Reality strikes at Sirius Minerals

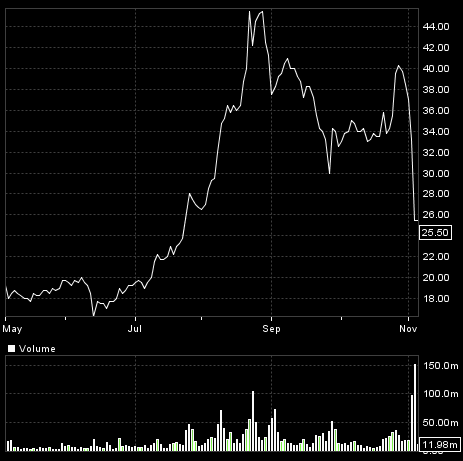

Shares in Sirius Minerals have rightly suffered a major pullback over the past few days, and many private-investor enthusiasts for the stock have been badly burned. The trouble with Sirius is that there is a lot of questionable analysis out there in the public domain right now. Here’s my attempt at setting the record straight…

The theme underlying all my posts has been how to value a share – particularly those in the mining sector. Readers will have noted my scepticism that anyone in the markets – analysts included – knows how to do it properly. My scorn is particularly directed at ‘bogus’ valuations for long-term projects where an ‘NPV’ per share ‘target’ is relied on by almost all analysts (as far as I can see) to bamboozle investors.

I was particularly sceptical of those two brokers trying (and succeeding for a time) to hype up Sirius Minerals’ shares in August (in order, of course, to ingratiate themselves into the accompanying juicy commissions gravy train) before the capital raise necessary to get its Yorkshire polyhalite fertiliser mine up-and-running in six to ten years’ time.

We now see my lesson (derided by some at the time) coming home to roost in a big way – after a lag during which time the ‘vacuum of ignorance’ and ‘momentum’ effects prevailed over any realistic value per share. The institutions just wouldn’t buy into those bogus ‘targets’. Nor anywhere near them!

Even though those analysts were more accurate (and honest) than most – in that they adjusted their NPVs per share for their estimates of the dilution to be brought about by the shares necessary to be issued – they spoiled their exam papers by using NPVs boosted by taking in an amazing 60 years’ future earnings. (What other share is ever valued on such a basis?) The analysts justified this because the mine will have a c. 100 year lifespan. But the same could be said for any other long-lived investment, such as a conventional company with an indefinite lifespan.

Imagine that that 60-year NPV basis applied to, say, a retailer who investors regard as a relatively stable earner into the future. Take Debenhams (merely as a mathematical example). Even though it is under its own short-term pressures, few people would bet on Debenhams not being around for a good while longer.

At the current 53p, Debenhams is valued at 7 times annual earnings per share (7.6p). At the same 8% discount rate over 60 years as used for Sirius, the ‘NPV’ of Debenhams earnings 60 years ahead would be 94p – twice the value the market is actually applying. And that is for pre-existing earnings, against the ten or so years investors will probably have to wait for Sirius.

So it is that the institutions have imposed reality – placing their own more sensible value (20p) on Sirius’s shares, against the 60p plus ‘targets’ those analysts would have had them think they were worth!

But at least Sirius now has the majority of the funds in place that it needs for stage one, I hear you cry! Yes of course, but at a cost substantially more than those analysts projected. The resulting fully converted shares in issue before the ‘stage two’ financing in a few years’ time will be 5.5bn (after conversion of the $435m bond) against the worst-case 4.3bn that I assumed in my own calculations (based on the analysts’ previous capital raising scenario).

Despite the very low price, it is being said that Sirius’s whole financing deal has been possible only because the $300m streaming (royalty) deal announced a week before has served as the cornerstone for the $1,150m total. But that didn’t exactly set the shares on fire either, despite being welcomed by the analysts who used it to inch up their ‘targets’ a little further.

In all other royalty and streaming finance deals that I have examined, they turn out to be considerably more expensive (although not obviously so) than would be loans or project finance. For Sirius the deal with Australia’s Hancock Prospecting is to take 5% of all revenue on the first 13Million tonnes of product sold each year and 1% of all revenue above that – for the whole life of the project.

At the selling cost assumed by those analysts, that works out at a repayment by Sirius each year (once 13Mt is attained in 2024) of at least $97m – in exchange for the ‘cornerstone’ upfront investment of $250m. On my crude assumptions based on the analysts’ production scenario, that turns out to be equivalent to a project loan at an eye-watering 33% per annum rate of interest!

Those sorts of calculations are, of course, never put in front of investors. But in this case the institutions may well have taken note that Sirius was somewhat desperate and willing to pay well over the odds for all its financing.

So now those analysts are back at the drawing board with their revised per share calculations. And although those will be more accurate this time – with the unknowns now limited to the stage two (or ‘expansion’) financing a few years down the line, which is expected to be by way of debt within a fairly small range of estimates – we are already seeing that they won’t be dropping their fantastical 60-year NPVs.

Why should they? They worked on the share price as far as private investors were concerned before the institutions did their own calculations. And now that the latter have filled themselves up with their requirement, it won’t matter that private investors might push the shares up again on still bogus ‘targets’. Sensible investors, however, should slash these new analysts’ targets (they never actually say that they are based on 60 years) in half at the very least.

To re-iterate: to accord more closely to the sort of rating the market puts on all other shares (mining shares in particular), an NPV based on no more than 20 years ahead has to be used, and even then tends to be valued less than that.

In any case, as I’ve explained in previous articles, why would any sensible investor pay right up to a ‘target’ price for a share? And why would he pay anywhere near that when the earnings (or the dividends) that make up the NPV won’t start for another 5-10 years (Sirius’s mine is scheduled to reach stage one full output – approx $2bn revenue – in 2024).

So now we have Sirius in the market at 25-30p. Facing the prospect that not a few of the investors who have bought an enormous 40% chunk of its shares in issue at a bargain 20p, will be tempted to take their juicy profit an anything above 30p. I personally won’t be ‘investing’ in Sirius for the long term any time soon.

(See previous post on Sirius August 31st “Is it time to get off the Sirius Bandwagon”)

Comments (0)