Delta Stocks for a Covid resurgence

Covid-19 isn’t over yet, but even if it were the stock market would still be at risk of a deep correction.

The other day, I read in the news that the S&P 500 has not fallen more than 5% below a peak during the last 200 sessions or so, which is a very rare event in the stock market. It has also accumulated a gain of 19% year to date and doubled in value since bottoming in March 2020. Considering that the pandemic isn’t over, this is an impressive outcome. Too good to be true, I would say.

I have two concerns. The first is related to the pandemic: I fear we’re not near the end of it. Covid-19 has proven to be a tricky virus, sneaking around us and leading the pandemic through several cycles. I wouldn’t discard the possibility of tighter restrictions materialising during the colder seasons, as cases increase, despite the success of the vaccination programme. My second concern is related to stock valuations. Growth expectations are still on the high side, so stock prices are vulnerable to a severe correction if something goes wrong, or even if market conditions just become less rosy.

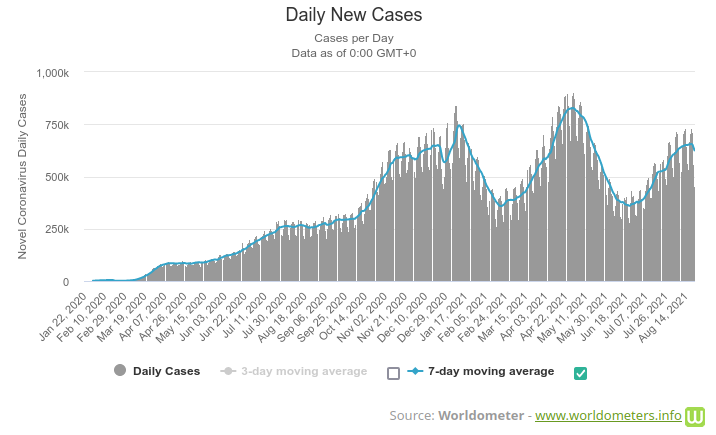

Cases are less serious but still increasing

Europe and the US were able to significantly reduce the number of pandemic-related deaths. This enabled a progressive lift of lockdowns and restrictions that helped these economies recover and contributed to boosting stock prices. However, the data on Covid-19 is still concerning. At the time of writing, daily new cases stand at 625,000 (seven-day moving average) in comparison with 825,000 during April’s peak, 739,000 during January’s peak and 255,000 one year ago. These numbers are still high, despite the vaccination programme. Daily deaths currently stand at 9,600, up from 6,205 one year ago. The number of serious and critical cases currently sits at 111,000, which is near a peak.

We must interpret global data carefully, as these numbers hide differing realities across the globe. For example, in places where vaccination rates are higher, the incidence of serious illness and death has decreased substantially. Nevertheless, we’re seeing a rise in the number of cases in places where vaccination rates are high. Even breakthrough cases (where someone who has been vaccinated contracts the virus), which were at first supposed to be rare, are rising. A mix of events explains this. Some people were vaccinated more than six months ago; new variants have emerged; and as more and more people are vaccinated, there is less social distancing. Israel is one of the countries that has led on vaccination but it is currently suffering from breakthrough infections. For more on all this, I would direct readers to Harvard’s Michael Mina, who explains the current concerns much better than I could. From a health-care perspective, I wouldn’t say we should be really worried, but from an investment perspective, I believe we should discount the ever more likely possibility that life isn’t going to normalise this year and then be careful about the current market levels.

Winners and losers

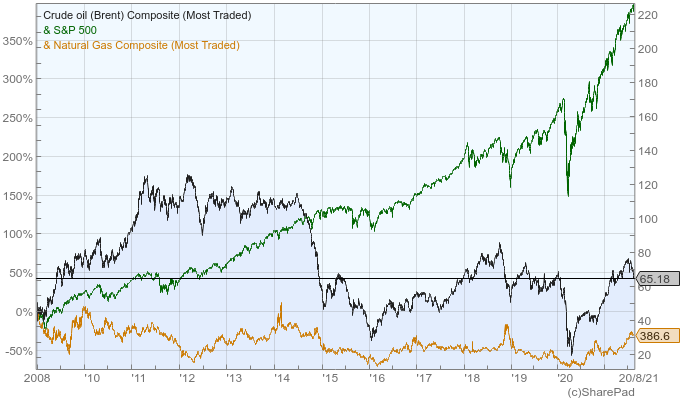

Mazur et al. (2020)* investigated the US stock-market crash of March 2020 caused by Covid-19. They report that natural gas; food and grocery distribution; health-care and medical devices; and software and technology were the best performing sectors during the panic selling on 9, 12, 16 and 23 March, that led to a cumulative loss of 26% for the DJIA (Dow Jones Industrial Average Index). The worst performers were the petroleum, real-estate, entertainment and hospitality sectors.

The investigators explain that petroleum suffered the most because there was a very sharp decline in oil prices. Between February and April, oil lost 65%, which drove all oil-related companies down, as they’re like leveraged bets on the commodity. However, natural gas is a by-product of oil extraction. The cut in oil production due to the sharp price drop, led to an automatic cut in natural-gas production, increasing prices and favouring the natural-gas sector.

The negative impact of Covid-19 on entertainment and hospitality is obvious. Many of these businesses were closed due to lockdowns. Real estate is currently doing well, but if we think, for example, about business rentals and the rise of remote work, we understand why the sector suffered at first. Looking at the food and grocery distribution outperformance, it’s easy to perceive that these businesses experienced an upward shift in demand, as restaurants were shut down. Health care is a natural beneficiary of the pandemic, as all of the focus has been and will continue to be on health and on the development of treatments. Moderna (NASDAQ:MRNA), for example, was able to post a profit for the first time since its inception, due to the development of a vaccine. Other companies are going to follow with new and alternative vaccines. With people working remotely and spending more time at home, the software and technology sector could only win, as software, hardware and networking products have been in high demand.

Considering the current Covid-19 risks and learning from the recent past, I believe that the health-care and medical-devices sector is the real ‘winner’ and one to keep an overweight exposure to for the time to come. Some ETF options for considering include the iShares Global Healthcare ETF (NYSEARCA:IXJ) for a broad and global exposure, the iShares US Healthcare ETF (NYSEARCA:IYH) for exposure within the US and the iShares US Medical Devices ETF (NYSEARCA:IHI) for a targeted exposure to medical devices.

Regarding petroleum and natural gas, I would rather maintain an underweight exposure to both, if not selling, because prices are currently high. I expect any future lockdowns and restrictions to be lighter than before and remote work to decrease, so I don’t foresee a positive impact on the food and software sectors as before. Additionally, I’m of the opinion that the tech sector is overvalued and more exposed to downside corrections. If I did anything, it would be to bet against it, as Michael Burry did against ARK.

Notes:

*Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the March 2020 stock market crash. Evidence from S&P 1500. Finance Research Letters, 38, 101690.

The upshot of this analysis seems to be: there’s a correction coming, so buy healthcare and medical devices, short Tech if you know how, and go underweight on everything else.

Fair summary? How about shorting the Nasdaq and US market generally too?