What the theory says about the January Effect

We are now approaching the Christmas season during which people prepare to take a small holiday and to make a few promises regarding the New Year. After all, January represents a new start; it’s an opportunity to correct all our past mistakes and the best time to cut out misbehaviour and improve our lives. The last few days of the year are a time of excesses, during which we amplify the mistakes we made during the year. It’s our way of saying good bye to the past! But the time for a revamp of our life is just around the corner! We’re not going to allow the ill-formed behaviour of the past to perpetuate. This is the time when we plan to quit smoking, exercise at least 3 days per week, eat healthier food, drink fewer pints at the pub, and spend a few more hours working. There is a strong change in attitudes between December and January. Fed by human interaction, the equity market could only suffer from the same effect – a strong December-January effect.

While the January effect in life was first perceived hundreds of years ago, we keep suffering from it every single year, one year after another. We know that life is just going to remain more or less as it was before, as soon as we reach mid-January when the New Year’s promises are forgotten, but we still love to think otherwise. Wouldn’t it be rational to just giving up making unrealistic promises year after year? Yes, it certainly would, but our human nature is not that rational…

…and if human nature is not that rational, how could we expect equity prices to be any different?

They just aren’t. A share price is the result of the interaction of human beings, which is strongly influenced by sentiment, and therefore the result of a sentiment-driven component that interfaces with a fundamentals-driven component. That helps explain why, 39 years after being documented, the January effect still plays out in the equity market.

The documented January Effect

The formalisation of what became known as the January effect occurred in 1976. Rozeff and Kinney (1976) found irrational patterns in the US equity market. They analysed the returns of an equally-weighted equity index in the NYSE and found that January returns were near 3.5% on average while the same for the rest of the year were just 0.5% on average (for the period 1904-1974). They additionally reported that this kind of difference was not observed when a large cap index was used, which led them to conclude that not only there is a January effect but it is a small-cap thing. Equity returns are higher in January and that is particularly true for small caps.

Further research added evidence to the January anomaly. Klein (1983) refined the outperforming period, reporting that half of the January excess returns tend to occur during the first five trading days of the New Year. Later, Reinganum (1985) found that shares showing negative returns over the previous year show higher returns in January. A possible justification is that people tend to sell losers before the end of the year to reduce capital gains tax. Soon after the end of the year, they just purchase them again. Such behaviour would explain why January is a positive month for equities and also help disentangle the value of contrarian strategies during the period as opposed to momentum strategies.

Further examinations of the findings extending the research to international markets confirmed the existence of a strong January effect. In fact, the effect seemed even greater for international markets. Interestingly was the fact that in markets were the fiscal year-end didn’t coincide with the calendar year-end (as was the case with the UK and Australia), the January effect was still present. In other countries (like Canada and Japan) where there was no capital gains tax, the effect was also observable. Taxes couldn’t explain the January effect in full.

A more intriguing finding was reported by Tinic and West (1984). They found that the higher return often attributed to the riskier shares (higher betas), occurs almost exclusively in January. So, investors are compensated for bearing the extra risk on these shares, only in January. Someone keeping a portfolio of high beta shares between February and December would achieve market returns, even though risk incurred was greater.

Market efficiency?

These findings have since always been strongly opposed by efficient market advocates, who say that a rational investor would anticipate the early-January gains and just purchase equities on 31 December. While the excess returns persist, more buyers would join the party, earlier and earlier, until the opportunity ceases to exist. Fama, French and other efficient market supporters have attempted to explain these market anomalies by incorporating additional risk factors into the traditional CAPM theory: investors are compensated not only for market risk but also for size and value factors. Nevertheless, anomalies continued to be found. In particular, the January effect seemed persistent.

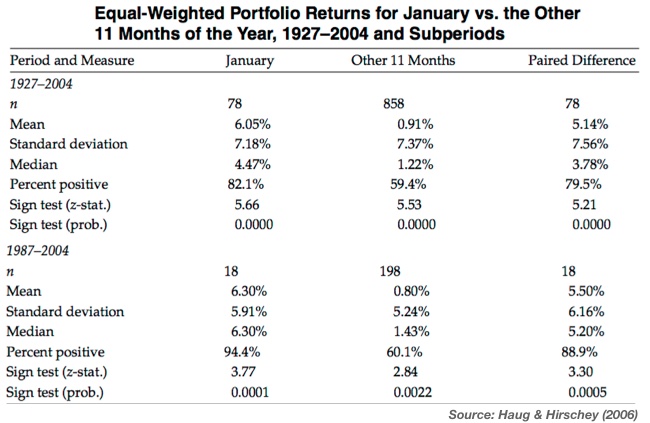

Haug and Hirschey (2006) analysed a large sample of value-weighted and equal-weighted equities for a period running up to 2004. The excess returns in January for small caps were still present, almost 30 years after the seminal work of Rozeff and Kinney!

The exact explanation for the phenomenon is still an open issue. D’Mello, Ferris and Hwang (2003) tried to analyse what happens during the holiday period. They observed increasing selling pressure just prior to the end of the year for shares with large capital losses, which corroborates the idea that investors tend to get rid of losers. At the same time they found that individual investors postpone the sale of winners to the New Year. While this happens, trading volume seems to decrease. The lack of institutional interest in the market can help explain why this pattern is still alive.

How to play the January Effect

The equity market is a mirror of human action. If the choices we make in our daily activities are often guided by emotion, we shouldn’t expect financial markets to be immune to it. The January effect is no more than the projected shadow of human behaviour in the equity market. It consists of people trying to get rid of everything deemed as being wrong to embrace a new and brighter future. In the market this translates into selling shares with large capital losses before the year-end and then buying these oversold shares again at the beginning of the New Year. While it is not worth preparing an investment strategy solely based on this January effect, knowing how it unfolds may help in tweaking a portfolio. Momentum strategies have a high probability of not working at this time because this is a time of change. This is the proper time to adopt contrarian strategies to embrace the change. By mid-January no one remembers the New Year as being a new start – and neither does the equity market.

Comments (0)