Profit from the latest small cap IPOs

In the hope that some of this year’s IPOs can repeat the success of the class of 2020, Richard Gill takes a look at a few of them.

I last covered the moribund small cap IPO markets back in October last year, a time when it looked as though AIM might have its worst ever year for new company listings. However, a flurry of new issues in the final few months meant that 2020 ended up as only the second worst year. There were 32 new issues on AIM by the end of December, up from 23 in 2019, with total funds raised relatively flat at just under half a billion. Secondary issues held up well however, with £5.27 billion of further funds raised by AIM listed companies in 2020, the highest since 2010.

Looking deeper into the stats, it’s worth noting that only 16 of the new issues during the year were traditional IPOs, with 12 re-admissions from transactions such as reverse takeovers, three transfers from other markets and one introduction. The clutch of IPOs have performed incredibly well, with an average gain from the issue price to today of 55.9%. Only two companies that IPO’d on AIM in 2020 have seen a share price fall, with three more than doubling in value. Amongst the risers are the two companies I covered in my last IPO article, with restaurant operator Various Eateries (LON:VARE) up by 31.5% and spectacles seller Inspecs (LON:SPEC) rising by 72.8%.

Into 2021 and we have only seen a handful of IPOs in the first few months of the year. In the hope that they can repeat the success of the class of 2020, let’s take a look at a few of them.

VIRGIN WINES UK

According to a recent survey by data firm Kantar, UK consumers brought home an extra 498.5 million litres of alcohol in the year to 4th October 2020. Keen to get their fix as pubs and restaurants remained shut for most of the year, boozy Brits turned to alternative suppliers such as supermarkets, off licences and specialist wine merchants, sending sales soaring. One of those latter firms recently toasted its success by going public on AIM along with a substantially oversubscribed fundraising.

Founded in the year 2000 by the Virgin Group, Virgin Wines (LON:VINO) has grown over the past two decades to become one of the UK’s largest direct-to-consumer online wine retailers. While the business has changed ownership several times over the years, it retains the “Virgin” branding, being the exclusive licensee of the Virgin Wines brand in the UK and Ireland from the well-known conglomerate Virgin Enterprises.

Sourcing its wines from a network of partners and suppliers, the company currently has an exclusive portfolio of around 600 products, provided to a loyal membership base of 147,000 subscribers along with pay as you go customers. The subscription model provides great visibility of income for Virgin Wines, with its flagship “WineBank” scheme seeing customers put an amount of money into their account every month – typically £15 to £100. Customers receive a generous 20% interest rate on their monthly deposits, which can then be spent on purchasing wines throughout the group’s range. The other subscription scheme offers members a 12 bottle mixed case comprising new discoveries and existing favourites every three months and at Christmas. These schemes help to drive high levels of repeat purchases, demonstrated by an excellent customer retention rate of 89%.

Virgin Wines’ recent IPO fundraise saw c.£35 million raised for selling shareholders at a price of 197p per share, with the company raising £13 million for itself (£8.6 million after expenses). The funds are planned to be spent on reducing debt and paying back preference shares, along with financing its strategic plans.

Chateauneuf Du Cash

Virgin Wines came to market with a good track record of revenue growth, operating profitability and strong cash generation. In the year ended 30th June 2020, it posted revenues of £56.6 million, with an EBITDA of £4.8 million. That was a two-year revenue compound annual growth rate (CAGR) and a two-year EBITDA CAGR of 19.1% and 57.9% respectively. The first half of the current financial year saw the positive trading trends continue, with revenues up by 55% to £40.6 million and EBITDA soaring by 196% to £4.5 million. That took rolling revenues for calendar 2020 to £71 million, with EBITDA of £7.7 million. On a pro-forma basis, assuming that the IPO fundraise had taken place last year, net cash would have been £15.3 million at the period end.

To further drive growth Virgin Wines has a number of strategic initiatives, including investing more in marketing and recruitment to drive the number of active customers. The company also sees the opportunity to expand its corporate and gifting businesses as well as continuing to promote its new product categories of beers and spirits. While being one of the top players in the market, there remains a lot more sales to go for, with the directors estimating that the current total addressable, off-trade market for wine specialists was c.£2.4 billion in 2020.

More fizz to come?

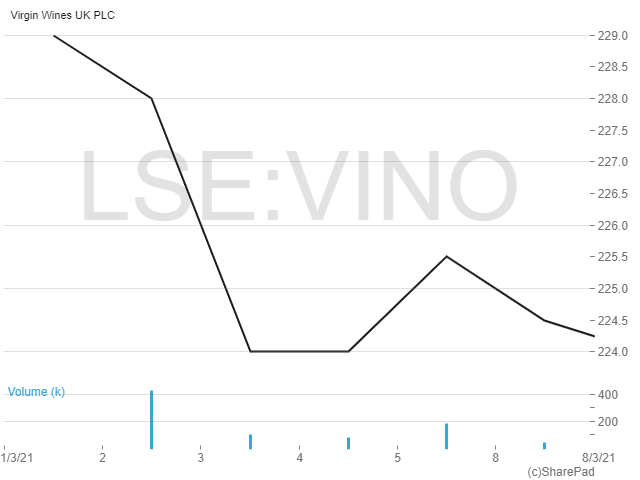

Virgin Wines has had a good start to life as a public company, with the shares rising from the IPO price of 197p to a current level of 224.5p, capitalising the business at £125 million. That puts the shares on a calendarised 2020 EV/EBITDA multiple of 14.3 times. While that valuation looks rather full, I note that listed peer Naked Wines (LON:WINES) is currently valued at just over half a billion pounds despite having lost money in the past few years.

On the upside, Virgin looks like a solid business, it is good at what it does and industry trends are going in its favour. Alongside the boost from the lockdown restrictions, there has been a wider increase in online wine sales growth and a shift towards “premiumisation” in the alcoholic beverage market as customers are willing to spend a few more pounds on the higher quality style wines that Virgin offers.

While there have been some concerns over whether buying patterns will revert in 2021 as lockdown restrictions are eased, Virgin saw positive trends continue following the lifting of the initial UK-wide lockdown in July 2020. A reduction in the market is nevertheless expected in 2021, with the off-trade market for wine specialists then forecast to grow at a CAGR of 2.8% from 2021 to 2025.

With the directors currently having no current intention of paying a dividend, investors are buying into a growth story here, although I would like to see the price edging down to around the IPO level before putting in an order.

SUPREME

Having been a customer of Virgin Wines on and off over the years I was surprised to find out that I have also given my money to this next company in the past. Supreme (LON:SUP) was founded back in 1975 by GS Chadha, the father of current CEO and major shareholder Sandy Chadha, as a general sales and small wholesaler of goods such as watches, radios, and clocks. After being bought out of administration in 2007 by Chadha junior the business has gone on to become a highly successful manufacturer, supplier and brand owner of a range of fast moving consumable goods. The business model is vertically integrated, offering product development and manufacturing to an extensive retail distribution network, and a route to market for well-known global brands.

As of today Supreme’s main business is the supply of products across the five categories of Batteries, Lighting, Vaping, Sports Nutrition & Wellness and Branded Household Consumer Goods. Core to the business model is a range of distribution, licensing and contract manufacturing agreements. In batteries for example, Supreme has long-established relationships with well-known global brands, including Duracell, Panasonic and Energizer, selling over 200 million batteries in the last financial year. In vaping meanwhile the company has developed its own brand, 88Vape, which since 2014 has become the largest producer of e-liquids by volume in the UK from its e-liquid manufacturing plant in Manchester. My favourite flavour is raspberry ripple.

Also core to the business model is the company’s network of third-party retail stores through which its products are sold to end consumers. These include; a range of discount retails including Home Bargains and Poundland; supermarkets such as Asda and Iceland; and wholesalers including Booker and Londis. Altogether, Supreme services a customer base of over 3,300 active business accounts including retail customers which have over 10,000 branded retail outlets and thousands of independent stores. In addition, Supreme has increasingly been selling products direct to consumers through its own websites.

The company’s February IPO acted as a partial exit for Sandy Chadha and a few other related parties including employees. The sale netted a total of £60 million although Chadha retains a majority 56.8% stake. There was also £7.5 million (£5.6 million net) raised for the company which is to be spent on paying back debt.

Diana Dosh

When buying the business out of administration Sandy Chadha made a gentleman’s agreement with the administrator that if the company could make £1 million profit a year he would hand over his £130,000 Bentley. While Chadha lost the bet, handing over the keys a few years ago, he definitely ended up happy as Supreme managed to smash that target.

In the last financial year, to 31st March 2020, revenues amounted to £92.3 million, up by a CAGR of 17% between 2015 and 2020. Meanwhile, adjusted EBITDA increased by a CAGR of 52% over the same period, to £16.2 million in 2020. More recently, in the six months to September 2020 revenues hit £56.3 million, up 43%, with adjusted EBITDA up 21% at £8.4 million.

The broad growth strategy is focussed on expanding the company’s presence in its core discount retailer base by widening product listings and benefiting from continued store roll-outs. While the Batteries segment is seen as a more defensive and stable business, good growth opportunities are seen elsewhere. For example, according to Euromonitor the vaping market in the UK is expected to grow at a CAGR of 13% from 2019 to 2022 as consumers continue to shift away from tobacco. The UK sports nutrition and vitamins markets are expected to grow at a CAGR of 9% and 7% respectively from 2019 to 2022, driven by the growing focus on fitness and healthcare. Meanwhile, the UK LED market is expected to grow at a CAGR of 10% from 2019 to 2022, backed by a greater focus on energy efficiency and demand for more aesthetic lighting products.

Up the Ladder to the Roof

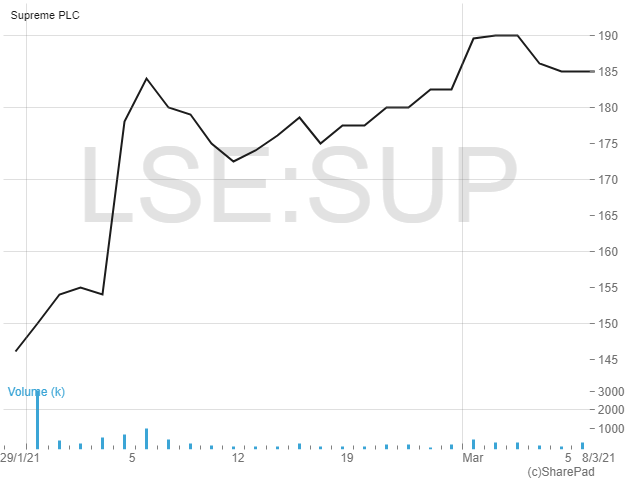

Shares in Supreme have also had a good start to trading on the markets, rising from the IPO price of 134p to a current 185p. That gives the company a market cap of £215.5 million. On last year’s earnings of £10.9 million, which were up by 35.5%, that puts the shares on a multiple of just under 20 times.

So the markets are pricing Supreme as a true growth stock. This seems reasonable to me given the earnings growth in 2020, H1 rise in profits seen since then and the fact that the company has grown revenues from c.£1 million in the first year since administration to what looks like being over £100 million for the current financial year.

Also, there is the prospect of some income here, with Supreme intending to pay dividends amounting to c.50% of net profits, retaining the balance to finance future expansion. The first (interim) payment is expected to be announced following the interim results for the six months to 30th September 2021.

NIGHTCAP

The two companies covered so far have ticker codes that suggest drinking – VINO and SUP. So let’s finish this month with a Nightcap (LON:NGHT). The company was set up in 2020, by a team including experienced bar and restaurant entrepreneur Sarah Willingham-Toxvaerd. They saw what they think is as “exceptional opportunity” over the coming years to acquire and grow ‘drinks-led’ hospitality businesses that focus on consumers’ social experience. On admission, the company raised £4 million (£3 million net) at 10p per share and acquired its first business, the London Cocktail Club, for an initial consideration of £5.7 million, paid for mostly in shares along with a modest cash payment of £162,116.

The London Cocktail Club is an award-winning independent operator of ten individually themed cocktail bars in nine London locations and one in Bristol, targeting the “millennial pound” of customers aged between 26 to 40 years old. Its concept is based on offering customers sophisticated cocktails, made by skilled bartenders in a vibrant ‘party style’ environment with first-class service. There is an emphasis on the decor and ambience of each venue, with each hosting a different theme. They are mainly located in basement sites, which as well as adding to the party atmosphere helps to keep down costs.

The overall vision for Nightcap is to become a leading operator of premium bars and drinks-led hospitality concepts in the UK. The model is considered to be scalable, with the company well positioned to take advantage of the current opportunity in the hospitality segment of the UK property market for taking on attractively priced sites against a backdrop of decreased competition. The current plan is to expand the 10 sites to c.40 over the next five years, with directors believing there are potentially 120 appropriate locations. Nightcap also intends to identify and acquire other drinks led hospitality groups that are considered to have significant potential for additional value creation through roll-out, refinancing, turnaround or market repositioning.

Drinking up

In the year to 30th June 2019 (the last “normal” year for the hospitality industry), the London Cocktail Club made revenues of £6.59 million and an adjusted EBITDA of £0.86 million. In the COVID ravaged 2020 financial year revenues fell to £5.2 million but the company was still profitable, making adjusted EBITDA of £0.14 million. All the London Cocktail Clubs are currently closed in line with government guidelines. But when they were allowed to re-open briefly last year they delivered encouraging trading, showing like-for-like growth of 8.4% in August and September compared to the same month in 2019. As at 30th November 2020, the company’s pro-forma balance sheet (assuming the IPO fund raise had taken place) showed net cash of c.£3.4 million (cash minus borrowings), although there is also £4.6 million of lease liabilities to consider.

It’s fair to say that the latest annual accounts don’t really reflect the true potential of the company’s current portfolio given that three sites had yet to reach maturity and given the lockdown impact. Also, since then a number of operational improvements have been made. As an illustrative guide, the company’s admission document has given an illustrated, normalised, adjusted historical company EBITDA of c. £1.8 million but this doesn’t take into account of any negative adjustments for COVID-19.

Good NGHT?

Twice since listing Nightcap has had to issue a statement to the market commenting on its share price movements, both times referring investors back to the strategy set out in its admission document and on the latter occasion saying that it knew of no reason for the rise.

At the current price of 26.4p, up 164% since IPO on no news, the business is capitalised at £35.7 million. With net assets of just £4 million as at 30th November 2020, all of its venues closed and the illustrative EBITDA figure implying an EV/EBITDA multiple of 20 times, it’s fair to say that the shares look to have got ahead of themselves.

But to give the company credit, it’s early days here and the long-term strategy looks like achievable. Several other entrepreneurs have seen a similar opportunity in the UK hospitality sector in the past few months, not least AIM listed peer and Strada owner Various Eateries which I covered last October.

If Nightcap does eventually open 40 venues it could be a very attractive proposition. With average capital expenditure per site of £339,000 and average EBITDA of £256,000, the bars have a high annual return on investment of 75% and EBITDA margins of 33%. Forty mature sites making those kind of profits would deliver total EBITDA of just over £10 million per annum. But with significant execution risk remaining I believe the shares are only worth watching for now.

Comments (0)