Turkexit Is Now a Reality

If I were President Erdogan, I wouldn’t congratulate myself too precipitously upon the failed coup attempt. While his government survived the weekend’s military coup, his country’s future may have been compromised, as Turkey has just exploded the bridge that was guiding Turkey into the bosom of the developed world. This represents the regression of a decades-long goal for Turkey. Given the movements observed during the last few days, it seems like Erdogan was anxiously waiting for such an opportunity to proceed with massive changes to the structure of the military and civil service and to turn the country into a Putin-style society. But such moves come at a cost: Turkexit is now a reality. After decades of negotiations aimed at opening the EU door to Turkey, Erdogan has just found the exit without ever entering.

Last Friday, the military invaded the streets of Ankara and Istanbul in a failed attempt to replace President Erdogan. Within hours, Erdogan’s government managed to contain the plot. Even though 230 people died during the coup, it was not particularly violent, because it lasted just a few hours. But 6,000 people were arrested and another 35,000 soldiers, police officers, judges and civil servants were detained or suspended in less than 48 hours. There’s no intelligence agency in the world capable of making such a complete list in years, let alone a few hours. The European Commissioner responsible for enlargement, Johannes Hahn, publicly condemned Erdogan’s moves, claiming that lists of arrested judges seemed to have been pre-prepared. Nothing seems to be able to stop President Erdogan, who has fully embraced the opportunity presented by the failed coup to proceed with major alterations in Turkish society and to turn the country into a much more authoritarian one, in a clear divergence from the culture within the EU. President Erdogan even mentioned the possibility of restoring the death penalty, which was abolished in 2004.

What all this means for investors

The Central Bank of Turkey (CBT) has just cut the overnight lending rate, by 25bps to 8.75%, for the fifth consecutive month. At the same time, regarding the unrest created by the coup, the central bank has promised to provide unlimited liquidity, as necessary, to keep lending at healthy levels. At the same time, the deputy minister Mehmet Simsek earlier promised the CBT would not intervene in the foreign exchange markets, and instead allow the Turkish lira to adjust to market prices.

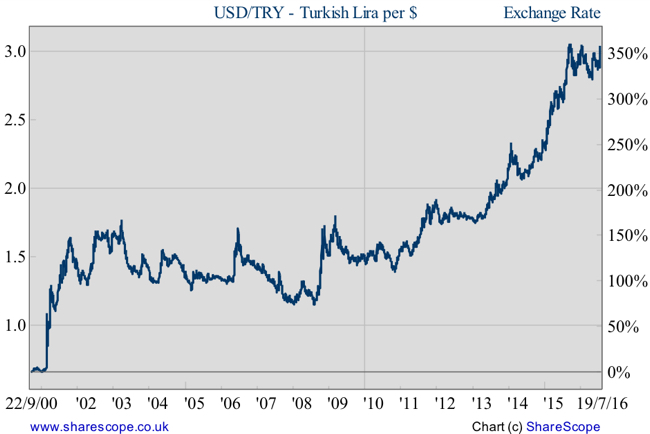

As soon as tanks were seen in the streets of Istanbul and Ankara last Friday, the lira started falling. Before the coup, 1 US dollar was worth around 2.8920 Turkish liras, before rising to 3.0500. Investors started exchanging the lira for foreign currencies out of fear that instability could surge. But as the coup was contained, the lira recovered half of its losses between Sunday and Monday, to trade back at 2.9265 to the dollar. While the recovery is justified by the coup’s failure, investors are now having second thoughts about the future and are again selling lira, which currently trades at 3.0289 to the dollar.

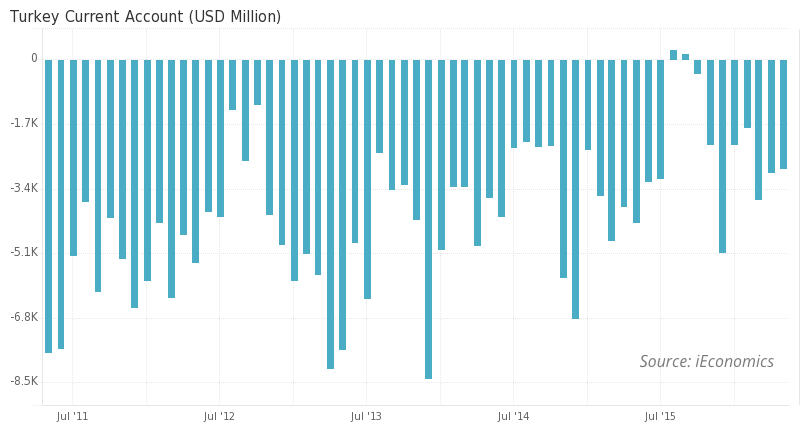

Turkey has benefited from its proximity to the EU and from the expectation it could one day enter the Union, but it is still an emerging economy with severe vulnerabilities. The country runs a huge current account deficit and has relatively low foreign exchange reserves, which make it highly dependent on capital flows. The low yields experienced in most of the developed world, combined with the emerging market opportunity Turkey offers and its pre-EU status, make the country relatively stable and attractive for international investors and allow the current account deficit to be perpetuated.

With the 10-year Turkish government bond yielding 9.66%, no one can really resist the temptation created by the “search for yield” movement. Taking into consideration the fact that Turkey’s government debt represents just 32.9% of GDP, the incentive for investors is huge, as default risk seems low. In fact – and unlike some Eurozone member countries – Turkey has been rated as investment grade by ratings agencies. But episodes like this one serve to remind us about the idiosyncratic risks that are so often associated with emerging markets. Erdogan’s attitude has turned investing in Turkey into a very risky business. The country seems much less politically stable than many may have thought. And in economic terms there were already big risks apparent. Someone exchanging dollars for liras three years ago, to benefit from the high-yielding government debt, would now lose money when exchanging the lira back into dollars, as the dollar has risen 59% against the lira during that time interval.

In my view, Turkey has lost its shine during the last few days – partly because of the coup, partly because of the clampdown conducted by Erdogan. While until now the lira has been holding up relatively well, the fundamentals related to the political, social and economic situation have turned unfavourable. The CBT has been following an easing policy of cutting rates while inflation is above the 5% target. I really doubt the CBT will be able to maintain its trend of cutting rates without accelerating the depreciation of the lira. I believe that the current low yields observed elsewhere are helping Turkey to retain some of its attractions. But as soon as ratings agencies start cutting Turkey’s rating, the EU-Turkey relationship deteriorates, and/or there is any sign the US may raise rates, the lira will stumble. Because of these considerations, I believe that there is a good fundamental reason to keep a long position in USD/TRY through spread betting to avoid the current sterling risk at a time when sterling is experiencing significant volatility.

Comments (0)