Small Cap Oil Services Plays

Sell-offs are often a great opportunity for patient investors to acquire prime assets on the cheap, and the recent sell-off in the oil & gas services sector appears to be a case in point. In this month’s small-cap section we have put together a selection of the most exciting companies in the sector, all of which have seen their valuations dragged significantly lower of late. All of the companies featured boast specialist capabilities and technology, which could make them prime targets when it comes to industry consolidation. They also boast relatively strong balance sheets, which should mean that each company is relatively well placed to weather the current downturn.

KBC Advanced Technologies at 99p

Walton-on-Thames based KBC Advanced Technologies (KBC) is a specialist provider of proprietary simulation software (70% of EBITA in FY 2014) and associated consultancy services (30%) to the oil & gas sector. It is also the market leader for profit improvements in refineries and processing plants. In upstream the firm’s proprietary software helps oil & gas firms minimise capital spending, through accurate modelling of reservoirs and flow assurance. Downstream, KBC can help clients manage their facilities more efficiently through optimising processes, eliminating bottlenecks and maximising yields. With the energy industry set to cut capex by $250 billion per annum by 2018 (according to Wood Mackenzie), KBC’s technology is likely to be in high demand.

The fact that KBC offers customers end-to-end services incorporating the entire production process from extraction to refining means that it is able to position itself as a ‘one-stop shop’ and punch above its weight. KBC currently has operations in 60+ countries with clients including state-owned oil companies, blue-chip integrated majors and 2nd-tier independent E&Ps. To operators such as these, even a minor reduction in costs in percentage terms can quickly stack up to millions of dollars in savings.

At the beginning of December, KBC won a two-year contract from a South American oil and gas company, to expand its support to the refinery with a focus on providing operational readiness and management support for the upcoming revamping of its facilities. The contract is said to be worth more than $48.6 million to KBC over a 24 month period and extends the current contractual relationship to 2018. What’s more, the contract same as a direct consequence of improving plant performance, with savings of c.$100 million said to have already been delivered. As Executive Chairman Ian Godden observes, “This is the third largest award in the Company’s history and gives us excellent revenue visibility into 2015 and beyond.”

More recently, at the end of December the firm secured a 7 year, £3.3 million landmark contract to license KBC’s simulation software. The agreement includes the Maximus, Multiflash and Petro-SIM modules covering all E&P stages from reservoir chemistry and well bore/pipeline modelling, through to process facilities simulation. This deal in particular is evidence that recent acquisitions intended to augment the firm’s upstream offering are having the desired impact, with the upstream market estimated to be worth c.10x the downstream market. As of January KBC still had around £15 million in net cash on its balance sheet, which means that further such acquisitions could be on the way in 2015. With the focus moving towards higher margin and more reliable software revenues, and the consultancy division becoming more selective in the type of work it takes on, the outlook for revenue quality is improving.

2014 results released last month showed that KBC has maintained its momentum in the face of the falling oil price. Adjusted EBITA climbed 15.1% to £10 million on sales up 16.7% at £76 million, driven by a record year for the software division. However, the standout metric was the record order book, which at £88 million was up by a whopping 40% since June and represents a H2 book:bill ratio of 1.25. With £40.5 million of this backlog set to crystallise in 2015, this provides excellent visibility and should help dispel any concerns the market may have over the impact of the oil price on the group. KBC noted that 2015 has got off to a good start with the market for its services decribed as “steady”. Nevertheless, KBC isn’t about to become complacent, and it has put in place “further contingency plans, should the market deteriorate”.

The markets seem to have taken an overly harsh view of KBC’s prospects in a lower oil price environment. Lower oil prices will force operators in the sector to become more efficient, and KBC can help them do that. Research house Equity Development has a price target of 162p for the shares, which still trade on a significant discount to the wider oilfield services sector. With the prospective earnings multiple only just into double figures, the valuation looks unduly cautious given the proprietary nature of the group’s technology offering, the strong growth prospects (Equity Development expects double-digit profit growth in each of the next three financial years) and the strong balance sheet.

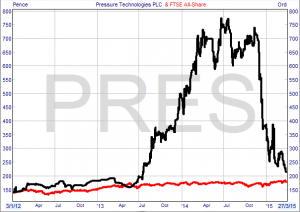

Pressure Technologies at 215p

After a remarkable ascent in 2013/14, shares in speciality engineering firm Pressure Technologies (PRES) have more than halved since November 2014, mainly on the back of investor concern over its exposure to the deepwater drilling and hydraulic fracturing ‘fraccing’ markets. The fact that these are the areas of the market most exposed to the downturn in the oil price (given the marginal nature of many of these resources) means that Pressure Technologies carries the most short-term risk of the three stocks mentioned in this piece – but on the flipside, it also suggests the shares have much to gain in a recovery.

Under its original identity as Chesterfield Special Cylinders (CSC), Pressure Technologies has been a leader in the design, development and manufacture of high pressure seamless steel gas cylinders for over 100 years. Its origins trace back to The Universal Weldless Steel Tube Company Limited, which was formed in London in 1897 and later acquired in 1906 by Chesterfield Tube Company Limited. Under a succession of owners, the business was at the forefront of all major technical advances in seamless steel cylinders throughout the 20th century.

The group comprises three key trading divisions: Chesterfield Special Cylinders (CSC), Chesterfield BioGas (CBG) and Engineered Products. CSC supplies Air Pressure Vessels (APVs) for oil rig motion compensation systems and deepwater offshore platforms, as well as breathing air cylinders and gas storage. In addition to the oil & gas market, CSC also has a world-class reputation in the submarine sector, delivering design, development and retesting services to a number of the world’s navies. Meanwhile, the Engineered Products division provides a wide range of control and testing equipment for drilling systems and precision engineered valve wear parts used for flow control in the subsea and surface oil and gas industries. The smallest trading division, albeit rapidly growing in importance, is Chesterfield BioGas (CBG), which was established in 2008 following the signing of a co-operation agreement with Greenlane Biogas Limited, the world leader in biogas upgrading, which was acquired outright by the company in September 2014.

Pressure Tech has been active on the M&A front of late, adding areas of technical capability and exploiting opportunities to utilise the group’s infrastructure to drive growth. Although this has left it somewhat more exposed to the downturn in some of ‘growth’ markets such as US fraccing, the balance sheet has not been left exposed as much of this was funded through fresh equity rather than debt. At the end of the financial year ended 27th September 2014, the firm had net funds of £5.8 million, and newly negotiated bank facilities have provided a further £25 million revolving credit line, which provides ample room for further acquisitions plus any deferred considerations from recent deals. Ultimately, the firm sees itself as a consolidator offering an attractive ‘umbrella’ platform for small but nevertheless very capable businesses operating in niches within the engineering sector.

A trading update in February made it clear that the group faces considerable near-term challenges. In particular, short lead times and pricing pressures are expected to present a tougher trading backdrop in H2, despite sales and ordering currently being in line. In addition, major oil and gas end markets for SCS still show no firm indications of recovery, and other divisions have experienced some contract slippage. While we believe forecast risk could still be to the downside over the near term, this is already reflected in a prospective current rating of 7.3x, falling to just 5x for FY16 (based on house broker Charles Stanley’s forecasts). There is also a historic dividend yield of c.3.7% on offer and management has pledged a continuation of the firm’s progressive dividend policy. The house broker’s current price target of 520p suggests there is scope for the shares to more than double from here.

Plexus Holdings at 237p

Plexus Holdings (POS) is living proof that small companies can compete with the big boys, given the right product. Utilising its proprietary “POS-GRIP” technology, Plexus has developed a safer, more cost effective, reliable and technically superior wellhead which it supplies to an impressive list of blue-chip oil and gas operators worldwide. Revenues predominantly derive from the rental of POS-GRIP wellheads for jack-up exploration, although the range of commercial and safety benefits of POS-GRIP also apply to surface production and subsea wellheads. Since the company was founded in 1997, its technology has been used in more than 350 oil and gas wells worldwide, and major operators are increasingly adopting its sophisticated technology, which is gaining significant traction in the face of strong incumbent competition from the established majors.

From its base in Aberdeen, the UK’s oil capital, Plexus currently has capacity for between 12-16 operations at any one time. However, in order to address the huge potential market for its technology, it recently secured a new factory directly opposite its current site from Baker Hughes, and it has also established a subsidiary in Singapore to address the booming Asian energy industry. But the real opportunities facing the company lie in translating the technology for other industry verticals. One major example is the firm’s Joint Industry Project (JIP) for a new subsea wellhead design labelled “HGSS”, which management reckons could deliver cost savings in the region of $506 million per well. This has attracted some high profile partners, including Senergy and BG Group, and a prototype is expected to be running by H2 2015. Management also believe that the company’s proprietary technology has additional wide ranging applications outside the oil and gas industry, and may well extend beyond conventional oil and gas to, for example, undersea deposits of methane hydrates, and geothermal drilling.

Results for the year to June 2014 saw a 5.7% rise in revenue to £27 million and EBITDA up 19% to £9 million. EBITDA margins grew an impressive 300 basis points to 33%, while net margins advanced by 700 basis points to 19%. This was primarily driven by growth in international revenues and HPHT (High Pressure High Temperature) wellhead rentals. The importance of product development and innovation to the group was highlighted by a 61% increase in R&D spend, to £2.37 million, while spending on intellectual property, patent development and filings also increased strongly, by 42.7% to £0.18 million. The momentum was maintained at the interim stage, with the firm’s results for the six months to 31st December 2014 showing a 7% rise in revenue to £13.51 million and a 14% increase in EBITDA to £4.16 million. The balance sheet looks relatively conservatively managed, with net borrowings of £4.07 million as of 31st December 2014.

One of the biggest issues investors have historically had with Plexus is the lofty valuation. While the quality of the product and strong growth prospects are pretty much undeniable, the fact that the shares have at times traded on earnings multiples well in excess of 50x has left it easy to argue that the upside is reflected in the valuation. However, the Plexus share price has pulled back significantly since the high of 321p reached in June 2014, and current forecasts from house broker Cenkos put the shares on a prospective multiple of c.40x for the current financial year. That may not sound ‘cheap’, but it is well towards the lower end of the spectrum in terms of the shares’ historic trading range and Numis’s “bull case” valuation of 1,145p. It is also worth bearing in mind the wider potential applications for the firm’s technology, and that Plexus’s founder Ben van Bilderbeek still owns a majority stake in the company, even after all these years. We suspect that rather than offload the shares to the market, Bilderbeek is holding out for a trade sale in the hope that Plexus’s competitors appreciate the potential value of its technology better than the market does.

Comments (0)