Is Buffett right to choose Coca Cola over Microsoft?

As a UK investor I am mostly interested in UK stocks. However, Master Investor’s focus last month on the US prompted me to look across the pond. Specifically, I wanted to see how some of the biggest and safest dividend payers in the US stacked up as long-term dividend investments. To be honest, I wasn’t optimistic. The US is not exactly known as a bastion of high yield stocks and US markets have been expensive for years. But on the flip side, the US is home to some of the most successful dividend-payers on the planet, where lofty prices may be justified.

Of course, the US is also home to Warren Buffett, who has been investing in high quality dividend-paying companies for decades. So with Buffett in mind, I thought I’d look at two very high profile, high quality companies he’s often spoken about, but only one of which he’s invested in.

Coca Cola: One of Buffett’s favourite investments

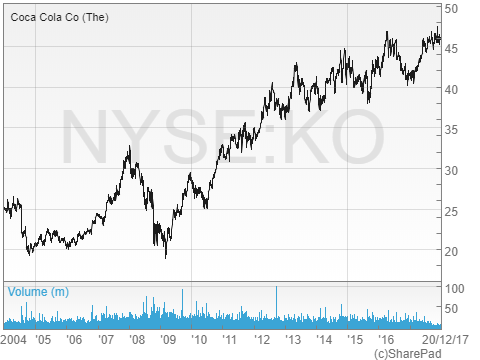

Warren Buffett invested in the Coca Cola Company (NYSE:KO) in 1988 and 1989, at a time when the company’s exceptional growth prospects were largely ignored by the market.

His premise was essentially that the company’s long track record of growth, which had seen it more than double revenues, earnings and dividends in the previous decade, could be sustained for many more decades to come. At the same time, the stock had a dividend yield of 3%, which suggested that its high future growth potential was not reflected in the price.

With hindsight, Buffett was largely right. Since his original purchase in 1988, Coca Cola has proven itself to be one of a select few global corporations which seem able to grow almost without end.

Notice though, that I said Buffett was largely right and that Coca Cola seems able to grow almost without end. That’s because the company could – after more than a century – be about to lose its position as a high growth dividend champion.

Infinite growth on a finite planet?

The famous quote about the impossibility of infinite growth on a finite planet is 100% correct. Trees don’t grow to the sky and no company can grow significantly faster than the rest of the economy forever. This inevitable slowdown shows up in Coca Cola’s financial results over the past 30 years.

Between 1979 and 1988, the decade preceding Buffett’s purchase, Coca Cola’s revenues grew by 113%, going from $3.9 billion to $8.3 billion. Over the following decade to 1998, those revenues grew by an even more impressive 127%. By that point, Buffett’s 1988 analysis was basically right; the company had maintained its high growth rate for another decade and still seemed capable of generating rapid growth in the future.

Buffett’s investment also generated massive capital gains. While the company doubled its revenues between 1988 and 1998, the share price increased ten-fold. Perhaps investors had aligned themselves with Buffett, in the belief that Coca Cola’s growth was inevitable and that such a fantastic company should command a very high price.

Don’t miss John’s next piece in the next edition of Master Investor Magazine – Sign-up HERE for FREE

I have no doubt that Coca Cola was and is a high-quality company, but by 1998 investors had become seriously carried away by how much it could grow and how much it was worth. In the middle of 1998, Coca Cola had a dividend yield of less than 1%. This means an investor looking for 10% annual returns must have believed that the company could grow at about 9% per year or more, decade after decade. That may have been possible in the past, but for the unfortunate Coca Cola investor of 1998, it has not happened since.

Instead, by 2008 the company’s revenues (from which dividends are ultimately paid) had grown by a more modest 70%. That’s still a fairly decent 5.4% annual growth rate, but 9% per year it is not. This less exceptional growth rate was probably one of the reasons why the premium valuation assigned to Coca Cola in 1998 gradually declined over the following decade. By the time 2008 rolled around, the shares had fallen by more than 30% compared to where they were ten years before, despite the company growing by 70% during that period.

The decade from 2008 until today has seen that trend of slowing growth continue. In fact, 2016 revenues of $42 billion were actually 7% lower than in 2008. Even if we optimistically assume that 2018 revenues can revisit their 2012 peak of $48 billion, total revenue growth from 2008 to 2018 will be just 50%. Again, this is not a bad growth rate; it’s 4.2% per year. But it is not exceptional in the slightest.

Is Coca Cola’s premium valuation deserved?

If this slowing growth trend continues, then Coca Cola should not command a premium valuation. With its dividend yield currently close to 3% and assuming growth over the next decade at 4% per year, Coca Cola has a yield plus growth total return estimate of just 7%. Personally, I won’t invest in a company unless the estimated return is north of 10%.

This doesn’t mean I’m bearish on Coca Cola as a company. I do think it will keep growing for many more decades. It is almost inevitable that more people around the world will become richer and more inclined to pay up for fizzy drinks rather than drinking water for free.

But there is another story, which is that tastes are changing. People want healthier drinks with less sugar. They want drinks that give them minerals or vitamins or some other health enhancing ingredient that Coke does not contain. They want new and exciting brands too. These are all things that the Coca Cola company can do, and is doing. But the company’s competitive advantage is tied up with the Coke brand, so as it moves into other areas with other brands, that competitive advantage goes away. All it’s left with then is economies of scale as the world’s largest beverage company, and that’s a pretty weak advantage.

Given the impossibility of infinite growth and changing consumer tastes, I think Coca Cola will probably continue to grow, but at a slower rate with lower returns on capital employed (which have already declined from over 20% a decade ago to barely 10% today). I would still invest in the company, but only at a price which reflected that low-growth outlook.

As a US company, Coca Cola isn’t on my stock screen of dividend-paying UK companies, but if it was then at its current price of $47 it would come 159th out of 220 companies. Needless to say, that is not very good.

To get into the top 50, which is what I’d call “good value”, the share price would need to fall below $25. That’s about 45% less than its current price. At $25 the dividend yield would increase to 5.7%, which would nicely offset my mediocre 4% growth expectations. Obviously, Coca Cola shares aren’t going to decline by 45% for no reason. It will probably take a major US bear market to push them down that far, and that could be years away. But that’s okay, because in the investment game patience really is a virtue.

Microsoft: Outside Buffett’s circle of competence

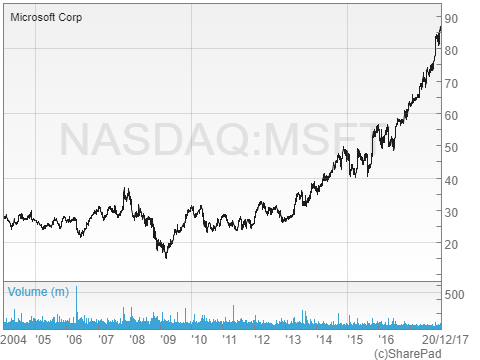

Unlike Coca Cola, Buffett has never invested in Microsoft (NASDAQ:MSFT). Originally this was because he had little understanding of the computer industry, but in more recent years it has been due to the close relationship between him and Microsoft’s co-founder, Bill Gates.

Also unlike Coca Cola, Microsoft does not have a century or more of impressive growth behind it. Instead, it has is a few decades of incredible growth and almost unparalleled industry dominance.

It all began in 1975, when Bill Gates and Paul Allen decided to write a BASIC programming language interpreter for the Altair 8080. From zero in 1975, the company’s revenues grew to a whopping $381,000 in 1977, generated by a total of nine employees. By 1987 the company had become a major listed US corporation, with revenues in that year of $346 million. That’s a near-thousandfold increase in a decade and an annualised growth rate of 98% (yes, 98% per year).

Obviously, that completely crushes Coca Cola’s growth over the same period. Microsoft was tiny and tiny companies can grow astonishingly fast, but roll forward through each subsequent ten-year period and we see the same inevitable decline in growth that we see with Coca Cola.

A story of exponential decay

Between 1987 and 1997, Microsoft’s revenues grew more than 3,000% to $11.36 billion, giving an annualised growth rate of 42%. While 42% per year is still incredible, it’s a long way short of the previous decade’s 98% growth rate. Roll forward another ten years and by 2007 revenues had climbed to $51.1 billion, giving total growth in that period of 350% and annualised growth of 16%. Yes, a 16% growth rate is still impressive, but it’s no longer incredible. And what about the most recent ten years? It’s the same story. From 2007 to 2017, revenues grew by a total of 76% to just shy of $90 billion. That’s an annualised growth rate of 6%, which is no longer even that impressive.

So Microsoft has gone from an insane growth rate of 98% during the ‘80s, to an incredible growth rate of 42% during the ‘90s. It followed that up with an impressive growth rate of 16% during the 2000s and then produced a pretty average growth rate of 6% during the 2010s.

Don’t miss John’s next piece in the next edition of Master Investor Magazine – Sign-up HERE for FREE

This is an almost perfect example of exponential decay. In other words, Microsoft’s growth rate has declined by a fairly constant percentage (about 60%) in each successive ten-year period. This won’t continue indefinitely, or at least Microsoft shareholders should hope it doesn’t, otherwise its growth will rapidly approach zero. More realistically, Microsoft’s growth rate will approach the market average, or perhaps slightly less, and we may be very close to that point.

As with Coca Cola, this doesn’t mean I’m bearish about Microsoft. I think it’s in an amazingly strong position and still totally dominates the world of PC operating systems. It very probably will have a long and successful future, but I don’t think it’s a future that will be characterised by high growth.

On the negative side, PCs are in terminal decline and, like Coca Cola, Microsoft is having to move into other areas. These include cloud computing and gaming consoles, to name but two. However, Microsoft has less of a competitive advantage in those arenas and will therefore find it harder to earn outsized returns on capital employed (ROCE has already declined from an excellent 29% in 2007 to a more pedestrian 12% in 2017). But as I said, I am not bearish about Microsoft and I would probably invest in the company at the right price.

So what is the right price? It certainly isn’t $84, which is where the shares sit today. At that price, Microsoft has a dividend yield of just 1.9%, which I’m sure you’ll realise is not particularly attractive to a dividend-focused investor. However, I am willing to invest in low-yield companies if I think they might offset that low yield with high dividend growth.

In this case, Microsoft has grown its dividend by about 13% per year over the past decade, which far outpaces its 6% revenue growth rate. There are two reasons for this: First, Microsoft has been buying back shares, reducing their number by about 2% per year, which pushes up per share revenues, earnings and dividends by about 2% per year (so per share revenues have grown by about 8% per year). Second, the ratio between dividends and revenues has increased from about 8% in 2007 to 14% today.

This is good in some sense because the company has been able to increase cash returns to shareholders at an impressive rate, even though its top line growth has been muted. But this can only go on for so long. At some point the ratio between dividends and revenues will reach a maximum, after which dividend growth will fall in line with revenue growth.

Microsoft’s low yield requires optimism

Let’s optimistically assume that Microsoft can grow its per share revenues, earnings and dividends at 8% per year over the next decade, which is equal to its current per share revenue growth rate. With a yield of 1.9% and estimated dividend growth of 8%, that’s a yield-plus-growth return of 9.9%. That isn’t bad, but it isn’t far off the expected return of the whole market.

That’s reflected in Microsoft’s position on my stock screen (once I add it in). At its current price of $84 per share, Microsoft ranks at number 108 out of 220 companies, i.e. pretty much in the middle of the pack. I’m not going to beat the market by investing in average stocks, so the price needs to be much lower before I would consider investing in Microsoft.

To break into the top 50 stocks on the screen and enter the “good value” zone, Microsoft’s share price would have to fall below $60. That’s a decline of almost 30% from today’s $84 price tag, which seems like a long way. But it’s where the shares were just a year ago, so I see no reason why they couldn’t revisit that price level, given a little bit of bad news.

In summary then, my opinion on both these companies is the same. I think they’re great companies with impressive track records of growth, but I also think they’re unlikely to grow so quickly in the future. At their current prices I don’t think either is particularly attractive, although that applies more to Coca Cola than Microsoft.

Comments (0)