One Step Closer to a Cash Ban in Europe

So, they finally mustered the courage to do it! The €500 note will no longer be produced in the Eurozone, in order to “fight illegal activities and terrorism”, the ECB claims. But, behind that false moralising lies a bigger plan to scrap cash and force people to depend ever more on banks for their money. At a time when monetary policy has completely failed to drive inflation higher, central banks are finding ways to introduce ever more negative interest rates. Today we see the €500 note disappear; tomorrow it could be the 1,000 franc one. In future other high denominations will follow, no doubt, to make it ever costlier to hold money outside the banking system. While this happens, we should also expect new legislation to be enacted in order to limit cash payments to very tiny sums like €5,000. When high denominations are scrapped and legislation exists to limit payments in cash, we will then have the equivalent of a cash ban. In the future, legally-imposed money is going to be traced, taxed, and charged a fee without reservations, while people will lose any rights to privacy. For now, we should take the ECB decision as a preamble to further interest rate cuts.

A Failed Boost

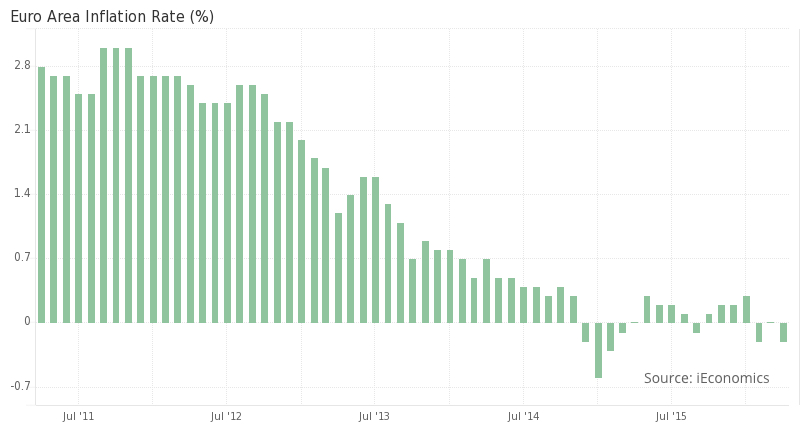

Many things can be said about the quantitative easing programme put in place by the ECB 14 months ago. Some would argue that without it we would be much worse off than we currently are in Europe, particularly because of the hard limitations on government policy across the Eurozone. Others would claim that it has done almost nothing for the economy, as the money has flowed almost entirely in the direction of financial assets, instead of contributing to increased levels of investment and consumption. While the precise effects are always difficult to measure, there is one certainty about the last 14 months of asset purchases: they were unable to push inflation back to its 2% target level. It was in January 2013 when the inflation rate was last seen near 2% in the Eurozone, having decreased since that time to hit -0.2% in the month of April.

Mario Draghi never tires of mentioning the benefits of the QE programme and low interest rates, but the truth is that said programme has been unable to produce the necessary effects for the ECB to accomplish its objectives. In my view, the QE programme and negative interest rates have been a complete failure and should be abandoned and replaced by other options. But that’s not going to happen. The plan is always to double down on failures, as the naive casino player does when accumulating losses.

The recently issued ECB economic bulletin recognises that “most measures of underlying inflation do not show any clear upward trend”. Despite a massive intervention from the ECB, flooding the market with liquidity, people in the Eurozone still believe that prices will remain fairly stable over the course of many years.

Preparing For Further Rate Cuts

In order to double down on its bet, the ECB decided to scrap the €500 note. The central bank argues that the €500 note ban is part of a crackdown on illicit activities and terrorism. Criminals always pay in cash and store money in the highest denominations available. To some extent, the €500 note makes life easier for criminals.

While the above argument is certainly reasonable, it most likely hides the true intent behind it. As far as I know the ECB was founded as an independent institution, out of government reach (in fact, out of anyone’s reach), with a single objective: to achieve price stability, interpreted as keeping the harmonised index of consumer prices growing near 2% per year. At a time when current monetary policy seems to be failing, the agenda of the ECB is to pave the way to further cut interest rates without leading to a large scale conversion of demand deposits into physical cash. The idea has been mentioned several times in academic literature and consists in concentrating ever more power in the central bank in order for it to be able to plan and manage the economy at its own discretion.

By scrapping the €500 note the ECB will certainly not put an end to criminal activities. If I were carrying those notes for illegal activities, I could very well exchange them for gold, silver, or even the 1,000 Swiss franc denomination. We should also not forget that the largest dollar denomination is $100. Still, illegal activities conducted using US dollars certainly surpass those conducted in euros. It would thus seem naive to believe that scrapping the €500 note will make a material difference to the volume of illegal activities.

But for savers, who must decide between storing wealth in cash or demand deposits, the ECB move to scrap the €500 note makes a difference because it increases the cost of carrying the hard currency. Carrying €1 million in €500 notes is the same as carrying 2 sugar bags in terms of weight. If the same had to be stored in €200 notes, the weight would increase 2.5 times. But that would most likely be not possible as there are too few €200 notes in circulation. Savers would have to store wealth in €100 notes, which would lead to a 5x increase in weight (and space required). The final result is an increase in the cost of holding physical money. When the increased costs are combined with laws limiting transactions in cash to tiny sums, we end up with a system that is not all that different to a cash ban, and one under which it is very difficult to avoid the banking system, exposing people to the implied fees and to any negative rates imposed on balances.

“Cash is one of the last remaining tools in the hands of people that impose a limit on central bank action”. In other words, the possibility of converting demand deposits into cash imposes a check on banks and central banks, similar to what happened during the age of metallism. At that time, the sovereign established the the official exchange rate between the metal used in coins, but people were free to ask for the minting of metal. If at any point people perceived the value of the metal as a commodity as being higher than its minted version, they would demonetise it. In our world, if people don’t see any benefit in keeping money in its electronic version they can simply convert it into physical cash. To avoid the first, we created fiat money; to avoid the second we’re going to ban cash and create electronic-only money.

While the end of the €500 note will not have any kind of impact on many of us at this point, it is clear that we’re moving in the direction of creating a monetary system that is centrally planned and in which we lose our right to anonymity when shopping. This move opens the door for the next central bank policy action, which will see further cuts in interest rates while allowing banks to pass the charges to clients without the risk of losing their business.

“Cash allows people to be forgotten; to make purchases while still preserving the right to privacy”. We should all prepare to lose this privilege.

Comments (0)