What’s wrong with central banks?

One thing central banks fail to acknowledge is that their medicines are a kind of chemotherapy that, while attempting to eradicate a problem, often end up damaging everything else at the same time. QE in particular is one of those unconventional treatments that should always be used with parsimony because of its extreme side effects. But central banks fail to recognise any side effects, as their focus is on consumer price inflation, for which they are willing to do whatever it takes, no matter the consequences.

For the last few years, the only concern for central banks has been to drive inflation towards a 2% target. The central idea behind price stability is that it is a necessary condition to achieve financial stability and improve economic conditions. But recent research has been challenging the idea that price stability is a sufficient condition for financial stability. When prices aren’t stable, the economy loses efficiency and the outcomes are worse than those that could be achieved under an environment of price stability; but prices reflect economic conditions, and to some extent are the ultimate guidance for an efficient allocation of resources. When these prices are severely distorted, there are reasons to believe that imbalances will arise. Recent research in monetary economics has suggested that an increase in financial imbalances could be the result of monetary policy action. In other words, central banks are creating boom and bust cycles due to their sole focus on price stability.

Concerning financial imbalances, there are two elephants in the room: one is monetary policy, the other is credit growth. Monetary policy distorts risk profiles and leads to an inefficient allocation of resources and a deviation of prices from their fundamentals. At some point, a correction occurs and many investments become impaired. Meanwhile, credit growth boosts economic activity without a corresponding increase in savings. At some point, the extra production cannot be entirely absorbed and needs to be cut. In either case the economy experiences boom at the expense of a future bust.

In forcing interest rates to remain low while purchasing trillions of dollars in government debt, the FED exacerbated the boom and bust described above. The boom is part of the past and is reflected in higher asset prices, lower unemployment rates and stronger economic activity. The bust is now manifesting itself as the FED attempts to normalise its policy, which is uncovering the poor decisions that were taken year after year. Money flowed towards riskier projects like junk bonds, emerging markets, and commodities. Now that money is fleeing.

QE is an indiscriminate weapon of mass destruction. It pushes the cost of government borrowing down and seduces investors to purchase riskier assets. It eliminates downside risk and encourages investors to ignore risk profiles. When QE is kept in place for extended periods, interest rates – yields – like any other measures of return, are pushed down, leading investors to jump into riskier assets that they probably wouldn’t consider under normal conditions. A hunt for yield means dropping the safety of government debt and jumping into corporate bonds. But then, as investment grade turns into a kind of sovereign debt, investors jump into high yield. Because the central bank is managing downside risks, investors don’t fully perceive the higher risk that comes with junk bonds, and instead see the higher yields a great incentive to invest, even though those yields would now be much lower than they used to be.

If all yields moved in tandem, one could argue that such policy doesn’t cause major distortions. But that is not the case.

Let’s say that at some point two bond types, A-Bonds (a safer, government bond) and B-Bonds (a riskier, corporate bond) are yielding 0.5% and 6% respectively. If a large scale asset purchase programme is implemented and targets A-Bonds, the yield on A-Bonds would decrease, as prices increase. At the same time, an increase in the price of A-Bonds would make B-Bonds more attractive. Over time one could expect a decline in the yields of both A-Bonds and B-Bonds. The effects of an initial purchase targeting A-Bonds spill over to all other asset classes. Let’s suppose yields are pushed lower to -0.2% and 5.3% as a consequence. However, because at some point it is better to hold on to the money rather than paying the government for the privilege of lending to it (as yields on A-Bonds are negative), central banks start targeting other bonds with positive yields while investors also look elsewhere for a positive return. The yield on A-Bonds would then remain near -0.2% (as there is a lower bound) but the yield on B-Bonds would continue to decline. At some point, a possible result would be A-Bonds yielding -0.2% and B-Bonds yielding 2%. The asset purchase programme would thus have helped not only to depress yields but also to flatten them, which means that the central bank would have artificially changed the risk profile of assets – a recipe for future disaster.

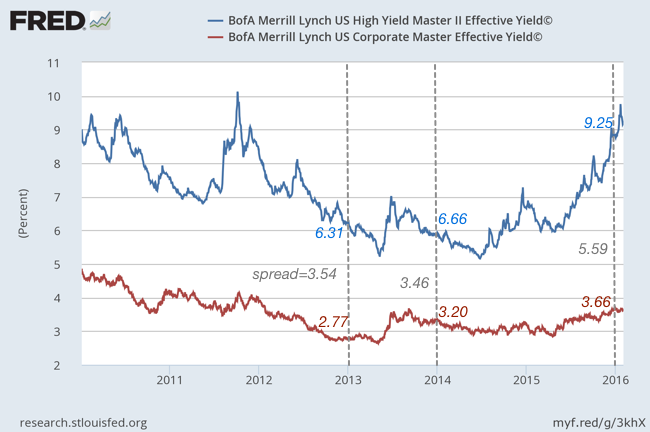

When taking the simple example above into consideration, it should not come as a surprise that the high yield bond market expanded by 41% during the five years after the start of the US QE package. A record $30 billion flowed into this market in 2009 and in 2012. Companies with debt rated as junk could issue bonds at small spreads relative to investment-grade and use the proceeds to repurchase shares, and in that way pay a huge dividend to shareholders. The spread between high yield and investment grade yields, which spiked to more than 14% at the end of 2008, narrowed to less than 3.5% while QE was in place. But as soon as the FED hinted towards policy inversion, the spread started increasing again, to the current level of 5.6% – as the yield on the lower grade issues rose from 6.66% (at the end of 2013) to 9.25% (today), while the pace for investment grade was much slower.

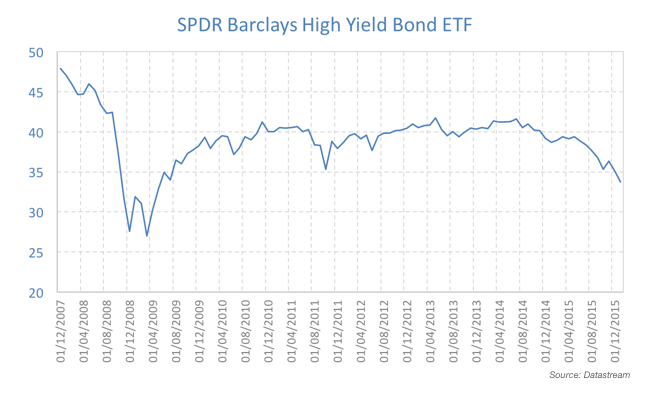

When QE ended, the value of the dollar started climbing and thus helped to depress commodity prices. It’s true that China also weighs heavily on current global economic conditions; but we can’t underestimate the distortions created by QE. It was QE that depressed yields and changed global flows of money; it was QE that financed a boom in oil production; and it was QE that distorted risk profiles and led to misallocation in an economy that was correcting past mistakes. Now, many oil projects will be shut down and the yields on junk bonds will continue to rise. Outflows from the high yield market amounted to $24.5 billion in 2014 and another $15 billion in 2015. The SPDR Barclays High Yield Bond ETF is now declining at a fast pace and further deterioration is expected.

While the FED moved quickly with the implementation of several QE packages worth trillions of dollars, the ECB failed to act in time. In the Eurozone, QE would have make sense, particularly at the time of the sovereign crisis. At that time, a QE package could have prevented the increase in yields faced by peripheral economies, which was mainly the result of speculation that the Euro would break up. The central bank could have acted to flatten yields and guarantee financial stability. Now, even though that problem is solved, we have the ECB implementing QE to push bond and equity prices higher.

Something must be really wrong with these people!

Comments (0)