Protecting a Portfolio against Inflation

“It pounds daily on the nerves: the insanity of numbers, the uncertain future… An epidemic of fear and naked need: lines of shoppers, long since a customary sight, once more form in front of shops, first in front of one, then in front of all… The lines always send the same signal: the city, the big stone city, will be shopped empty again. Rice, 80,000 marks a pound yesterday, costs 160,000 marks today, and tomorrow perhaps twice as much. The day after, the man behind the counter will shrug his shoulders: “No more rice!”

– Friedrich Kroner on hyperinflation, August 1923

At a time when inflation is at very low levels, everybody tends to forget about the dozens of historical episodes when prices doubled from one day to another, decimating the purchasing power of a unit of local currency. That happened in the German Weimar Republic in the 1920s, in Mexico during the 1980s, and in Zimbabwe in the 2000s. It may be just about to happen now in Venezuela. When such episodes occur, those owning real assets tend to be better positioned, as inflation, by definition, is a general decrease of the price of money. In such times, the only thing one doesn’t want to own is money and all its equivalents. When I say equivalents, I also mean fixed income. While there’s no reason to believe inflation will get out of hand as it did in the Weimar Republic, there’s a reason to believe it may rise, at least, to fit central banks’ objectives. And if it does, portfolios owning bonds will suffer.

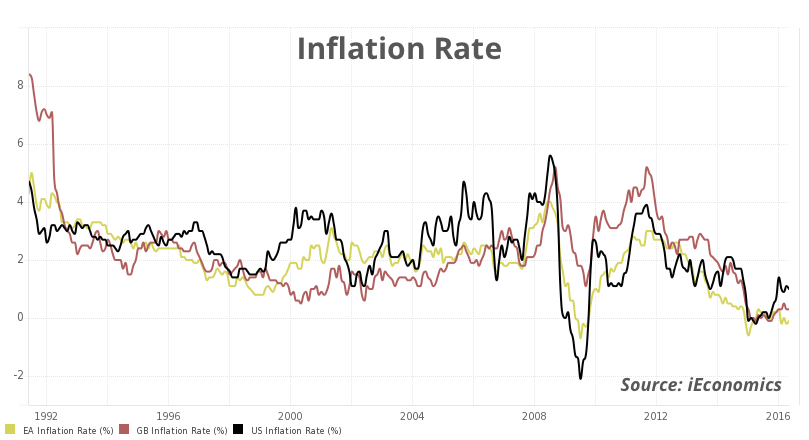

The fight today is not against inflation but against the exact opposite – deflation. Due to the financial crisis felt in the US during 2007-2009 (and extended almost until today in Europe), the majority of the developed world entered a period of recession during which it experienced low growth rates and high unemployment levels. With governments already saddled with high debt levels, instead of trying to boost their respective economies they had to cut spending during a crisis, which had a massive deflationary effect. In the specific case of the Eurozone, the problem is serious, as the ECB seems unable to boost economic activity… not even temporarily! And with regard to inflation, despite the massive asset purchase programme the bank rolled out last year, the latest four inflation readings have not been positive.

When inflation is at very low levels, as it is today, money tends to retain the majority of its purchasing power over time. But just because inflation has been subdued recently, it doesn’t mean it will continue to be so during the coming years. With major central banks across the globe all engaged in extraordinary monetary policy in the form of low (sometimes negative) interest rates and quantitative easing, one should be prepared for the possibility that at some point they could get it right and boost the general price level. As I said before, even if hyperinflation isn’t generated, there’s a risk that they at least achieve their 2% or 2.5% price targets. With inflation having been so low recently and so difficult to boost, there’s even a risk they could overshoot their target levels. At a time when government debt is so high, higher inflation is the best gift these governments could hope for, as it decreases the real value of existing debt. Under this scenario, I wouldn’t be happy owning a portfolio in which inflation is treated as non-existent.

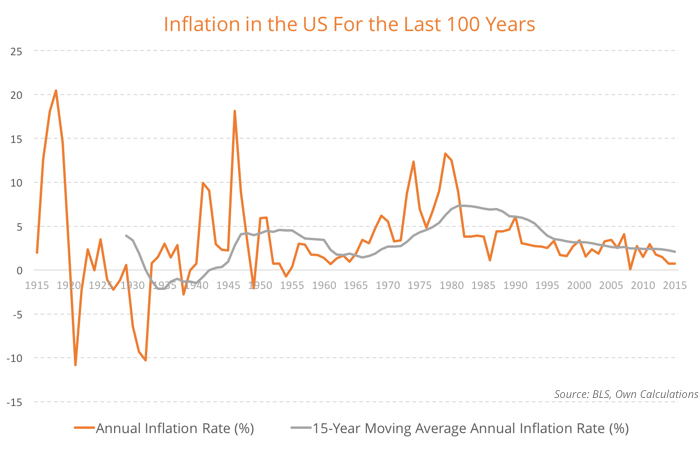

History plays against current inflation expectations. Inflation is like economic growth: it goes through cycles and tends to revert to a long-run average. It is true that average inflation has been decreasing since the 1980s when central banks became more effective in keeping prices under control, but the average has still been positive. In the US, the average annual inflation level between 1914 and 2016 has been 3.3%. The same average for the last 30 years has been 3.2% and for the last 15 years it has been 2.1%. The latest CPI reading points to an inflation level of just 0.73%. It is declining, but will it hold at these levels?

While deflationary episodes sometimes occur they have never lasted for more than three years (1926-1928, 1930-1932). The drift is definitely positive, which means that keeping money under the mattress will make you poorer over time.

After presenting the above data, my central argument is that, at this point, we should expect inflation to revert to its historical levels and not to remain subdued. If inflation accelerates, fixed income will lose you money. The reason is very simple: if you purchase a bond that yields 1.5% when inflation is 0%, you get a real return of 1.5%. But if inflation rises to, let’s say, 1% then your real return declines to 0.5%. Most institutional investors and some retail investors are currently purchasing long-term bonds with maturities of 30-years or more to get a higher yield. With a significant part of sovereign debt yielding negative rates, the solution to overcome the problem has been to purchase longer-dated debt. But as I will show in the next issue of Master Investor Magazine, these longer-dated bonds are much more sensitive to any change in interest rates or inflation. The 5-year and 10-year breakeven rates, which measure inflation expectations, are currently both pointing to 1.43%. These figures are below the 2% target inflation the FED follows. In buying long-term debt with these expectations entrenched, an investor is exposed to severe losses if the FED is able to attain its objectives.

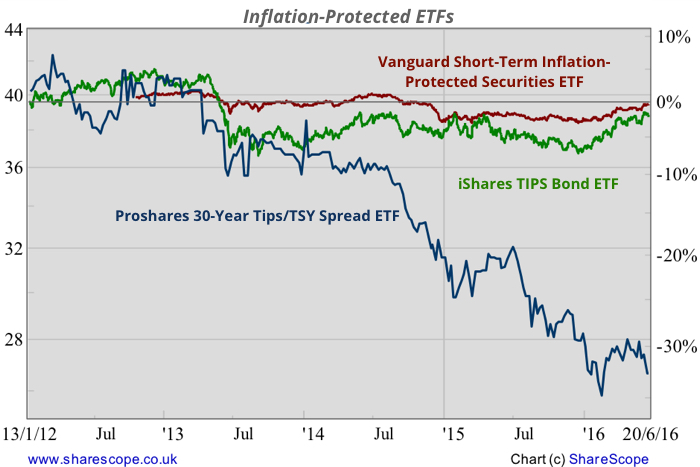

One way of protecting against inflation is to purchase inflation-protected securities like TIPS (Treasury Inflation Protected Securities). These will adjust face value when paying coupons in order to retain the purchasing power of an investor. There are several alternatives. TIPS may be purchased directly from the US Treasury for a minimum of $1,000. An alternative way is to purchase a TIPS ETF like the iShares TIPS Bond ETF (TIP) or the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP). The first has a higher average duration than the second and then is also more exposed to interest rate rises.

The main problem with TIPS is that, while they generally perform better than the nominal bonds when inflation is rising, they’re also exposed to interest rate risk like any other bond. The higher the interest rate, the lower the value of a bond. If inflation is rising at the same time, TIPS would outperform; if not, they underperform.

The so-called breakeven rate is a measure of inflation expectations. Roughly speaking, the 5-year breakeven rate is the resulting rate from purchasing a 5-year Treasury and selling a 5-year TIPS. If the yield on the “nominal” Treasury is 2% and the yield on the “real” TIPS is 0.5%, then inflation would be expected to remain at 1.5%. An investor who believes that inflation expectations are going to rise can bet long on this spread; an investor who believes that inflation expectations are going to decline can short the spread.

But how to bet on the spread? One way is, of course, purchasing a Treasury and selling the TIPS at the same time, but that is a difficult operation. Fortunately, there is another option available in the form of the Proshares 30-Year TIPS/TSY Spread ETF (RINF). This ETF tracks the Credit Suisse 30-year breakeven inflation index, which is a measure of 30-year inflation expectations.

The performance of this ETF has been ugly since inception. But remember, unlike other fund, the main goal behind the creation of this ETF hasn’t been performance, but rather to offer some kind of protection for a portfolio. Because I fear inflation expectations are too low, I believe that investors should protect against rising expectations in the near future. And because I fear interest rates may also start rising (even if not today), I prefer going long on the spread rather than purchasing TIPS. There’s another good reason to purchase this instrument: it provides diversification. I computed the correlations between the Proshares ETF and the S&P 500 using all daily data available between 17 January 2012 and 20 June 2016 and estimated the correlation at 0.137, which is near zero. That means that the Proshares ETF is relatively insensitive to the market, which is excellent for portfolio diversification. I’m adding RINF at $26.63.

Comments (0)