Follow the fund managers for a profitable 2019

| This article was originally featured in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

As we say goodbye to 2018 and enter a new year it’s time for my annual review of how the UK small-cap markets have performed and to provide a few investment ideas for 2019.

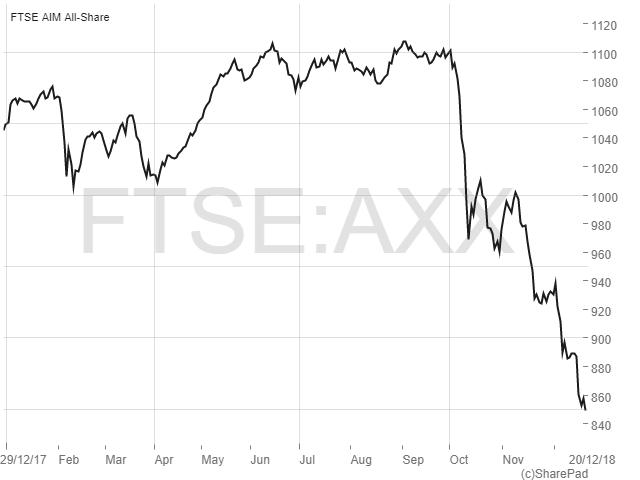

Unfortunately, unlike previous years, 2018 was a pretty dire one for small-cap investors. As I write, with a few trading days of the year left to go, the FTSE AIM All Share has shed 18.9% since 1st January. Despite reaching an 11-year high during the year, the sharp sell-off of the index’s constituents which began in October is still in full flow. The FTSE Small Cap Index put in a slightly better performance but still saw 13% shed from its value.

Blue-chips outperformed small-caps during the year, but only by putting in a less bad performance. Despite reaching its own all-time high in May, the FTSE 100 had a difficult year, losing 12.2% of its value as investors’ concerns over Brexit dominated the agenda. Only 22 blue-chip companies finished the year higher than they started. The UK heavy FTSE 250 index performed even worse, down by 15.3%, and ended its decade long bull run.

Small cap “blue-chips” drive disappointment

The usually reliable FTSE AIM 100 constituents, the largest AIM companies by market capitalisation, drove the fall of AIM shares during the year given their outsized contribution to the index. As a whole they were down by 19.1%. There are now only ten billion-pound businesses on AIM, down from 16 at the end of last year.

Online fashion business ASOS (LON:ASC) was a major disappointer, with a pre-Christmas profits warning seeing the shares down by 66% for the year to date as I write. Now capitalised at just under £2 billion, the company has lost its status as the largest AIM listed business. Other small-cap heavyweights plunging in value included online estate agent Purplebricks (LON:PURP), down by 64%, and carpet seller Victoria (LON:VCP), down 44%. While posh fizzy drinks seller Fevertree (LON:FEVR) only slipped by 4% over the year, it is currently trading at almost half its September peak.

At the other end of the AIM 100 there were of course some good performances. Litigation financing firm Burford Capital (LON:BUR) surged by 41% after securing new funding, taking it to a market cap of £3.3 billion and the top of the AIM hierarchy. Elsewhere, music products business Focusrite (LON:TUNE) surged by 47% after trading well during the year, with celebrations and gift wrapping company IG Design Group (LON:IGR) also up 47% after growing earnings by 20% for the 2018 financial year.

As bad as it seems?

The largest 10 AIM companies currently make up just over 25% of the total market cap of the AIM All Share out of a universe of 807, so the index’s performance is highly dependent on these select few stocks. Therefore, an alternative, and perhaps a more accurate way of reflecting small-cap performance, compared to looking at the AIM All Share, is by taking an equal weighted approach – in other words assuming that an equal amount of money was put into each AIM company at the start of 2018.

To complete this analysis, I take all AIM companies (including those not listed in the All Share) which were listed on the market at the beginning of 2018 and remained listed for the whole year (new listings during the year or those which left the market are excluded). There are 924 qualifying companies, to which I give each an equal weight in my theoretical index.

Of these, 243 companies (26.3%) finished the year with a higher share price, 8 (0.9%) were flat and 673 (72.8%) lost value. The average loss per share on an equal weighted basis was 17.8%, so not much better than the AIM All Share’s loss. Whichever way you look at it 2018 was a bad year for small caps.

Top Performers

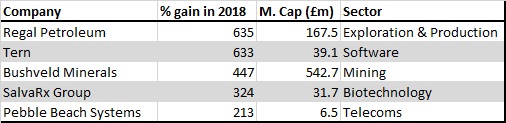

Amongst the malaise there were of course a clutch of small caps which saw their share prices surge during 2018. There were 20 companies which saw their shares double or more over the year, with 48 growing by more than 50%. Notably, unlike previous years, oil & gas and mining companies did not dominate the biggest gainers, with a broad range of sectors being represented amongst the year’s big winners.

Internet of Things investment company Tern (LON:TERN) was the number one AIM share of the year, rising in value by 663% after the company raised further funds and expanded its investment portfolio. Oil & gas explorer and producer Regal Petroleum (LON:RPT) was not far behind in second place, its shares rising by 662% following an increase in revenues and upgrade in reserves at its Ukrainian assets. In third place was vanadium producer Bushveld Minerals (LON:BMN) which grew by 447% despite the company receiving a fine for breach of the AIM rules.

Table: 5 biggest AIM risers in 2018. Performance measured from 1st January 2018 to 19th December 2018

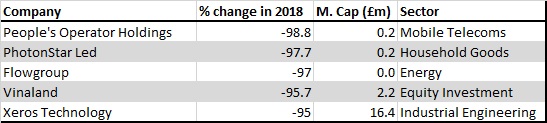

At the bottom of the market 55 AIM shares lost 80% or more of their value over the year. The worst performer was The People’s Operator (LON:TPOP), the good cause-focussed mobile virtual network business, which was down by 98.8% after it hit financial troubles and its advisor resigned. LED lighting business PhotonStar LED (LON:PSL) collapsed by 97.7% after it remained loss making and appointed administrators to its main trading subsidiary. Also falling from grace was Flowgroup (LON:FLOW), down by 97% before it was delisted in December after it sold its energy business and appointed administrators.

Table: 5 biggest AIM losers in 2018. Performance measured from 1st January 2018 to 19th December 2018

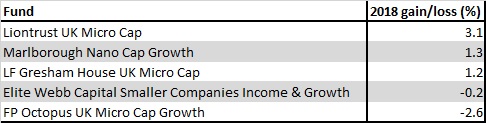

Follow the fund managers

Unsurprisingly given the market backdrop, it wasn’t a great year for small-cap fund managers in terms of absolute performance, although some did a good job of minimising losses. Looking at Trustnet’s universe of 48 UK small-cap funds, only three have made a gain in the year to date. However, all but one have performed better than the AIM All Share.

Data source: Trustnet. Note: Performance measured from 1stJanuary 2018 to 19thDecember 2018

So will it pay to take guidance from the professionals this year? Here follows two growth stocks which some of last year’s top performing small-cap funds are hoping will perform well in 2019.

MIND GYM

Last year’s best performing small-cap fund, the Liontrust UK Micro Cap, has 2.1% of its assets in Mind Gym (LON:MIND), a unique business which joined the markets in June last year. Co-founded in 2000 by the Harry Potter-esq named CEO Octavius Black (at his kitchen table), the company uses behavioural science to develop learning products which help large organisations to improve the productivity and effectiveness of their workforces. Topics covered include performance management, management development, change, ethics, customer service and (hot topic of the moment) diversity.

Mind Gym has built up a portfolio of over 300 learning products which have been used by an estimated two million people in c.1,500 companies and 94 countries around the world. These are typically short duration training courses (less than 90 minutes) and are delivered face-to-face, in virtual classrooms or digitally through a worldwide network of c.300 coaches or by a client’s own in-house Mind Gym certified coaches. Revenues are primarily made via the delivery of products by the company’s coaches, designing products for clients, content licensing and eLearning.

The products aren’t all psychobabble, with Mind Gym having a raft of case studies which show that they deliver a return for clients. For example, one US childcare centre saw client conversion rates up by 24% after implementing one of Mind Gym’s behavioural programmes.

So far, Mind Gym has built up a strong market presence in the UK along with a rapidly growing US operation and a small presence in Singapore. Clients are quality blue-chip organisations, with the company having to date worked with 62% of the current FTSE 100 members and 59% of the current S&P 100 constituents. Not only is the client base high quality, in the last financial year Mind Gym had a high level of repeat business, with 88% of revenues coming from returning customers.

The June IPO saw £50.8 million raised for selling shareholders at 146p, giving the firm a valuation of £145 million. Although these kinds of IPO (which act as exit events for the founders) are often criticised, the main selling shareholders (including Black and co-founder Sebastian Bailey) retain a 64.6% holding in the business. What’s more, the placing saw an influx of institutional investors, with the share sale said to be “significantly oversubscribed”.

Thinking big numbers

This is a fast-growing business, with revenues growing at a compound annual growth rate (CAGR) of over 20%over the four financial years to March 2018. Profits have also been rising quickly, with the pre-tax figures up from £1.85 million in 2016 to £6.16 million in 2018.

In early December this year Mind Gym released a decent maiden set of results which covered trading in the six months to September 2018. While revenues only grew by 13% to £19.4 million, growth in margins, combined with the operational gearing effect, saw pre-tax profits adjusted for IPO and other one-off costs up by 31% at £4.1 million. Repeat business again drove growth, with 86% of sales coming from clients who have done business with the firm in the past three years. In addition, new clients acquired during the period represent 46% of the total by number. The performance was good enough for the company to announce a maiden interim dividend of 0.8p per share.

Net cash generated from operations in the first half was £2.5 million but this was before the IPO costs of £2.3 million and £3.2 million of pre-IPO dividends. Investors will have to wait until next year (when these one off costs have been eliminated) to get a true idea of cash generation potential. But there are no balance sheet issues, with £2.5 million of net cash at the period end. Should the need arise, the company also has a £2 million unused overdraft facility with HSBC to tap into.

Trading since the end of the period is said to have been positive, with therebeing a good pipeline of opportunities and the company confident of meeting full-year expectations. Boding well for further margin growth, the percentage of revenue from digital products is expected to grow steadily in the second half and beyond. The company also has high hopes for a recently launched suite of products aimed at preventing bullying and harassment at work.

Mind the valuation gap

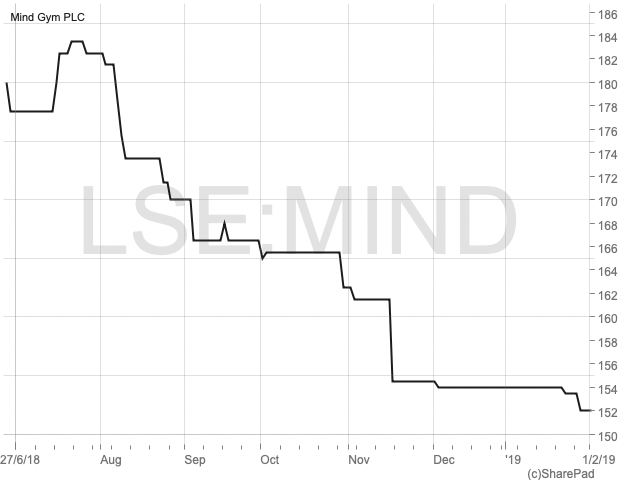

Despite a positive open to trading on AIM, shares in Mind Gym have slipped back from a high of 183.5p to the current level of 154p – only a few pence higher than the IPO placing price. Trading has been subdued, which is surprising given that the current market cap of £153 million should be attracting attention.

| This article was originally featured in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

House broker Liberum is currently looking for adjusted pre-tax profits of £8.5 million for 2019 and earnings per share of 6.6p. That puts the shares on a chunky price earnings multiple of 23 times but one which could prove to be worth paying should growth seen over the past few years continue. Andthere look to be excellent opportunities for further growth.

The talent and workforce consulting market in which the company operates is large – estimated by analysts at ALM Intelligence to be worth $11.5 billion globally and expected to grow at a steady CAGR of 5.2% from 2016 to 2020. Mind Gym believes that its total addressable market for the EMEA region alone is $2.1 billion. So, with a proven product and strong brand name, combined with an increasing focus by companies to improve on issues such as gender diversity and workplace equality, I believe the company looks well placed to expand in this market and beyond.

What’s more there are modest income attractions. The dividend policy set out at IPO is to pay out not less than 35% of profits after tax as a distribution to shareholders. Based on Liberum’s expectations that would equate to a yield of at least 1.5% at the current share price.

D4T4 SOLUTIONS

Performing well in 2018 for the Marlborough Nano Cap Growth fund was data products provider D4T4 Solutions (LON:D4T4). Previously known as IS Solutions until a name change in 2016, (the 4s are a play on the letter A) the business is now focussed on providing what it calls “solutions for complex data problems”, helping companies make the most from their data – from collection through to management and analytics.

D4T4’s flagship product is the Celebrus customer data platform, which the company promotes as the most advanced real-time data capture capability in the market, enabling companies to acquire customer data compliantly from websites and mobile applications in real-time as well as from across their entire digital operations. This data can then be used in applications that deliver artificial intelligence, customer insight and analytics, personalisation and customer relationship management. The company focuses on clients in industries which gather and use large amounts of data such as retail, financial services and telecoms.

D4T4 currently reports its revenues via four streams. The main business is Products Own IP – a combination of the Celebrus data platform software and software written for use with the company’s hybrid cloud data platform business. This comprises automated data management software tools, data migration tools and management support, monitoring and configuration software.

The three other units are: Products 3rd Party – bought in products, hardware and software, to provide environments for the hybrid cloud data platforms; Delivery Services – time and materials services for project inception and deployment and; Support and Maintenance- running, supporting and maintaining the data platform software and hybrid cloud data platforms offerings.

Following a period of investment, trading in the six months to September 2018 was very strong, continuing the momentum seen in the second half of the previous financial year when D4T4 booked in the two largest contracts in its history. Revenues for the period surged from £4.75 million to just under £14 million for the half following significant growth in sales of Celebrus and the hybrid cloud data platform. Sales of third-party products also surged, from £0.45 million to £3.62 million. Combined with gross margins rising from 43.8% to 51%, the adjusted pre-tax profit for the half was £3.35 million compared to a first-half loss of £0.38 million in the previous year.

Without a doubt, the highlight of the period was the superb cash flow performance. D4T4 saw a net £9.4 million inflow from operations in the period, with this mainly being the effect of receivables falling (debts being collected) by £17.9 million, offset by a £12 million fall in payables (creditors being paid). That took net cash at the period end from £3.92 million to £12.06 million, representing 18% of the current market cap. Perhaps conservatively, the interim dividend was increased by 12% to 0.7p per share.

| This article was originally featured in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The outlook for the rest of the year was positive, with the company saying that considering contracts forecast to close before the year end, recent new business wins and the depth and quality of prospects, it is confident that the business will achieve a “solid finish” to the financial year.

Worth p4ying 4?

While D4T4 shares have slipped back with the rest of the market over the past few weeks, they remain well ahead of their April lows of 98p. At the current price of 175.5p, the company is capitalised at just under £67 million and trades on a historic earnings multiple of 16 times. House broker Finncap is looking for earnings of 12p per share for the current financial year, meaning the multiple falls to 14.6 times. However, if we strip out the net cash of c.31.6p per share, the multiple falls to a more attractive 12 times – well below the sector average.

With a dividend of 2.8p per share being pencilled in for next year, the current yield is a moderate 1.6%. Providing modest upside to earnings the company recently commenced a share buy-back programme. But with the maximum spend allocated at just £100,000 the effect will be minimal. Finncap has a target price of 240p, which implies 37% upside from current levels.

Comments (0)