Should you consider investing in cryptocurrencies?

Over the last five years, cryptocurrencies have experienced a huge expansion from a $12.2bn market to $1.3tn one. This number is still small when compared with the $36tn capitalisation of the S&P 500, but a hundredfold rise over a period of five years is too big to be ignored.

Bold investors like Cathie Wood and Michael Saylor have fully embraced crypto, seeking the abnormal returns it promises. But the price to pay for this expectation is high, as this market can lose half of its value in a matter of days. According to data from Visual Capitalist and recently published by the WSJ, since 2012, Bitcoin went through 14 sell-offs of more than 30%, six of more than 50% and three of more than 80%. Looking at the other altcoins, the selloffs are even more extreme. Retail investors have been jumping heavily into this market since the start of the pandemic, but many have now been scared away as the price of Bitcoin sank from $63,000 to $32,000 in less than one month.

This kind of price movement is scary but not atypical for an asset deriving its value mainly from sentiment, as there are no tangible assets behind it. Nevertheless, many claim that Bitcoin offers diversification to a portfolio of stocks and that it is the new gold, a real form of money, which offers protection against inflation. All of this raises questions for investors looking for ways to improve portfolio returns.

I collected data for 15 crypto assets, gold and the S&P 500 index and will try to answer four questions:

- Does crypto offer diversification to investors?

- How risky is the crypto market?

- Is Bitcoin a replacement for gold?

- Where are crypto returns positioned in risk-adjusted terms?

1) Does crypto offer diversification to investors?

The crypto market is bigger than many think in terms of the number of assets (tokens) available to invest in. There are a few thousand and the number is growing by night. However, Bitcoin alone represents 46.5% of the total market and the top 10 tokens represent as much as 83% of the market. That’s a very high concentration, which is not seen in the stock market. If you buy Bitcoin (BTC) and Etherum (ETH) you’re taking part in two-thirds of the market. Thus, when thinking about the diversification offered by cryptocurrencies, two new questions arise. First, what’s the correlation between cryptocurrencies and stocks? If we were to diversify away from stocks, we need an asset that is uncorrelated with stocks to some extent, otherwise we are getting more of the same. Second, what’s the correlation between cryptocurrencies? We need to understand if it makes a difference investing in 10 or 20 cryptos or just in Bitcoin and Ethereum.

To keep things simple, I will use weekly returns data for 15 crypto assets: Cardano (ADA), Bitcoin Cash (BCH), Binance Coin (BNB), Bitcoin (BTC), Dash (DASH), EOS (EOS), Ethereum (ETH), Litecoin (LTC), Miota (IOTA), NEO (NEO), Tron (TRX), Stellar (XLM), Aerum (XMR), XRP (XRP) and Zcash (ZEC). I’m dealing with weekly data for two reasons. First, daily data is too volatile. Second, there are differences between crypto and stocks, as the first trade 7 days a week and the second 5 days a week.

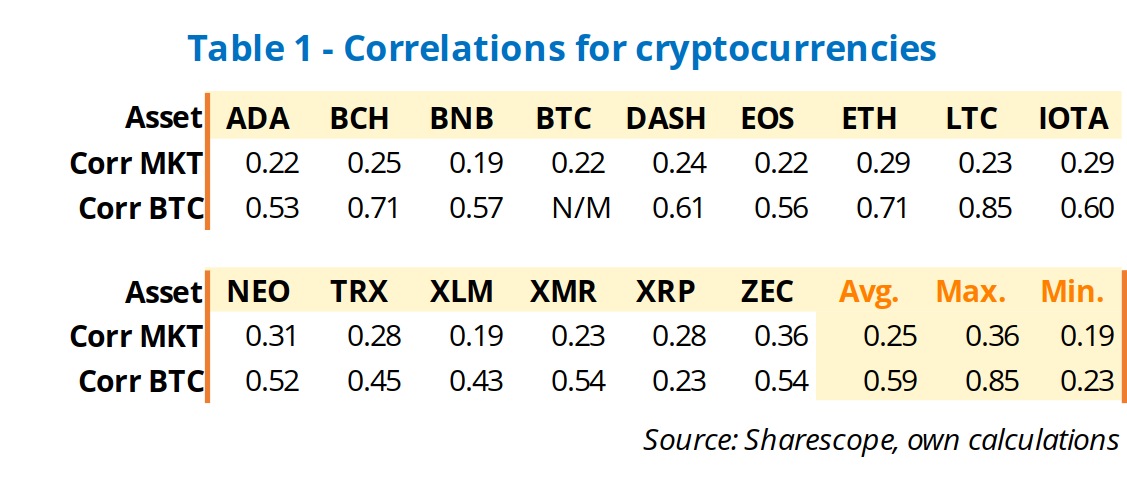

Let’s take a look at Table 1, which shows the correlations between the returns of our 15 crypto assets and the S&P 500 and between the same crypto assets and Bitcoin. While Bitcoin isn’t the crypto market, given its predominance, we may roughly use it as if it were a crypto index like the S&P 500 is for stocks. The correlations between all of the cryptos and the S&P 500 are low, ranging from 0.19 (BNB) and 0.36 (ZEC). Bitcoin shows a correlation with the S&P 500 of just 0.22. These values are low enough to provide huge diversification benefits to investors. However, these correlations are based on data for the last 52 weeks. If we calculate the correlations in rolling windows of 52 weeks, we see that there are significant changes over time.

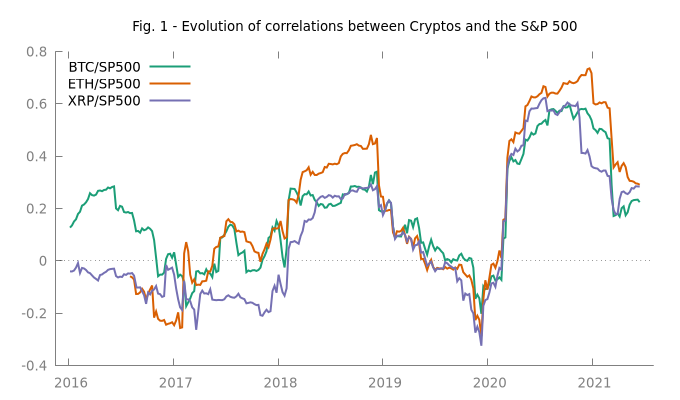

Correlations have been relatively low for most of the time and near zero at some points. During the pandemic they rose but they are now on the decline again. As a side calculation, I confirmed that there is no statistical significance between the change in correlations and market returns. This is important because we don’t want correlations to rise during a stock market downturn, for example. If that was the case, it would mean that, despite correlations being low, they would be high during market downturns and thus amplify market losses instead of diversifying our portfolio. Fortunately, this is not the case and crypto appears to offer good diversification benefits.

Looking again at table 1, but now at the correlations between cryptos and BTC, we see they are higher than for the S&P 500, ranging from 0.23 (XRP) to 0.85 (LTC). These higher correlations are normal within an asset class and still provide diversification benefits. In summary, cryptos provide diversification benefits to investors and it may be worth building a portfolio of cryptos instead of just buying Bitcoin and Ethereum.

2) How risky is the crypto market?

There are two good ways of measuring risk. From the perspective of an investor without a diversified portfolio, the standard deviation is the measure we’re looking for. From the perspective of someone already running a diversified portfolio and thinking of adding a new asset, the best approach is to use beta. Betas measure market risk. A beta above one represents more risk than the broad market while a beta below one offers less risk than the market. But, what’s the market? When we determine betas for US stocks, we may use the S&P 500 or an even broader index like the Wilshire 5000 as a proxy for the market. In the crypto market, we would have to determine such an index. There are a few options, but to keep things simple and because Bitcoin is almost half the market, I will use it here as the market to determine betas. As an alternative measure, I also use the S&P 500 as the market. Let’s take a look at the results.

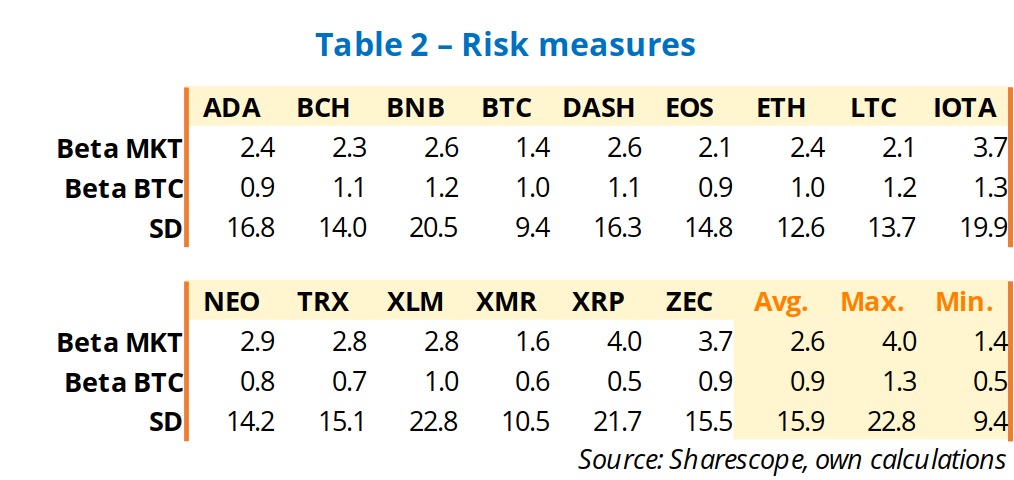

Betas for the cryptocurrencies vary between 0.5 and 1.3, allowing investors to increase or reduce the risk of their portfolios by looking at this number. Betas using the S&P 500 tell an important story though. They vary between 1.4 and 4.0, which means investors are adding a lot more risk to their portfolio when adding a crypto than they incur in the broad stock market. This reality is well reflected in the standard deviations. They vary between 9.4 and 22.8. In the same period, the standard deviation for the S&P 500 and gold were 1.5 and 2.4 respectively, which is way lower. Thus, the crypto market brings diversification and opportunities but comes with high risk.

3) Is Bitcoin a replacement for gold?

One of the greatest myths regarding crypto is its presentation as a replacement for fiat money and even for gold. The key idea is that Bitcoin is not in the hands of a government or any one group or individual and thus cannot be managed. Given its fixed supply, Bitcoin would generate deflation. I could say many things about how Bitcoin is still far from fitting the definition of money. But my goal is just to compare it with gold and understand if it is a replacement for gold, as many say.

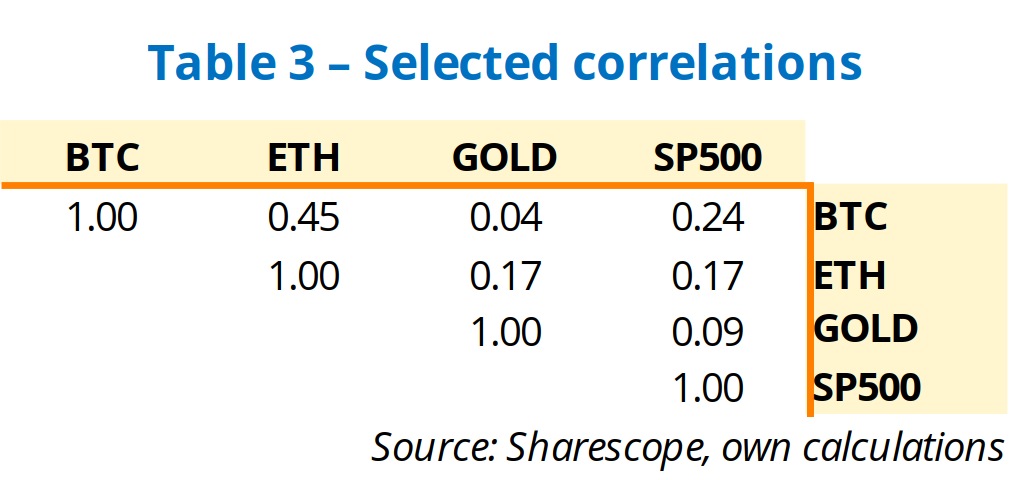

For the period 10/Aug/2015 – 10/Jun/2021, the correlation between gold and the S&P 500 was 0.09. This is a near zero number, which supports the idea that gold may be uncorrelated with stocks. During the same period, the correlation between Bitcoin and the S&P 500 was much larger at 0.24. Fig. 2 shows the evolution of correlations. During 2018, the correlation between gold and the broad market was higher than for Bitcoin, but for the rest of the period gold is less correlated with the market than Bitcoin is. This observation doesn’t support the idea that Bitcoin is the new gold, in particular when we take into consideration the fact that the estimated standard deviation for gold is 2.42 while it is 9.43 for Bitcoin. Money should have low volatility and be uncorrelated with the market. On that front, gold is way better positioned than Bitcoin. Out of curiosity, if we determine a beta for gold using the S&P 500, it comes in at 0.12. That’s a very low value that confirms its low correlation with the broad market.

But then, if Bitcoin isn’t a replacement for gold, what is it? Checking again on table 3 and figure 2, we see that the correlation between Bitcoin and gold is 0.04. Over time, this correlation has been moving between -0.2 and 0.2 with an average value of -0.02. Bitcoin is not a replacement for gold. It’s a complement! With a correlation near zero, these assets offer the maximum diversification benefits an investor can dream of, when combined in a portfolio.

4) Where are crypto returns positioned in risk-adjusted terms?

Now the last question. Crypto offers opportunities in the form of very high expected returns. However, as we have seen, these come with additional risks because the standard deviation of returns is very high for cryptos. From night to day, the whole crypto market may easily lose 10% of its value. But if we adjust the returns with a risk measure like the standard deviation, what happens?

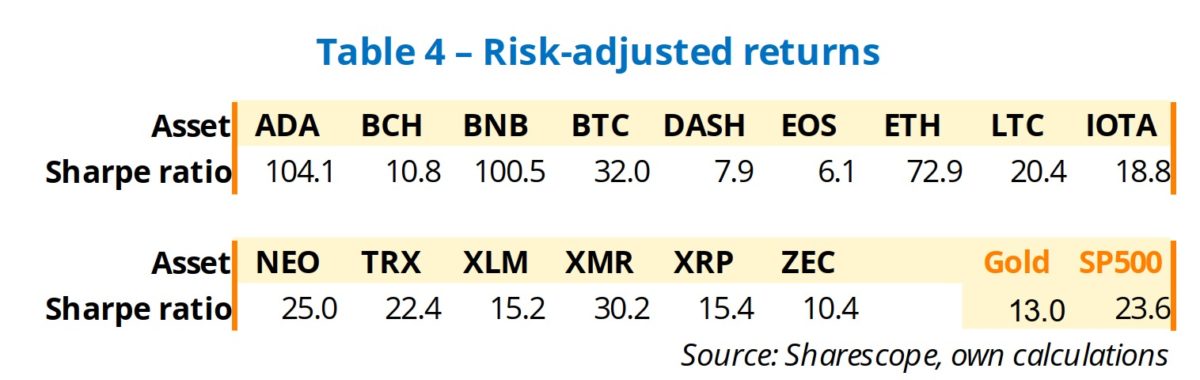

The Sharpe ratio adjusts returns by the standard deviations. If we divide the returns for the last 52 weeks by the standard deviations, we get the data shown on table 4. Higher numbers are better. While the returns for crypto are gigantic, the scenario is less rosy after adjusting them for risk. For example, the Sharpe ratio for BTC is 32.0, which isn’t much higher than the same for the S&P 500. BCH, DASH, EOS, LTC, IOTA, TRX, XLM, XRP and ZEC all show worse risk-adjusted returns than the S&P 500. Thus, not all cryptos are the same and in many instances the risk-adjusted returns aren’t better than those an investor can achieve in the stock market.

Final words

The crypto market offers good opportunities for investors, as it provides good diversification benefits. However, investors must proceed with caution when adding cryptos to an undiversified portfolio, because they come with a lot of risk. In risk-adjusted terms, cryptos seem less attractive than when looking at returns in isolation. Finally, Bitcoin doesn’t look like a replacement for gold but rather a complement, as the two assets seems unrelated and their correlations have been low over time.

Comments (0)