A Bank You Can Trust?

As most investors will know, shares in UK listed blue-chip banks have delivered some pretty dreadful returns over the past ten years. As a result of the Great Financial Crisis of 2008/09 share prices plunged across the sector, numerous lenders were forced to accept bailouts from the UK government and two banks (Northern Rock and Bradford & Bingley) saw their shares become worthless after being de-listed from the London markets.

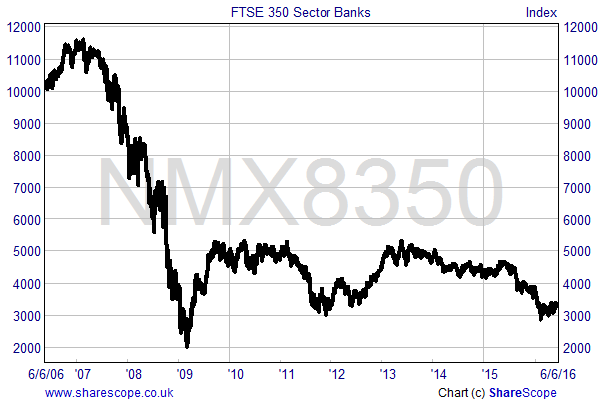

The chart below shows the overall effect of the devastation, with the FTSE 350 Banking sector index plunging by 82% in little over two years between February 2007 and March 2009. While a partial recovery has taken place since then, increased regulatory burdens, along with further scandals such as PPI mis-selling and LIBOR fixing, have meant that the blue-chip lenders are shadows of their former selves.

In the wake of the financial crisis a number of so called “challenger” banks have either launched or significantly expanded their activities in order to fill the “trust gap” left by the major UK banking institutions and to gain market share in what was previously an oligopolistic sector – one dominated by a small number of sellers.

The UK challenger banks consist of smaller institutions which are challenging the big five of HSBC (LON:HSBA), Lloyds (LON:LLOY), RBS (LON:RBS), Santander (LON:BNC) and Barclays (LON:BARC), by offering better deals and better service in order to gain market share. These include the likes of Shawbrook (LON:SHAW), Aldermore (LON:ALD) and Virgin Money (LON:VM.), which have all frequently topped the “best buy” tables in recent years as they seek to bring in customer deposits, and the quirky Metro Bank (LON:MTRO), which offers free dog biscuits to customers’ canine pals as an incentive for their owners to open accounts.

And the strategy seems to be working.

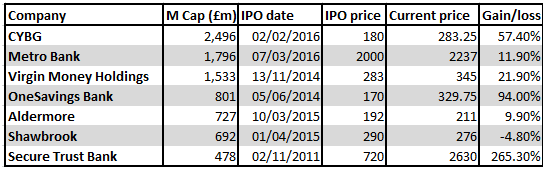

A recent report from KPMG showed that the smaller challengers delivered a 17% return on equity in 2015, up from 15.8% in 2014 and well ahead of the big five banks, which only posted a 4.6% return on equity. As the table below shows the challenger banks have delivered decent returns on the whole since listing in London, with only Shawbrook seeing its shares fall.

Table: Share price performance of mid-cap challenger banks since IPO. Data source: Sharescope

While the market is becoming more competitive for these second tier lenders, I see a good potential investment opportunity at present in the best performer to date, Secure Trust Bank (LON:STB).

The Business

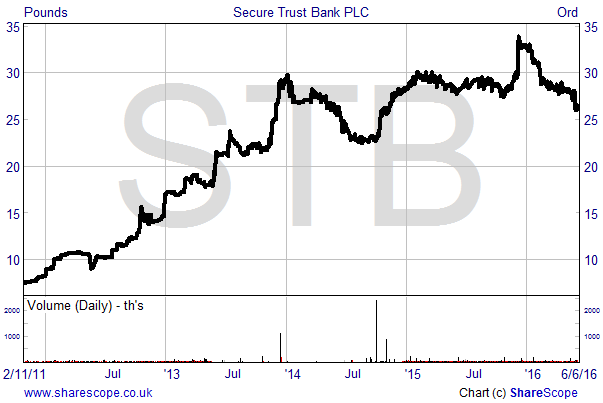

While being classed as a new breed of challenger, Secure Trust Bank has in fact been around since 1954, providing financial services to UK customers who may not be adequately served by other banks. From 1985 the company was a subsidiary of Arbuthnot Banking but in September 2011 was spun out of the business and gained its own listing on AIM.

Secure Trust has built up its operations over the years to incorporate a range of financial activities which give it a diversified lending portfolio. It currently runs two divisions: Consumer Finance, which offers unsecured personal loans, motor and retail finance, and Business Finance, which includes asset finance, commercial finance and real estate finance. With a loan to deposit ratio of 104% as at 31st December last year lending is almost entirely funded by customer deposits, with limited exposure to short-term wholesale funding.

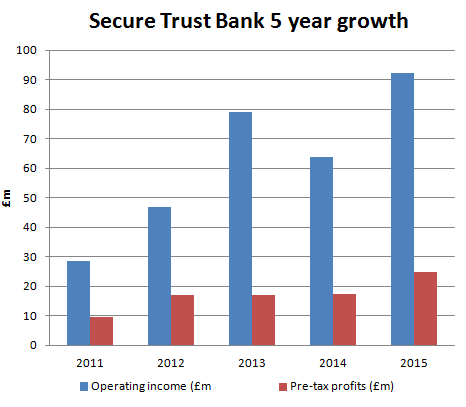

As the share price performance suggests, Secure Trust’s operations have performed very well during its time on the markets. Over the four years from 2011 to 2015 operating income from continuing operations grew by a compound annual rate of 34% to £92.1 million, with pre-tax profits up by a CAGR of 26.8% to £24.8 million. This has been driven by a rapid increase in new clients, with customer deposits up by 70% to £1.03 billion in 2015 alone, lending balances up by 73% at £1.08 billion and customer numbers up by 33% at 570,759.

* from continuing operations

Two recent events create value opportunity

As well as organic growth, Secure Trust’s expansion over the past five years has been driven by several acquisitions. But in December last year the firm made its first disposal.

Having received an unsolicited approach from sub-prime lender Non Standard Finance (NSF) it was agreed to sell the firm’s branch based non-standard consumer lending business, Everyday Loans Holdings, for consideration of £107 million in cash and £20 million in NSF shares. As part of the deal NSF will also repay £108 million of intercompany debt to Secure Trust, giving the transaction an enterprise value of £235 million.

While Secure Trust had no previous intention to sell Everyday Loans, the offer from NSF was too good to refuse. The price paid was a multiple of 18 times historic operating profits, with a £115 million net profit expected to be booked on the sale. With the proceeds STB is looking to strengthen its capital ratios and further support the growth in customer lending. A special dividend payment of £30 million, or 165p per share, has also been proposed by management, with its payment date expected to be announced shortly.

In addition, on 27th May this year it was announced that former 100% owner Arbuthnot had sold a 33% stake in STB for £150 million, taking its holding down to 18.9%. The deal was done via an institutional placing but at a price of £25 per share was at a 10.7% discount to the previous day’s closing price. Subject to a general meeting, the sale is expected to close by 16th June and after completion Secure Trust will be looking to move from AIM to a Premium Listing on the Main Market of the LSE.

Time to secure a bargain?

In reaction to the Arbuthnot stake sale shares in Secure Trust fell by 7% to an 18 month low of £26 and have remained around that level since. This fall seems unfair to me given that the share sale has no effect on the company’s operations. So at current levels I believe investors have the opportunity to pick up a bargain.

For starters the 165p special dividend should be paid shortly, which by itself equates to a yield of 6.35%. Then there is the historic annual yield of 2.77%, with the firm having a progressive payment policy.

While the sale of Everyday Loans is expected to reduce group earnings in the short term, it does provide the capital for further long-term expansion in the strongly growing consumer and business operations. With the Tier 1 capital ratio expected to be around 24% following the Everyday Loans sale (well ahead of the regulatory minimums) there is significant scope for further lending increases. On that front, STB is also planning to offer mortgages in the second half of this year.

Analysts at Edison expect c.217p of earnings in 2017, which equates to a reasonable looking price earnings multiple of 12 times. Elsewhere, Peel Hunt has a target price of £38 and Canaccord Genuity a target of £40, implying respective upside of 46% and 54% from the current share price.

I also note this recent article in The Telegraph which suggests that the company could lead a consolidation of the challenger bank sector.

So for growth, income and possible value enhancing corporate activity STB looks like a secure investment.

Comments (0)