Signs of life in the eurozone

Last Thursday, the ECB decided to keep its monetary policy unchanged, as widely expected, and delay a significant change in its stance until the next meeting, as the political situation in France is still sensitive. While experiencing some volatility during the meeting, the euro is currently trading at almost the same level as it was pre-meeting, marking out the meeting as a non-event.

Nevertheless, the meeting gave clues not only about the future path to be followed by the ECB but also on the performance of the European economy, in particular the eurozone. For now, the eurozone will live with a refinancing rate of 0%, a deposit rate of -0.40%, and a pace of monthly asset purchases of €60 billion.

Asymmetric risks

While the ECB’s decision was widely expected at this point, investors were mainly waiting for clues to be given in the introductory statement made by Mario Draghi and the Q&A session that follows.

One of the most important points investors were looking at was the language used to describe risks. The ECB has been using some pessimistic wording regarding its view on eurozone growth, stating that risks are tilted to the downside. But, with the most recent economic data showing clear signs of improvement, such language seemed inadequate, and thus investors were looking for a change to a more neutral view which could open the door to near future changes in monetary policy, in particular a tapering of asset purchases before December. That didn’t happen. While the ECB changed its statement to reflect the more positive incoming data, it still kept the previous language, as Draghi seemed concerned about the impact an upgrade of the ECB’s view could have on expectations, and that way undermine the Bank’s efforts to keep long-term yields low. The introductory statement prepares us for a future change but without changing much now:

“The risks surrounding the euro area growth outlook, while moving towards a more balanced configuration, are still tilted to the downside and relate predominantly to global factors.”

Basically, the adopted tone is the result of having a heterogeneous board at the central bank, one where the hawks from Germany are fighting against a dovish Draghi. At the same time it also reveals how cautious central bankers are regarding policy statements. The opacity of the language used by central bankers is such that I remember a comment from Zerohedge on Twitter related to a FOMC statement that very well describes this:

Policy statements together with any press release that follows are a monetary policy tool that’s sometimes as powerful as the official policy rate…

Regarding the rest of the introductory statement and the Q&A session that followed, it is clear that the ECB sees improvement in the eurozone economy, but at the same time it sees several risks in the near term.

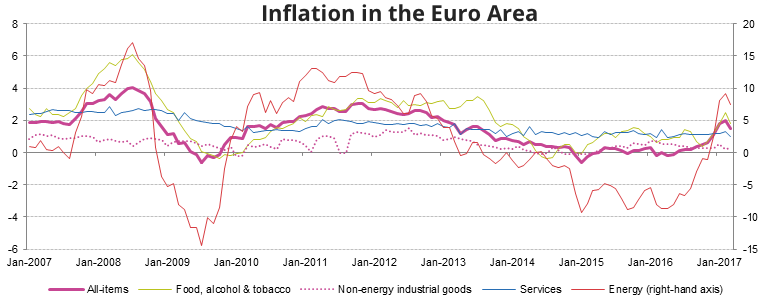

First of all, and while Draghi avoided any mention of politics, the ECB understands the risks that come from European elections (in France and Germany), which could have prevented it from adopting a more direct language regarding the current balance of risks. Nevertheless, when asked about domestic risks, Draghi said he believes they have diminished. Second, the central bank now points to global factors as the main source of risks to stability. While Draghi didn’t elaborate much, this class of risks includes the post-Brexit developments, the unclear policy in the US, emerging-market risks, and of course, the likelihood of rising protectionism (even though it has decreased substantially). Third, Draghi admits prices have been rising and he believes they will rise again next month, but he also expects them to remain subdued thereafter across the year. Rising oil prices have been the main source of general price rises. With oil prices now on the decline again, Draghi eventually fears that price rises may lose strength.

I must admit that I always believed that the ECB would trim asset purchases before the end of this year, but after listening to Draghi several times in the meantime, I am now in doubt. He is concerned with the sustainability of price rises. He will only move after seeing a few months of inflation close to or above the 2.0% target. Without that, he will insist on claiming there is a justification for the ECB easing to continue.

I believe GDP, PMI, Industrial Production, Consumer Confidence and other output related data are very important but not the kind that will make Draghi move. Draghi has pinned himself to the inflation target and he is unlikely to tighten policy before the headline inflation number is at 2.0% or above, no matter how good the economic data is. Tracking what happens to wage growth and oil prices may provide better clues for investors. Oil prices have been declining fast but an OPEC meeting is scheduled for May. I believe they will proceed with output cuts, which may boost oil prices again. If oil prices don’t rise, then the headline inflation numbers will be brought down once again, and asset purchases may be extended to the next year.

Digging into the data

Some summary data for the eurozone:

- Inflation rate stood at 1.5% in March, up from negative values in early 2016;

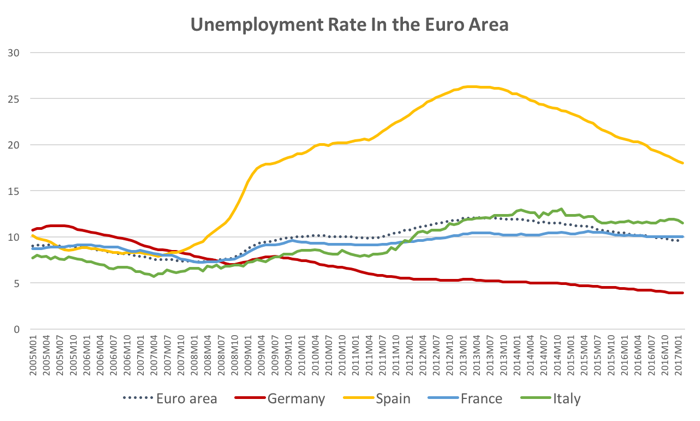

- Unemployment rate is at 9.5%, the lowest level in 8 years (since May 2009);

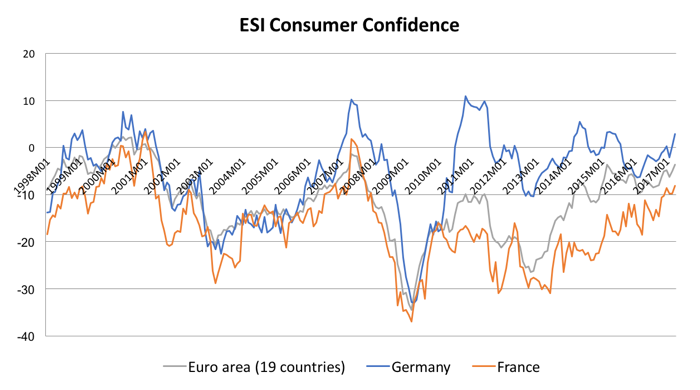

- ESI Consumer Confidence is at -3.6, which is near pre-crisis levels;

- Markit Flash Eurozone Composite Output Index hit a level of 56.7, a 72-month high;

- Markit Flash Eurozone Services PMI Activity Index hit a level of 56.2, a 72-month high;

- Markit Flash Eurozone Manufacturing PMI Output hit a level of 58.0, a 72-month high;

- GDP growth hit 0.5% in Q4 2016, the 15th consecutive quarter of growth.

To paraphrase Mark Twain, “reports of the death of the eurozone have been greatly exaggerated”. The eurozone went through a prolonged period of underperformance during which unemployment rose to unacceptable levels and differences between member-countries became evident. The euro was adopted without making sure all countries were aligned and/or without creating an adjustment mechanism that could compensate for the effect of asymmetric shocks. Conducting policy towards the average only works when the standard deviation of that average is low. When that isn’t the case, such a policy may in fact not be appropriate for any constituent state. This is somewhat the case with the eurozone. The current euro exchange rates are too depressed for Germany but too high for a battered-down Greece.

Notwithstanding this, while problems were exacerbated by the financial crisis, the euro and the eurozone are not dead. In fact, recent data supports a decent recovery. GDP growth is rising slowly, at a very moderate 0.5% pace, but it is in the 15th consecutive quarter of growth. The widely regarded forward looking PMI data for composite output, services and manufacturing has been recording growth from period to period and is currently at a 72-month high. The unemployment rate, despite being the Achilles heel of Europe and highlighting the need for deep structural changes in labour markets, is improving. The unemployment rate is at 9.5%, down from a peak of 12.1% in 2013 and the lowest since May 2009.

The near future

While there are many hurdles to surpass in Europe, there’s no doubt the euro will survive for longer than it appeared one year ago, while the eurozone puts the crisis behind the back. Many political errors have been made, many structural changes need to be accomplished, and growth will take time to return to pre-crisis levels. France is a country in trouble. Unlike Germany, which recovered from the crisis robustly, France is fighting a stubbornly high unemployment rate of 10.0%, which remains above the eurozone average. At this point, some of the peripheral countries like Spain and Portugal are improving faster than France. Nevertheless, it is precisely at these times that opportunities arise. Unlike the US market, which has been rising on the back of optimism – and is therefore prone to disappointment – European markets (with the exception of Germany) have been experiencing much more modest advances. A good example is the CAC 40.

Provided that Emmanuel Macron wins the election (which is a highly likely outcome), the CAC will get a boost. At the same time, as the eurozone is on the path to recovery, the French market offers better value than others. Such a trade may be done through a spread bet on the index, or through an ETF. A few examples of ETFs on the French equity index are: Lyxor CAC 40 DR UCITS ETF (CAC:PARIS:EUR), Amundi CAC 40 UCITS ETF (C40:PAR:EUR), BNP Paribas Easy CAC 40 UCITS ETF (E40:PAR:EUR) and Lyxor CAC 40 DR UCITS ETF GBP (CACX:LSE:GBX). The first three are quoted in euros, while the last one is traded in London and is quoted in sterling.

Comments (0)