Bargains remain despite small caps surge

Despite the recent rises, Richard Gill, CFA, believes there still looks to be plenty of value available amongst London’s small cap companies.

Since bottoming out in March last year, small cap investors have been reaping the rewards of the stock market resurgence. From a low of just under 600 points 15 months ago, the AIM All Share Index has gone on to more than double in value, currently standing at a near 15 year high of 1,251.

Top performer by far since last March is All Active Asset Capital (LON:AAA), up by an astounding 30,500% after investors got excited about the potential of its holdings in a range of technology companies. Alongside technology, investors have unsurprisingly been attracted to pharma and healthcare stocks since the pandemic began, with Sareum (LON:SAR), Avacta (LON:AVCT) and SkinBio Therapeutics (LON:SBTX) all seeing their shares rise by over 1,000%.

The FTSE Small Cap Index meanwhile has seen similar gains, rising from 3,638 to 7,340 from nadir to peak to currently trade just off its all-time high. Best performing constituent is inkjet technology business Xaar (LON:XAR),the shares up by 867% after management initiated a turnaround strategy. Just behind is lighting business Luceco (LON:LUCE), up by 774% after earnings doubled in 2020. Also, a number of Small Cap listed retailers recovered strongly as the pandemic restrictions eased, with bike seller Halfords (LON:HFD) up by 727% and T-shirt seller Superdry (LON:SDRY) surging by 452%.

Despite the recent rises there still looks to be plenty of value available amongst London’s small cap companies, three of which I take a look at below.

CENTRAL ASIA METALS

While the pandemic reduced the global demand for copper in 2020, an expected reduction in supply of the metal over the coming years looks set to benefit the bottom line of producers. According to analysts at S&P Global Market Intelligence, “… consumption will outstrip production over the period to 2024, resulting in a growing refined market deficit and increasing copper prices.” On the demand side, increased usage from the power and construction sectors is expected to continue, along with growth in copper-intensive new green technologies such as electric vehicles. According to Berstein Research, global copper production would need to rise by between 3% and 6% per annum by 2030 for countries to meet the targets of the Paris Agreement on climate change.

Looking set to benefit from this demand/supply imbalance is AIM listed Central Asia Metals (LON:CAML) the owner of the Kounrad SX-EW copper project in central Kazakhstan. The company operates a copper recovery plant at the site which recovers copper from waste dumps that originated from the Kounrad open-pit copper mine, an asset which was decommissioned in 2005 following 71 years of activity.

Sitting on the surface, the dumps (known as Eastern and Western) have a significant amount of contained copper metal. The company’s processing plant produces copper cathode (the primary raw material input for the production of copper) and the metal is delivered from the site by rail and sea to end customers, mainly in Turkey. The plant was completed on time and under budget in 2012 and began producing copper shortly after. Since then, over 110,000 tonnes of copper has been produced, pretty consistently year-on-year, with costs in the lowest quartile of the global copper cash cost curve.

Alongside its copper interests, CAML owns the Sasa zinc and lead mine in North Macedonia. Sasa is an underground mine that processes c. 820,000 tonnes of ore each year, producing a separate zinc and lead concentrate. CAML typically receives approximately 84% of the value of its zinc in concentrate and approximately 95% of the value of its lead in concentrate from smelter customers.

Coining it in

The last financial year was a challenging but profitable one for Central Asia Metals, with results for the year to December 2020 coming in ahead of expectations. Net revenues for the period were down from $171.7 million to $160.1 million as a result of lower commodity prices, with a leakage at a tailings storage facility at Sasa also causing some disruption. EBITDA of $95.7 million and free cash flow of $58.9 million were also down slightly but remained strong.

As a result of the performance, and buoyed by a recovery in metals prices in the second half, the company made the perhaps surprise decision to hike the full-year dividend from 6.5p to 14p per share. This represented 57% of free cash flow, just above the upper end of its dividend policy range of 30-50%. Also due to the strong cash flow, net debt at the period end was down significantly, from $80.2 million to $36.2 million over 12 months as CAML further looked to reduce its borrowings.

Into 2021 and in April the company announced a positive operational update for the first quarter of the year indicating that, while production was impacted by the cold winter months, its targets set out at the time of the full-year results remained on track. At Kounrad, copper production was 2,880 tonnes, with all of this leached from the Western Dumps during the winter period for the first time. Sales meanwhile were 2,875 tonnes, with full year guidance being for the production of 12,500 to 13,500 tonnes.

At Sasa, there was a period of unplanned mill maintenance, which resulted in a loss of production for up to four days. However, 11,521 tonnes of concentrate containing 49.8% zinc and 9,730 tonnes of concentrate containing 72.1% lead were produced. Given that deliveries from Sasa to smelters occur on a regular basis, payable base metal in concentrate sales for the quarter were similar to production levels at 4,779 tonnes of zinc and 6,686 tonnes of lead. Guidance for the full year is for 23,000 to 25,000 tonnes of zinc in concentrate and 30,000 to 32,000 tonnes of lead in concentrate.

Copper up

Since the beginning of 2021, copper prices on the London Metal Exchange have risen from $7,740 a tonne to a current $9,432.50 as Chinese users have looked to restock depleted inventories. While prices have slipped back from over $10,700 a tonne in May the outlook looks good for the foreseeable future, with demand set to stay high and supply issues continuing – it can take up to a decade to commission a new copper mine.

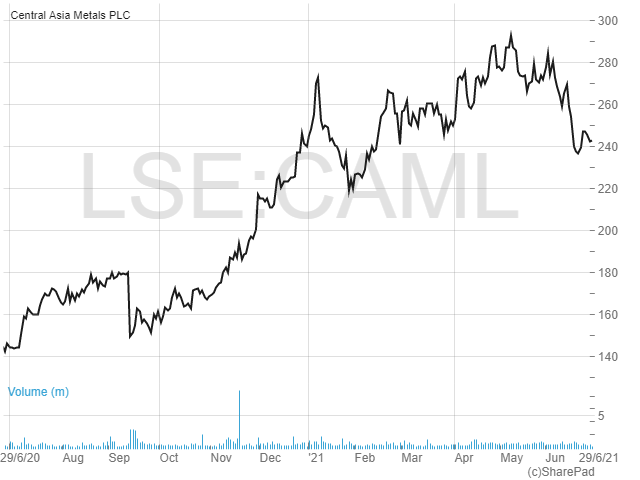

Shares in Central Asia Metals have reacted well to the rise in the copper price, with the current price of 245p being more than double last year’s low of c.113p. They still look cheap, however, in my view, trading on a multiple of 8.5 times broker VSA Capital’s 2021 earnings forecasts and yielding a historic 5.7%. With steady metals production expected and with a historic free cash flow yield of an impressive 9.8%, that should enable the company to continuing paying down its debt and returning income to shareholders.

Following the April production update analysts at Berenberg reiterated their 290p target price for the shares. Meanwhile, VSA Capital is more bullish with a 325p target, saying that Central Asia Metals is its preferred exposure to copper.

BEST OF THE BEST

While the pandemic saw revenues for a lot of UK businesses fall to zero, many others flourished during the severe lockdown periods as people shifted their spending habits online. One of the beneficiaries was Best of the Best (LON:BOTB), an organiser of online competitions to win cars and other luxury lifestyle prizes. Its flagship event is the Weekly Dream Car Competition, where entrants pay a small fee to enter a “spot the ball” style game for a chance to win one of a range of luxury vehicles. The person whose guess is closest to where a panel of judges determines the centre of the ball to be is the winner.

Adding to this is a midweek competition, which has a more focussed selection of prizes, along with the Weekly Lifestyle Competition, which features luxury watches, motorbikes, holidays, gadgets/technology and cash prizes. Winners of the weekly car are surprised in person at home by a member of the BOTB team, which provides great marketing material after being filmed. Having operated since 1999, the company now has a database of over 1.7 million players, which supports existing competitions and opportunities to launch new successful products.

When it started out, BOTB focussed on signing up customers at airport locations, enticing them to enter its competitions by displaying a flashy car. Luckily, given the near complete shutdown of airports during the pandemic, several years ago the decision was made to exit physical sites and make all operations digital. Now, 100% of revenues are derived online and from mobile devices. Not only is this more efficient in terms of capital and effort, it gives the company a highly scalable business model which is able to add new customers at a low cost.

Best ever year

The financial performance for the year to 30th April 2021 was highly impressive, with revenues up 157% to £45.7 million and pre-tax profits surging by 235% to £14.1 million. Helping the performance was the digital only model reducing costs and improving margins compared to the previous capital intensive retail operations. Online marketing was also ramped up and the midweek contest launched to increase competition frequency.

All of this was achieved amidst a strategic review which explored early-stage discussions with a number of interested parties regarding a potential sale of the company. However, after talks with several parties it was decided to focus on the continuing growth of the business under its existing strategy.

With BOTB being debt free and cash at the year-end standing at £11.8 million, the decision was made to increase the final dividend by 2p to 5p per share. More exciting however was an additional 50p special dividend to add to the already paid 40p special payment announced at the interim stage. Best of the Best has a long history of making such payments going back to 2014.

Unfortunately, despite the record financial performance, investors focussed on a mixed outlook statement, which sent BOTB shares plunging on the day of the results. Into the new financial year, and in contrast to summer 2020, there has been a reduction in customer engagement. This was noted to be specific to the easing of lockdown restrictions in April and the re-opening of hospitality and non-essential retail venues. Management are said to be closely monitoring trends but expect engagement to return to normal levels before too long.

Cash Prize

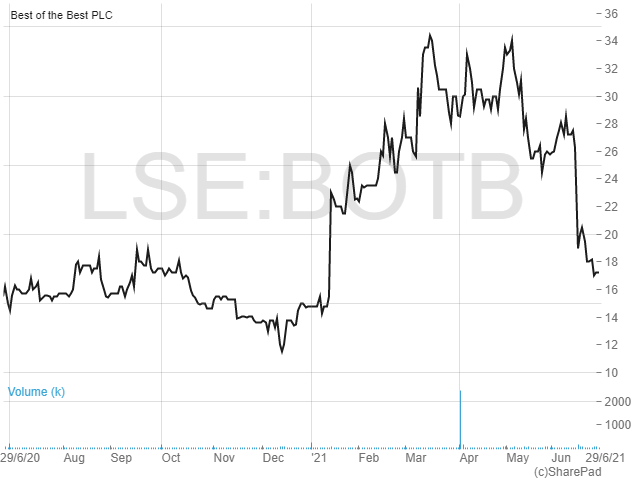

Following the cautionary statement announced in the results shares in Best of the Best have practically halved from their March 2021 all-time high of 3,440p, currently down at 1,725p. However, analysts at finnCap have left their forecasts for this year and next unchanged, noting that there are a number of initiatives open to management to offset any softening of customer demand if the downward trend is maintained.

If forecasts for 142.4p of earnings in the current financial year are achieved, that puts the shares on an earnings multiple of just over 12 times. For a business that has grown earnings from 9.7p per share to over 120p per share over the past five years, along with a consistent track record of paying special dividends, I believe that looks like good value for investors with a slightly increased risk appetite. finnCap reckons the shares are worth £31 each, implying capital upside potential of 80%.

TCLARKE

While construction is highly cyclical industry, the UK is currently seeing a resurgence in activity. The recent UK Construction PMI Total Activity Index reported a rapid rise in new business volumes during May, with output growth accelerating to its strongest since September 2014. What’s more, new order volumes increased at the fastest pace since the survey began just over 24 years ago.

One company looking set to benefit from this is TClarke (LON:CTO), a specialist engineering company focussed on delivering complex, technical engineering solutions to key projects across the five sectors of Infrastructure, Residential and Hotels, Facilities Management, Engineering Services and Technologies.

Engineering Services is the largest division, making up almost 40% of revenues in the last financial year. One of TClarke’s flagship projects here is the KGX1 at Kings Cross where it is working on delivering a major office for Facebook. Elsewhere, the company is working on a 950,000 sq ft premium office development in the City of London, providing services such as installing CCTV, power generators, wiring and lighting.

Half a billion ambition

TClarke was another company facing a challenging year in 2020, with revenues falling by 31% to £231.9 million after the effects of the pandemic lockdown disrupted operations and supply chains. From mid-March to the end of July there were multiple site closures or sites operating with much reduced numbers. That forced underlying pre-tax profits down from £9.2 million to £5.1 million. However, the company remained cash generative, with net cash at £10.2 million at the period end and the dividend was able to be maintained.

Attracting the attention of investors, in the results management set out details of an ambitious plan to grow the business to £500 million of revenues within three years, while maintaining operating margins at current levels of 3%. To achieve this, TClarke has aligned its resources to match the anticipated growth in revenues, with a number of areas expanded including the core Engineering Services business with capabilities also increased in technology and infrastructure. The company intends to grow market share organically by winning and delivering larger scale opportunities across all sectors throughout the UK and will continue to target Data Centres in Europe on a selective basis.

The most recent news was a May update that revealed trading in the first four months of 2021 was positive and in line with expectations. Encouragingly, the forward order book now stands at a new record level of £472 million, up by 3.5% since the end of December, driven by project wins in technologies (data centres) and infrastructure (healthcare).

Building wealth

The half a billion revenue target may seem somewhat challenging for TClarke given that it’s more than double that achieved in 2020 and some 50% higher than in the peak year of 2019. However, the company has an excellent reputation in the industry, with 90% of turnover in 2020 coming from repeat clients, with a range of growth opportunities available across its five man sectors. Pipeline bid opportunities are said to typically exceed £1 billion. There is decent earnings visibility already, with £288 million of the 2020 year-end order book due to be recognised in 2021 and £168 million in 2022 and beyond.

Analysts at Cenkos have a fair value price model which suggests a share price of 150p to 160p is justifiable for TClarke over the next 12 to 24 months, up from the current 131.5p. They are looking for earnings per share to recover to 15.4p in the current financial year, rising to 21.1p in 2022. If met, that puts the shares on attractive looking multiples of just 8.5 and 6.2 respectively. The historic dividend yield is a modest 3.3% but there is clear scope for increases in the payment if these forecasts are met, especially given that management have stated they continue to be fully committed to a progressive dividend policy.

Comments (0)