Centrica: Out of the Woods?

Centrica’s cash position has improved markedly suggesting that the current prospective dividend yield at an estimated 5.3% looks sustainable. There is also the support of a significant net asset backing for the shares. For those seeking income, Centrica looks like a dividend stock to accumulate at these levels.

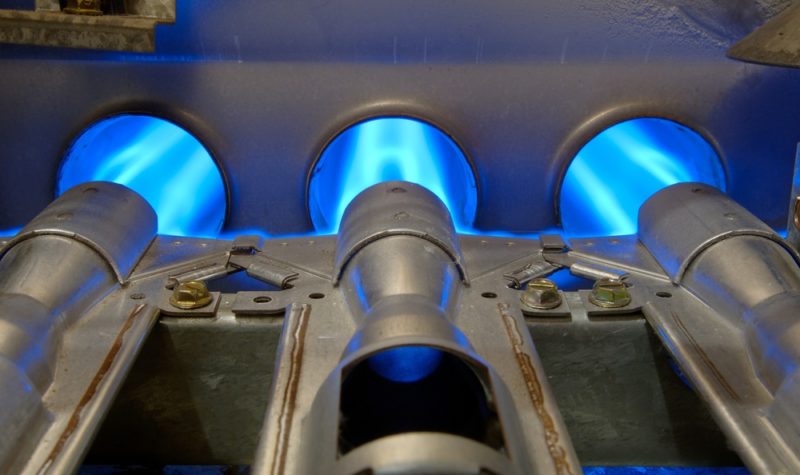

To most of us, Centrica presents a marketing picture of itself as one of cosy domesticity, with ‘British Gas’ blue and white vans, domestic boilers and quarterly bills. But that is a deceptive image and stands in contrast to the view it took of itself three years ago.

Centrica is one of those companies that set out to conquer the world by turning itself into an energy exploration and production company operating on the high cost frontier of expensive energy, at a time when oil and gas prices were extraordinarily high. It is a classic example of a management that pursued an obvious but mistaken policy of what they like to call equity asset destruction, although it appears nothing like the scale on which the bankers destroyed theirs.

It previously regarded its dull but reliable energy supply business in the UK as a useful cash cow for such expansion. In the six years up to 2013, it made six acquisitions of oil and gas production companies for a total investment of a reported £5.4 billion, from the North Sea to Trinidad and Canada. It was a big money, high stakes game which came unstuck when oil and gas markets – aided by advancing ‘fracking’ technology – produced more supply than the world demanded, particularly when China was moving away from ‘infrastructure’ building led growth towards one of more domestic consumption. For Centrica, balance sheet debt between 2010 and 2015 rose every year.

Where to from here?

The recently published half-year results to June 30th 2016 suggest that the worst may be over and that the current prospective dividend yield of 5.3 per cent for this year is a signal reason to buy the shares. Two years ago, operating cash flow (in the year to December 31st 2014) collapsed nearly sixty per cent from £2.94 billion to £1.22 billion. Given that investment spending had been £2.35 billion the previous year (with another £0.86 billion paid out in dividends) it was clear that something had to be done.

Last year’s accounts show that annual investment spending had been slashed from the earlier peak of £2.94 billion to a relatively sedate £0.61 billion whilst the dividend payout – which had peaked at £0.86 billion in 2013 – had been cut by more than two thirds to £0.38 billion.

In the meantime, the share price was also falling dramatically to discount the cash shortage problem which management were moving to solve, largely by curtailing investment spending on oil and gas exploration acreage as well as cutting the dividend payout.

Technicals

If you take a look at the share price chart you will see that the share price briefly went through the 240p overhead resistance but then pulled back to a little below it again. Arguably the share price is still on an upward trend and bouncing encouragingly. Taking a longer term perspective by looking at a three year chart, one may clearly see that the Centrica share price has broken out from the downtrend which began in 2013. The technical situation looks attractive. Is there enough in the fundamentals to justify a bullish view?

Reasons for buying Centrica now

Centrica offers a handsome estimated and prospective dividend yield of just under 5.2 per cent for this year and slightly higher for next year at 5.3 per cent. In a week following the announcement by the Bank of England of yet another cut in base rate, to 0.25 per cent, that is a strong enough reason for buying Centrica shares, assuming that the dividend looks safe from further cuts. The estimated dividend yields based on a share price of 236p (last seen) derive from the latest market consensus estimates for Centrica covering this year and next.

The 2016 first-half results

H1 results seem to support a bullish view of the dividend and earnings. They show, for example, that operating cash continued to be strong, rising two per cent more than the operating cash generated in the same period a year earlier and being nearly two thirds the cash generated in the whole of 2015. Moreover, operating cash covered investment spending and the interim dividend payment. Centrica now appears to be living within its cash means, thus making the aforementioned forward dividend estimates look affordable.

Moreover, last year’s annual operating cash flow of £2.2 billion means that the shares, on the current share price of 236p (last seen), are valued at only 5.8 times operating cash flow and that balance sheet cash and near cash in the June balance sheet are worth an estimated 42p a share, giving a balance sheet cash to price valuation of 5.6 times.

In relation to cash generation, the first half June 2016 profit and loss account also shows that operating margins at 13.2 per cent were significantly up on the operating margin of 8.7 per cent a year earlier and of course far better than the negative operating margin last year.

Other measures of value include the metric that at their much reduced share price, Centrica shares are selling at half the value of estimated annual turnover for this current year. That seems a modest enough valuation. Furthermore, net assets which are attributed to ordinary shares stood at £2.6 billion in June, or one fifth of the share price. Stripping that out of the said market price of 236p gives a nominal share price for earnings alone of around 190p.

Comments (0)