Loving Apple, but Selling It

As ubiquitous as its namesake fruit, Apple has turned its macintosh species into a range of highly desirable brand name products that are now part of our everyday lives. Steve Jobs led Apple into revolutionising mobile computing, which helped to build an untouchable corporate image. Apple is the Ferrari of technology. Everyone wants to own Apple, not only because of its cutting edge features but also because of the social status that is often related to it. Such consumer success could only translate into huge financial success for investors, who were able to enjoy a return north of 30% per year for the last 15 years.

But, 15 years later, and while enjoying writing this text on a Mac while keeping an eye on an iPad, a few questions arise in my mind. How different is my current Mac from the other I owned five years ago? What does my iPad mini offer that my second generation iPad didn’t? There are certainly some differences. My Mac is faster than the older one and my iPad mini is smaller than the second-generation iPad. But is there anything more? Is there some outstanding feature revolutionising the new models? Nothing flashes in my mind.

Of course, as a consumer I love Apple. Who doesn’t? The design is really appealing, the features are so rich, and the simplicity is outstanding. But, as an investor, I need to think in relative terms. If 10 years ago Apple offered something different, now the competition has been able to fill the gap and offer something similar. Over the last few years, all Apple has done is offer updates on its products. It no longer seems to be able to innovative in a meaningful way, which has allowed competition to gain traction. In some particular cases, it has even lost its lead. I’m thinking in particular of the iPad Pro, which was launched as a reaction to the Microsoft Surface. I feel that Apple will have to show something more than an iPhone 7 with a 24M camera on top of a 256GB memory if it wants to preserve its leading position. But I’m not confident Apple has anything significant to show anytime soon.

The last time Apple upgraded its Macbook Pro line it was one year ago. By then it equipped its most expensive model with a Haswell processor. At that time, it was not the latest model. One year later, Intel is now selling its 6th generation Skylake line of processors, which is two generations ahead of what the MacBook Pro carries. Most computer brands ship a few models with this processor while Apple is still relying on the 4th generation Haswell on its upper end MacBook Pro, which sells for £2,000.

While one could argue in favour of the Haswell processor, one thing is true: Apple is behind the curve when compared with Asus, Lenovo and Dell, all of which offer products equipped with the latest line of processors. While the Macbook is no longer Apple’s main product in terms of revenue, I interpret this lag as an alarm bell regarding the ability of Apple to continue leading the tech world.

Instead of renovating its lines, Apple seems to be jumping from product to product, concentrating on whatever enjoys momentum. Currently, it is all about the iPhone. Apple sells iPhones and then complements its line of products with a few other tech offerings, which include the Macbook, Apple Watch, the iPad, the iPod and a few services. There’s no meaningful diversification. If iPhone sales falter, Apple gets in trouble. The issue of diversification is even worse because Apple not only depends on the iPhone but on its success in China, which is the only market that currently has potential for significant growth. If China falls short of expectations, Apple’s shares will race downhill.

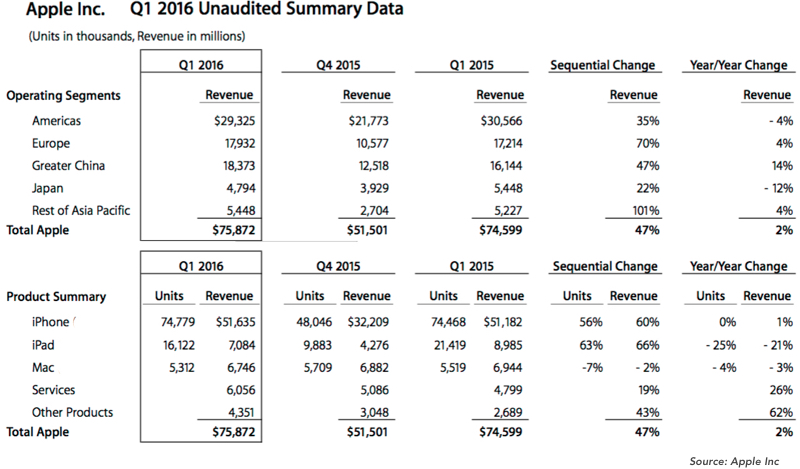

The latest news showed that China is willing to raise its network coverage from 57% to 87%, which would unlock a market of 385 million users for Apple (and others). That is certainly good news for Apple. While Europe is still showing some growth, there are signs pointing to saturation in the cell phone market. The iPhone is now in its 6th generation (or even 10th if counting models). The smartphone is no longer a new project, and sales are stagnating as the market matures. In Q1 2015, Apple sold 74.5 million iPhone units. This year it sold 74.8 million in the same quarter, which is just slightly above last year’s figure. The iPad is losing momentum and the Macbook was moderately boosted due to the introduction of the new 12” slim model, allowing the company to compete in other segments.

When looking at the latest figures, there are a few things that are worrying. First of all, the iPhone represents almost two-thirds of total revenue ($51 billion of $75 billion). With its best-seller being a product sold in a highly saturated market, I really struggle to foresee growth for Apple at the rates seen in the recent past. Prices will start declining, as will sales. Second, Apple is also reliant on how well the iPhone continues to do in Europe and in particular in China, as other markets are softening for the iPhone. Summarising this, I would say the near future depends on how the iPhone does in China, which is worrying for a company worth $587 billion.

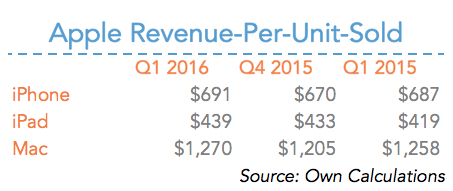

Let’s just dig a little more into the data to check revenue per unit sold. The findings are summarised in the table below.

Apple has been able to maintain impressively high prices for all its products, in particular the iPhone, with an average revenue of $691 per unit sold. This number represents an increase from the same period last year, when the average was $687. The average revenue for the iPad line of products is now $439 and for the Macbook it is $1,270. Those are impressive numbers, which have allowed Apple to maintain gross margins around 40%. But, as Warren Buffett puts it, “the investor of today doesn’t profit from past growth”. The investor of today profits from the prospects of future growth. At a time when Apple has not been innovating sufficiently, competitors offer ever more refined products and the market experiences some saturation, I wonder how much fire power is still left in the company. In my view, Apple will be forced to either cut iPhone prices or to introduce new, cheaper models. While this may allow the company to retain its market share, the impact on revenue will be negative. As for the other products, they’re all on a huge downtrend and represent a small share of total revenue. The iPad currently represents a 9.3% share; Mac products represent 8.9%; other products, including Apple Watch, Apple TV, Beats products, the defunct iPod and third-party accessories, don’t even have their own separate category as they cumulatively represent just 5.7% of Apple’s revenue.

When summing everything together, a few warning signs are uncovered, which would make me uncomfortable investing in Apple stock. The main points are:

- Revenues from core markets have stalled

- Heavy dependence on one single product – the iPhone

- Low likelihood of being able to keep the iPhone average revenue near $690 in the future

- Since Steve Jobs passed away, the company has not introduced any significant new products

- It is not Apple that is gaining market share from defunct systems but the Android

- High dependence on how well the Chinese market develops

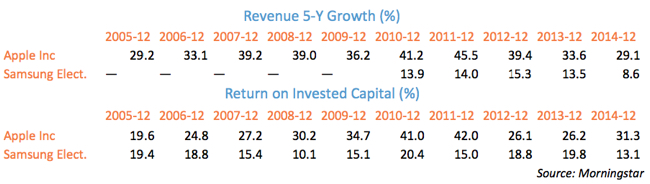

Apple currently trades around $107 a share ahead of its quarterly earnings, to be released next Tuesday, April 26th. While the price performance for the company has been impressive for the last 15 years, it has been less impressive during the last few years. I believe that investors are already weighing the risks Apple will face in the near future. The company has seen its revenue growth increase from a five-year average rate of 29% in 2005 to an average of around 39% in 2008. Since then the figure has been hovering around 2008 numbers. When compared with other companies this seems very high and will most likely decrease in the future, as Apple will start looking for less lucrative iPhone alternatives.

Apple is still a wonderful company in terms of the products it provides to consumers, but I fear it has lost its shine as an investment candidate. Before entering into any investment position I like to make a cross-check based on a Warren Buffet advice: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”. In Apple’s case, I’m worried about the next two years, let alone the next 10. I currently don’t own Apple’s shares, but if I did, I would now sell them and wait until I’m sure the company is really able to create something new and continue to lead the market.

Comments (0)