Facing Upcoming Risks With Dividend Stocks

The uptrend in stock markets has been so strong that it’s almost forbidden to mention even the possibility of a downside correction. But we should keep in mind that markets cannot rise forever at the current pace. With valuations for growth stocks so high, the slightest profit warning can deliver a price crunch. However, turning all the way towards a 10-year Treasury may not be the best bet, in particular when inflation is flying high and the yield on the safest instrument hovers around 1.25%. This is when dividend stocks come into play. A good dividend may protect for the downside while providing what is difficult to find nowadays − income.

It’s undeniable that markets are out of sync with fundamentals. A quick look into P/E data shows ratios of 23x for the UK, 31x for the US and 21x for Europe. If the past track record serves for comparison purposes, then these figures are alarmingly high, in particular for the US market. Profits have been growing well after a pandemic low, but the required growth rates to align P/E ratios with historical levels are just too high to avoid a correction in prices. For this reason, either you can find some hidden gems somewhere in a market around the world or it’s time to protect the downside by avoiding the high-flying growth stocks. However, fixed income is no alternative, in particular the safe Treasuries, because they come with a tiny reward for the interest-rate risk they currently carry. With inflation rising fast and key interest rates still at a low, central banks may need to hike their key rates, which would depress bond prices. Even if interest rates are frozen by central banks, there’s inflation risk. You may well end up with a negative rate of return after discounting for inflation. In this scenario, I believe a good option is to invest in stocks with bond characteristics − those paying out a large part of their profits as dividends. We just need to find the best dividend payers. A dividend-paying stock is an investment with a much shorter duration than a high-growth, non-dividend stock and then much less exposed to interest-rate risk. At the same time, dividend payers usually are well-established businesses in defensive sectors, which are well-equipped to weather any economic downturns.

To select the best dividend stocks, I propose two alternatives: a passive route and a DIY route. The first involves buying ETFs and paying portfolio managers to do the hard work for you. The second involves thinking about what makes a good dividend-paying stock and developing a strategy to filter out the best from the rest, by yourself. Let’s take a look at both strategies.

The passive route − buy ETFs

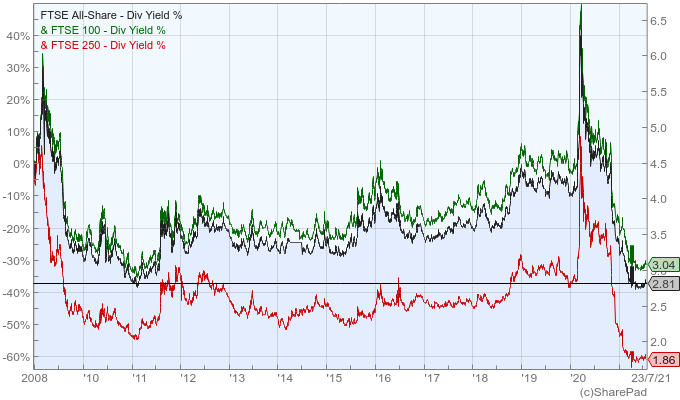

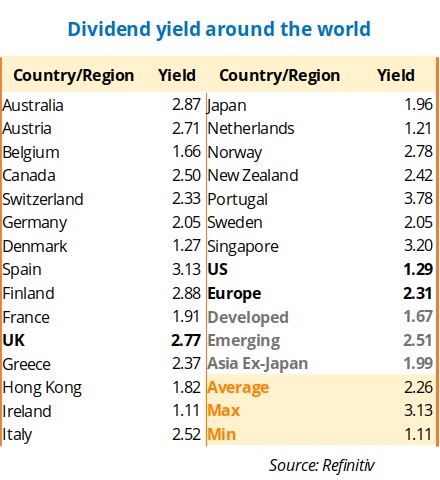

The first big problem you will face, no matter the route you choose, is to find good dividend yields. If you take a look at the table below, where the current dividend yields for several countries around the world are depicted, you’ll quickly become disappointed with the values. For example, stock prices are so high in the US that the current yield is just 1.29. In the UK, the scenario is better, but the yield is still low at 2.77. There are a few European countries where the picture looks ‘shinier’, such as Portugal and Spain, but the overall conclusion is that dividend yields are very low everywhere. This means that it will be difficult to get a high yield, in particular if investing in a diversified portfolio with many stocks.

If you’re looking for the safest, the SPDR S&P Dividend ETF and the SPDR S&P International Dividend are excellent options. These ETFs don’t offer the best dividend yields but are the best replacement for Treasuries.

SPDR S&P Dividend ETF (NYSEARCA:SDY)

SDY is linked to the S&P High Yield Dividend Aristocrats Index, offering exposure to dividend-paying, large-cap stocks from the US. It invests in some of the safest companies in the world, including big names like Exxon Mobil, AT&T and South Jersey Industries. To be included in the index the ETF requires that a company must have increased dividends every year for at least 25 consecutive years. Past dividend payments are no guarantee of future dividend payments, but this restriction is one of the most stringent I know about and the best assurance you can get about the future. This comes at a cost, though. The SEC yield* for this ETF is just 2.50%. SDY is well-balanced across sectors, with top exposures in financials (16.0%), industrials (14.9%), consumer staples (14.8%) and utilities (14.7%). The expense ratio is 0.35%.

SPDR S&P International Dividend (NYSEARCA:DWX)

If you’re looking for international exposure, DWX is an alternative to SDY. It gives you exposure to dividend payers in Canada (20.0%), Japan (13.4%), Switzerland (10.5%), UK (9.5%) and Taiwan (6.5%) among many other countries. From the list of ETFs I have today, this is the one investing in the larger number of countries. Its SEC yield is 3.42% and the expense ratio comes at 0.45%.

Global X SuperDividend US ETF (NYSEARCA:DIV)

For an alternative ETF investing in the US, Global X offers the SuperDividend ETF, which invests in 50 high-dividend-paying stocks. This comes with an improved SEC yield of 4.91%, relying less on financials and more on real estate than SDY does. It comes with an expense ratio of 0.45%. The fund is well-balanced across holdings and includes some big names like Philip Morris, Pfizer, Duke Energy, 3M and Gilead Sciences. A particular feature of Global X dividend ETFs is their monthly distributions. For someone looking for income every month this is a plus.

Global X SuperDividend ETF (NYSEARCA:SDIV)

For investors looking for a global exposure, Global X offers this SuperDividend alternative, which invests in 100 high-dividend-paying stocks across the world. Its top country exposures include US (29.8%), China (17.0%), Hong Kong (11.4%) and UK (6.4%). One important point to highlight is its P/E of 6.7x and price-to-book ratio of 0.77x. These values are well below those found for US ETFs and a very good reason for investors to shift their focus away from US markets at this point because they can find much cheaper stocks elsewhere. SDIV comes with a SEC yield of 7.18% and an expense ratio of 0.59%. Almost half of the assets are concentrated in real estate, though.

Global X MSCI SuperDividend EAFE ETF (NASDAQ:EFAS)

For more targeted international options, Global X offers an EAFE and an emerging markets version of its SuperDividend ETFs. The EAFE ETF invests in 50 companies across Europe, Australasia and the Far East. For investors looking for a tilt towards the UK, this fund may be a good option as its top exposure is the UK (20.2%), followed by Hong Kong (10.3%), Italy (9.9%) and Spain (9.6%). The fund trades with a SEC yield of 4.58% and with an expense ratio of 0.56%. In comparison to SDIV, it has less exposure to real estate and more to financials and utilities.

Global X SuperDividend Emerging Markets (NYSEARCA:SDEM)

The last ETF under review today targets emerging markets, investing in 50 high-dividend-paying stocks. Its top country exposure includes China (23.4%), Brazil (13.1%), Hong Kong (8.8%), Taiwan (8.4%) and Malaysia (7.6%). It relies on materials (20.5%), financials (19.5%), real estate (15.5%) and utilities (12.6%). The SEC yield is 4.5% and the expense ratio 0.67%.

The DIY route − develop a quantitative strategy

If you feel more like an active investor willing to ‘DIY’, then what you need is to develop a strategy to pick high-dividend payers. A first filter that comes to mind is, of course, dividend yield. We may start by filtering companies paying 3%, 4% or even more. But that’s not enough. We want companies with strong financials, which can easily surpass bad years and continue paying dividends without interruption. The dividend yield tells a story about the past. It gives no guarantees about the future. Thus, besides setting a filter for a minimum acceptable dividend yield, we should set some additional filters. Here is my quantitative strategy to capture reliable dividends:

- Dividend yield >= 4%

- Dividend cover >= 1.5x

- Number of consecutive dividend payment years >= 7

- Average return on capital employed (ROCE) for last 7 years >= 7%

- EBIT yield TTM >= 7%

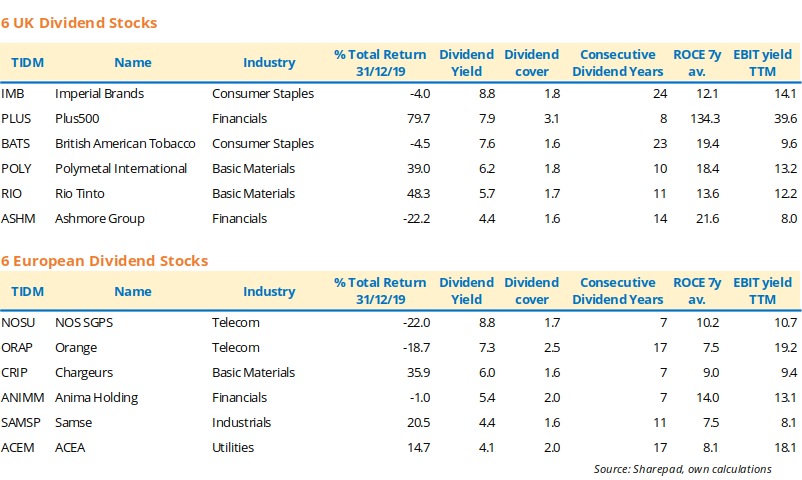

I’m focusing on the FTSE All-Share market for which the dividend yield is around 2.81%. I set the first filter a bit higher at 4%, which I believe is a good starting point for our screener. The second filter is very important because it gives us an idea about the ability of a company to pay the dividend. If this ratio is too low, sooner or later the dividend would be suspended. For the third filter I’m being much more flexible than the SDY ETF is at choosing seven consecutive years with dividend payments. My last two filters are aimed at filtering just quality, profitable businesses that are able to return decent rates on the capital invested and that aren’t too expensive. I started with 604 shares and ended up with just 11.

In continental Europe there are also a few good opportunities, as these markets are not at the price levels of US markets. I applied the same quantitative strategy to European shares and came up with exactly six stocks. The table below shows the top six stocks by dividend yield for the UK and continental Europe. Two telecoms stocks are at the top spots for Europe: Nos, from Portugal and Orange, from France. These companies are solid and currently trade on very high yields due to the deep price corrections they suffered in the recent past.

Final words

If you believe the market is a bit overvalued, because you’re worried about inflation, or if you’re looking for some regular income stream, adding a value layer to your portfolio filled with high-dividend stocks will certainly help. It doesn’t hurt to forget about price for a while and live from income, provided that such income can cover for the risk taken, which is hardly the case with Treasuries. For those of you looking for a simple strategy, there are many ETFs that can give you the dividend layer cheaply and without much trouble. For those seeking some action (and eventually trouble), there’s always a quantitative strategy you can implement to filter out those high-dividend payers.

Notes:

- The SEC yield is a standard yield calculation developed for fair comparison of bonds. The yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year.

Comments (0)