Bloomsbury Publishing – A magical trading update on the way?

Bloomsbury Publishing is due to announce a trading update soon – and Mark Watson-Mitchell thinks it work could work magic for the shares.

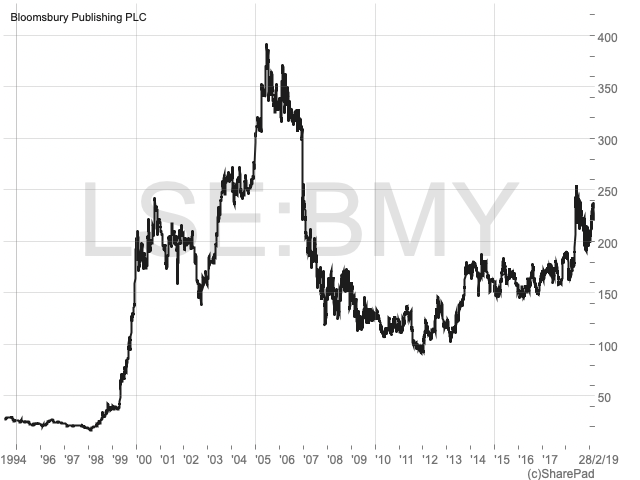

I am a big fan of Nigel Newton, the boss of Bloomsbury Publishing (LON:BMY), and have been since I first met the company as it went public way back in 1994.

Unless you are ignorant to what goes on around you, it surely cannot be possible that you have not heard about Harry Potter.

When I first went in to the company’s offices I was introduced to the Editorial Director, who was extraordinarily pleased about having signed up an authoress by the name of JK Rowling.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

That writer has subsequently been a major contributor to Bloomsbury’s fortunes, as her Harry Potter series was published across the world – over the last 20 years she has sold over 500 million copies of her books and they have been published in 80 different languages.

But Bloomsbury is not just about Harry Potter – it is now so very much more.

Today Bloomsbury is a leading independent publisher of fiction, non-fiction, children’s, specialist, academic and professional titles. Its mission is to publish works of excellence and originality. It is one of the few publishers with a portfolio that includes both general and academic publishing. And it also has an expanding digital publishing offering as well.

Its ambitious growth story has seen the company become a significant global publisher, with offices in the UK, US, Australia and India.

It is a very professional business; it has certain publishing niches and prospers them well. It has an expanding catalogue of esteemed and top-selling authors, both fictional and reference, and has a mass of ever-increasing digital content to exploit.

The Interims to end-August 2018 saw the group deliver a strong first-half performance and trading was on track to achieve the Board’s expectations for the full year. Traditionally, sales of trade titles peak for Christmas and sales of academic titles at the beginning of the academic year in the autumn. As in previous years sales are expected to be second-half weighted.

The current trading year comes to a close at the end of this month. So, within the next few weeks we might well see a Trading Update. The 2017/18 year saw sales revenue up from £142.56m to £161.51m, with pre-tax profits growing from £9.44m in the 2016/17 year up to £11.64m, worth 14.02p of earnings per share and a healthy 7.51p dividend to boot, giving a 4.5% yield.

Broker estimates for the current year are suggesting a slight increase in revenue to £163m and pre-tax profits of nearly £14m, worth 14.5p in earnings. For the coming year sales of £173m could produce £16m pre-tax, some 16.5p of earnings. Further out estimates for 2020/2021 are for £180m sales to produce £17.8m pre-tax, some 18.5p per share in earnings.

I like Bloomsbury. It is tightly controlled financially and has a good cash conversion, with a balance of about £16.9m at the last count. Its shareholders list contains top name institutions, and I know why – because it is so well run and offering a good yield. I rate the shares, now 231p, as capable of soon breaking through their June 2018 High of 257p and heading up to trade the 280p/300p levels.

Comments (0)