What can we expect from 2016?

As seen in the January edition of Master Investor Magazine.

We’re now at the beginning of the year: a time when investors, analysts, journalists, and politicians make a series of predictions for the year to come. Most of them will prove wrong, as the many interactions between all the variables involved make it impossible for a human being to predict what is going to happen. Financial theory says that, most of the time, all that analysts do is recycle their past expectations; but reality shows that the past falls short of telling the full story, and they just miss the target. I myself am no oracle or soothsayer. So rather than wading in with price targets, I shall simply explore a few outcomes based on recent economic and political developments. Some will materialise, others just won’t; some are pretty serious, others are wrapped up in some fantasy. But all of them tell a story about the real world in which we live.

We are in a time of change. The past few years came with a few extremes, particularly in terms of monetary policy. The theoretical zero lower bound (ZLB) that policy makers marked as a floor for interest rates was tested in many European countries and the new normal is now a negative lower bound. At the same time, the relationship between the expansion of money and inflation seems to have broken down – otherwise the world would by now live under the hyperinflation umbrella that branded the Weimar Republic. But this is not a time to celebrate, as the negative effects stemming from extreme monetary policy may be lagging and show up only after the policy is put into reverse. With the FED having hiked its key interest rate from 0-0.25% to 0.25-0.50% at its December FOMC meeting and with policymakers at the committee predicting a few more hikes for 2016, this is the time when the mettle of financial markets will be tested. Can markets still rise without life-supporting policies? With trillions of dollars pumped in the direction of bonds and equities during recent years, we don’t really know whether the current price level is the result of real improvement or merely financial disconnection. As rates increase, corporate America will need to show profits – otherwise the market will suffer from the lack of FED support.

A reversion in monetary policy will certainly be a key point in 2016 but not the only one. With the UK and Continental Europe lagging behind the US in terms of monetary policy, the divergence in monetary policy is expected to increase. This may contribute to a continuing rise in the dollar and to a deterioration of profits in the US, which may serve as a delaying factor in the path the FED is expecting to follow over the next two years. That’s one of the main reasons why investors predict a much smoother rate increase than the FED does. Betting on this divergence will be an investment theme for 2016.

A point of real concern is China. The world’s second largest economy is no longer able to grow at double-digit rates simply by investing in infrastructure. The Chinese government is determined to jump to the next level of country development, through turning its economy into a consumer-oriented one, while in the process allowing it to abandon manufacturing and embrace services. That can only be taken with a grain of salt by all those emerging economies depending on their raw material exports to China. A changing China is a changing world, which means world growth and the commodities market will be in the spotlight in 2016.

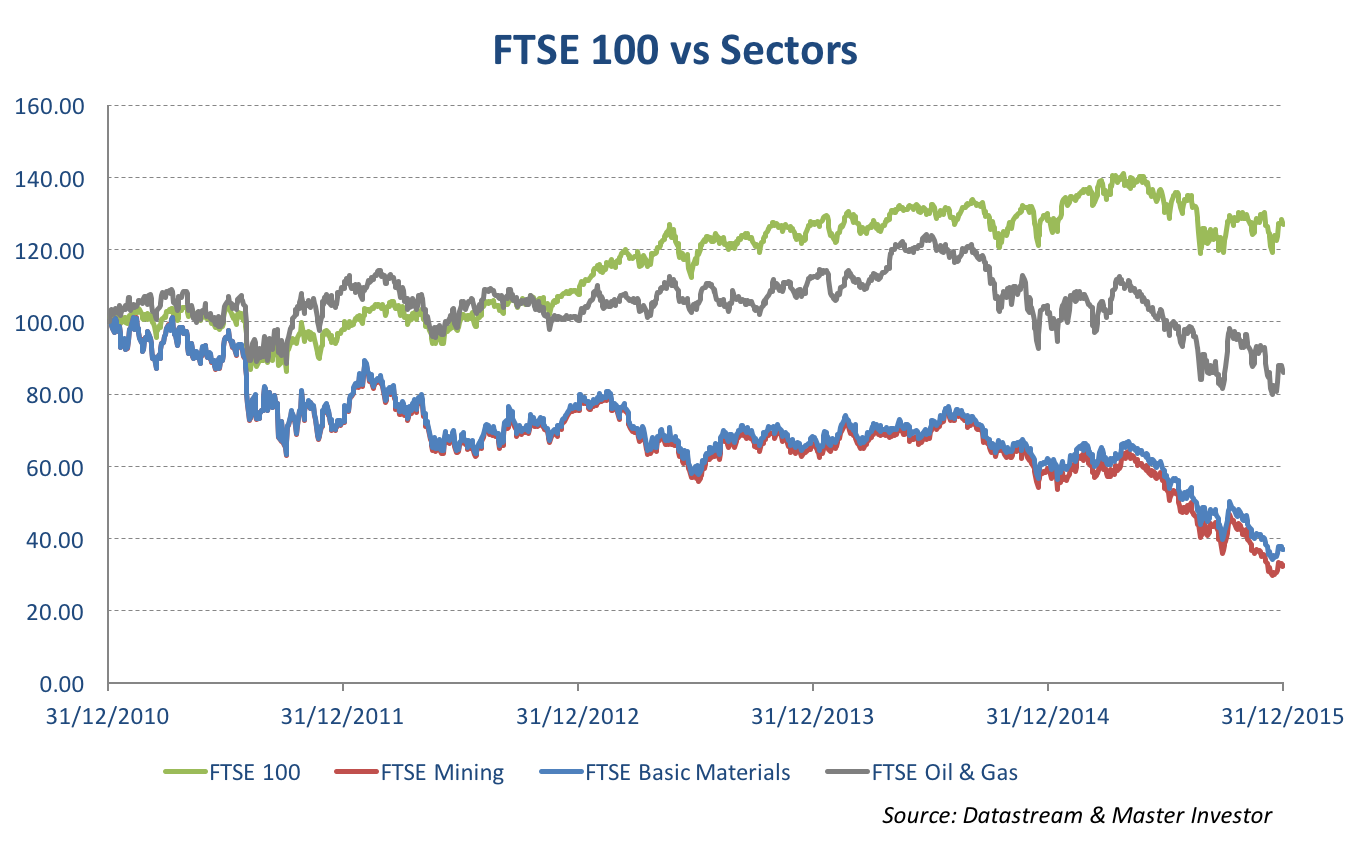

Speaking of commodities, Jim Rogers is certainly puzzled with the inversion of the super cycle. Oil prices sank 35% and hit 11-year lows in 2015. Russia entered a massive recession, and not even the super-low cost producer that is Saudi Arabia could escape the carnage. While trying to bust everyone, the Saudis are also hurting themselves and having to tap their sovereign funds to finance day-to-day expenses. Investors are predicting oil prices to at least stabilise around the current levels, if not improve a little. But if such a prediction doesn’t materialise, world growth may be worse than expected and several redistributions of income may occur. India and Japan will certainly come off as heavy winners in this game, but I’m not sure about the UK, for example, where the FTSE index is full of resource-based earnings.

Finally we should also not underestimate the effects of a few political matters on the regional and global economy. Brexit is one of those sensitive matters that may end with a severe impact on the future of the EU and the UK. Another important matter is the changing political landscape across Europe. The austerity solution to the crisis is becoming part of the past, as it wasn’t able to deal with the many problems faced by the Union as a whole and by its members separately. Greece, Portugal and Spain all went through elections that saw austerity-backing governments voted out. If the wave comes to the core of the Union, we may observe important changes in the direction taken by fiscal policy, which may ease the excessive reliance on monetary policy.

When the rates rise

It took years for the FED to start normalising its policy after cutting its key rate to the 0-0.25% range in 2008. Unlike what happened during prior crises and recessions, this time the FED had to cut rates to zero and inject a few trillion dollars into the economy through asset purchases in order to boost the economy towards growth. But even though seven years has already passed, the US economy is clearly short of boom territory. The US economy is growing and the job market seems to be on track again, but there is a widespread feeling that the improvement is mild and could derail at any moment, in particular if the FED presses the brakes too fast. The headline numbers in current data seem strong, but hide a few weaknesses. An example is the unemployment rate, which currently stands at 5.0% after having peaked at 10.0% during the crisis. The headline number seems near full employment. If the economy continues to improve (and because it may be near full employment), wages will start growing, which is needed for inflation to perk up a little and consumer spending to grow. But something doesn’t stack up here: wages are not growing and companies are not investing. This observation suggests that the real unemployment rate may be higher than the numbers show. When taking into account the decline in the labour force participation rate observed during the last few years, an adjusted number for the unemployment rate could be more realistically near 8.7%, which would explain why there are no wage pressures at this point (for more check my previous article). This simple fact may lead to delays in rate hikes from the FED in 2016. I would not be surprised if there is only one rate hike and the FED funds rate is still below 1.00% at the end of 2016, which contrasts with FED policymakers’ projections of 1.375%.

In Europe rates are certainly not expected to rise in 2016. For now the ECB is following the same path as the FED did before 2013. The ECB is still expected to increase the pace of asset purchases. The divergence in monetary policy between the FED and the ECB may help the ECB delay such an increase, but if commodity prices continue to decline and translate into very low consumer price growth, then the ECB may still need to loosen its policy, possibly by increasing its monthly asset purchases to €75/€80 billion. If that happens, I wouldn’t be surprised if the ECB expands its target purchases to corporate bonds. Such a move would prevent the central bank from having to cut its deposit rate too much. But not all would be happy with this scenario. Switzerland would be pushed into further trouble if the SNB needs to cut its rates again. Demand for CHF 1,000 notes may quickly increase and money could vanish from banks. Many economists and academics will once again suggest a cash ban as the best solution for monetary policy to regain effectiveness.

The BOE is expected to remain halfway between the FED and the ECB. Rate normalisation is already on the cards but is not expected to start until later in the year at the earliest. Again, commodities prices will play a central role in the path taken by the BOE. Given the current situation, the likelihood of no hike in 2016 is greater than that of a hike.

China and other emerging economies

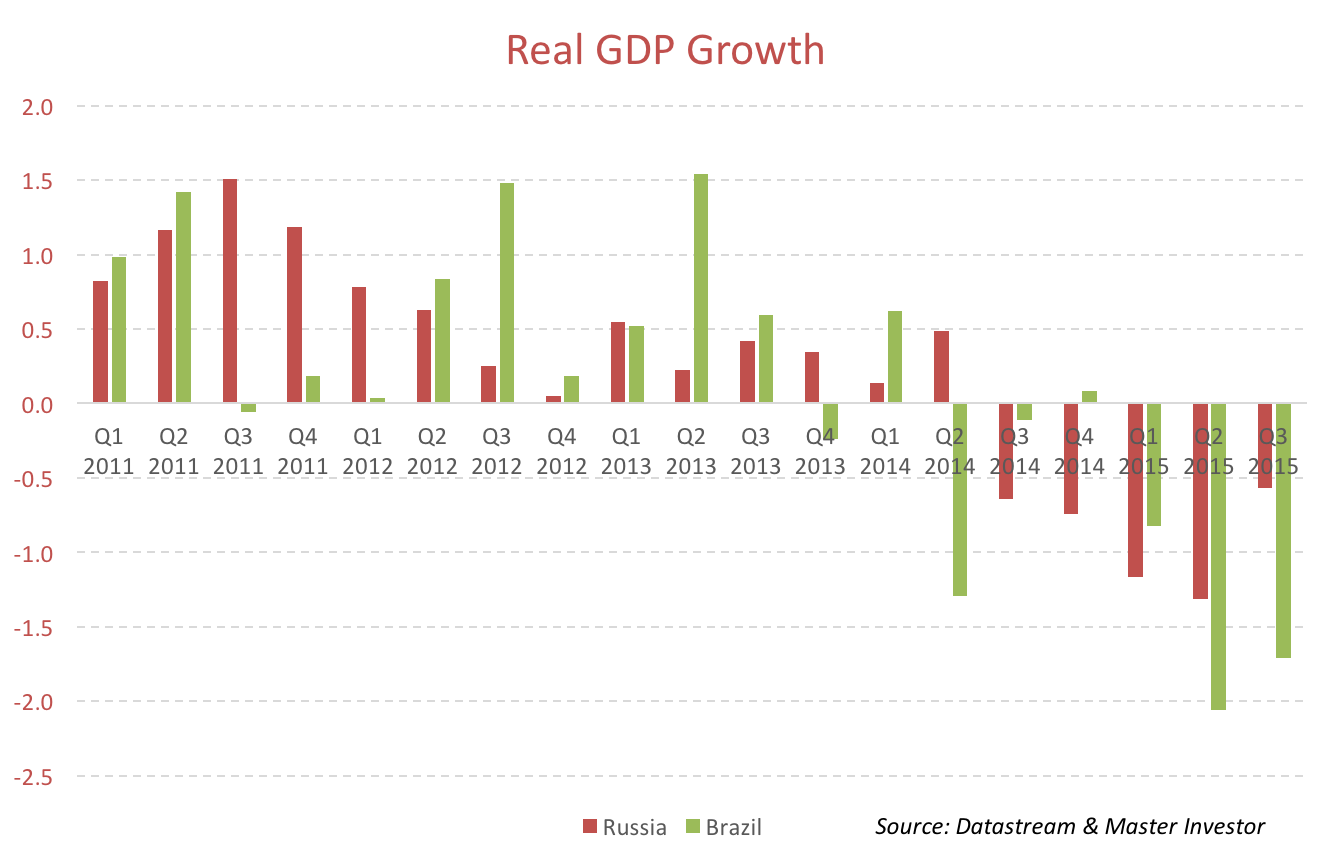

Analysts have been predicting a hard landing for China for many years. That is not going to happen, as the Chinese economy still has a lot of margin to grow and the government holds enough firepower to avoid any major derailing. It is just a matter of allowing for a structural change from an investment-based economy to a more consumer-oriented one. At a time when world growth is mild, the impact from China may be substantial, particularly in countries that rely on commodity exports. Brazil is one of those countries that have been suffering. It takes too much time to reduce the size of projects related to raw materials exploration. Prices will continue to adjust down, but will start normalising at some point in the near future. The negative impact on emerging markets may be approaching an end.

Equities

As rates start normalising, expensive stocks will become vulnerable and value investing will become the norm again. For the last few years, following momentum strategies has paid off handsomely. That’s because while central banks were injecting liquidity into the market, investor sentiment was rising, attracting ever more investors to the market. A feedback effect is responsible for the momentum effect. But as momentum starts retreating, there is a return to fundamentals and stocks with very high valuations will be discarded by investors.

In 2015, while the S&P 500 and the Dow 30 declined 0.9% and 2.2% respectively, the Nasdaq 100 rose 8.4%. Recent academic research shows that equities that are smaller, younger, more volatile, unprofitable, and non-dividend-paying, are more difficult to value and thus more exposed to sentiment. Equities quoted on the Nasdaq market better fit such a description than equities in the Dow. With interest rates near zero, speculators tend to push Nasdaq equities above the overall market. But as soon as rates start increasing the Nasdaq may see its gains reversed and it may underperform other indices.

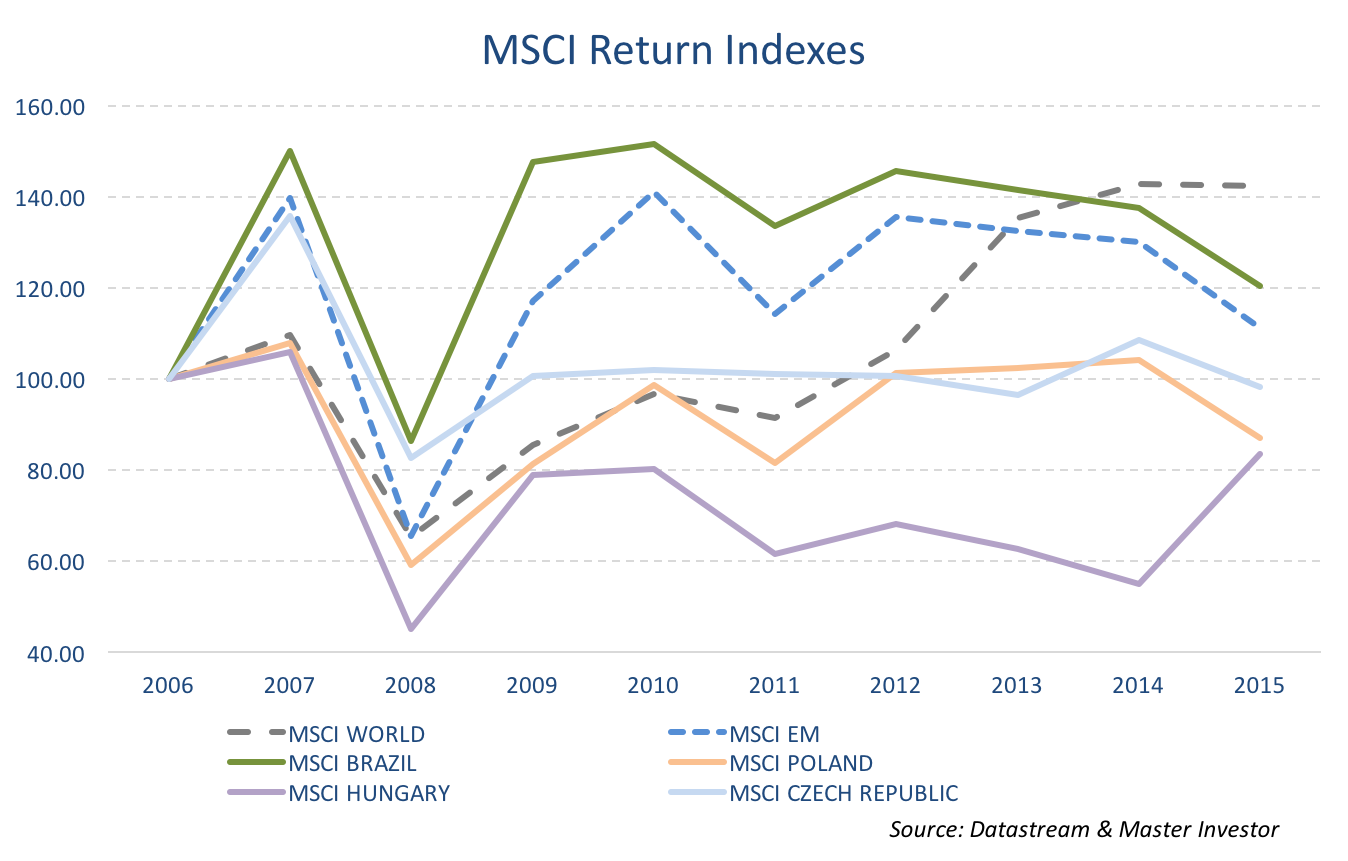

Nevertheless, in aggregate, US equities still look overvalued. The Shiller CAPE ratio shows a reading around 25x, which is much above its historical mean of 16.6x. With analysts expecting sluggish earnings growth for US companies and with many risks accumulating due to a potential dollar appreciation, I would say that investors are better off looking elsewhere for equities. With that in mind, and following the CAPE indices published by Star Capital, there are two major countries that currently look extremely undervalued: Russia (4.7x) and Brazil (8x). Russia was battered by the decline in oil prices and by the sanctions applied in the advent of the Crimea war. Brazil was hammered by the slump in commodities and many internal scandals. I believe there has been overreaction in both cases and that the worst is already behind. Equities in both countries appear a good medium term investment.

But it is not only in BRICS that opportunities exist. In a year many predict will be stronger for the emerging world than for developed countries, it is in Emerging Europe that opportunities lie. Hungary (8.2x), Czech Republic (9.9x) and Poland (10.0x) all seem undervalued, by CAPE ratios.

Brexit

One of the most important risk events to occur in 2016 is the referendum on Britain’s place in the EU. If Britain were to face the Brexit, a lot of volatility could be observed in financial markets. I believe that leaving the EU is not the best option for the UK. The country benefits from the common market and has been able to retain much of its sovereignty. Unlike what happens with Sweden, Switzerland, and Denmark where monetary policy is dependent on the ECB’s actions, the UK retains the independence of its central bank, which gives the country an extra cushion against negative impacts coming from the Eurozone. But if Britain leaves, it may end up with less independence, more market turbulence and it may very well see the City of London lose influence to Paris or Frankfurt. In the end, the UK would depend on the common market, without taking part in the decision process.

Commodities

Unlike what many were led to believe, commodity prices do not go up forever. Price is the best mechanism available in a free market for agents to adapt their actions. High prices allow for other suppliers to join the market and to increase the speed at which demand replaces its reliance on such products (substitution). Low prices attract higher demand and make producers more efficient. There are forces pushing for mean reversion. In 2015 OPEC tasted its own medicine. Years of high prices attracted new suppliers from the nascent fracking industry and allowed demand to find a few energy alternatives. While Saudi Arabia may try to push prices down to eliminate its competition, I am no longer sure if they can push them higher again. OPEC has been significantly weakened and the demand faced in the future will be permanently lower and more sensitive to prices than before. At the same time, as soon as prices start rising again, there is a battalion of new companies waiting to re-enter the market. The bearish oil market is here to stay for a while. We just don’t know whether the market has already found a floor or not. If not, raw-material producing countries as well as resource-based equity indices like the FTSE 100 may continue to suffer in 2016. While 2015 has not been the best performing year for equities, the core European countries closed with decent gains. The same isn’t true for the FTSE 100 which closed the year with a 4.9% loss.

Japan

Japan is a training field for Abe’s archery. The Prime Minister, now in his third year in power, has been trying everything to drive the country back to growth and to boost inflation, but not even the bold policy followed by the BOJ was able to permanently boost prices and GDP. Japan’s problem is demographic. Its working age population declined by nine million between 1995 and 2014 to its current level of around 78 million. The population is ageing fast and can no longer drive the same kind of real growth it has driven in the past. Abe is so desperate for growth and inflation that his next arrow may even feature immigration. He could open Japan’s doors to the refugees that are desperately trying to enter Europe and give them a fresh start. That is the fastest route to a solution!

A few final words

Of course, it is impossible to predict what is really going to happen in 2016. What is for certain is that we are living in an age of extremes. On one hand, we have been testing the limits of monetary policy to generate growth and inflation; but on the other, we just don’t know if that was enough. At a time when the FED is reversing its policy and hiking its rates, there is a fear that financial markets may not keep the same price levels as before and that a few distortions created across the years may now start showing up. I would say that momentum is fading and that value will be crucial going forward. Investors now need to become much more selective than before as it will start paying to diverge from the herd. Opportunities in Brazil, Russia and emerging Europe look more promising than the US market.

Comments (0)