre to the cabinet solution, leaving the market well placed to be served by a nimble specialist such as RBBS. The acquisition of a niche provider with a substantial customer base is in our view a more likely route for the larger players to enter this space than organic expansion.

RBBS is likely to take advantage of the Rural Gigabit Voucher Scheme (RGV), a £200m scheme introduced in May 2019 where infrastructure builders such as SWS can claim back capex to upgrade ‘rural’ (over 60% of properties outside cities and large conurbations) properties currently on infrastructure which cannot receive a service of over 100Mbps. Vouchers can be redeemed for £1,500 per home and up to £3,500 for each small to medium-sized business (SME) to support the cost of installing new fast and reliable connections.

The RGV scheme closes for applications in March 2021. However, in May 2019, the Chancellor announced a £5bn commitment to fund gigabit-capable deployment in the hardest to reach 20% and whilst the mechanics are not yet fully defined, we are encouraged by this pledge.

SWS has been built by providing super-fast broadband alternatives (30Mbps +) to customers who have otherwise been reliant on the limited speed and latency of the Openreach (copper) infrastructure. The company has insignificant churn across its customer base, demonstrating high levels of customer satisfaction. The path to establishing its 2,300-customer base has been largely community driven and through word of mouth. It is estimated that at least a further 2,000 customers (households) receive less than 10Mbps out of SWS’s catchment of 40,000 households in its geographical market. These are the low hanging fruit covered by the Universal Service Obligation where SWS is the only game in town. The balance of customers (circa 35,000) receives more than 10Mbps from an alternative supplier and it is RBBS’s objective to target them with both 30 + Mbps services and ultimately a “Gigabit” capable service utilising the RGV scheme.

The business has a proven track record in deploying the latest mixed fibre/wireless technologies. The management of RBBS believe that following necessary upgrades to the SWS network it will be capable of delivering Gigabit capable services and that most or all the capex required to do so will be reclaimable.

The network currently consists of 75 masts providing coverage across some 1,600 square kilometres. To enable gigabit connectivity, SWS will increase the number of wireless aggregation points enabling a greater proportion of the final connections to the home to be fibre based. These are then trunked back wirelessly from a local pole to the wireless node where backhaul/connection to the global internet is completed. Such an approach should ensure that SWS will be the only supplier of comparable broadband in its localities.

RBBS will also be selectively targeting acquisitions where it is possible to capture 60-70% gross profit margins across a customer base. According to ispreview.co.uk (one of the United Kingdom’s biggest locations for Internet Service Provider related news), there are close to 100 fixed wireless broadband providers in the UK. RBBS is well placed to consolidate these niche players. Whilst we expect limited competition from larger providers in expanding into other deep rural locations. RBBS plans to become the dominant provider to such locations. It stands to rapidly grow a high-quality revenue stream, with attrition rates likely to remain at near zero. The offer to customers is future proofed and well-priced. Customers generally do not have a viable alternative. Whilst organic deep rural expansion may not be viable for larger players, the acquisition of an infrastructure-rich specialist and its customer base may well be on corporate and private equity agendas. We have already seen this in urban areas with high multiples paid for CityFibre (62x EBITDA) and Kcom (12x EBITDA) in recent years.

Comments (0)