Can factor investing deliver alpha?

One recent addiction to the already huge portfolio of investment possibilities is factor investing, which aims at revolutionising the way we invest. Until today, investors have been allocating the money in their portfolios into several asset classes: bonds, equities, foreign equities, real assets, commodities, currencies, and so on. But what if instead they could allocate money to investing themes, such as value, momentum, quality, size, and any other relevant factors?

During the 1950s and ‘60s a few attempts were made to modernise portfolio theory and to find valuable models that could explain how asset prices reach equilibrium. One of the most important models ever developed is the Capital Asset Pricing Model (CAPM), which states that the expected return on some asset depends on their exposure to market risk, which is measured by beta. An asset with higher beta incurs more market risk and therefore should be rewarded with better expected returns. The returns of any assets would then be proportional to the returns of the market, and the market would be the only factor explaining the returns of an asset.

But this one-factor model was insufficient when explaining returns with the necessary precision, so researchers added a few more factors they found relevant. For example, small caps have been showed to outperform the market over long periods of time and such outperformance was not captured by market beta. According to the CAPM, these equities would then lead to alpha, which shouldn’t be achievable in a market that tends to equilibrium. In order to capture this anomaly, and another that usually sees lowly valued companies outperforming the market, Fama and French developed what became known as the Fama-French three-factor model, aimed at replacing the one-factor CAPM. This model adds value and size to the market factor. Higher market returns explain higher equity returns. But, companies with lower price-book ratios or price-earnings ratios also earn higher returns, as do smaller companies. This way, we have market, value and size as three relevant factors explaining returns. According to this new model, small companies no longer deliver alpha. The extra returns, above the market, are explained by the new factor – size. Thus, size seems to be a fundamental source of risk.

Each individual equity has its own sensitivities to each of those factors. If one can buy the market, why not buy size and value? The main idea of factor investing is to invest in these factors, rather than investing in the traditional asset classes, like bonds and equities.

As we know, picking individual equities is a tough and time-consuming activity. Academic research has not been able to clearly provide evidence that active management outperforms the market, in particular when we consider these extra sources of risk. That being true, oftentimes the best an investor can do is to try to capture beta (or betas, if we take into consideration the new sources of fundamental risk). (In the “How To Invest Like…” section of the next Master Investor Magazine edition, you will meet one investor that spent decades of his life claiming that passive investment outperforms active management through reducing fees and costs, which motivated him to create the first passive index fund ever available to individual investors.)

Through the years, the stable of passively managed index funds has grown substantially. Investors can bet on many different equity indices, in countries, sectors, commodities, currencies, and in investment styles and factors. A few ETF providers are now giving investors the opportunity to adopt the new factor approach instead of investing in asset classes. The MSCI recognises six main factors that are investable and able to deliver consistent profits over time: low size, momentum, value, high quality, low volatility and high yield. Investors can invest in at least four of these factors through, for example, the iShares ETF offering.

The concepts behind size and value are explained above. Traditionally, researchers and market participants find that companies with low valuation ratios, as well as smaller companies, outperform the market. But as research advanced, other factors have also been found to lead to outperformance. A well-known example is momentum. It is said that those equities that outperformed over the last few months tend to outperform over the next few. A portfolio trying to mirror this factor basically buys these recent outperformers in the expectation that they continue to outperform. The high quality factor buys companies with high quality balance sheets, with features like a low debt ratio, low earnings volatility and a high return to equity. The high yield factor looks for companies paying higher dividends. Finally, the low volatility factor is based on the notion that equities with lower volatility tend to outperform in the long run. All these funds are built in a relatively automated fashion and offered with very low expense ratios. With the help of these factors, an investor can decompose returns and invest only in the themes he finds attractive.

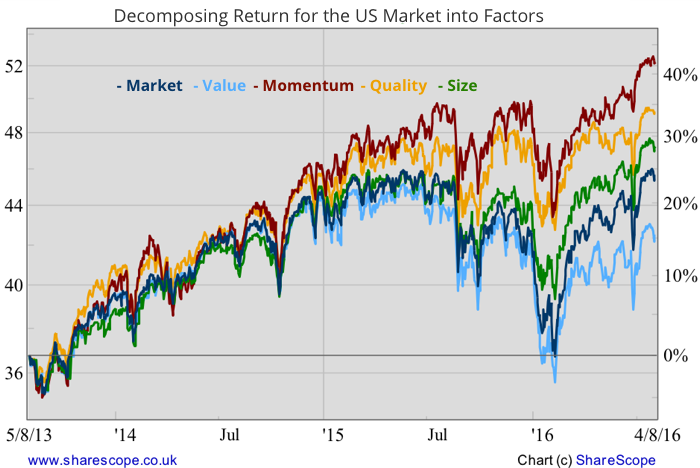

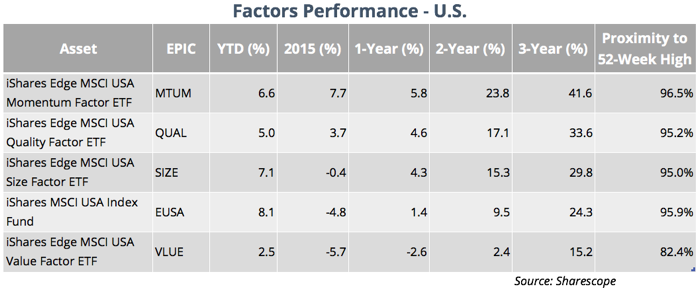

As you can see in the above chart and table which show the returns on the MSCI factors for the US market, the returns offered by each factor vary widely. Since 2015, momentum seems to have been the outperforming factor, while value seems to have been underperforming. But these factors are highly cyclical and they can outperform or underperform the market for long periods of time. Nevertheless, they allow investors to decompose the market return and build a portfolio based on just a few factors, eventually changing their allocation across time, pretty much like traditional investors do with equities and bonds. For example, value, momentum and low size are highly cyclical factors that tend to perform better when the overall market (and the economy) is growing. Quality is a more defensive feature that does pretty well when the market is declining. Instead of increasing exposure to bonds and reducing exposure to equities, through factor investing, an investor could instead increase exposure to quality. The main point here is identifying the exact correlations these factors have with the economy in order to allocate money to the factors in an optimised fashion.

In theory, factors are not correlated with each other. But that isn’t the case with the offer you get in the market. When you purchase both the iShares MSCI Size factor (LON:SIZE) and the iShares MSCI Momentum Factor (LON:MTUM) you get two different ETFs with low correlation between them, but some. The reason for this is the fact these factors are identified using ad-hoc procedures and not statistical techniques. In theory the correlation between factors should be zero. At the same time, just because the above factors have been more or less present at all times, we can’t be sure these are the most important factors at every moment and for each market. A few years ago I conducted some research on the FTSE 100 in order to identify factors using statistical procedures. Unlike the ad-hoc procedure, what I found were real factors for that particular moment. The first and most important factor, which explains the most part of returns, is always the market. So a change in market return is the most prominent reason why Barclays or AstraZeneca also change. Low volatility was my second factor, which seems to be in accordance with MSCI factors. Curiously, my third factor was something opposing commodity producers to non-commodity producers. In a market where there are quite a few heavyweights in the raw materials business, it came to me as no surprise that being a commodity-related producer should be an important factor. My fourth factor was the opposition between financial and non-financial companies. These factors should be completely uncorrelated with each other but I’m not sure they haven’t changed. At the same time, size, value, or momentum may have a less important role than featured by MSCI.

Factor investing is a relatively new concept which may be highly desirable for sophisticated investors. But unlike what many say, these factors are not able to deliver alpha over long periods of time. They aim to explain returns and are highly cyclical. They are not tailored for a Buffettesque buy and hold strategy but rather for a Lynch-style buy and rotate one. Investors should be very careful because the factors offered for investment purposes depart from their theoretical conceptions, which may have an important effect. Nevertheless, this existing offering may be good enough to vary exposure to the market according to economic conditions in a more sophisticated way than through the traditional equity-bonds view.

Comments (0)