Is it time to get off the Sirius Minerals bandwagon?

When I discussed Sirius Minerals in March, I thought it expensive at around 16p, being too far ahead of any meaningful return even though exceptional once it starts (slowly) in ten years time. I thought the same in June at around 19p.

However there has been good news recently, and Sirius became doubly more expensive. The question is: Will that hold?

The good news included permission for the Teeside port terminal; initial capital expenditure revised downwards; and the vital first-stage funding for the required initial $1.1bn moving ever nearer. And Brexit has made Sirius’s majority overseas earnings that much more valuable.

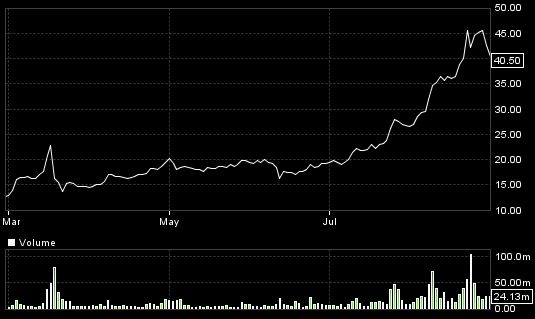

SXX – last 6 months

But can it be a coincidence that in the run up to funding, where achieving the highest possible share price will determine the extent of value dilution for many years ahead, the brokers who will be (or hope to be) charged with raising the required initial £0.85bn (assumed half in shares), with the juicy fees it will entail, have found compelling reasons to increase their valuations?

I leave it to readers to make up their minds from the following:

The cautious case

Firstly, of course, Sirius’s polyhalite (potash) mine has always looked a most attractive proposition if it comes off. In the face of initial scepticism, the share price momentum now recognises that it looks almost certain. It will be a great contributor to UK GDP, and institutions will want a stake – especially once the listing moves to the main market (as it probably will soon in conjunction with the initial capital raise).

But how far in advance does one pay for that prospect? One year? Five years? Ten years? Investors now are paying more than ten years in advance. Will institutional investors – as opposed to the private investors behind recent buying – pay today’s price for the new shares they’ll be asked to bid for in the coming months?

Perhaps that question was in the minds of the professional investors invited for a look-around on Aug 23rd – when the spike engendered beforehand was well and truly reversed that same afternoon, with the shares falling 20% on heavy volume to finish 10% down. Today (Aug 31st) the shares look weak again.

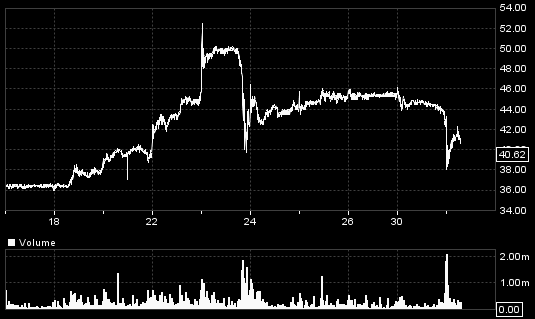

SXX – last 10 days

That leg of momentum above 40p had been boosted a few days before by the publication (by the previously most bullish analyst) of a yet more bullish long-term share price projection (25% higher) – based on the news I’ve mentioned plus another key upwards assumption for the price Sirius will achieve for its polyhalite. But the most significant new assumption is that the institutions will now (after the share price surge) pay 35p for their new shares in the forthcoming fund raise, compared to 22.5p originally assumed, bringing down the initial dilution for present shareholders from the fund raise significantly, and therefore boosting the projected earnings per share.

But, overall, there remains the extraordinary basis for arriving at the broker’s long-term target share price (no different, admittedly, from other analysts and the company itself based on the technical reports) of calculating an NPV taking in projected earnings up to 55 years ahead.

(55 years ahead? Come On! What can happen over those two generations? Wars, climate change affecting fertiliser demand, negative interest rates and deflation (reducing the prices achieved), a stronger £ (ditto), competitive new products, or polyhalite discoveries elsewhere! A child could rattle off numerous Black Swan possibilities. Institutional investors will think of more.)

I said in my first SXX note that to take in projected earnings a still optimistic 20 years ahead for a project with level earnings would halve the calculated NPV. But in Sirius’s case, the projections are for earnings to steadily rise after 15-20 years. Which means that if the full figures were available (I haven’t time – I suspect no-one has – to do the detailed calculations) the reduction in calculated NPV for 20 years as opposed to 55 would be a lot more.

In other words, I believe the case remains that investors are being presented with ‘valuations’ that are just not honest, let alone sensible. But the analysts are using NPVs on that basis because they look so good.

Again, in my view, the most recent share surge has come about on the back of good news about progress, but more so on those more bullish analysts’ targets where NPV figures impress private investors more than they will institutional investors.

(To re-iterate my explanations elsewhere, an NPV is only appropriate where a short-term project – such as in mining – is involved, because valuing on a PER basis is only logical when a company’s earnings are assumed to go on forever.)

But for Sirius, there won’t be any meaningful earnings per share for at least ten years, probably nearer 15. The only alternative option is to quote those NPVs.

But even they have been pushed up in the recent upgrades on the backs of a series of speculative improvements in the assumptions behind them – each speculation on the back of another. Thus:

Speculation 1 is that polyhalite really will capture the highest estimated share of its market and an accordingly higher price. Previous assumptions were more cautious.

Speculation 2 is that the lenders and investing institutions will sufficiently believe speculation 1 as to invest at the new, higher share price that won’t incur the same dilution as before – so enabling analysts to inch up the resulting per share targets.

Speculation 3 is that “If all goes to plan, there would be no further need to raise equity after Stage One. Further dilution would cease to be a concern, and we believe the resulting improved clarity on potential equity returns could trigger a significant re-rating.” So argues Shore Capital.

The other way to look at it

OK, I’ve put forward the ‘cautious’ case. Suppose the forecasts – ten years out – are met. What will be the share price then? And if you bought today and ignored the slings and arrows of a roller-coaster price meanwhile, how well will your investment have done?

This is the other strand of the analysts’ arguments. On an NPV basis (due to the way it works) over the next 5-10 years as capital spending winds down, the ‘NPV’ from that point on will steadily increase. So in five years’ time (before any earnings) analysts can point to even higher, ‘very high’, NPV calculations (i.e. still taking in earnings 50 years ahead).

The current phase is like the early stage of a large, mining discovery, where initial excitement takes the shares up into the stratosphere before entering a financing stage and then relapsing for many years until earnings start.

So what happens when earnings do start and a PER basis becomes appropriate? On present forecasts, there won’t be any earnings per share until 2023. Even then, they will start at around 2p and take the next five years to rise to about 20p – even on Shore Capital’s more optimistic ‘base case’ scenario for the revenues SXX will achieve.

So, if all goes according to Shore’s plan and no more shares have to be issued, they might rise to 200p in ten years time. Is that enough profit for a shareholder over that time?

So, when do the sensible take profits? Here we have recent share strength based on estimates based on speculation piled on speculation. I can’t think of a better definition of a bubble. No-one can tell when a bubble will burst of course. And while you and I might recognise a bubble, newcomers might be tempted to jump into an expanding bubble (aka onto a rolling bandwagon) and keep it expanding (or rolling) for some time!

Comments (0)