Betting on the Brexit

Do you want to know the true probability of Brexit happening? Then forget about political polls and look at predictive markets instead. The odds offered at betting exchanges and bookmakers provide more accurate forecasts of future outcomes than polls can ever command. While the Brexit vote is now a tough call at newspaper and other media outlets, the “leave” option is a long shot on betting markets with decimal odds of around 3.00 and a probability of occurring of just 33 percent.

Should I stay or should I go?

With David Cameron now set to start a campaign in support of “Remain”, while half of his party will likely oppose him and support the “leave” campaign, we are assured of four months of intense debate on several sensitive matters, such as the economy, security and immigration. With at least 20 percent of British voters still undecided and four months left until the final decision day, these may be the longest four months ever and bring with them a lot of volatility to financial markets. We have already felt it, as the pound is near a seven-year low. Personally, I’ve found myself cursing in front of my notebook whenever I’ve had to exchange pounds for the euro, as 10 percent of the Sterling value is lost in translation (if Dec 2015 is taken as reference). With polls promising a fierce struggle, the wild ride on the pound may quickly turn into a bloodbath.

With so much still to decide, investors seem disturbed. If there’s something financial markets don’t like, it’s uncertainty, and there’s already too much of it regarding the referendum. If there is uncertainty about the final outcome of the referendum, there is also a clear split on whether a Brexit may be good or bad for the UK. Just look at Master Investor, for example. If you have been following us lately, you will have noticed that we couldn’t agree on the best outcome.

Jim Mellon believes that “without the net transfers of wealth that we [the UK] make to the EU on an annual basis, without the red tape that comes with being a member, and without the inevitable compression of wages that occurs because we must take in all comers, the UK would grow even faster”. Jim rightfully believes the European project is failing and that a future breakup is inevitable. He argues that the UK would be better off leaving now rather than waiting for that final collapse. Victor Hill sets himself as agnostic on Europe, even though he often asserts that Britain could be better off in the long run by leaving. Being a naive, long-term believer in the European construction, who thinks the UK could dispute leadership with France and Germany and help build the most important economic bloc on earth, I sit at the opposite corner.

The Brexit is a really sensitive matter with complex implications that extend beyond the foreseeable future, which turn it into one of the tougher decisions ever made. There is no agreement at Master Investor, within the UK government, among economists, within British companies, or among the Great British public. Until the last minute we will be in doubt and markets are expected to react accordingly, which means to gravitate between ventricular fibrillation and bradycardia. Investors will become nervous and will drive the market up and down, testing support and resistance while they wait to know the future of the UK, as was very well put by Adrian Kempton-Cumber. Trend following strategies would most likely fail while the market tends to mean-revert everything.

Doing something

But in the meantime, investors can do something to know more about the potential Brexit outcome, to bet on that outcome and to eventually protect against that particular outcome. The way to do it is by using betting markets, which are said to clearly outperform any other means of gauging the public will in terms of politics and similar matters. Fortunately (or unfortunately), there is always a market for everything, in particular in the UK, where taking a punt is part of the British culture. Almost all main bookies now offer a few markets on the Brexit outcome. For example, William Hill, not only offers a market on the Brexit; they even split the options to reflect the will of the English, the Welsh, and the Scottish. Currently William Hill believes that the Scottish are the most likely to vote in favour of a “stay”, as they offer a paltry 1.08 odds on that outcome.

My affinity for betting markets is not only down to the fact that I believe they offer a good way to bet or speculate on the final Brexit outcome, but more importantly, because recent research shows that the predictive ability of these markets far exceeds the value of polls. A recent study (2015) conducted by Leighton Vaughan Williams and J. James Reade, published at the Journal of Forecasting, shows evidence supporting that view. Polls are less biased but much less precise than bookmakers and betting exchanges are. In particular, when the election (or the referendum) approaches its final day, the dominance of betting markets is supreme. This all means that a Master Investor would most likely disregard polls and follow the Betfair website to gauge the current trend instead.

Why is all this important?

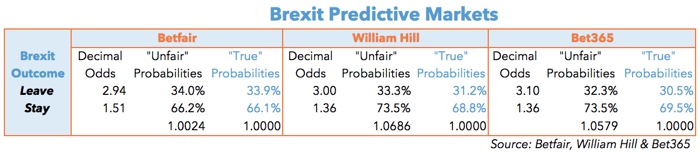

All this wouldn’t be important were it not for the current abysmal difference between the probabilities reflected in polls and those reflected in bookmaker odds. A recent poll of polls published by the newspaper The Telegraph shows “stay-leave” probabilities around 54%:46%. Keeping in mind that 20% of the voters are still undecided, these results reflect a tough call on the final outcome. But the same is not reflected in betting markets. The following table summarises a few odds taken from Betfair, William Hill and Bet365:

The odds on offer for a “stay” outcome are lower than 1.50, while the odds for the “leave” option are as high as 3.00. When these odds are converted into true probabilities, we come up with “stay-leave” probabilities around (34%:66%). That is a huge difference to the probabilities reflected in polls! *

Who to believe?

While the study conducted by Williams & Reade (2015) provides empirical support in favour of betting markets, we could also attempt to provide some theoretical rationale to justify the superiority of betting markets over polls. A bookmaker is not exactly a market but rather a single entity. But due to huge competition between bookmakers and betting exchanges, these are pressed by market forces. The odds they offer are pressed towards efficiency, otherwise arbitrageurs would push them out of business. If at some point a bookmaker offers too generous odds on a certain outcome, market participants (including other bookmakers), would jump in and bet on that particular outcome, which would press odds down. Faced with the high volume, a rational bookmaker needs to cut those odds, otherwise it would risk a huge loss. Odds across bookmakers converge due to arbitrage forces.

In liquid markets such as these, the odds reflect the average opinion of a large number of people that have put their money where their mouth is. Contrasting with this is a poll, where surveyed people don’t have any incentive to give the right answer as they don’t stand to lose anything. It’s like playing for fun. This may be the reason why Williams & Reade found that polls have lower predictive power than bookmakers. For all those serious about Brexit, betting markets is the way to go while polls can give some amusement.

* When true odds are involved, the inverse of decimal odds is equal to probabilities. The sum of all probabilities involved in a single event should amount to 1.00 (100%). In the case of betting exchanges like Betfair, that is “usually” the case. As you may have noticed, the “unfair” probabilities calculated in the table above for Betfair are near 1. But that is not the case for bookmakers, as they stand to profit. The “unfair” probabilities for William Hill amount to 1.0686. The excess 0.0686, or 6.86% is the bookmakers’ profit, known as over-round. To compute “true” probabilities, I redistribute this excess proportionally.

Comments (0)