3 High Yield Capital-Light Compounders – MAGAZINE EXCLUSIVEMAGAZINE EXCLUSIVE

MAGAZINE ARTICLE

This article first appeared in Issue 40 of Master Investor Magazine.

Click here to download the article as a printer-friendly PDF

Get this article and many more – for free! |

Most investors understand the magic of compound interest. Just put your money into a high yield investment, reinvest the income at similarly high rates of return and watch the value of your investment grow exponentially. One nice feature of the stock market is that you don’t even have to reinvest your income to benefit from compound interest. That’s because most companies retain a significant portion of their profits even after dividends have been paid. Those retained profits are then re-invested in the business, compounding profits even if you use dividends for income.

The best capital compounders

Some of the best compounders are those that: a) generate high returns on invested capital; b) can invest significant amounts of capital at those high rates of return; and c) require relatively little capital to grow, which means they don’t need to borrow to fund expansion and are able to pay significant dividends to shareholders.

To find these companies I restricted my stock screen to stocks with: a) ten-year average ROE or ROCE (depending on the type of business) of more than 15%; b) ten-year growth rates of more than 5%; and c) ten-year capex to profit ratios of less than 50% and debt to five-year average profit ratios of less than 300% (both of which are below average).

I then sorted the remaining stocks by yield and picked three companies with dividend yields of more than 4%. The three companies I chose to look at this month were Admiral (the car insurance company), Dunelm (the homewares retailer) and Telecom Plus (the utility services provider).

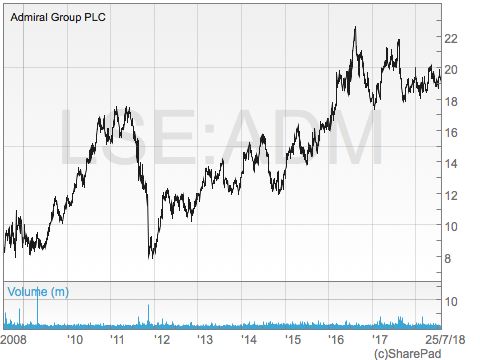

Admiral Group (LON:ADM): The capital-light insurer

- Share price: 1912p

- Dividend yield: 6.0%

- 10-Year ROE: 52

- 10-Year Growth: 8%

- 10-Year Capex/Profit: 9%

- Debt/Five-Year Profit: 7%

Admiral Group is the company behind the well-known Admiral car insurance brand and the confused.com insurance comparison website. It’s one of the UK’s leading car insurers, with significant overseas operations as well.

It’s basic business model is to access customers directly through comparison websites such as its own confused.com, rather than through traditional insurance brokers.

For this to work, Admiral must be price competitive and so cost efficiency has been at the core of the business since the very beginning. An obvious example of cost efficiency was its decision to locate its offices in Wales. A more fun example is the story of the photocopier push-ups, where staff had to do one push-up for every sheet of paper they used in the photocopier (I’m not sure if the company still does this because it sounds like a discrimination case waiting to happen).

With this business model, Admiral has generated lots of extremely profitable growth over the years, with very little use of debt or need for capital investment.In fact, I’ve written about Admiral on and off for years, precisely because it’s long had the sort of growth, quality and income characteristics I like. So, what exactly is it that makes Admiral a high-quality capital-light compounder?

Being an insurer certainly helps. Insurance companies don’t need big factories, machines or other expensive capital infrastructure. All they need is a few desks, some phones and a small number of extremely clever underwriters. This is why Admiral’s capital expenses are typically less than 10% of its profits – an exceptionally low amount.

There’s more to it than that though; Admiral is capital light, even for an insurer. Another definition of capital for insurers is the amount of cash they need to keep in the bank to pay future claims. The more insurance Admiral writes, the more profit it can make, but it also needs to put aside (or reserve) more cash to cover future claims, so there is a clear relationship between profits and claim reserves.

To boost the amount of profit it generates relative to those claim reserves, Admiral uses a few tricks. One trick is to pass insurance policies on to other insurers in exchange for a fee, via coinsurance and reinsurance contracts. This allows Admiral to generate additional revenue without needing to have additional capital. It also helps Admiral build scale more quickly, and scale is absolutely necessary if you’re going to be profitable as a low-cost insurer. Another trick is to run insurance price comparison websites such as confused.com and compare.com (a newer US-based alternative). These not only acts as a route to market for Admiral by disrupting sleepy insurance broker-based markets, but they also generate a useful amount of non-insurance returns from other insurers who are on the platform.

This combination of relentless cost efficiency, plus coinsurance, reinsurance and non-insurance profits is key to Admiral’s success as a capital light compounder, and it’s why I’ve been a shareholder since 2013.

Dunelm (LON:DNLM): The capital-light retailer

- Share price: 526p

- Dividend yield: 4.8%

- 10-Year ROCE: 39%

- 10-Year Growth: 13%

- 10-Year Capex/Profit: 46%

- Debt/Five-Year Profit: 160%

Dunelm is the UK’s number one homewares retailer, selling more than 300,000 household items (cushions, lamps, etc.) primarily through 160 out-of-town superstores and its Dunelm.com website. The company also moved into furniture retailing recently with the acquisition of Worldstores, a previously struggling online furniture retailer.

What’s interesting about Dunelm is that this isn’t exactly a new market. Dunelm isn’t trying to disrupt anybody, and it isn’t selling previously unheard-of products like electric self-driving cars or phones that will make you a cup of tea. It sells cushions, which people have been selling for thousands of years, so it’s a pretty mature market. For me, that makes its ten-year growth rate of 13% all the more impressive.

Part of the reason for its success has been its long-term focus on large, low cost out-of-town superstores. This isn’t exactly a new idea, but Dunelm was early to the out-of-town party with its first superstore opening in 1991, just seven years after its first high street store (prior to that it operated as a market stall). These superstores are cheap to build, cheap to run and have economies of scale that smaller high street stores can only dream of. That’s why supermarkets used them to expand during the great Supermarket Space Race of the 1990s and 2000s.

While Dunelm’s ten-year average return on capital employed is an impressive 39%, some investors would argue that the true figure is far lower. That’s because Dunelm’s superstores are not counted on its balance sheet because it rents them. If it owned them then they would show up as a fixed capital asset, and that would increase Dunelm’s capital employed and lower its ROCE.

Some investors will “lease-adjust” capital by multiplying rent by seven (or thereabouts) and adding that amount to the company’s fixed capital. I can understand why some investors do that, but I don’t. I think there are pros and cons to it, and as long as you’re consistent it probably doesn’t really matter. For example, I don’t lease-adjust capital employed for any retailers and on my stock screen only W H Smith and Next are more profitable than Dunelm. Both those companies are generally thought of as extremely efficient operators, so I think the standard ROCE ratio works just fine (or at least that’s what I’ll think, until its proven otherwise).

Of course, retailers aren’t exactly the flavour of the month at the moment, which is why Dunelm has a dividend yield of almost 5%, despite its high profitability, low debts and impressive growth rate.Mr Market is very pessimistic about UK cyclicals, particularly retailers, at the moment, but Mr Market has a long track record of occasionally being very wrong and this could well be one of those times.

Like Admiral, Dunelm is another company I’ve owned for a few years and, as things stand today, I expect to be a shareholder for at least a few more.

Telecom Plus (LON:TEP): The capital-light utility

- Share price: 1154p

- Dividend yield: 4.6%

- 10-Year ROCE: 30%

- 10-Year Growth: 11%

- 10-Year Capex/Profit: 27%

- Debt/Five-Year Profit: 250%

Telecom Plus is an unusual business. It trades as the Utility Warehouse, offering a wide range of utility services such as gas and electricity, phone and broadband services and more recently, home and boiler insurance. That may not sound unusual given that many utility companies are looking to provide a wider range of services, including those mentioned above; but there are two things that Telecom Plus does differently:

The first is its long-held policy of not providing any of the infrastructure needed to supply its products. Its gas and electricity are supplied through pipes and wires owned and operated by other companies, and the same goes for its phone and broadband services. And as far as I can tell, even its insurance services are provided by another company.

So, what does Telecom Plus actually do? It provides the necessary customer-facing services. It has a sales force (which I’ll comment on in a moment), a customer support team and it sends out bills and accepts payments. So, it does all of the customer-facing activities, but the actual service – the gas, electricity or insurance – is provided by other companies.

The second thing that makes the “Utility Warehouse” different is that it’s run as a discount club. As a club it doesn’t advertise and it doesn’t have an employed sales force; instead, existing members of the club (i.e. customers) can become Partners and earn an income by bringing new members into the club. This is effectively a multi-level or network marketing system, where Partners earn a percentage of the revenues generated by members they bring into the club. If those new members go on to become Partners and introduce yet more members, then the original Partner earns a percentage of those revenues too.

This is a legitimate business model, but it does sound a bit like a Ponzi or Pyramid Scheme and it has had a lot of bad press recently, especially with Herbalife (the world’s largest nutrition network marketing business) receiving a $200 million fine for operating as a pyramid scheme. There is a difference though. Telecom Plus’s compensation structure incentivises Partners to sell services to customers, whereas Herbalife’s compensation structure incentivised their version of Partners to simply bring in more Partners rather than customers who actually use the end product (e.g. electricity or broadband in the case of Telecom Plus, nutrition products in the case of Herbalife).

So why is Telecom Plus such a capital light company? The main reason is that it doesn’t build or own any energy or telecoms infrastructure. Vodafone (which I also own) has recently paid out vast sums of money to build a leading 4G network, and that will soon have to be upgraded to 5G. That will then have to be upgraded to 6G and the cycle of heavy investment in expensive physical infrastructure goes on, seemingly without end.

Telecom Plus completely sidesteps this and effectively rents infrastructure from companies like BT (which I definitely don’t own). This is still a cost of course, but as long as Telecom Plus can provide the non-infrastructure-related services (i.e. those customer-facing services) more cheaply than the infrastructure owner, it can undercut them on pricing.And this really is the core of Telecom Plus’s business.

By lumping together energy, telecoms, insurance and other services, Telecom Plus gathers a larger number of customers over which to spread its customer services costs. Add in a relentless focus on technology-driven cost efficiency, plus a low-cost method of acquiring new customers/members (the network marketing model rather than advertising) and the result is services that are consistently cheaper than most of its previously state-run monopoly competitors.

There are risks of course, primarily in the deals it negotiates with infrastructure owners. But so far that hasn’t been a problem and this business model has produced excellent results: double-digit annual growth over the last ten years and an average return on capital employed of 30%.

And yes, Telecom Plus is another one of my holdings, precisely because of its attractive growth rate, profitability and yield. So entirely coincidentally, I own all three of these companies. And while I don’t think capital light companies automatically make the best dividend stocks, it’s usually a nice feature to have.

But there are downsides, primarily the fact that it’s usually easier for new competitors to compete against capital light companies than it is to compete against capital intensive companies. That’s why there are so many tech start-ups; because the capital investment required to make software is tiny. This is good for competition, but bad for incumbents. So,if you do look for capital light compounders, look for evidence of competitive strengths which might keep an army of new competitors at bay.

|

Comments (0)