The Trumpification of the US Economy

Over the last few months we have witnessed a series of presidential primary elections and caucuses to determine which candidates will represent the Democratic and Republican parties (among others) in the final stages of the US presidential race. The last few months have been not only a time for reflection about economic, political and social conditions, but also a period of hilarious entertainment. The comic aspect is of course provided courtesy of Donald Trump and his cutting edge ideas that involve ending free trade, building a wall to separate the US from Mexico and investing heavily in weaponry to show the world what a big stick the US possesses (in military terms of course).

Comedy descended into farce as the campaign progressed. But, as time went by, more and more Republican candidates withdrew their candidatures, until the point when they left Trump alone in the race. He is now the last man standing in the Republican Party. The controversial populist has turned into the likely final Republican candidate for the US election, which is a risk that investors can no longer ignore as the singular ideas he advocates are deemed as big a threat to the global economy as the jihadist terror. The Trumpification of the global economy is a severe risk that many still seem to be content to ignore. But do you know the odds of a Trump victory? They’re much bigger than many believe and exponentially higher than they were six months ago. With still another six months to go until the Election Day in November, investors must carefully monitor the progress of the campaign, as Trump promises severe changes to the US economy. Portfolios must be prepared accordingly.

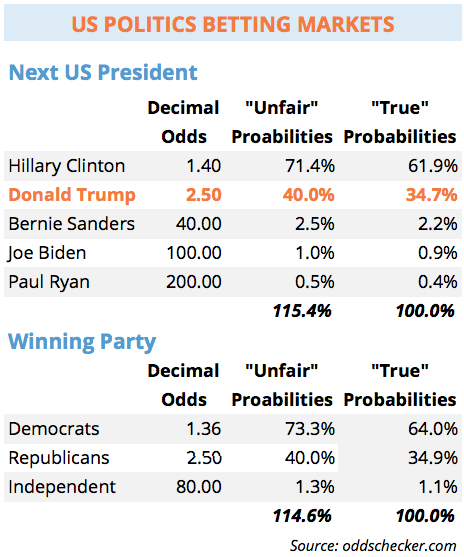

As I explained in February (in the context of Brexit), I don’t tend to use polls to evaluate anything because their predictive value is limited. Of much higher value are the betting odds offered by bookmakers and exchanges. Only when there is money (or another valuable resource) involved does the tool become valuable and predictive. You know what they say: “put your money where your mouth is”. By this token, the best ‘bet’ is to look at the odds offered by bookmakers.

The odds on offer imply a 35% probability of Donald Trump becoming the next US President. That’s too big to be ignored, in particular because Trump promises economic isolationism, which would imply a complete reorganisation of global trade flows and change the pricing path of many asset classes. There is thus a 35% chance of the US experiencing a reversion of a free trade process that was started after the Second World War and perpetuated until today. While there is still a 65% chance of that not happening, it is time for investors to look at the possible implications for their portfolios.

While a battle between Democrats and Republicans always means two potential different outcomes for the US economy, the specific battle of this year is between free trade and protectionism. At a time when there is global dissatisfaction with free markets – much due to failed government policies, prolonged and failed central bank action, and slack economic growth – the rise of populism has been huge. Factor in the latest terrorism episodes into the equation and you have a full explanation of why someone promising a full break with the achievements of the past can become so popular. Global discontentment still has another six months to build, which could very well push the odds for a Trump win even higher, in particular if Japan and Europe continue to push rates into negative territory, the dollar continues to decline, the job market exhibits further signs of weakness, and GDP growth stagnates in the US. That is a real possibility.

If the long odds do materialise, then we will most likely observe: (1) the end of birthright citizenship; (2) the building of a permanent border wall with Mexico; (3) a cut in corporate taxes from 35% to 15%; (4) the abolition of inheritance tax; (5) the rise of hostility towards China and free trade in general; (6) an aggressive retaliation against countries that are “killing us on trade” like China, Japan, Mexico and South Korea; (7) the introduction of punitive tariffs on countries that take “unfair” advantage of free trade (as high as 35% to 45%); (8) the growth of infrastructure investment to boost the economy and improve roads, bridges and buildings across the country; (9) the boosting of companies focused on the internal market; (10) an increase in the defence budget; and many other measures that result in growing protectionism and isolationism.

The effects of all this may be really severe. I’m thinking for example about the effects any protectionism and hostility towards China may have on the biggest US conglomerates and companies that heavily depend on external markets, either to sell their products or to purchase their inputs. Apple, for example would see its iPhone sales prospects trashed, as China would certainly cut the company’s prospects short from the very beginning. But Apple is just one of thousands of companies that depend on China and external markets. Almost all tech companies have production units in China. If they lose access to this market while European companies retain it, US companies would also lose competitiveness. The US consumer will need to pay more for the same, if the same is still available.

But while Trump plans to disregard the global economy, he wants to boost the US economy by adding $1 trillion per year to the budget deficit. If that happens (and taking into consideration the IMF projections), by 2020 the US would hold a gross national debt above $27 trillion, which would surpass 100% of the country’s GDP. That would certainly boost many construction and defence companies but would also press the yields on Treasuries higher. The risks involved in US government debt issues may rise and it would then become ever costlier for the government to issue new debt. Besides which, we shouldn’t forget an important effect on demand. With so much agression originating in the US, why would the world buy US Treasuries? External demand would vanish and help to boost yields (depress prices). With this in mind, I would certainly think twice before adding a 10-year Treasury to my portfolio at a current yield of 1.79%. It would seem wiser simply to sell the dollar and purchase gold. In fact, gold seems to be the only currency in a world gripped by pestiferous currency wars.

While the Trumpification of the economy should in general weigh negatively on Wall Street, there are some stocks that may benefit from it. With the government budget being expanded to increase defence and infrastructure expenses, one should expect that companies directly involved in those areas may benefit. In the defence sector we have Lockheed Martin (NYSE:LMT), Raytheon (NYSE:RTN), Boeing (NYSE:BA) and Northrop Grumman (NOC). With the exception of Boeing, all the others seem a little overvalued right now, but if Trump wins, their revenues would increase significantly, making them look cheap again. We could add Smith & Wesson (NASDAQ:SWHC) here, as Trump supports the notion of “one American, one gun”. In terms of infrastructure, for those who believe in Trump’s comments about improving the country’s infrastructure, a good bet would be to purchase a specialty ETF like SPDR S&P Global Infrastructure (GII) or iShares Global Infrastructure ETF (IGF).

Finally, and because of the huge bet on the internal market Trump is going to make, investors may focus on smaller companies that don’t rely as much on external markets. Purchasing the iShares Russel 2000 ETF (IWM) or the iShares Core S&P 500 Small-Cap (ISR) may well do the trick.

In summary, while a Democrat win is still more likely, we should not ignore the possibility of a Trump win, which is rising and is already significant. If that were to take place, the final effects on the global economy would be wide-ranging. In the US, markets would likely suffer on the whole, but defence, infrastructure and small-cap stocks would probably stand out from the crowd to benefit from a revamp of the internal economy, while bigger companies with strong external relations may find tough days ahead. Meanwhile, the lax position on government finances would put pressure on the US dollar and Treasuries, and interest rates could start rising faster than expected.

Comments (0)