It’s time for the ECB to turn hawkish

The tone used by the US Federal Reserve to express its attitude towards monetary policy has changed significantly since last December. With the US economy operating near full employment, the emergency stance that guided Ben Bernanke into unchartered territory has now been completely replaced by a more hawkish stance, where the doom and gloom has given way to a brighter outlook.

Janet Yellen has had to wait one whole year to hike rates for a second time; but policy normalisation now seems more plausible, and there is a good chance the path of rate hikes could be steeper than first thought. But while there is a major change in monetary policy in the US, there is a permanent sense of emergency in Europe.

While Ben Bernanke announced the end of QE in 2013, the ECB keeps sticking to a near-zero interest rate policy embellished with an €80 billion/month asset purchase programme to prop-up the Eurozone economy. While Janet Yellen will likely hike the upper limit for the FED funds rate to 1.0% at the Fed’s 15 March meeting, the ECB will likely keep its repo rate at 0.00% while keeping the pace of asset purchases unchanged.

The divergence in policy is expected to increase; but for such a divergence to remain, there should also exist a divergence in terms of economic fundamentals. While it’s true that Europe has been sailing through choppy waters, it is also true that Trump’s leadership has done little for the US economy so far and his promises may fall way short of expectations. The US is leading but Europe will fill the gap. Monetary policy will have to converge because the latest data no longer support the ECB’s current stance.

From deflation to inflation

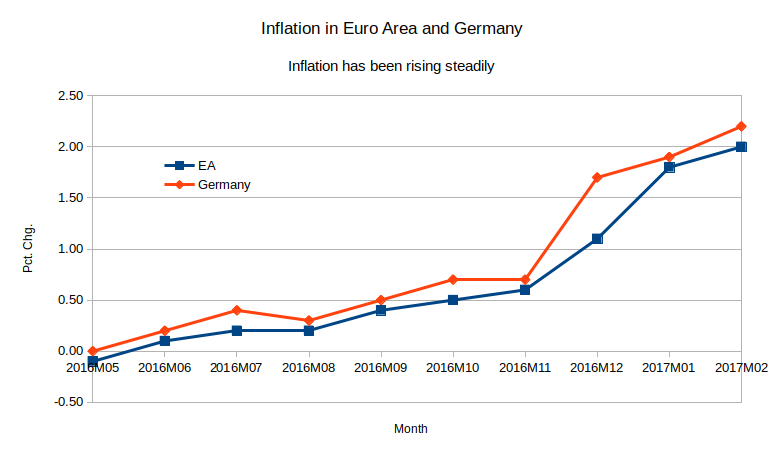

A few days ago, Eurostat published inflation data for the Eurozone where the headline figure came in at 2.0%, which is exactly at the upper limit established as a goal for the central bank.

The main objective attached to the ECB is to maintain price stability, which is defined as “a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%.” Thus, “the ECB aims at inflation rates of below, but close to, 2% over the medium term”. In a strict sense, when the HICP points to 2.0%, the ECB is already operating outside its mandate. But, since the beginning of the monetary union, a broader view has been applied to the inflation goal and policy officials tend to disregard short-term changes in inflation to instead focus on medium to long-term trends, looking at alternative core inflation measures as a way of discerning future movements in the headline figure.

Monetary policy will have to converge because the latest data no longer support the ECB’s current stance.

While the mandate of the ECB places price stability at the top of its goals, the central bank also aims to “support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union”, which include “full employment” and “balanced economic growth”. These secondary objectives should not compromise price stability, but they introduce some flexibility into the way price stability is pursued, allowing inflation to overshoot the “close to 2%” level during short periods of time. With inflation in the Eurozone last seen at 2% four years ago, I would say the ECB will delay touching interest rates as much as possible, unless inflation continues rising at the pace of the last few months.

While the current inflation figures are far short of alarming, they at least put the deflation scenario in the rear-view mirror, which should be sufficient for the ECB to abandon its current dovish tone. Time will tell how strong the price movement is, but the central bank cannot wait for too long, at the risk of creating further holes in the already fragile monetary union. There is no longer a sense of urgency and it is time for Mario Draghi to adapt his rhetoric to the real world and start tapering the asset purchase programme. It is time to start preparing the market for the need to raise rates and to help banks return to profitability.

Inflation is picking up in Germany

The Eurozone is composed of 19 different economies, which means ECB policy is directed at an average: inflation will be higher in some countries and lower in others. Because deflation is to be avoided at all costs (at least central banks perceive it this way), target inflation has been set near 2%, instead of at zero. But by allowing inflation to rise to 2.0%, the central bank is allowing some countries to live with a higher inflation reading. That shouldn’t be a problem as long as the group living with inflation above 2% doesn’t include Germany. But, according to the latest numbers, inflation is currently at 2.2% in Germany, which will turn into a big headache for Mario Draghi if he insists on keeping his dovish outlook.

Because of the prolonged ECB action, markets are completely rotten. The yield on a 10-year German bond is 0.32%, which corresponds to an epic overvaluation of the country’s debt, which will lead to massive real-terms losses on German bonds. The only good explanation for this situation to be perpetuated is the fact there is too little German debt outstanding and too many institutions forced to buy it at whatever price it trades. Debt prices aren’t moving in step with inflation numbers, which is helping to create a bubble. I would be a seller of any kind of sovereign European debt while this situation persists.

What Germany wants, Germany gets

Mario Draghi has insisted on retaining a dovish policy stance for some time now. But with the Eurozone economy growing at an annual pace of 1.7% and inflation at 2.0%, it is becoming harder to maintain an intellectual basis for this stance.

I would be a seller of any kind of sovereign European debt while this situation persists.

The ECB previously announced that its asset purchases “are intended to be carried out until the end of 2017 and in any case until the governing council sees a sustained adjustment in the path of inflation that is consistent with its aim of achieving inflation rates below, but close to, 2% over the medium term”.

This means the bank may tweak the programme whenever it wants to, in particular if inflation is at its target. Investors should track the next inflation numbers carefully. If they come in high again, Germany will put more pressure on Draghi to tighten. It will be tough for him to hold out alone. But I still don’t expect any significant change to occur at the next meeting on 9 March. The ECB will need to revise its inflation estimates for the year but that’s all. The ECB is holding out as long as it can. But when the time for change finally arrives, many will be caught off guard. At the current 1.0560 level, the euro seems good value against the dollar. It may prove too early for a long position, but the fundamentals and balance of risk looks favourable.

Comments (0)