The FED’s new cycle is already rotten

So, they finally did it! The FED has just announced the first rate hike in almost a decade. Investors have reacted very positively so far… but will the enthusiasm last? There’s no fundamental reason to think it will, as the risks that accumulated during the ZIRP-era will now weigh on the US economy.

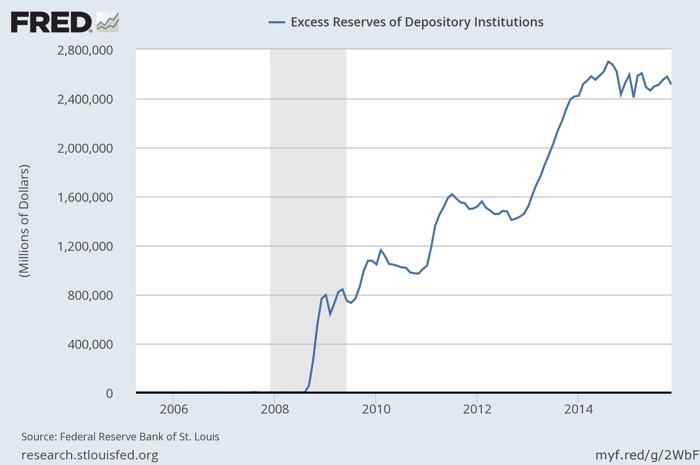

Yesterday, Janet Yellen announced what the market widely anticipated: the FED is going to target a funds rate in the range 0.25-0.50pc, hiking its prior target by 25bps. If it wasn’t for the fact that the last change in rates occurred in September 2008 and the last rate hike in 2006, such a small change would remain unnoticeable. But yesterday’s decision puts an end to a major experiment conducted by the FED, which not only involved near zero rates but also a large scale liquidity injection, which increased the central bank’s balance sheet from below $1 trillion to above $4 trillion.

The FED’s chairwoman said that the hike “reflects our confidence in the US economy”, and policymakers upgraded their views on the pace of future rate hikes. They now expect quite a few rate hikes for the next three years to drive the FED funds rate to 1.375% by the end of 2016, 2.375% by the end of 2017, and 3.25% by the end of 2018. If this scenario does materialise, the FED needs to hike its target by a quarter percentage point each quarter of next year. That is significant if we keep in mind that it took years for the FED to move the same target by just one quarter percentage point!

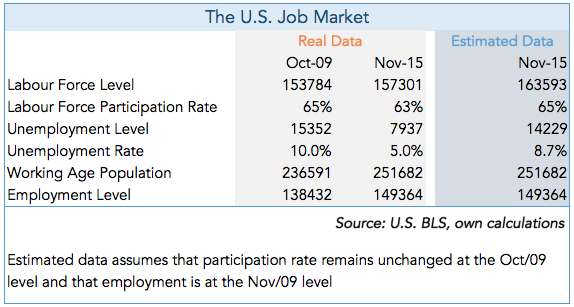

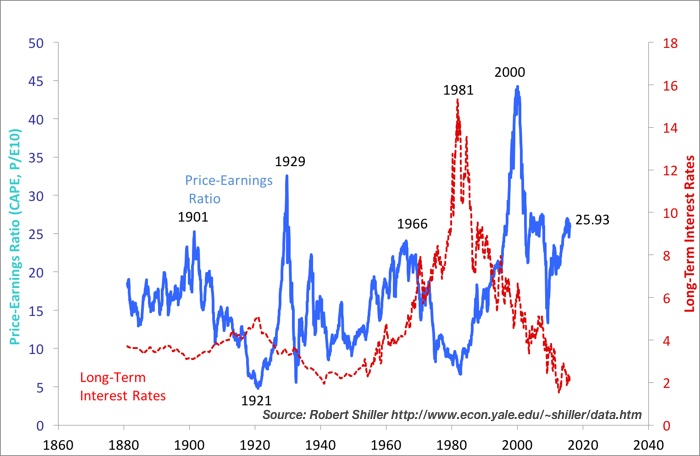

Investors’ reaction was positive overall. On the one hand, the rate hike has put an end to a period of uncertainty created by the FED, as the central bank has been threatening to hike rates but always failing to take action at the FOMC meetings. The divergence between promise and action has been negatively impacting the value of financial assets and has been another source of uncertainty for corporations. But on the other hand, we should not forget that a rate hike also comes with risks. As yields are pushed higher, the value of equity is pushed lower. Usually, rate hikes come at times when the economy is prospering and operating near full employment. At such times, corporations should also face increased demand for their products and easily accumulate more profits that more than compensate for the higher discount rate and increased financial expenses. But I am not sure that description fits current data. The US economy is certainly growing and the jobless rate has been brought down from a peak of 10% (in October 2009) to the current 5.0% level. But the data hide an alternative reality that may be worse than the numbers would suggest. The work force participation rate declined from 65.0pc to 62.5pc in the period. This figure may seem negligible, but it isn’t. If we recompute the unemployment rate assuming that the participation rate was kept unchanged and the same level of employment was achieved, the unemployment rate would currently hold at 8.7% instead of 5.0%.

The above number shows that the qualitative improvements may have been worse than the unemployment rate number reflects. When unemployment remains high, many people just give up on finding a job. So the gains in the unemployment rate come not only from job creation but also from declines in the participation rate. While the first is good, the second isn’t. In theory, a government could convince a large number of people to leave the work force instead of creating jobs to achieve the same results in terms of unemployment rate. Qualitatively the results would be very different! So, for the US economy we have a mixed bag. Jobs are being created but not at the pace required to prevent people from giving up on finding one. This reality mixed with the lack of inflation makes me wonder how long the FED will keep tightening.

The list of concerns doesn’t end there. The actions taken by the major central banks do influence the rest of the world. When the ECB moves, the SNB prays; when the FED moves, the emerging markets panic. In a world where capital flows from country to country freely, any decision taken by a central bank like the FED may lead to extreme capital movements that can lead to currency crises and recessions. With the dollar showing a zero yield for seven years, emerging markets enjoyed lower rates than ever, allowing corporate debt to increase, in particular debt denominated in US dollars (which increased to $3.4 trillion). But now that global aggregate demand is sinking, rates are increasing and the dollar is appreciating, it may be tough to service and repay existing debt. At the same time, the rate of credit growth will now retreat, and companies will no longer get financing. Recession is inevitable in many emerging economies that grew on the back of the easy credit.

We must also weigh the fact that many of these countries live from extracting/producing raw materials. Quantitative easing boosted global growth and, with it, the appetite for commodities. Corporations in emerging markets increased capacity to feed demand. But demand is now retreating and commodities prices have already started decreasing – fast. Mixed with the rising dollar and rising interest rates, the lower global demand and commodities prices may lead emerging markets into a massive deleveraging period. It’s just a small side effect Ben Bernanke ignored a few years ago.

The problem is not about increasing rates but about having kept them too low for too long. We can’t keep low rates forever. When setting policy, that fact should be weighted. By keeping low rates, we are giving an incentive for corporations to produce more than can ever be consumed. A point comes at which the excess capacity must be shut down. This is the boom-bust cycle created by a central bank.

Summing it all together, we may say that low rates helped boost the US economy and put and end to a financial crisis that would have led to severe consequences if nothing was done. But central banks’ models are rotten because they ignore the effects of money. This is not just about inflation, but also about the imbalances created when households and corporations just try to get rid of the excess money they have by exchanging it for other assets. The money flew through the economy to purchase houses, equities, bonds, junk bonds, paintings, art, and of course several international assets in emerging markets. While the flow lasts, no one notices any imbalances; but when monetary policy is normalised, all imbalances are uncovered and start to weigh on the economy. The rise in the dollar will drive emerging markets towards a crisis and will make life more difficult for US exporters. At the same time, it will decrease production costs and drag inflation lower at a time it is already low. The decrease in liquidity will also have negative effects in the equity market because the economy has not been growing at the same pace as equity prices. The Shiller CAPE ratio very well depicts this issue.

The tightening of monetary policy will lead to the unwinding of massive amounts of excess liquidity. The movement that led investors towards riskier assets will now reverse. Unless the US economy can perform above expectations and deliver the high growth asset prices are discounting, we’re heading towards a crash again. That’s why I believe the FED won’t deliver on its promises and will just abandon rate hikes at some point next year. It’s a vicious cycle.

…Across the pond, some are now anticipating the New Year and just celebrating! That’s certainly the case with the Swiss. The divergence in monetary policy between Europe and the US will help Draghi leave policy unchanged for some time. There’s no rush to push for more asset purchases and there’s no rush for the SNB to further dig into negative rates.

Comments (0)