When Will The Fed Hike Rates?

We live in strange times in terms of economic reasoning and thinking. One Nobel laureate economist believes that saving is public enemy number one, as it prevents economies from growing, hence he preaches the virtues of macro policies aimed at leading people to spend whatever they produce, and eventually a little extra if they can borrow against their future. Some respected economists go the extra mile of demanding punishment for savers through the use of negative interest rates, in a desperate attempt to revive the economy. Some others go even further to argue physical money should be banned and the economy turned cashless, so that people can be charged for bank accounts in credit, and monetary policy can regain its effectiveness, leading to ever more spending…(and, of course, more debt).

But let us forget about the particular delicacies of exquisitonomics and take a look at the US Federal Reserve’s current agenda. It seems they’re scared to death. I can’t remember a time like this in decades; a time in which, after nine years of leaving the interest rate untouched, a central bank is still scared to raise rates. The message to the economy is quite simple: we won’t hike rates, because we believe our economy is fragile; it is not creating enough growth and job creation isn’t sustainable. That is the wrong message at a time the country needs more investment from companies that prefer to spend money repurchasing their own equity. While central bankers believe a higher interest rate leads to lower investment and slower growth, I would say that after nine years of near zero rates, a small hike would inspire confidence and have a positive effect. I’m not saying the Fed should start hiking rates like it did in the 2004-2007 cycle, when every FOMC meeting led to a hike in rates. I’m just saying that Janet Yellen should have increased rates by 25 bps and let the market adapt to it to see how it reacts, instead of carefully choosing her words, ever looking for an excuse to keep rates unchanged, and giving an impression of distrust and lack of confidence.

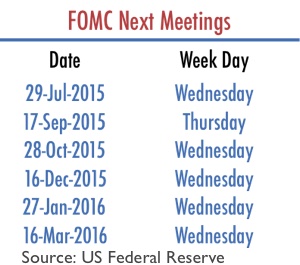

Richard Fisher, former president and chief executive of the Dallas Fed, told CNBC that an interest rate hike by the Fed should come in September. He believes markets have already discounted such a hike and that the US economy is sufficiently strong to assimilate it. He justifies his choice of September with the fact that December usually sees decreased volume in markets, such that a rate hike could easily lead to extreme movements and unnecessary volatility. The Fed would most likely be willing to avoid it. But between now and December there are other meetings: July and October.

Most likely, however, is that the Fed won’t be willing to hike rates on its next meeting because it is too soon from their perspective. Additionally, the latest developments in Europe, where the negotiations between Greece and its creditors are far from concluded, is also weighing on sentiment. While the US is not directly exposed to Greece (at least not in a way that would create difficulties for its banking sector), Yellen knows that a default or an exit from the Eurozone would increase market volatility. Regarding its October meeting, it would be unlikely that Yellen wants to mix the first rate hike in nine years with the quarterly economic projections the Fed will give out at that meeting.

With a mandate that lasted for 10 years, Fisher became known as a policy hawk. He has consistently pushed for a more hawkish policy and has opposed too much easing. But his predictions about the first rate hike occurring at the September meeting are rather more quixotic than realistic. September is his mental deadline, which may or may not be Yellen’s deadline. Even though I agree with Fisher on his view over monetary policy, I believe he’s not right when he says the market has already discounted a rate hike. The market may have discounted the rate hike in the sense that the rates will not permanently stay at the current level, but has not discounted the hike in the way Fisher believes it has. The odds for it occurring sooner rather than later have been changing over and over again.

At the other extreme of the spectrum lies William Dudley, the influential president of the Reserve Bank of New York, who believes the Fed could raise rates this year, but also argues that the central bank is not in a hurry and may accommodate its policy to global developments if needed to. Well, with the Eurozone at risk of being dismantled, emerging markets heavily dependent on low interest rates from the developed world, and with a market crash always occurring somewhere, one doesn’t need to look to far to find an excuse to keep rates unchanged. There’s always a risk associated with rate hikes, in particular for financial markets where the price of assets is negatively correlated with the discount rate.

Dudley believes the recovery in wages and growing consumer spending (soaring at its fastest rate in six years) are key factors supporting the first rate hike. But still Dudley seems concerned with GDP growth and sees any rate hike dependent on the 2nd quarter GDP numbers yet to be released. While all economic indicators have been pointing towards a consistent improvement, GDP growth turned negative during the first quarter. Dudley hinted that the Fed might wait a little longer if GDP growth doesn’t recover to near 2.5% during the 2nd quarter. Let’s wait for July 30, when the advance estimate for GDP will be released by the US Bureau of Economic Analysis.

Dudley is much more in line with Yellen’s thinking than Fisher is. He believes the risks of hiking rates too soon are higher than those of being behind the curve by waiting too much. With oil prices being so low and Iran at the brink of flooding the world with cheap oil, I understand why they’re not worried about the risks of delaying a decision. The Fed doesn’t perceive the negative externalities that derive from its actions and thus consistently underestimates the risks of inaction. But this inaction has a strong negative consequence on asset prices, as it leads to price bubbles and enhances the boom-bust cycle. Ignoring such a risk is like driving a car in Istanbul and ignoring there are other drivers, when estimating your arrival time.

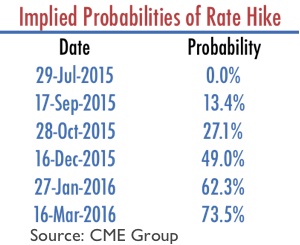

It is interesting to put Fisher’s and Dudley’s predictions in perspective by looking at what the market thinks. The CME Group FedWatch tool is a great way of looking at the odds for a rate change. Computed from CBOT 30-day Fed Funds future contract prices, the tool gives an estimate for the probability of a rate change. The compiled data, matched against the next few FOMC meetings, is depicted in the table below:

The implicit probability of a rate hike occurring at the next FOMC meeting (to be held at the end of this month) is currently near zero. Even for the September meeting, and on the contrary to what Fisher claims, the odds are still slim at 13.4%. Only at the December meeting are the odds for the first rate hike to occur near even. The market is much more in line with Dudley than with Fisher. The implied probabilities postpone the first rate hike to the very end of the year or, eventually, to the next year. As I mentioned above, Yellen has always expressed concern over major global developments, which may kick the first rate hike into the unforeseeable future. In the latest policy statement, the FOMC expressed that “several [members] mentioned their uncertainty whether Greece and its official creditors would reach an agreement”, which clearly closes the door for any rate hike in July while giving the Fed an excuse to delay rate hikes even further.

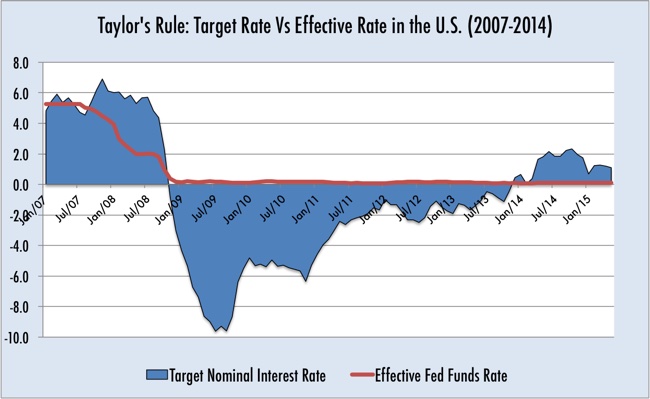

In previous blogs I have been urging for the need to hike interest rates in the US. The first rate hike should have occurred last year and by now rates should be at least near 1%. While the Taylor rule is not a closed-end structure that must be followed, it at least is a good indicator against which a central bank may measure its policy rate. When it differs from the rule, the central bank should carefully justify it. If it can’t, it is because there is no justification for the policy. The numbers given by a simple Taylor rule suffer a lot of volatility due to changes in inflation and GDP (or unemployment rate). But still it shows a trend that seems to fit reality quite well. Since December 2013 the advised policy rate turned positive, which coincides with the exit of Ben Bernanke and with the announcement of the end of QE. Since that time the Taylor rule has been pointing to key rates around 2% during the second half of 2014 and around 1% for this year (with the decrease being the result of decreasing inflation).

While no single indicator should be used in a rigid way because each has its own weaknesses, one starts scratching his head when all indicators point in the same direction advising a rate hike and the central bank still prefers to use full discretion to decide in the opposite direction. As a trader put it the other day, “the Fed is giving a put to equity investors.” Being that the case and with Yellen so firmly in favour of keeping rates unchanged, one can foresee a bubble but one cannot sell this market… at least, not this year.

…And regarding the investment/saving issue. If something leads to delayed investment decisions and a lack of growth, that something would most likely be a vacillating monetary policy rather than too much saving.

Comments (0)