This rally has gone too far too fast

The number of new Covid-19 cases is still rising fast but investors are already looking forward and foreseeing a brighter future. Filipe R. Costa doesn’t share their optimism.

The number of new Covid-19 cases is still rising fast but investors are already looking forward and foreseeing a brighter future. I don’t share their enthusiasm, as the latest developments on the pandemic are disturbing. For that reason, I believe the fast market recovery to be more of an opportunity to get out or short sell rather than a confirmation the worst is already behind us.

The latest US employment figures have been pointing towards some kind of recovery. The ADP report revealed last Wednesday showed that private sector companies added 2.37 million jobs in June while the figures for May were surprisingly revised from a loss of 2.76 million to a gain of 3.1 million. The nonfarm payrolls report released on Thursday confirmed the upside momentum in job creation as the US added 4.8 million jobs in June, clearly above the expected 3.7 million, while the unemployment rate fell to 11.1% from a high this year of 13.3%. These data are bringing even more enthusiasm to the markets.

However, even though the latest economic numbers reported seem rosier than one month ago, they reflect an improvement from a very depressed baseline. The current fundamentals are way worse than they were before the pandemic started. At the same time, the numbers concerning unemployment figures are tricky to read. While the unemployment rate stands at 11.1%, companies have cut hours, put workers on furlough, reduced pay and taken other steps to cut costs. This masks the true unemployment rate.

In the EU, the pandemic numbers have already peaked, and lockdowns have been eased with decent success. But in the US the situation is far from stable as the number of new cases is still on the rise, currently sitting above 50,000 per day. The country has recorded 2.8 million cases, a quarter of global cases on record. Lifting lockdowns seems premature and Trump’s reluctance to wear a face mask is possibly the most important explanation for the current setback. So far, the country has been much less effective than Europe in managing the health crisis and the peak is nowhere to be seen yet.

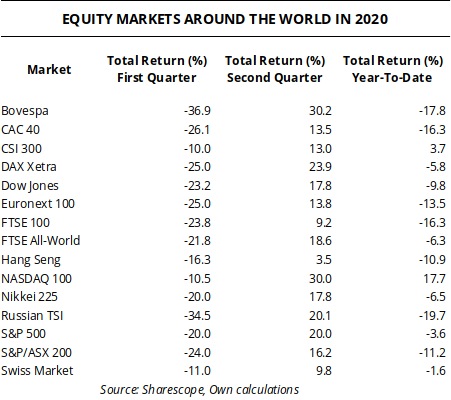

The first quarter of 2020 was ugly for equities. The Dow Jones, Trump’s preferred benchmark, declined 23.2%. Markets declined around the word, with the German DAX down by 25.0%, the French CAC declining 26.1% and the British FTSE 100 retreating by 23.2%. Out of all the benchmarks, it was the tech-heavy Nasdaq that did the best, even though it still lost money for investors. But the second quarter brought a quick recovery, which reversed a good part of the accumulated first-quarter losses. The Dow Jones, the Dax and the FTSE 100 recovered 17.8%, 23.9% and 9.2% respectively. The Nasdaq skyrocketed by 30.0%.

My perspective is that just because lockdowns are coming to an end, it doesn’t mean the Covid-19 crisis will end at the same time. If there’s something about this virus it is its resilience. In continental Europe there is a sense of fear which led to a generalised use of face masks along with the adoption of several preventive measures to contain any sudden spread of the virus. That’s not the case in the US, where the easing of lockdowns is leading to a new spike in infections. Some companies like McDonald’s and Apple have retreated on store openings and others will eventually follow. The next economic reports may be less encouraging. For this reason, I believe the risks are still very high and despite the current optimism, I still see considerable downside for the Dow Jones.

Stating that the numbers of cases is rising fast without quoting numbers and stating where these numbers come from is just a scare story with no evidence.

In any case the number of cases and, more importantly, the number of those who recovered without being included in government statistics, is completely unknown. None of those that I am sure had the virus, or were exposed to it without having any noticeable symptoms, were included in the statistics. We know that of those isolated in cruse ships who tested positive some 83% never had symptoms.

Whilst a lot of the population are still worried, this virus is not going to go away and will almost certainly still be around in 5 -10 years and maybe even longer. Up to now, just over a 1000 people under the age of 65 have died that had no underlying problems, and even more surprisingly just 3 people have died under the age of 15. I can guarantee that more people would have died through accidents at school had they been open . It is unbelievable therefore that teachers and teachers unions are blocking the complete reopening of schools when figures show the vast majority of schoolchildren are safe. By all means protect the vulnerable, but come on..get real and stop being so negative