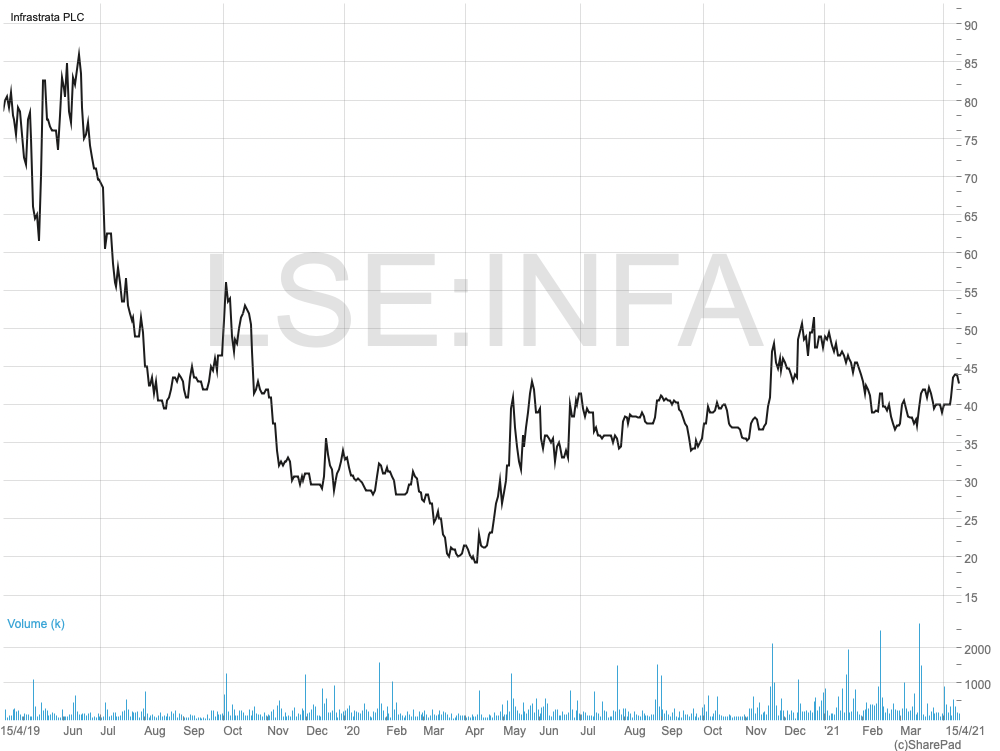

InfraStrata could be in the right place at the right time

InfraStrata is in the process of transforming itself into a multi-faceted infrastructure services group, which could prove to be rewarding for patient and adventurous investors.

I first came across InfraStrata (LON:INFA) in its former guise as Portland Gas when I began working in the City at the time of the financial crisis. The company demerged from Egdon Resources plc on 16 January 2008 and was admitted to the AIM market on 17 January 2008. The change of name to InfraStrata plc took place on 15 December 2009.

Back then, the company was focused solely on its gas storage projects, for which the economic rationale seemed very strong. However, it was always a jam tomorrow-type situation, and the company struggled to make significant progress. While the company retains its Islandmagee gas storage project, it is not this side of the business that interests me today; what interests me the most is the Harland and Wolff drydocks business, which it acquired piecemeal out of administration in 2019 and 2020.

The largest drydocks in Europe

These are significant assets, comprising two of the largest drydocks in Europe and the largest undercover drydock specialising in vessels over 120 metres. Moreover, Harland and Wolff is one of only three UK shipbuilders suitable for major MoD contract work. The company strengthened its position in this sector in February when it acquired the assets of Burntisland Fabrication Limited (Bifab) out of administration for £0.65m (plus £0.2m if stretch targets are achieved). These assets include two waterfront sites in Scotland that are well-positioned for the growing fabrication requirements needed for wind farms in the North and Irish Seas. Given that these sites achieved peak annual revenues of £175 million, the Bifab acquisition could well prove itself a coup in due course.

The acquisition of Bifab means that Infrastrata now has the UK’s largest fabrication footprint – not bad for a company with a market cap of under £40 million. And this comes at a time when the UK shipbuilding and servicing industry looks to be entering a renaissance, supported by a £24 billion increase in UK defence spending over the next four years and a plan for offshore wind to power every home in the country by 2030. With a weighted pipeline worth over £2 billion, InfraStrata appears well positioned to capitalise on these developments.

Encouraging progress

There are signs that management is beginning to deliver on its strategy to turn around the performance at the Harland and Wolff assets, with a total of 30 ships having now been brought into its yards for servicing and repair, at increasing contract sizes. Over the next 12-18 months, management has identified revenue opportunities of £80 million, but there are also medium-term revenue opportunities of up to £750 million, including the fabrication of various new-build vessels and wind-farm equipment, along with multiple cruise dockings.

A trading update in April reported “steady progress” since the beginning of the new financial year, with revenues in the eight-month period to 31 March 2021 at c. £6.5 million. This is significant growth from the year-end results, where revenues of c. £1.4 million were recorded. Harland & Wolff has achieved a cash break-even position within the cruise & ferry market since October last year and contract values are expected to increase over time. Furthermore, following the UK Government’s announcement allowing cruising to commence around the UK from May onwards, the firm has seen a rise in the level of inquiries for dry-docking of cruise vessels ahead of their sailings. Consequently, management expects to see a number of dry-docking contracts signed in Q2 and Q3 of this year.

Substantially undervalued?

According to broker Cenkos, InfraStrata only requires the conversion of a “very small proportion of its significant weighted pipeline (£2bn+) in order to have a transformational impact” on the group. While the broker does not offer any forecasts for the current financial year, it judges the shares to be “substantially undervalued” and has a ‘buy’ stance on the shares.

My take is that this is a highly speculative but potentially very rewarding investment proposition. InfraStrata seems to have put together a portfolio of assets that look very well positioned to take advantage of the UK’s shift to a domestically-led economic agenda, with renewable energy at the forefront. Its drydock assets have significant scarcity value and there is considerable operational gearing built in which could see the company move into profitability as economies reopen and management sweats the assets. As an added bonus, the gas storage assets provide wildcard potential.

Comments (0)