Switzerland is a testing ground for negative interest rates

The epic experiment with negative rates continues to unfold, as central banks are unable to boost consumer inflation with the current level of asset purchases. The Swiss National Bank (SNB) is already all negative in terms of its key interest rates, but is preparing further action. Strong side effects may occur.

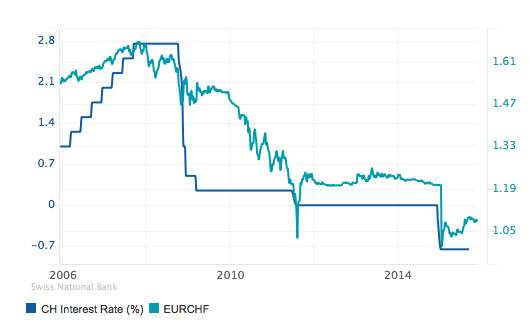

It was almost one year ago when the SNB had to introduce negative rates to prevent the hot money flows coming from the Eurozone seeking the safety of the franc. With the ECB cutting its key rates and Draghi promising in December 2014 to roll out a QE package early in 2015, the inflow of money to Switzerland was high, pressing the franc to appreciate against the euro. With a pledge to keep its ceiling for the euro/franc pair at 1.20, the central bank had no other option than to accumulate euros while providing the heavily demanded franc. The three-year ceiling was threatened, leaving no other option than to fight currency appreciation with negative rates. While the ECB was just massaging its deposit rate from -0.10pc to -0.20pc, the SNB fearlessly cut its deposit rate from 0.00pc to -0.75pc in a single shot. That was the first serious challenge to the zero lower bound predicament, which claims that central banks cannot cut key rates below zero because depositors would withdraw all their money and the economy would become cash-based, undermining and limiting future central bank action. In the US the FED has always excluded a negative rate scenario and in the UK the BoE didn’t want to risk anything lower than a positive 0.50pc rate.

While it may be difficult to determine the exact negative number at which deposit money is turned into mattress money, the negative rates should at least deter inflows of money. But that was not the case in Switzerland, as money continued to flow into the country, pressing the franc higher.

In mid January the SNB gave up on the euro peg, suddenly scrapping the ceiling and allowing the franc to appreciate against the euro. In a few hours the euro sharply declined against the franc from 1.20 to 0.86. The SNB introduced the ceiling to protect the national economy against the unfavourable global economic conditions and external monetary policy conducted by the FED and the ECB. With the US and the Eurozone facing severe economic downturns, and with the FED purchasing trillions in assets, the SNB feared that a flight to safety could lead to an extreme overvaluation of the franc and push the economy towards a severe recession due to a loss of competitiveness. But in January 2015 some of the risks were no longer on the table: the FED had put an end to quantitative easing and the sovereign crisis in Europe was a much milder issue by then. The franc was losing value against the dollar and the SNB thought that the overvaluation against the euro was no longer a primary issue. Removing the ceiling would seem like a natural step. This, at least, has been the explanation given by the SNB for the removal of the euro/franc ceiling. But, reality departs from such reasoning. The removal of the peg caught everyone off guard, as it came in suddenly, as a surprise. The move generated chaos among several financial institutions and almost put FXCM into bankruptcy. The SNB abandoned the peg just one week before the ECB provided the details of its QE programme. The SNB move seems more like a desperate attempt at anticipating the difficulties rather than a natural consequence of something.

With interest rates at -0.75pc and legislation on bank capital requirements being tight, bank margins were expected to erode. Soon after the negative deposit rate was announced by the SNB, major banks like UBS and Credit Suisse announced they would pass it on to their larger institutional clients. Such a step is not a surprise because there was no risk of losing these clients. For large clients, money needs to be readily available and then either deposited in a bank account or held in short-term riskless debt instruments. With yields on Swiss government debt also negative, there was not much choice available. But if these rates remain at negative levels, banks will be confronted with difficulties, as they would never be able to pass them on completely to clients.

Bank ABS (Alternative Bank Schweiz) has just sent a letter to individual clients informing them the bank will start charging on deposited money from the beginning of 2016. Current accounts will carry an interest rate of -0.125pc and client deposits in excess of 100,000 francs will incur a charge of -0.75pc. This step represents a new level for the negative rates experiment, with ABS being the first bank to charge individual clients a negative interest rate on deposits. The bank justifies the move by an erosion of profits due to the negative rates it incurs on reserves kept at the central bank. This observation adds evidence to the fact that banks have been unable to lend their excess reserves and that cutting interest rates will just add to their existing problems. Banks fear to pass on the rate cut in full to clients’ deposits and they fear incurring too much risk if passing them on completely to clients’ borrowings. When this happens, banks may end up increasing their lending rates to compensate the lost margin and reducing the availability of money for lending purposes. They may additionally prefer to lend to speculative activities that can put down some collateral and pay higher rates. As a consequence, one shouldn’t expect much from consumption and investment and should be wary of asset bubbles.

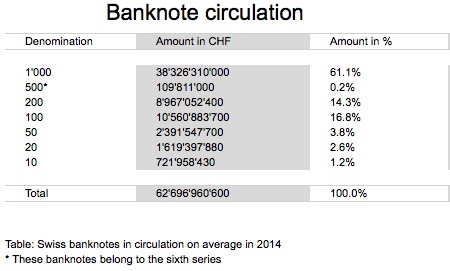

Until now we haven’t seen much side effects from negative rates. Zero is not the lower bound in Switzerland, as the SNB has just proved. Nevertheless, a lower bound exists. It is costly to keep money out of banks, which gives the central bank some margin to set negative rates, but there is a level at which keeping money out of banks is less expensive than keeping it deposited. Is it 1.25%, 3.00%, 5.00%? We just don’t know yet. What we do know is that if that barrier is broken deposited money would just vanish from banks. Alternative systems to keep money safe can arise, including a few solutions provided by banks themselves. If that happens, the central bank would lose control of the money supply and its key rates would be disconnected from the money supply. Monetary policy would by then become sterile. The SNB believes there is still margin for further interest rates cuts, but the risks are growing. In Switzerland, more than 60% of the total amount held as banknotes in circulation is kept in 1,000 denominations. In the Eurozone the corresponding proportion for its highest denomination, the €500 banknote, is just 30%. Those banknotes are certainly not used as a means of payment to process daily transactions. The only reason for the use of these high denominations is for a second function of money: store of value. In a country where there is a tradition of storing value in physical currency it is a risk to set interest rates near storage costs.

Since mid January the SNB was able to effectively manage the euro/franc exchange rate within a tight band. The euro never returned back to the 1.20 level but at least recovered from below 1.00 to the current 1.08 level. With the Fed threatening to increase interest rates, the pressure on the franc has been alleviating, but the path taken by the franc against the euro will crucially depend on the monetary policy decisions taken by the ECB (Dec. 3) and the FED (Dec. 16). In the worst-case scenario, the ECB would increase the pace of asset purchases and cuts to key rates, pushing the main refinancing rate into negative territory. If that happens and if the FED opts to keep rates on hold, the SNB may need to contain the value of its currency by further cutting key rates, eventually decreasing the deposit rate to -1.00pc or -1.25pc.

While the interest rate may be an excellent tool to contain currency appreciation, I am not sure about the positive effects it may have on consumption and investment. If the SNB cuts deposit rates to -1.25pc, Swiss banks will be in trouble, as they will be trapped between a wall and a hard place. Contrary to what theory predicts, under these special conditions the transmission channel wouldn’t work, as banks are likely to decrease lending for investment activities. If that happens, a lower interest rate would in fact mean a more restrictive monetary policy with a negative impact on consumption and investment. In the end, the Swiss economy may finally enter the recession it just marginally avoided this year and accelerate its deflation process. Monetary policy, as it is used today, is not a way out, but rather an instrument to perpetuate low growth and create asset bubbles. The ECB is creating a lot of trouble, as it attempts to counter-balance austerity. A new balance of power must be found in Europe; one in which the role of monetary policy is severely reduced; and one in which fiscal restraint is more severely applied during upturns, not downturns. In the meantime, let the ECB use Switzerland as a testing ground. If something fails there, the ECB would still have time to retreat.

Comments (0)