How Can We (Legally) Invest in the Black Market?

As seen in the latest issue of Master Investor Magazine.

There are board meetings at regular intervals for all companies. Of course there are. They’ll no doubt discuss business opportunities and also the cost of new regulation. Perhaps how the sugar tax will impact revenue and profit. Across town the same meeting is happening in reverse. Organised crime is as well organised as any business, perhaps better since there is more likely to be some form of physical reprimand for failure. Perhaps they’ll even sit around a big board room table as well. They may well be discussing the new sugar tax too, and how it will put soft drinks on the hit list, alongside alcohol, if there’s a tax free source to be found.

The minimum wage will have been on the agenda of both groups too. The thing to bear in mind about organised crime is that they aren’t hindered, but rather helped, by all this over-regulation. The minimum wage, which I wrote about in this column in September 2015, doesn’t make people at the lower end better off for more than a very short time – if at all – but creates more unemployment, and more ‘off balance sheet’ slave labour. If you have a differential in standard of living it must be maintained by other people accepting less and supporting your lifestyle. It should be machines doing all this work, but Luddites keep resisting progress and insisting that jobs are good. They’re not. Jobs are in essence slavery in themselves. But the mentality of the electorate, and thus politicians, is highly conservative at the best of times, and rarely progressive in any sense. We have plenty of people from overseas here in the UK, scared of being deported, or of their families back home being murdered, and so willing to work for a few tens of pounds per week, or even minimal accommodation and sustenance. Obviously not Brits, as it’s simple for Brits to claim benefits, and in any case they’d squeal and expose the operation. Brits are priced out of the black labour market.

It’s not really as simple as black and white though. As humans, we have a tendency to polarise ideas rather dramatically. I think this is a consequence of our physiology: two eyes, two ears, two hands. We interact with the world in the planes up/down, left/right and backwards/forwards. I don’t imagine if we were spiders with compound eyes there’d be this binary approach to problems and philosophy. Then we’d be saying something like “oh that argument is soooo third eye in, third eye round, I’m not even going to give it the time of day!” When I host debates I dispense with the ‘this house thinks…’ format as it is entirely limiting, and something of a straight-jacket on possible outcomes. There is then one economy with many, many facets ranging from at least Black to White.

Government, rather like alcohol, is a great servant but a terrible master. There’s a picture of Dorian Gray somewhere, which is the Black Market, while the government pretends it doesn’t exist, and that the whole economy is green, clean and always growing. But anyone who’s seen Panorama often enough in the last year or two will have seen the exposés on donkey burgers, poor hygiene in our main supermarket suppliers’ factories, duty free cigarettes being sold under the counter, slave conditions in Asian factories supplying clothes to our High St chains, and so on. It’s a disaster. The Black Market in the UK is determined to be 10% of economic activity, according to the Institute of Economic Affairs (IEA), and the Bank of England says half of our printed bank notes are either overseas or in the Black Market. This is no small anomaly.

So in the same way that most charity shops on the High Street identify and expose a failure in government policy, so the existence of a Black Market in everyday items exposes a failure in government policy too. Or perhaps more starkly the presence of government policy as opposed to its absence.

Bizarrely, the greenest developments in society in the last few years have brought harsh criticism from some quarters. The first is zero hours contracts, which obviously make the workforce of a company flexible enough to maintain efficient numbers for their flexible workload. It also enables companies to afford to pay the minimum wage, and not be pushed into off-the-books undocumented labour. This is game theory at work creating equilibrium. The point is government policy usually has unintended consequences. What those consequences will be may be hard or impossible to predict, but what is entirely predictable is that there will be unintended consequences.

The second green development is Uber, which seeks to make the best use of private transport resources. It should be welcomed with open arms by a government that has emissions targets to meet. It’s also much closer to the model that will be in place when mini cabs and taxis drive themselves. Then it really is just a matrix algebra job to deploy them to the required point.

Creating jobs and economic activity is not in the least bit green. This is the paradox government faces.

The first Anti-Slavery Commissioner is Kevin Hyland. He said that, according to the government’s own figures, there are “between 10,000 and 13,000 in modern day slavery at any given time”. There doesn’t seem to be much information about him and his department online, save for announcing his appointment, so it’s hard to either contact him or his department to find out what he’s been doing about it. I’d suggest that if the Black Market is 10% of the economy that 10k-13k, being a very small fraction of 10% of the workforce, is probably a massive underestimation. 140k migrants disappeared in Germany this winter. That’s around 15% of the total influx. Well, I wonder where they’re literally slaving away to pay off their debt to the people trafficker travel agents.

We have a notion that it was Britain that led the abolition of slavery, and that it was done because we became more civilised. I would put an alternative theory forward: it suited Britain very well, having started the Industrial Revolution, to enhance its technological advantage by making competing countries, like the US, abolish slavery. In other words, abolishing slavery was a technological and economic advance, not a social one. A case in point is that jobs which can’t yet be done by machines, like prostitution, for example, feature highly as areas where slavery still thrives. Interestingly, in Greece, where there still hasn’t been a revolution, an article in The Times suggested hookers there are charging €2 for 30 minutes, whereas it had been €50 prior to the financial crisis. According to the author of the report, Gregory Lazos, a professor of sociology at Panteion University in Athens, the market place is becoming saturated due to the high levels of unemployment in Greece.

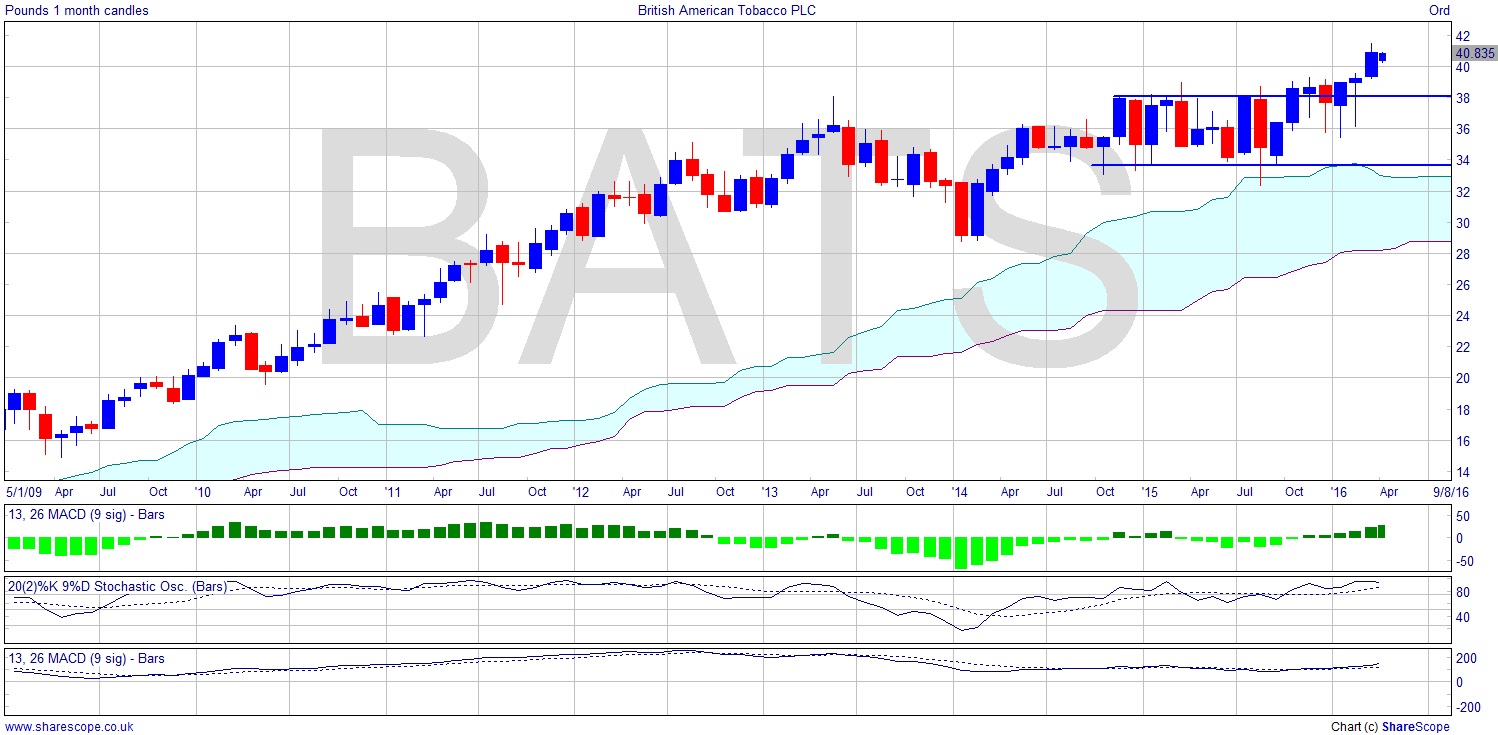

So, far from slavery being a thing of the past, people trafficking is in a growth phase, while drugs and sex are already well established. The question is how can we invest in these areas we are denied access to by legislation, short of handing money to people who are inevitably involved in crime? Well we know that the duty free cigarette under-the-counter business is reselling real cigarettes, so British American Tobacco (LON:BATS) is a good way to get at that market (foreign manufactured cigarettes simply being illegally imported without the duty being paid). It could be argued that this Black Market in cigarettes reduces crime, as if there were no parallel discounted market to buy these, then crime may well have to provide the funds to buy them at the full market price. It could even be argued that this non-violent essentially victimless crime is protecting us from more violent crime. BAT plc is performing very well indeed. I wrote about BAT on the Master Investor Blog last June in a piece called ‘British American Tobacco – The Future Is Lit Up’, and suggested it as a great pension share as they have huge potential for growth in poorer countries. There’s a great looking chart, as you can see, and the share is quite possibly playing out a measured move upwards.

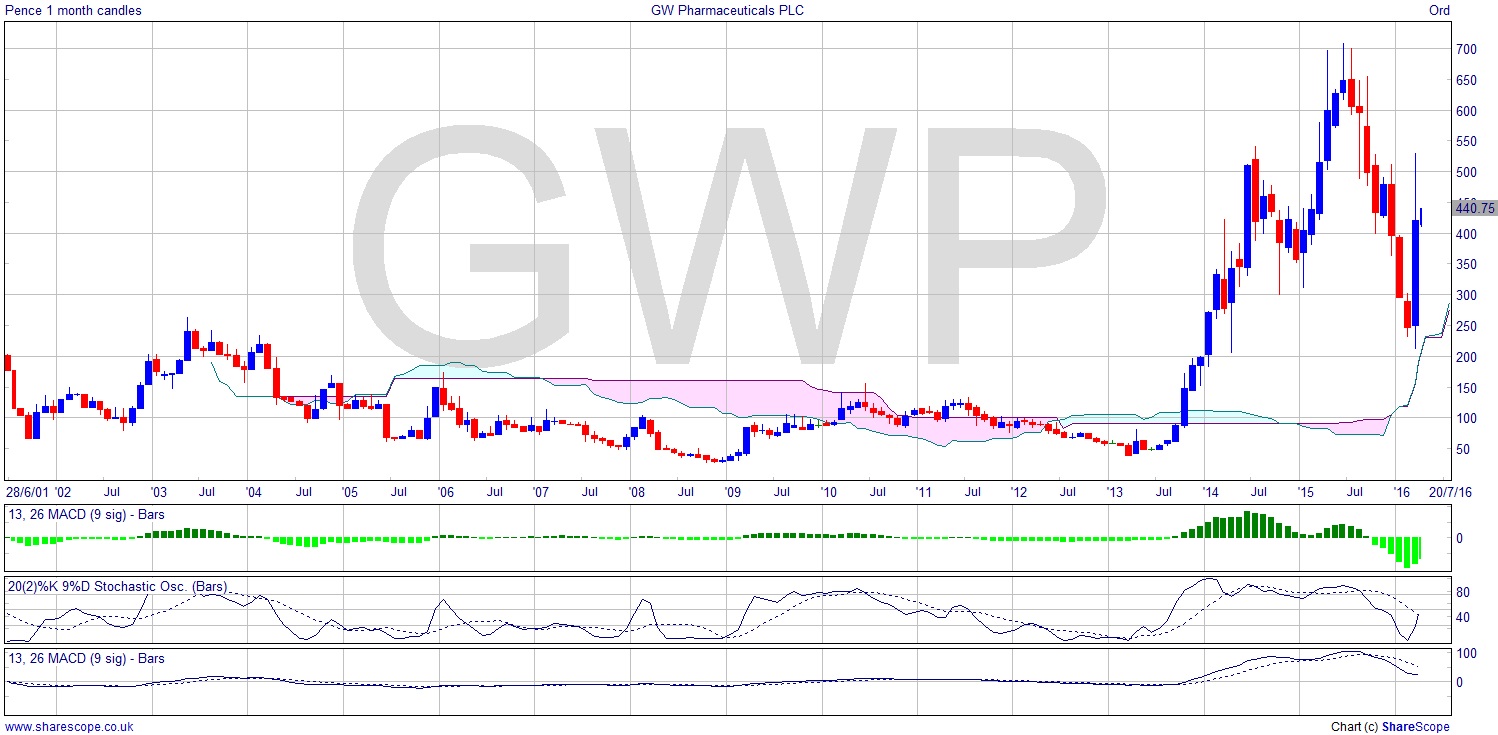

Another area we can invest in is the drugs arena, albeit somewhat obliquely. GW Pharmaceuticals (AIM:GWP) is a company I’ve dabbled in over the last 15 years. They are involved in the pharmaceutical applications of cannabinoid products. Happy days. An opportunity to make money out of society’s pathetic inability to accept report after report recommending decriminalising drugs, and instead GWP are making money jumping through society’s pointless self-inflicted hoops. The chart shows a volatile share price that does offer opportunities, but really must be treated with humility if you don’t want to catch cold.

Economies are a lie unless they rely on abundant providence. But with over 7 billion of us that is not possible. As a result we humans are a Ponzi scheme. A population that only appears to be economically successful as long as there are more and more of us, and thus the illusion of growth can be created by printing more money and still having inflation, even if there is no actual growth. And the only way to avoid this fact becoming obvious is to keep moving the goal posts – rather like new publicans may do when they change everything about their pub so any scam they run won’t be easily detected. In the past this has usually been achieved by fairly regular wars.

Politicians must know all of this, so I’m saying that they regard unintended consequences rather like military generals regard collateral damage, and that their actions are equally responsible for the Black Market as any other part of the social economy. Over-regulation of many industries has created so many opportunities for crime that the old phrase ‘prohibition never works’ might be replaced with ‘over-regulation never works’. On the bright side, at least we can invest in trafficked fags and medicinal whacky baccy.

Comments (0)