3 small-cap bargains

“In this world nothing can be said to be certain, except death and taxes.” So said Benjamin Franklin. But while meeting the Grim Reaper might be an inevitable occasion, there are a number of ways investors can keep the taxman off their well-earned wonga.

| Seen first in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Perhaps the most popular way is to take advantage of the generous £20,000 annual allowance which Phil Hammond lets savers and investors put into one of several types of Individual Savings Accounts, more commonly known as ISAs. According to government stats, around 10.8 million Adult ISA accounts were subscribed to in 2017-18 for a total value of £69 billion. The figures also show that the average subscription per Stocks & Shares ISA for the financial year was £10,124. That means investors as a whole (personal income aside) are missing out on around half of their tax free allowance.

SIPPs, meanwhile, are a flexible way to effectively manage your own pension fund. The related tax benefits for basic-rate taxpayers see your SIPP provider able to claim back 20% of your contributions from the government and add it to your pot – in effect £800 becomes £1,000, with the annual allowance being £40,000. Higherand additional-rate taxpayers can claim back a further 20% or 25% respectively. Yet, as with ISAs, much of the annual allowance goes unused.

On that note, and with the April tax year end looming, this month I have chosen three stocks which look like a good bet to tuck away for the long-term in your SIPP or ISA, with all having low valuations, good levels of dividends and a solid recent track record.

S&U

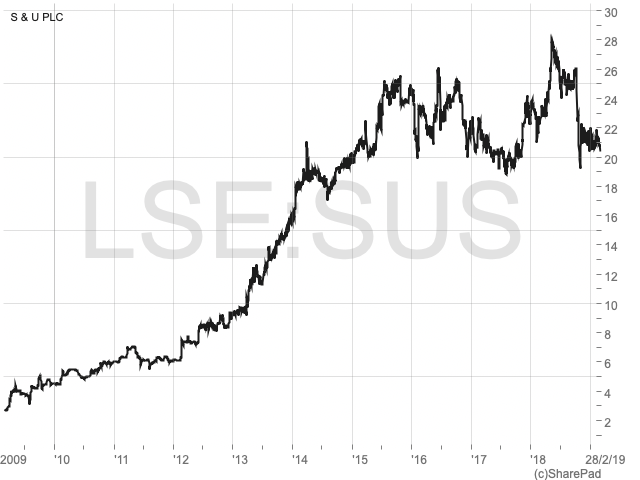

Small-cap stalwart S&U (LON:SUS) has seen its shares fall by around 25% since reaching an all-time high in May last year. Wider economic concerns have been the main driver of the fall. But with the business currently having record levels of customers, along with well-funded growth plans, I believe now is an opportune time to stick this stock in your long-term buy and hold portfolio.

The company is a specialist finance provider which has a history going back to 1938. Founded by Clifford Coombs (and still run by his descendant, the charismatic Anthony Coombs), S&U has delivered significant returns to shareholders during its history. On a capital basis, since bottoming out at 242.5p at the start of 2009, the shares are up by 750%.On the income side, from 1988 the dividend has been maintained or increased every year for 30 years. It was held flat during the financial crisis but has since resumed its annual rise every year since 2010.

Motoring on

In 2015 the business was fundamentally changed after the decision was made to sell home credit business Loansathome4u, for £82 million. Investors benefited from a special dividend of 125p per share from the sale, with management looking to deploy capital in faster growing areas.

Core to the business now is Grimsby based motor finance business Advantage. Founded by the group in 1999, the division, via a network of UK motor dealers, is a leading supplier of specialist finance facilities that help customers to buy new and used personal vehicles such as cars, vans, motorbikes and caravans. Advantage operates in the non-prime section of the market, with finance being provided to consumers via hire purchase contracts.

In the last financial year (to 31stJanuary 2018) Advantage posted another record set of numbers, with new transactions up by 22% to 24,500 and live customer numbers up by 26% to 54,000. The loan book was up by 30% at £251.2 million, driving revenues up by 30% to £78.9 million and pre-tax profits up by 20% to £30.2 million. A record 860,000 applications were received by Advantage during the year but less than 3% were accepted, reflecting the firm’s strict attitude to lending.

The second line to the business is Aspen Bridging, which was launched as a pilot in early 2017 and has since grown steadily in the property bridging loan market. These loans are typically higher cost, secured short-term loans, designed to help people complete the purchase of a property before selling their existing home. The average loan size is £380,000 over terms of up to 12 months for customers who are generally smaller refurbishers and developers. Here, S&U is looking to take advantage of a market which, according to research by industry player West One Loans, reached a high of £6 billion in annualised lending by the end of Q2 last year and is growing rapidly.

Steady & unmoved

After interims to July reported pre-tax profits up by 17% to £16.7 million, early December saw investors treated to a positive update covering trading since the half-year end. The headline news was that full-year results are expected to be broadly in line with expectations, despite the economic and political uncertainty being witnessed.

| Seen first in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

On the Motor Finance side of the business,while recent months have seen a slowdown in the wider UK motor industry, the impact on the used car finance market in which S&U operates has been less marked. New loan agreements in the year to date fell by 7% to 18,710, with tightened under-writing procedures and an increase in competitive pressure also being contributing factors to the slippage. These were still the second highest volumes in Advantage’s history by a comfortable margin. The total customer base now stands at 59,000, with net receivables at £267 million, both figures being at record levels.

Meanwhile, over at Aspen Bridging, good progress is being seen, with the loan book now reaching £18 million of net receivables after the business ended its 15 month pilot. This year the firm is looking to increase its total investment in Aspen to c.£30 million, with further funding dependent on Aspen’s requirements and performance.

On the funding side it was noted that the firm has become more cash generative, with the current committed banking facilities of £135 million expected to provide “ample and sensible headroom” for planned growth.

Solid & undervalued

S&U is a sensibly run and conservative business but one which still has attractive growth prospects for investors. Following the recent price fall the shares are now looking very cheap in my view, trading on a multiple of just 9.9 times historic earnings. Assuming last year’s dividend of 105p per share is maintained, then the yield is a very attractive 5.1%. Analysts at Edison have a £28 valuation on the shares, which implies 36% upside from here.

NORCROS

This next company also has an excellent track record as a public company, but only if you ignore the two years prior to 2009. Norcros (LON:NXR) is a UK and South Africa based supplier of high quality bathroom and kitchen products which listed in July 2007 at the equivalent of 780p per share (after considering a 10 for 1 in 2015). However, the shares sunk to 40p just before Christmas 2008 as the effects of the global recession took hold. But after posting a £10 million loss for the 2010 financial year, things have only got better, with the shares now changing hands for almost five times their nadir worth.

Miles and miles of kitchen tiles

Norcros’s core market in the last financial year was the UK, with around two-thirds of revenues coming from the country. Here the company operates under seven brands including: Triton – the market leader in the manufacture and marketing of showers, Vado – A leading manufacturer and supplier of taps, mixer showers, bathroom accessories & valves, and Johnson Tiles – a leading manufacturer and supplier of ceramic tiles.

The UK business was significantly expanded in 2017 following the £60 million acquisition of Merlyn Industries, a designerand distributor of mid- to high-end branded shower enclosures. The deal added c.£31 million of annual revenues to the group as well as a number of well-established and market leading brands to the existing portfolio. Since the deal completed, Merlyn is said to be trading strongly and in line with expectations, with the business being fully integrated.

In South Africa Norcros operates under three brands: Tile Africa – a chain of retail stores focused on ceramic & porcelain tiles and associated products such as sanitary ware, showers & adhesives; Johnson Tiles South Africa – a manufacturer of ceramic and porcelain tiles; and TAL – a manufacturer of ceramic and building adhesives.

Sinking no more

For 2018 Norcros demonstrated the progress made since the recession, reporting its ninth consecutive year of growth. Revenues for the year to March were up by 10.7% at £300.1 million, with underlying pre-tax profits rising by 14.8% to £26.3 million. Underlying net cash flow from operations was strong at £17.5 million, even after £2.5 million of pension contributions (see more below).

Interims to September showed further growth with sales up 12.1% at £162.6 million, underlying pre-tax profits up by 23.5% at £14.2 million, with the interim dividend hiked by 7.7% to 2.8p per share. This was driven by organic revenue growth of 4.4%, along with the contribution from the acquired Merlyn business.

| Seen first in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

As a small caveat, there are two points to note about the Norcros balance sheet. First, net debt stood at £53.5 million as at the interim period end, up from £20.8 million 12 months earlier after the company took on more borrowings to finance the Merlyn deal. Second, the deficit relating to the firm’s UK defined benefit pension scheme stood at £28.8 million as at the same date. However, this was down from £48 million as at 31st March, primarily due to a 0.3% increase in the discount rate (which lowers forecast liabilities). Notably, both interest payments and pension obligations are both well covered by underlying cash flow.

In mid-January the group released a pleasing statement saying that it has continued to trade in line with expectations in both the UK and South Africa, despite a challenging environment, since the interims were announced in November. Alongside this Norcros revealed that it has agreed to buy South African firm House of Plumbing for up to £12.1 million, subject to regulatory approval. In the 2018 financial year the business made revenues of £22.1 million and a pre-tax profit of £1.9 million, with the deal expected to be earnings enhancing immediately.

Make some brass

Last year’s market troubles have seen Norcros shares fall from a peak of 230p in June to the current 196.75p. That’s despite all trading updates since then reporting that the numbers have been in line with expectations. As a result I believe that now looks like a good time to get on board.

On last year’s underlying earnings, the shares currently trade on a multiple of just 6.7 times and yield a useful 4% – the intention is to continue a progressive yet prudent dividend policy. I’m not the only one who thinks the shares look cheap, with analysts at Canaccord Genuity having a 360p target.

NORTHERN BEAR

For my final company we move down the market cap scale but up even further north than Grimsby. Based in the North-East of England, mainly around Newcastle and Gateshead, is Northern Bear (LON:NTBR), the owner of eleven companies which provide a range of specialist building and related support services. These include roofing, solar panel installations, asbestos management and drone surveys. Clients include local authorities, housing associations, NHS trusts, universities, construction companies and national house builders.

Like Norcros, Northern Bear hit some trouble during the financial crisis but has since recovered and gone on to deliver excellent returns to shareholders. Prior to 2009, the firm had a rather aggressive buy-and-build growth strategy, acquiring 12 businesses within 16 months of joining AIM in December 2006. But this came to an abrupt end after the building sector experienced trading conditions which the then CEO called, “the worst experienced in recent memory”. With profits falling and net debt having risen to over £10 million, the company began to focus on repairing the balance sheet by disposing of underperforming businesses, paying off debt and cancelling the dividend.

Fast forward to 2019 and the business is now making record profits, increasing the dividend, is pretty much debt free on a net basis and has even gone back on the acquisition trail. That progress has been reflected in the shares rising from their 2012 low of 8.25p to the current 75p – that’s a gain of 809% over seven years.

Geordie jumpers

The 2018 results demonstrated the progress made over the years, with revenues from continuing operations up by 18% at £53.6 million and pre-tax profits up by 9% at £2.6 million. Net debt was £0.8 million at the period end, with management’s confidence reflected in a 20% rise in the final dividend to 3p per share along with a 1p special dividend. These numbers contrasted markedly with 2010 when a £1.36 million loss was posted, net debt stood at c.£9 million and there was no dividend. Northern Bear also made its first acquisition in almost ten years during the period, buying interiors and fit-out business H Peel & Sons for up to £2.9 million.

More recent interims for the six months to September showed revenues up by a modest 5% at £28.6 million but net profits rose by a more pronounced 21% to £1.29 million as margins improved. The clear highlight of the period was a £1.95 million net cash inflow from operations, which management called “outstanding”, leaving net debt at just £0.3 million.

| Seen first in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

On the outlook, management said that the company continues to hold a high level of committed orders, with trading in the second half of the year expected to be very good. It was also noted that acquisitions of established specialist building services businesses, with a consistent track record of profitability and cash generation, continue to be sought.

Angel of the North

Northern Bear currently has no forecasts on the market but the interim results and guidance suggest to that net profits of around £2.5 million (and earnings of c.13.5p per share) look likely for the full year to March 2019. At the current share price, this values the business on an earnings multiple of just 5.6 times. On the income side, the company has stated that it expects to continue with its policy of paying a final dividend only (no interim dividend). If, like the last financial year, the pay-out ratio is c.24% of earnings we are looking at a payment of around 3.25p per share, which equates to a yield of 4.3%.

While the price looks good there are a few minor issues investors should be aware of. Northern Bear is pretty quiet on the stock exchange announcements front, typically only publishing its interim and full year accounts and a couple of trading updates every year. But if last year is anything to go by, we might see an update in early February, which could be a catalyst for a share price rise.

Also, it has been argued that the low valuation could tempt management to take the business private. But the company has traded at much lower earnings multiples in the past so this is looking increasingly unlikely. We should remember that this is a cyclical stock, with the shares having fallen significantly following the economic crash of 2008/09. In addition, with a market cap of just £13.9 million the shares are relatively illiquid.

All things considered, I believe applying a valuation of 8 times expected 2019 earnings to the shares would not be an unreasonable way to set a target price. That would equal 108p, implying 44% upside.

Comments (0)