What the Terrost Attack Means for EU Economic Policy

The terrorist attacks that occurred last weekend in Paris will certainly be part of our memories for a long time; but the implications for our society and for the future of the European Union are manifold. While the attacks carry many regrettable implications and challenges, they also help shed some light on the unsolved puzzle of why the EU economy is so depressed and how it might be reinvigorated.

During the last few years, the austerity imposed on peripheral European countries, along with global fiscal tightening, has led to contracting global demand and a vicious cycle of deflation and economic contraction. With commodities embroiled in an epic bear market, not even the trillion-euro asset purchase programme rolled out by the ECB seems able to do much for the EU economy. After all, banks are still not lending money, people are not borrowing, companies are not investing and the euro has been stubbornly reluctant to depreciate. In fact, this euro resilience is a real pain for economies that have been subjected to severe internal devaluations, only to then see their efforts dismissed by a strong euro. As a whole, the EU economy is a relatively closed economy, but exports are still an important source of growth for many peripheral countries. Taking into account the fact that imports of commodities are ever cheaper, the harm in terms of growth and deflation is significant.

However, yesterday’s statement from Francois Hollande at the French parliament has opened a door that was closed five years ago and that should lead policymakers to scratch their heads as to why and how. Hollande stated that France is currently at war with the Islamic State and that no budget cuts on defence are expected, even as far out as 2019. The country will step up its campaign against terrorism. At a time when it is difficult for the EU to keep its members in line with the Stability Pact and its 3-60 rule, it will become ever more difficult for the Pact to survive, as Hollande has just completely dismissed it stating that “the security pact takes precedence over the stability pact”.

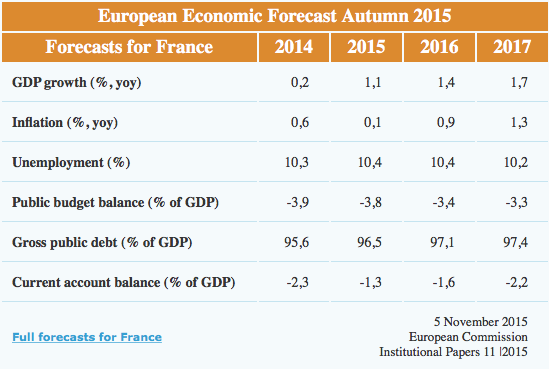

The European Commission expects France to present a government deficit of 3.4pc of GDP in 2016 and 3.3pc in 2017, but the real figure may come in higher if Hollande commits to his pledge to fight terrorism until it “eradicates” ISIS. Hollande will invoke a solidarity rule in the Lisbon Treaty that obliges other member states to come to France’s help with “all means in their power”. That may mean a complete budget slippage in Europe, as no fiscal rule would still apply if national interests relating to security and defence were at stake. Hollande’s statement helped the euro break below 1.0650 against the dollar – a level not seen since April, at a time when the ECB was just starting its QE programme.

Europe has a lesson to learn about its lack of cohesion and common policy stance regarding sensitive matters like defence. It has long been relying too much on the US, a country with different interests in the Syrian region. Migration is a huge European problem, not a US one. At the same time, all this underlines the need for the EU to do more than just rely on the ECB to boost the economy. So far, the ECB has been unable to reverse a six-year crisis. Austere fiscal policies piled on top of very unfavourable international conditions have simply leveraged the crisis to a new level. Many structural reforms need to be implemented, but those should not mean cutting government deficits in a pro-cyclical way. Under the current scenario, the government is a huge burden on the economy. A 3pc deficit is rather too much when the Union is growing healthily but it is too little when the economy is retreating. The support of the ECB would do much more for the economy if it were used in support of fiscal policy, injecting or absorbing liquidity as needed rather than being used to counter-balance a fiscal tightening. Europe should stick to sound government finances, but that should not happen at the expense of everything else. In order to keep deficits tight, the EU is allowing the ECB to create bubbles. At least government spending would create some real spending at a time when no one seems to be willing to kick-start it. In some respects, some budget slippage, even if on defence, may be desirable.

Comments (0)