Follow the fund managers for a profitable 2020

As we say goodbye to an eventful 2019, it’s time for Richard Gill’s annual review of how the UK small cap markets have performed – and to provide a few investment ideas for the new year.

Despite huge volatility in individual stocks, 2019 turned out to be a pretty good year overall for small-cap investorsand a lot better than the dire 2018 which saw the FTSE AIM All-Share lose 18.2% of its value. The index pretty much bottomed out at the start of January 2019, rallied through the spring and fell again in summer. But after a welcome ’Santa rally’/’Boris boost’, the index finished the year (with half a trading day to go) up by a decent 11.6%, at a level of 957.72. However, there remains some way to go before we return to the decade-long high of 1,107 seen in September 2018. The FTSE Small Cap Index put in a slightly better performance, gaining 15.1% in 2019.

Blue-chip stocks performed just as well as small caps during the year, with the FTSE 100 rising by 13.3% but remaining short of its 2018 all-time highs. Nevertheless, an impressive 82 of the 100 constituents finished the year with a higher share price. The FTSE 250 delivered the most impressive performance of the major markets, with the UK-focused index soaring by 25.6% after Brexit-related blues were blown away.

Small-cap blue-chips once again drive returns

Given their larger weighting in the All-Share index, it’s no surprise that AIM’s biggest companies continued to drive the wider performance in 2019. The FTSE AIM UK 50 was up by a more pronounced 18.6%, seven percentage points higher than the All-Share. There are now 15 companies listed on AIM with a market cap of over one billion pounds, up from 10 at the start of the year.

Online fashion retailer Boohoo Group (LON:BOO) overtook rival ASOS (LON:ASC) to become AIM’s largest company, after rising in value by 84%. The company, now valued at just under £3.5 billion, announced a number of positive updates over the year, with growth surging both in the UK and internationally. Other major movers included analytics business GlobalData (LON:DATA) which soared by 120% after some good financial results, and identity-verification firm GB Group (LON:GBG) which rose by 86% after doubling profits in its first half. Elsewhere, airline owner Dart Group (LON:DTG) added 119% to its share price following the demise of rival Thomas Cook.

At the other end of the market, it was a dreadful year for litigation financing firm Burford Capital (LON:BUR); its shares plunged by 57% after the infamous short attack from research firm Muddy Waters. It was also a bad year for Impellam (LON:IPEL), with the staffing business experiencing difficult markets and the shares falling by 37%. Former punters’ favourite and wafer manufacturer IQE (LON:IQE) also dropped, by 24%, after a disastrous November profits warning.

Everyone’s not equal

According to my calculations, the top 10% of AIM All-Share constituents make up 64% of the index’s value, so its performance is highly dependent on these select few stocks. Therefore, as in previous years, as an alternative way of reflecting small-cap performance, I have used an equal weighted approach − assuming that an equal amount of money was put into each qualifying AIM company at the start of 2019.

To complete this analysis, I take all AIM companies (included those not listed in the All Share index) which were listed on the market at the beginning of 2019 and remained listed for the whole year (new listings during the year or those which left the market are excluded). There are 866 qualifying companies, each given an equal weight in my theoretical index.

Of these, 409 companies (47.2%) finished the year with a higher share price, 13 (1.5%) were flat and 444 (51.3%) lost value. There was therefore a slightly higher probability that an AIM share would have lost value rather than increased in value last year. My headline metric shows that on an equal-weighted basis, the average gain per AIM share in 2019 was 9.6%, two percentage points behind the All-Share. While still a pretty decent result, this goes to show that the larger-cap stocks drove the additional gains in 2019.

Soaring stocks

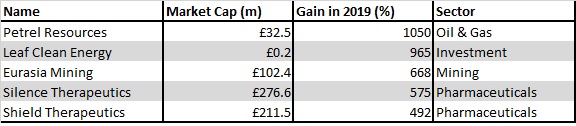

There were some stonking performances from small-cap companies last year. Top of the pile with a dazzling 1,050% gain was oil and gas explorer Petrel Resources (LON:PET), after attracting investment from a group of influential shareholders. Also up there was Leaf Clean Energy (LON:LEAF), with the renewable-energy investor, which is set to de-list shortly, surging by 965% after winning substantial damages in a court hearing. In third place was Russian palladium miner Eurasia Mining (LON:EUA). Its shares rocketed by 668%, mainly on the back of two Chinese and Russian investment banks assisting the company with the potential sale of its Kola and Urals assets.

Table: Five biggest AIM risers in 2019. Performance measured from 1 January 2019 to 30 December 2019

Biggest losers

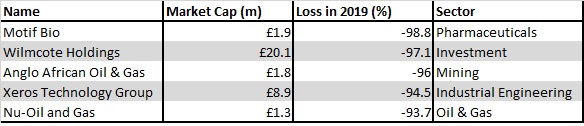

The worst performer in this period was drug developer Motif Bio (LON:MTFB). Its shares collapsed by 98.8% after US regulator, the Food and Drug Administration, said that it could not approve the company’s new drug application for skin infections drug iclaprim in its present form. Not far behind were shares in investment company Wilmcote Holdings (LON:WCH) which lost 97.1% over the year after the acquisition of a speciality chemicals business fell through. After an awful 2018, shares in water saving and filtration products firm Xeros Technology Group (LON:XSG) lost a further 94.5% as it remained loss making and sought further funding.

Table: Five biggest AIM losers in 2019. Performance measured from 1 January 2019 to 30 December 2019

Follow the fund managers

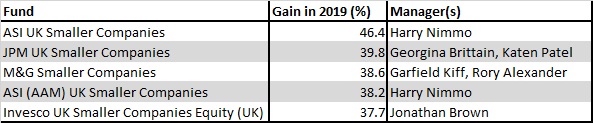

Given the volatility in the market there was a highly favourable environment for small-cap fund managers in 2019, and most did not fail to impress. According to Trustnet’s universe of 51 small-cap funds, all but four beat the AIM All-Share in 2019, with only three showing a negative return. Congratulations to Harry Nimmo, who runs the ASI UK Smaller Companies fund, which posted a market-and-peer-beating 46.4% return in 2019, helped by stocks including Gamma Communications, Dart Group and GB Group.

Data source: Trustnet. Performance measured from 1 January 2019 to 30 December 2019

So, will it pay off to take guidance from the professionals this year? Here are two growth stocks which some top fund managers are hoping will perform well in 2020.

PEBBLE GROUP

In the last edition of Master Investor magazine, I discussed the moribund small-cap IPO market, with 2019 turning out to be the lowest ever year for new listings on AIM since the market was formed in 1995. In early December, however, promotional-products company The Pebble Group (LON:PEBB) cheered the market by completing the largest listing of the year. The company raised around £79 million for itself at IPO with selling shareholders receiving another £56 million on top.

Pebble Group is a provider of products, services and technology to the global promotional products industry. Following an acquisition at the end of 2018, the business now comprises two differentiated units, focused on specific areas of the promotional-products market, one which management estimates to be worth $50 billion per annum. Companies are attracted to promotional products as they can increase brand awareness among various stakeholders and can also provide a high return on investment.

The original business, Brand Addition, is a provider of promotional products, such as bags, t-shirts, packaging and so on, to global brands. These items are are sourced and delivered by Brand Addition through a global network of suppliers. Clients are typically major global brands, using products for corporate programmes and consumer promotions, which operate in a range of sectors from FMCG to banking and finance. The division contributed 92.5% of total group revenues in the last financial year.

The smaller division, Facilisgroup, is a software as a service (SaaS) business which provides subscription-based services to SME promotional-product distributors in the US and Canada. Proprietary software @ease offers a SaaS technology platform that enables clients to improve order management and CRM, as well as sales analysis and reporting.

Making a splash

Pebble came to market ’IPO ready’, with a good recent record of financial growth. From 2016 to 2018, group revenues grew at a compound annual rate (CAGR) of 16% to £99.8 million, with adjusted EBITDA up from £7.6 million in 2016 to £13.7 million in 2018 – that’s an impressive CAGR of 34.3%. Further, the six months to June 2019 saw revenues up 30% at £48.1 million and adjusted EBITDA surging from £2.5 million to £5.3 million. The IPO proceeds have been applied to paying off debt, leaving the company with a pro forma net-debt position as at 30 June of just over £6 million.

The growth strategy is relatively simple, with the company looking to continue growing the number of clients that use promotional products as a stakeholder-engagement tool and SME distributors that are looking to professionalise and grow their promotional-products business in the US. Pebble is also looking to increase sales to existing customers and provide a number of new services across the divisions.

Notably, the company operates in a highly fragmented industry, typified by a large number of promotional-product distributors. Management already have a good track record of acquiring and integrating complementary businessesand believe there may be further opportunities to buy other businesses in the US and Europe.

Shares are rocking

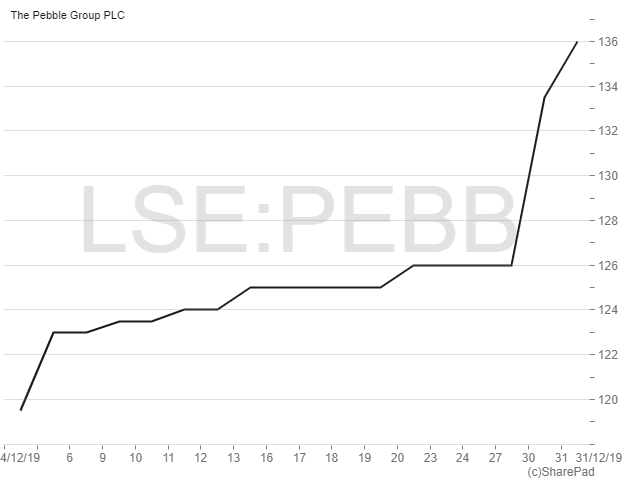

Shares in Pebble Group have had an excellent start to life on the markets despite the company not having announced any further significant trading news since its IPO. From the IPO placing price of 105p, the shares have risen by almost 30% to 136p, capitalising the business at £228 million.

Notable about Pebble’s shareholder list is a long line of quality institutional investors, with Liontrust Asset Management the largest holder, with a 16.12% stake. Others include BlackRock, M&G, Fidelity and George Soros’ vehicle Soros Fund Management. Adding to that list, Yvonne Monaghan, non-executive director, recently bought 15,000 shares at a price of 126p each.

In terms of valuation, the shares are on a historic EV/EBITDA multiple of just over 17 times, but that doesn’t look so high when we consider that profits have consistently grown by over a third every year over the past three years. Income seekers will be interested to know that the dividend policy is to pay out around 30% of annual profits to shareholders, with the first expected to be declared following publication of the financial results for the year to 31 December 2020.

ALUMASC GROUP

From growth we now move to value and income in the form of premium building-products business Alumasc Group (LON:ALU). Previously part of mining giant Consolidated Gold Fields in the 1960s, Alumasc today is a UK-based supplier of premium building products, systems and solutions which operates through three divisions.

The core roofing and water management division, which made up 66% of sales in the last financial year, is a provider of high-performance flat roof systems, waterproofing and green roof systems. One recent large project was on Tottenham Hotspur’s new £1 billion stadium where the company provided a ’Rain to Drain’ water-management system. In the architectural screening, solar shading and balconies division, which makes up a fifth of sales, the business is involved in the design and supply of said offerings along with balustrading systems through the Levolux brand. Finally, the smallest division, housebuilding products, manufactures a range of premium products through the Timloc brand including cavity trays, cavity closures, access panels, loft hatches and ventilation.

Providing a degree of resilience in what can be a cyclical market, almost 80% of Alumasc’s revenues are driven by building regulations and specifications because of the performance characteristics offered. Key strategic aims are to grow revenues at a faster average rate than the overall UK construction market and to complement UK sales through the development of selected export markets.

Tough trading

The last financial year was a mixed one for Alumasc. While roofing and water management and housebuilding performed well, both growing revenues and profits, Levolux experienced numerous project delays and incurred losses. In reaction, a plan to restructure the business was announced in June. Highlights include the solar shading, screening and balconies offerings being combined within the roofing business in a new division, and an increase in sales resources, to accelerate growth in the profitable US business.

The overall result for the year to June 2019 was a 4% increase in revenues to £90.1 million and underlying pre-tax profits slipping by £0.4 million to £5.6 million. Encouragingly, the total dividend for the year was maintained at 7.35p per share, reflecting confidence in the future and the expected positive impact of the restructuring actions. Net debt at the year end rose slightly to £5.1 million, with cash interest payments covered 5.5 times by net cash from operations. One major caveat to the investment case, however, is a required £3.2 million of annual contributions to pension schemes.

The most recent statement, released in October, reported that first-quarter revenues from continuing operations were similar to those of a year ago against the backdrop of a challenging UK construction market. Importantly, the company said it was on track to deliver a planned £2 million of cost savings in the current financial year, with changes having so far improved operating margins by one percentage point. The recovery plan at Levolux is said to be progressing broadly in line with expectations.

Time to rebuild

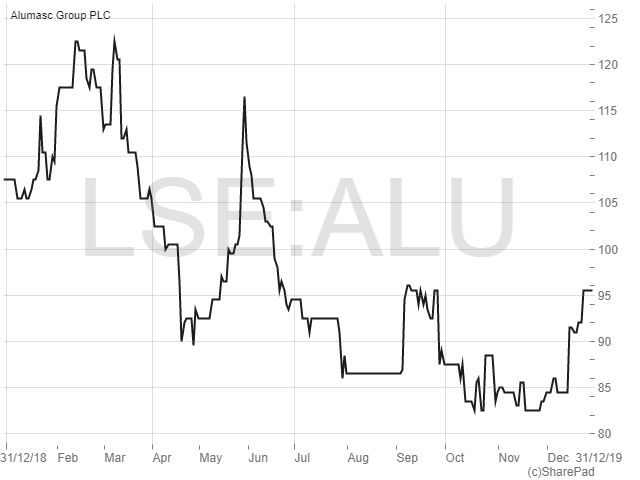

In light of its troubles, shares in Alumasc have been on a long-term downtrend for over four years now and in my opinion look oversold, especially given the recent restructuring actions. At the current price of 95.5p, the shares trade on a multiple of just 7.7 times underlying earnings for the last financial year. This falls to 5.7 times for the year to June 2020 on broker FinnCap’s forecasts for 16.9p of earnings.

What’s more, should the dividend be maintained at current levels, the yield is a huge 7.7%. FinnCap comments that as earnings resume growth in 2020, the dividend cover will rise to a safer more than two times. Given that the payment was maintained in a down year and that it takes into account pension-scheme funding commitments, I believe that the payment is relatively safe unless a significant trading downturn occurs.

FinnCap has a target price for the shares of 122p, which suggests potential upside of 28%. The broker also points out that Alumasc shares trade at less than half the value of many of its building products industry peers. Amongst the fund managers holding the shares and hoping FinnCap’s target will be hit include the likes of AXA Investment Managers, Unicorn Asset Management and Chelverton Asset Management.

Comments (0)