Atlantis Resources Is a High-Risk Punt in a Growing Sector

Atlantis Resources – AIM: ARL

Market cap £66m @ 62.5p per share

Master Investor is planning a series on “The Energy Revolution”. Meanwhile, as a taster, here is an interesting company already well ensconced in what is a significant developing sector of renewable energy, and the only one in its field (where there are some big engineering players world-wide) in which (as far as I know) investors can take a direct stake.

ARL listed on AIM in March 2014 at 94p, and although the shares fell away in its first year, this was due mainly to small selling by some legacy investors able for the first time to monetise some of their early investment, coupled with a relatively small free float in the shares. It may, also, have been due to lack of general knowledge of its field, and a company which is a daunting one to analyse even for the most experienced. (The initiating report by the company broker was nearly 60 pages long and the prospectus over 260 pages – full of highly technical regulatory, energy policy, engineering and financial detail – not to mention a scarier than usual catalogue of risks for the investor.) Now, however, after two years as a listed company and plenty of news of its progress, the shares look to have entered a period of a price moving towards a valuation (notwithstanding having to be tentative) by the house broker (the only one following it) which is considerably higher.

By the same token, however, the scale and complexity of ARL’s business means that I will only be able to provide a sketch, given the limited space afforded here. But as a ‘project’ company having to raise funds from time to time from other participants to develop its schemes, and the resulting complexity in assessing what value remains for ARL shareholders, it is like many miners, which helps. As a relatively unique leader in its field in any case, it looks worth considering almost as a ‘concept’ stock by investors wanting long-term exposure to a newer segment of the expanding renewable energy sector. But while there appears to be considerable long-term scope, there may be considerable risks to get there.

ARL has built itself to be among the global leaders in developing tidal power systems and manufacturing key components (such as turbines) and is involved in some significant schemes. These aren’t the ones consisting of a tidal ‘barrage’, which are usually very large and time consuming, and extremely expensive, but those tapping tidal streams such as in the Pentland Firth between Scotland and the Orkneys, and in the Bay of Fundy in Canada, and also the ones being considered on both sides of the English Channel. These schemes consist of individual submerged turbines which can be combined into ‘arrays’. While still very expensive compared with off-shore wind power (with which it obviously has some similarities), these are much more dependable and capable of being expanded. With practically no environmental drawbacks, but with scope to reduce costs with scale, these projects are attracting considerable subsidies from governments and other bodies who see it as a key ‘dependable’ part of a renewable energy mix, with far less environmental impact than even off-shore wind farms.

There are other schemes elsewhere, but the UK is considered to have among the largest scope in the world to exploit the tidal power around its coasts. ARL has already in a short time built a portfolio of projects, of which one – the 10-30MW, £75m initially, Sound of Islay scheme – is expected to reach financial close and to start construction by this year end, and to deliver first power to the Scottish Grid in 2017. But ARL’s flagship scheme, of which it owns just under 80%, is the near £1bn, 400MW, Meygen project in the Pentland Firth, of which the £60m 6MW first phase comprising four turbines is being installed this summer, with first power by the end of the year.

These schemes are essentially ‘demonstrations’ – not only of the array but of ARL’s latest and largest turbine the AR1500, and their success (which should be evident or not within the next few years) – and will be critical to Atlantis’s and the sector’s future.

In all, ARL has a pipeline of potential projects now – including in Canada, China, Indonesia, and India – which will eventually generate over 600MW (equivalent to a large conventional power station) but which is only the start of those in which it expects to become involved.

This involvement is characterised by close collaborations with some of the world’s key engineering concerns, keen to tap into what is seen as a significant long-term growth sector, including Siemens, Lockheed Martin, and China’s Dongfang Electric Machinery Co, while funds recently contributed to the two Scottish projects by some key European infrastructure players such as Dutch/Belgian group DEME (deeply involved in large off-shore wind farms in Europe) and Equitix (managing £1.7bn of UK infrastructure) are adding to the credibility of ARL’s still young business.

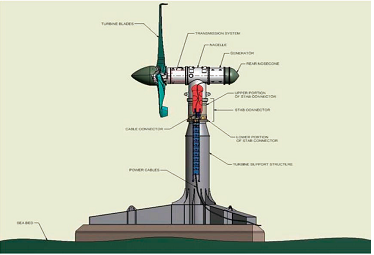

The figure shows a typical single 1.5MW turbine – the most advanced of the four types manufactured by ARL – and destined (with three others by long established Andritz Hydro) for Meygen.

(For scale, the blade tips reach to 75ft above the sea floor; the turbine generates the equivalent of 2,000 HP from a tidal stream flowing at 5-10m/sec and would power about 750 homes; while 25 such turbines would generate the power to propel a 7,000 tonne Type 45 destroyer at more than 30 knots.)

The company started as a developer of tidal water turbines in the 1990’s in Singapore, and in 2007, after it had become only the second company world-wide to connect its first 100kw turbine to the Australian grid, attracted investment by Morgan Stanley’s Renewables arm (still the major shareholder with 42%), who later, in 2008, injected its marine power business, Current Resources Ltd. Atlantis developed from there, attracting more industry investors including Norway’s long established hydro-power group Statkraft, who had been examining the MeyGen project. It installed its first 1MW turbine at the European Marine Energy test centre in Scotland in 2010; and in the same year it won the rights from the Crown Estate’s first marine energy leasing round to develop the UK’s largest project, Meygen, at the Pentland Firth between mainland Scotland and the Orkneys.

After gaining more development and research contracts – including one from China’s Energy Conservation and Protection Group to trial Atlantis’s 1MW turbine for the Daishan tidal demonstration project offshore Shanghai (and possibly later to use its turbines, manufactured by Dongfang, for The Three Gorges scheme) and in 2013 with Lockheed Martin to help develop its latest AR1500 turbine – Atlantis listed on AIM as about the only company purely exposed to the industry outside large conglomerates such as Kawasaki, Siemens, Alstom, Andritz-Hydro, and DCNS in France.

There are now three strands to its business, these being the development and manufacture of turbines, which has yet to develop steady external sales beyond a few initial contracts, but is expected to continue to increase sales and has a toehold with numbers of other hydro companies; the planning and project management of tidal schemes; and consultancy work.

Forecasting how ARL’s diverse businesses will contribute to reported profits in the medium term is difficult and probably irrelevant to how investors will view it. The turbine business is the only one where straightforward profits (if any) will flow from the increasing, but lumpy, deliveries to its own and external projects. But forecasting how profits and costs will flow as ARL’s larger projects progress through construction, via completion profits or losses, and before revenues start to flow from electricity sales, is almost impossible for outsiders to do. While keeping their eyes on the build-up of value in the balance sheet, investors will concentrate on corporate cash flows to judge whether they, or more likely others, will be called on for more funding.

For the very long term, in its initiating report in 2014 the then company broker estimated that Meygen’s (then 100% owned) NPV12 value to ARL’s shareholders after all funding costs for the whole Meygen project, if held for its 25 year life, would be some ten times the present 62p share price – or, if measured at the point in about 2020 when only the first phase had been built, about three times. That depended on assumptions (e.g. the new CfD power pricing regime and on problem-free development) so is obviously speculative.

The latest report from a new company broker places a value on ARL’s existing projects at their current stage of development of around £100m, based on the prices paid by recent new participants for their shares in ARL’s Scottish tidal power subsidiary. That does not include ARL’s other projects still in their infancy, nor the turbine manufacturing side which will only start delivering in size from next year on. Meanwhile, the broker suggests a current value for the latter above £60m, based on take-over deals for similar companies (illustrating that the majors already mentioned are still building their interests in the sector) which, added to the power projects, underpins their ‘target’ for the shares of 140p. In the medium term, it suggests a value for the shares of 260p once the first 100MW of the 400MW Meygen scheme is complete.

While tentative, that and the earlier long-term broker valuation show the long term potential for ARL should all go well. ‘Should all go well’ is obviously the key. (The list of risk factors in the 2014 prospectus runs to 17 pages!)

However, separate from Meygen, ARL has to support its other activities and projects so will need to raise other funds which will dilute these valuation figures unless – as they undoubtedly will be – devoted to equally profitable fresh projects or unless raised from new partners via ‘farming in’. In this way ALR has already sold off just over 20% of Meygen to Scottish Power Renewables in exchange for its 10MW Sound of Islay project and the 100MW Duncansby Head projects, and to Dutch-Belgian offshore engineering group DEME for £2m cash and the intention to develop a working partnership.

Following its first year as a listed company, during which time there was little news to counter small share sales by legacy investors, the shares have come under greater demand as these recent deals have shown how ARL is continuing to strengthen its position. In 2015 it linked with Macquarie Capital to help attract more long-term, strategic investors into its expanding Scottish portfolio of projects, now numbering four in addition to Meygen, bringing potential generating capacity offshore Scotland alone to over 650MW.

And in the last month has come the deal with DEME, who already has a stake in offshore wind farms, with its intention to take stakes in other ARL projects, while infrastructure fund management group Equitix has signed an agreement by which it will fund at least 25% of the equity at financial close in each new Atlantis project.

A further boost came from the announcement in only the last week of a MOU with international power project developer SBS to develop a $750m, 150MW tidal project in Indonesia, bringing ARL’s pipeline to over 700MW.

In advance of results for the year to December 2015 promised by the end of May, ALR has also just raised £6.5m at 55p (expanding shares in issue by about 10%) and the annual results will no doubt be scrutinised for signs that it may or may not need to raise more, as well as signs that the Meygen project is on track to deliver first power to the grid during 2016 in line with expectations. In view of all this current activity investors should obviously make up their own minds as to timing any investment.

Comments (0)